Development of Korean Industries and Hyundai’s Strategy

Korean industries have always had a strong sense of risk-taking.

On the 21st of this month, Hong Nam-ki, Deputy Prime Minister and Minister of Strategy and Finance of South Korea, set a goal in the Creative Economy and Innovation Committee meeting: to use all efforts to promote the development of “BIG3,” the three major growth industries of semiconductors, future cars, and bio-health, and strive to enhance the competitiveness of these three major industries to the world’s first place by 2025.

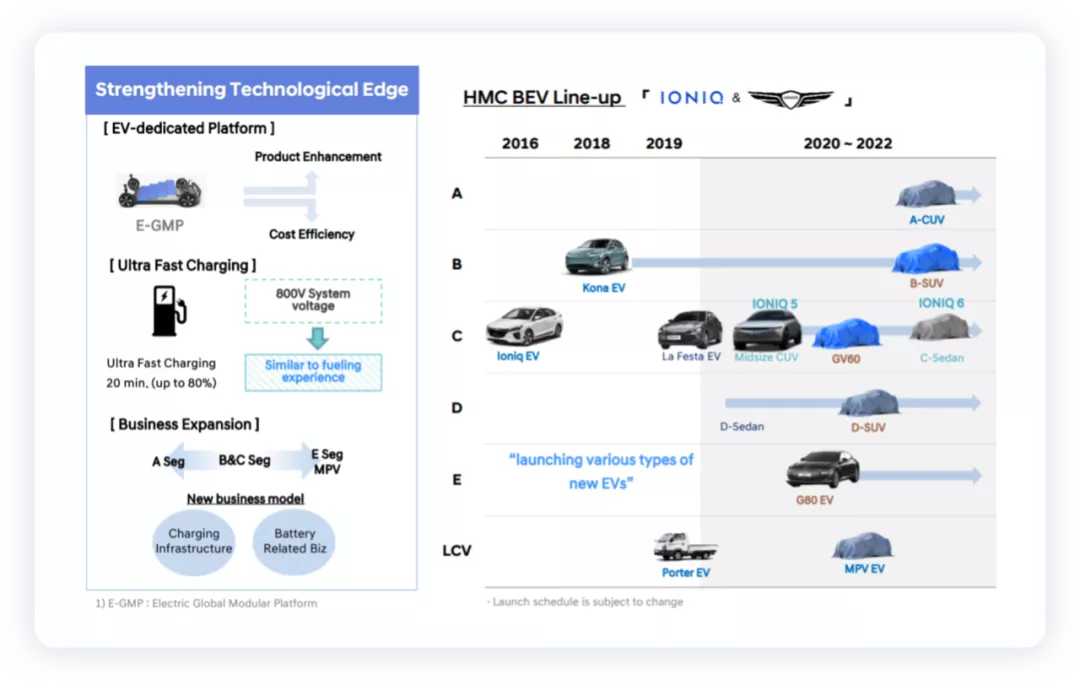

In the automotive sector, with regard to the strategic aspect of Hyundai Motor Group, Jaehoon Chang, CEO of Hyundai Motor Company, announced that the focus of Hyundai (IONIQ) and Genesis brands is currently on electrification. At the same time, due to limited overall cash flow, Hyundai and Kia will stop investing in the development of new internal combustion engines to reduce costs.

Genesis will gradually phase out ICE starting from 2025 to make room for 8 BEV/FCV models in 2030 to achieve 100% electrification.

Hyundai’s Plan

Hyundai’s earliest plan, to some extent, was still difficult for me to understand. In fact, Hyundai and Kia copied Volkswagen’s similar plan of MEB and PPE, and went all-in on continuing to expand their electric vehicle lineup based on their product portfolio.

Currently, Hyundai’s plan is to launch 13 fully electric models by 2030, including Hyundai Ioniq 5 that has already been launched and Hyundai Ioniq 6 and Hyundai Ioniq 7, a large three-row SUV, to be launched soon.

Note: These vehicles are likely to be divided into two versions: ternary and lithium iron phosphate. High-end models will use ternary, while mid- to low-end models will use lithium iron phosphate.

These three BEVs are the first BEVs based on the E-GMP platform. Hyundai continues to iterate the EMP platform, while other BEVs will be based on another dedicated BEV platform (the platform has been hinted at but not yet announced, and is likely to be the EMP2 platform). Hyundai/Genesis aims to sell 220,000 BEVs in 2022, 57% higher than the expected 140,000 cars in 2021 (with sales of 90,000 cars in 2020).

