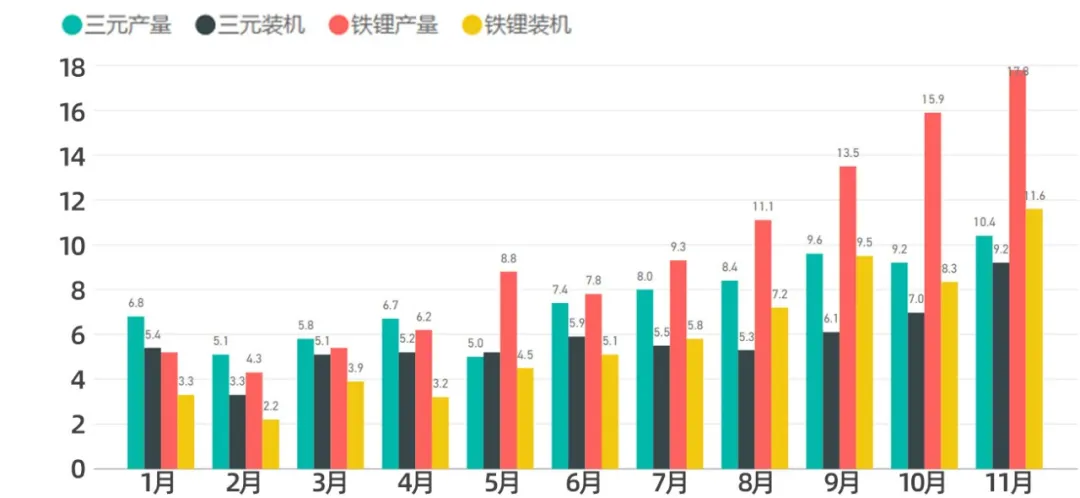

The trends of ternary batteries and lithium iron phosphate are increasingly divergent.

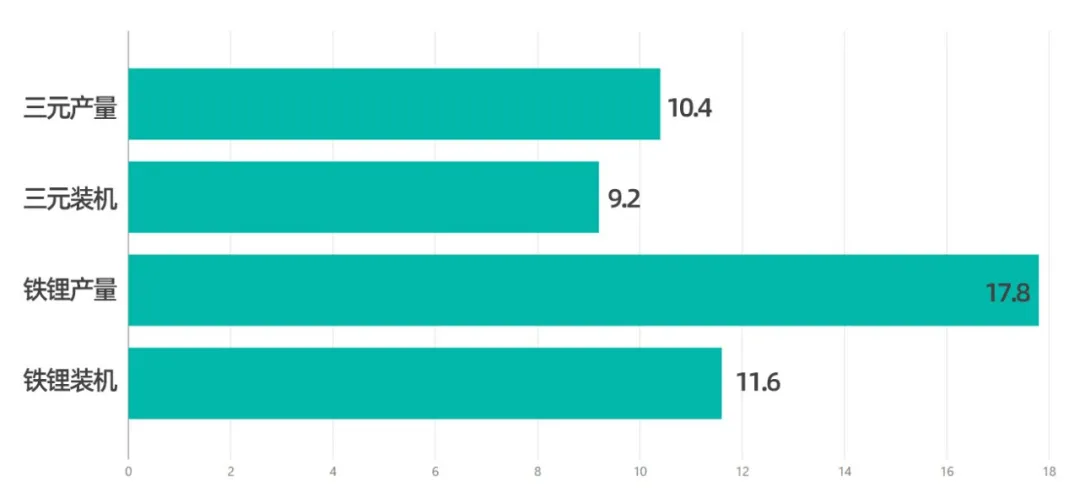

In November, the total output of power batteries was 28.2 GWh, with the output of lithium iron phosphate batteries at 17.8 GWh, accounting for 63.0%; the output of ternary batteries was 10.4 GWh, accounting for 36.8%. Year-on-year growth rates for lithium iron phosphate and ternary batteries were 229.2% vs 42.6%, respectively.

After analyzing the market this month, I will focus on discussing the choice of different packaging routes for lithium iron phosphate technology among various enterprises.

For the battery industry, 2021 has been a year of both good news and bad news.