## Modern’s Sales Figures in November for Pure Electric Vehicles

## Modern’s Sales Figures in November for Pure Electric Vehicles

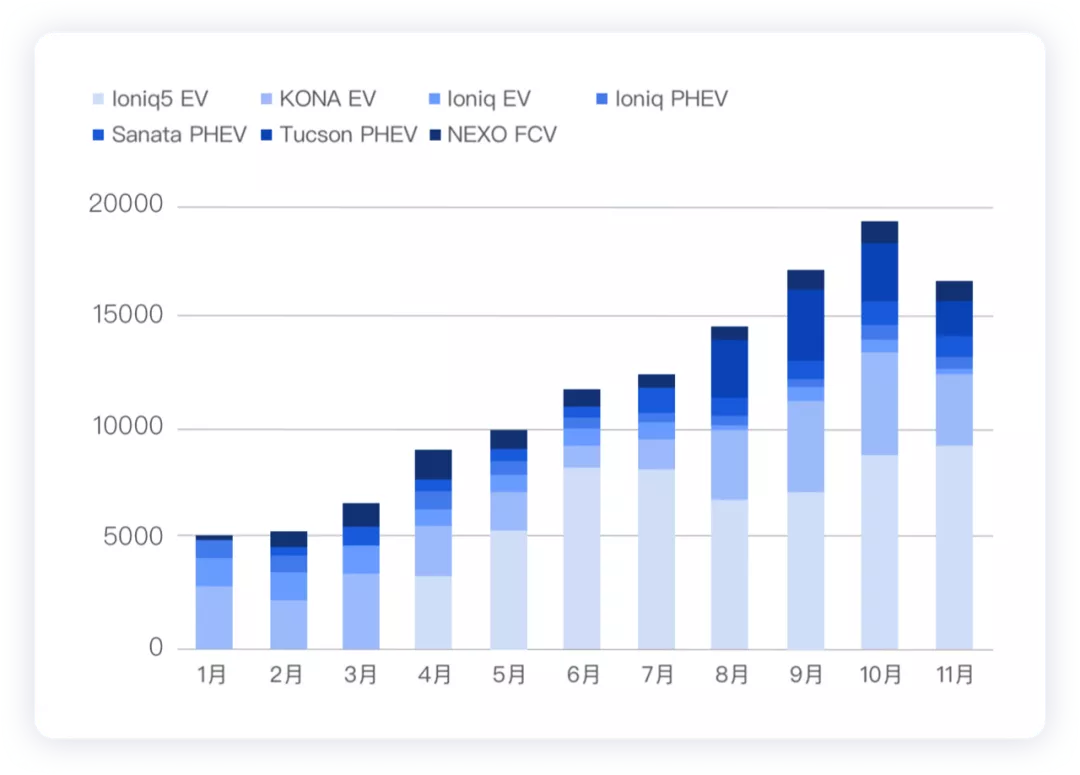

Modern’s sales figures have dropped 17% globally in November, to 312,602 units. This was partly due to the shortage of semiconductor chips. However, new energy vehicle sales totaled 15,783 units, up 59% year-on-year, accounting for 4.1% of total sales. Pure electric vehicles (BEV) sales were four times those of plug-in hybrid electric vehicles (PHEV), while sales of hydrogen fuel cell electric vehicles (FCV) are expected to reach 10,000 units.

● Pure Electric Vehicles: 12,748 units (up 62%)

● PHEV: 3,035 units (up 47%)

● Fuel Cell Electric Vehicles: 946 units (up 155%)

As shown in Figure 4, Modern’s BEV strategy has been very effective.