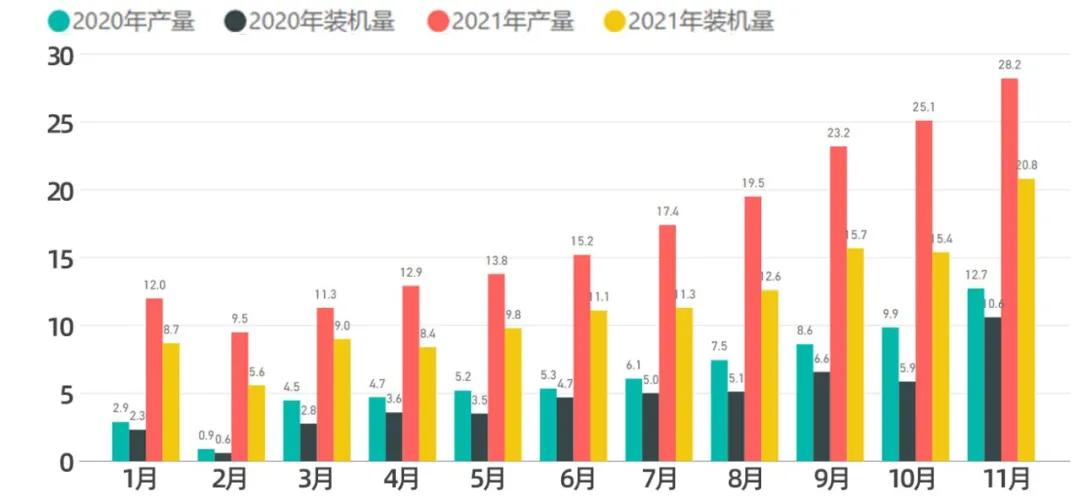

From January to November 2021, the total output was 188.1 GWh, a cumulative year-on-year increase of 175.5%. Such a high growth rate has created a pull on upstream raw materials, resulting in a rapid increase in prices. In fact, this has led to a shortage of upstream raw materials and increased prices, meaning that small battery companies will need a lot of capital to purchase upstream materials, and will face difficulties when adjusting downstream prices next year.

Overall production and installation of power batteries

In November, the total output of power batteries was 28.2 GWh, a year-on-year increase of 121.8% and a month-on-month increase of 12.4%; the installation of power batteries was 20.8 GWh, a year-on-year increase of 96.2% and a month-on-month increase of 35.1%.

From the overall trend of power production, it is clear that the power battery industry is booming.

Here, we can analyze the data by dividing it into production and installation:

In terms of production, the output of power batteries was 28.2 GWh, with the output of ternary batteries at 10.4 GWh, accounting for 36.8%; year-on-year growth was 42.6%, and month-on-month growth was 12.9%.

The output of lithium iron phosphate batteries was 17.8 GWh, accounting for 63.0%; year-on-year growth was 229.2%, and month-on-month growth was 12.0%.

In terms of installation, the installation of power batteries was 20.8 GWh, with the installation of ternary batteries at 9.2 GWh, year-on-year growth of 57.7%, and month-on-month growth of 32.5%; the installation of lithium iron phosphate batteries was 11.6 GWh, with year-on-year growth of 145.3%, and month-on-month growth of 37.2%.The systematic data shows that currently the export volume of lithium iron phosphate batteries is relatively low, mainly due to the export of Tesla cars. Therefore, this data reflects that the ternary material installation volume in 2022 has reached its peak, and there is no rapid increase in production during the rapid growth stage of demand. However, the data for lithium iron phosphate batteries is still on the rise.

This difference can reflect the forecast of the installation volume for the next few months.

If we look at monthly data, we can better reflect the situation of explosive demand for lithium iron phosphate batteries. If we remove the disturbance of Tesla’s exports (about 15,000-40,000 units exported, 60kWh, fluctuating about 900MWh-2.4GWh), the actual installed capacity of lithium iron phosphate is also rapidly increasing.

In terms of overall data, the cumulative production of power batteries from January to November is 188.1GWh, with a year-on-year increase of 175.5%. The cumulative production of ternary batteries is 82.4GWh, accounting for 43.8% and a year-on-year increase of 106.1%. The cumulative production of lithium iron phosphate batteries is 105.3GWh, accounting for 56.0% and a year-on-year increase of 275.7%.

The cumulative installed capacity of power batteries from January to November is 128.3GWh, with a year-on-year increase of 153.1%. The cumulative installed capacity of ternary batteries is 63.3GWh, accounting for 49.3% and a year-on-year increase of 92.5%. The cumulative installed capacity of lithium iron phosphate batteries is 64.8GWh, accounting for 50.5% and a year-on-year increase of 270.3%.

From this perspective, the proportion of lithium iron phosphate in production is the first to reflect market changes. From this perspective, the proportion of iron phosphate in 2022 can increase to 70% or even 80% of the overall passenger car market share.

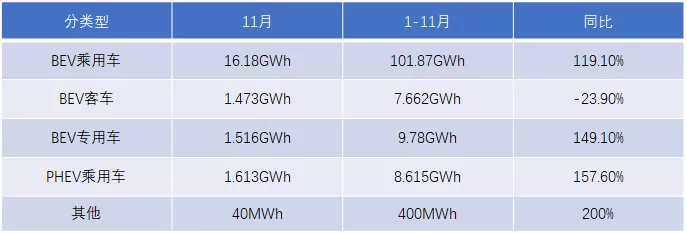

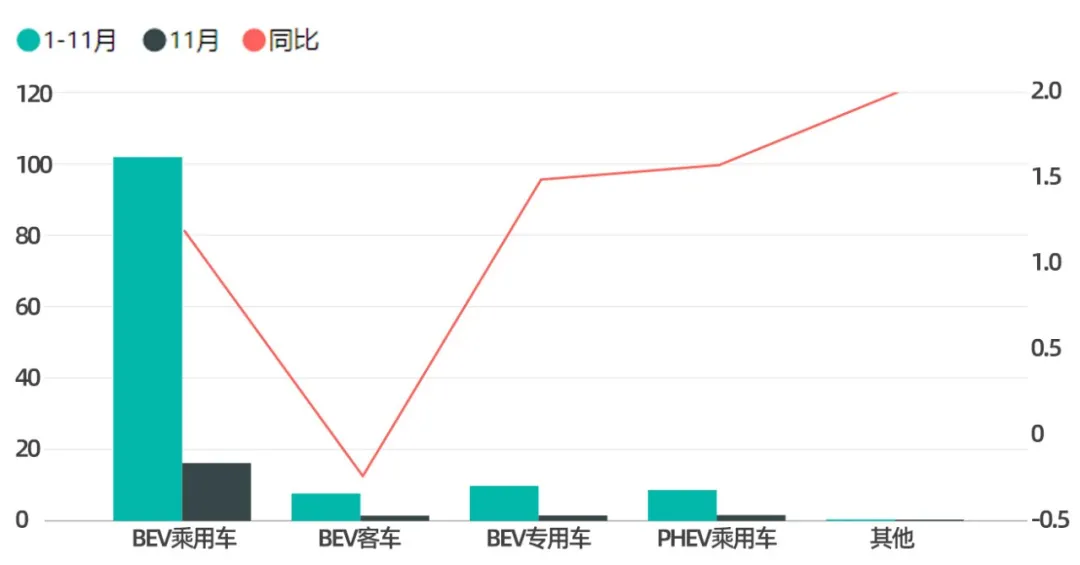

Power Battery Installation Distribution

Looking at the two charts for November and January to November, the largest usage in November was still in pure electric passenger vehicles, with an installed capacity of 16.18GWh, accounting for 77.7%. With the increase in plug-in hybrid vehicles, battery usage in November also reached 1.613GWh, fully reflecting the growth rate of this segment market, and a monthly increase of 47.7%.

From this perspective, the traditional passenger car market that uses only lithium iron phosphate batteries has a total of 7.662GWh. A large amount of lithium iron phosphate will be used in the passenger car market in the future.

LFP “Eight Immortals Crossing the Sea”