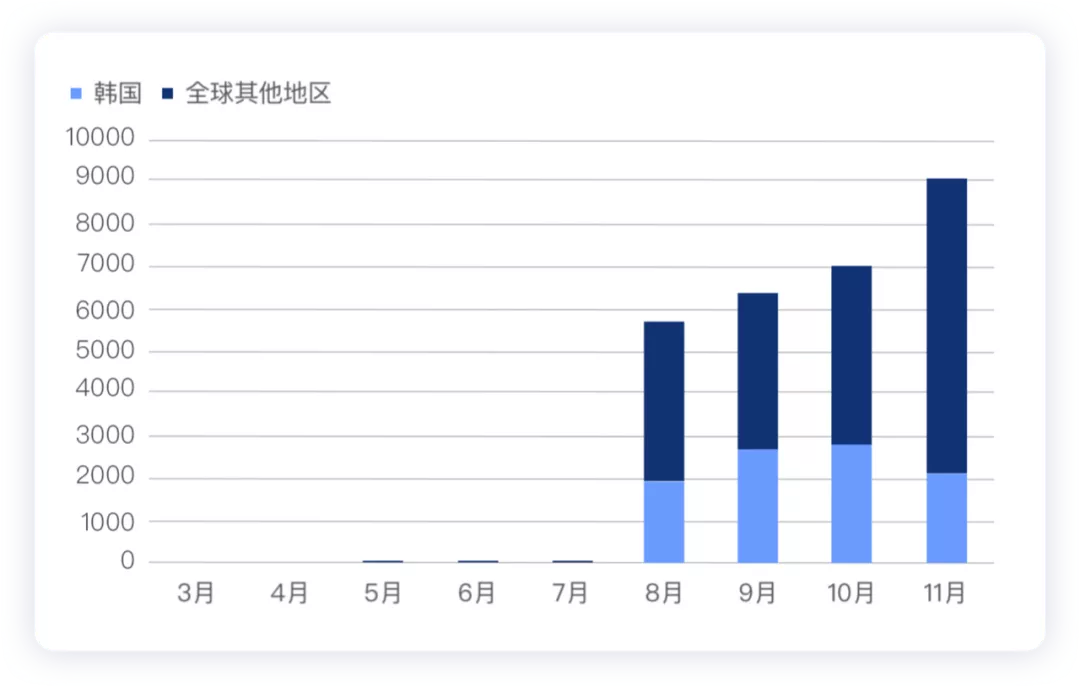

Modern delivered about 21,000 units of the Ioniq 5 to Korean customers and more than 15,000 units to European customers (within eight months). Currently, these vehicles are mainly sold to Europe. Wholesale sales of the Ioniq 5 in November reached 9,100 units. Retail sales reached 3,630 units (a new high).

It is expected that by the end of this year, the production of the modern Ioniq 5 will exceed 60,000 units, and the production of the Kia EV6 will reach about 30,000 units, for a total of 90,000 units, based on the new E-GMP platform.

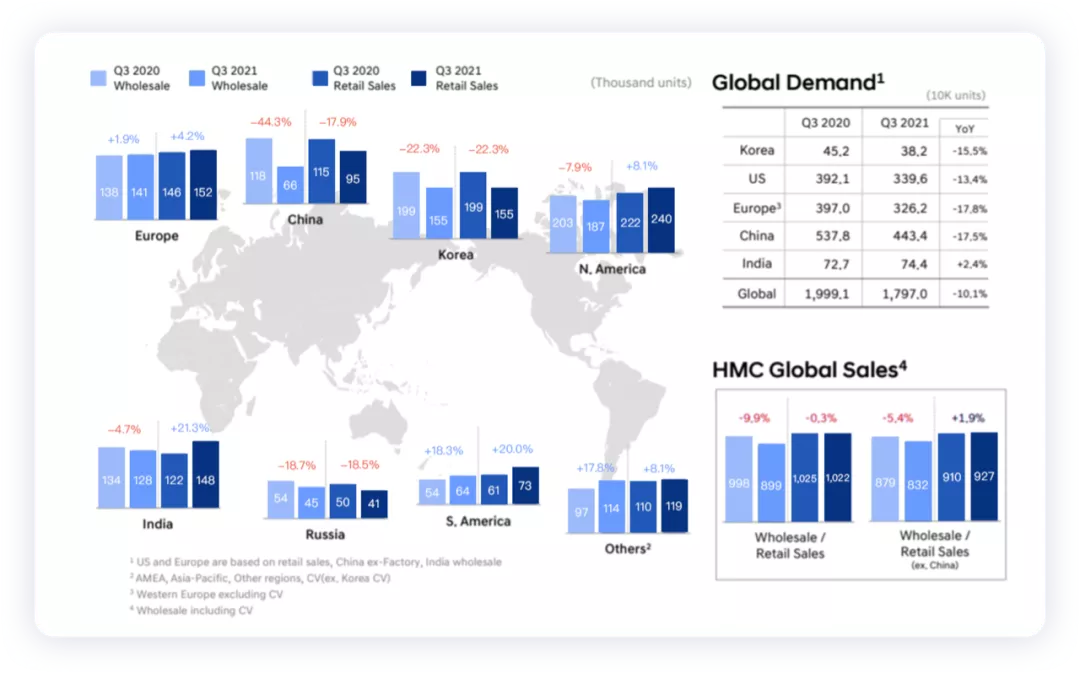

In summary, overall, Modern is fully committed to the new energy vehicle sector, although the overall share of sales still accounts for a small percentage. However, the trend and momentum are very strong. The All-in EV approach is also supported as the traditional combustion engine vehicle market in China is entering a state of collapse. Therefore, it is reasonable to introduce EV brands such as Ioniq and Genesis to enter the market.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.