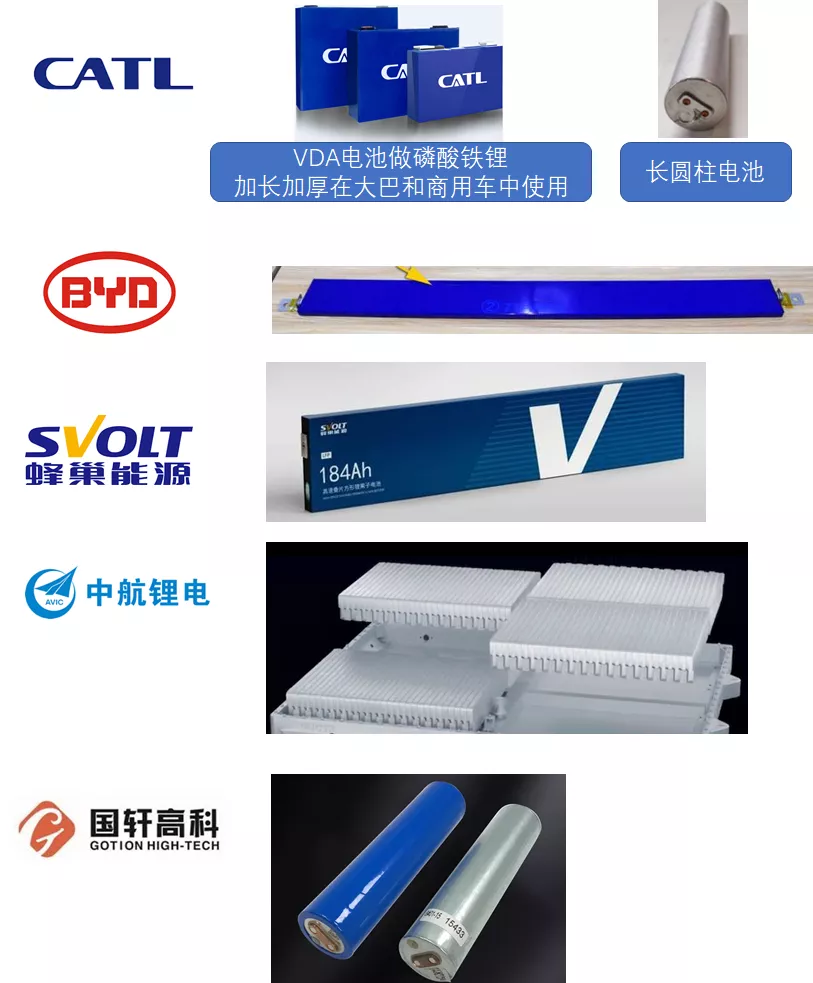

At present, LFP (lithium iron phosphate) has become the mainstream design trend, and major battery companies are making LFP encapsulation in the following forms:

CATL: Two main routes are taken. In passenger cars, the company continues to use the original VDA 148 width, 220 width, and Tesla custom width. Then, in response to the demand for electric bicycles, the company produces cylindrical cells to make A00-level vehicles. The former reuses all production lines, and the latter is compatible with low capacity to reduce production line investment.

BYD: Whether it is the EV blade battery or the PHEV blade module battery, BYD is currently All in LFP among Chinese battery companies. From the packaging of passenger cars, the blade battery adopts stacking technology, and then seals it in a square shell (possibly with some aluminum-plastic film inside).

Lishen: Lishen started developing low-cost cylindrical LFP battery schemes earlier. The biggest challenge in this technological route is the stability of quality. When making a single 15Ah LFP logic, the challenge is posed to the battery factory’s quality system, especially in terms of welding. If LFP cannot solve the leakage problem, its safety cannot be guaranteed.

CATL: At the recent CATL Battery Day, the company launched a technology route that switches its entire line to short blade technology. I think this design length not only increases the universality of the application but also considers the current technical processes. This path can achieve breakthroughs in product energy density and yield.

CALB: CALB’s One Stop Battery also switched from the original VDA route to the blade stacking mode, as did the three companies that made square shell batteries.

I believe that in 2022, with the white-hot competition of LFP, these LFP companies will engage in very fierce competition, and NINGDE TIMES still has a considerable advantage. From the breakthrough of Freedom Battery in 2021, there will be some changes in 2022, especially as many car companies begin to adopt LFP comprehensively, which objectively affects NINGDE TIMES, which has a decisive advantage in CNP.

Summary: In 2022, the power battery will continue to differentiate into two paths: high nickel and lithium iron phosphate. We will see that the proportion of lithium iron phosphate will be increased by most companies due to the current cost structure, which will also narrow the gap in the material system between first-line and second-line battery companies in China. Previously, the biggest gap between Contemporary Amperex Technology (CATL) and other battery companies was in the electrochemical system.

References:

Lithium Thoughts Series 22: The Milestone of the European Lithium Resource Strategy – Eramet of France Reopens the Construction of Salinas Grandes in Argentina.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.