*This article is reposted from the autocarweekly WeChat official account.

Author: Finance Street Lao Li

Discovering and solving market pain points is the most difficult thing for startups from 0 to 1, while building a moat is the most difficult thing for giant enterprises from 1 to 100.

A moat is the dream of all founders of large companies. Alibaba’s goal is to span three centuries and become a company that lasts for 102 years. This may seem like a joke, but it reflects a fact: no public company in China has lasted for over 100 years, and there are not many companies with an average annual revenue growth rate of over 30% for ten consecutive years. However, under the goal of 3060 carbon neutrality, it is possible for China to produce such a company.

CATL is becoming the first publicly listed company in the new energy industry with an average annual revenue growth rate of over 30% for ten consecutive years, while BYD is currently not, but may become one in the future. Recently, BYD held a media communication meeting in Shenzhen, where Wang Chuanfu talked enthusiastically about many issues related to BYD’s technology, market, and future plans.

BYD is one of the most important indicators of the A-share new energy sector, as well as one of the targets that fund practitioners and Lao Li have been following for a long time. Today, Lao Li will chat with everyone from a capital perspective about why technology is BYD’s moat, the vertical depth of BYD’s new energy vehicle industry, and BYD’s networked technological layout.

Technological philosophy determines the depth and width

Zhang Lei of Hillhouse Capital said that a company’s most long-lasting innovation in the moat is technology. At this media communication meeting, Wang Chuanfu said that BYD’s moat is technology.

The two are not contradictory. Zhang Lei has invested in almost all mainstream tracks and companies, and has profited in both primary and secondary markets. He speaks more about methodology, which is applicable to various industries and is a latent concept. Wang Chuanfu is talking about an explicit concept. Technology is the most important factor driving BYD’s development, and technology is a relatively abstract yet concrete concept in business operations. For friends who are not familiar with the industry, technology is difficult to fathom and difficult to judge as a barrier.

Lao Li rarely mentioned moats in the past because it is a saying that is contradictory to the current social environment. From a business operational point of view, we can equate a moat with commercial competitiveness. In a fair competitive environment, the commercial competitiveness of different companies is indeed present.

The 18 martial arts of the whole vehicle enterprise are highly skilled. From a business perspective, Lao Li believes that the most representative three companies are BYD, NIO, and Tesla: BYD’s commercial competitiveness is technology, NIO’s commercial competitiveness is service mode, and Tesla’s commercial competitiveness is technology + mode. From a commercial competitiveness perspective, Lao Li thinks Tesla is first, BYD is second, and NIO is third.# Companies’ Competitive Strengths in the New Energy Vehicle Industry

Although all three companies are in the new energy vehicle industry, their commercial competitiveness differs significantly from a capital perspective. Tesla undoubtedly holds the top spot, ranking number one globally both in terms of market value and technological innovation. Its diversified product line always places it in the top three, regardless of location. The market data speaks for itself and requires no further explanation.

BYD’s technical advantages stem from two factors: first, high maturity in technology, including performance, cost, and stability; second, a high degree of industry chain completeness, with a layout in both the horizontal and vertical directions of the new energy industry. There is no need to worry about industrial chain safety issues.

NIO’s service model far exceeds the other two companies. However, it is not as strong as the other two regarding safety on the industrial chain. This is not because NIO does not value core technology but because the current stage of development for the company does not allow for it, with manpower, financial, and material resources all being limited. Safety on the upstream side of the industrial chain is the lifeline of a company. To illustrate, if there is a global IGBT shortage or an unequal agreement, including NIO, most domestic electric vehicle production lines would come to a halt, with the impact of IGBT shortages on the industry far outweighing this year’s “chip shortage.” Advantages in controllable core technology would be fully displayed at such a time.

Capital markets do not care about a company’s stage of development, nor do they care about changes in international relations. The researchers in reality will only analyze whether the industry is likely to be policy-driven or whether companies have the ability to respond. The pharmaceutical industry is an excellent example. Until this year, the market value of high-quality pharmaceutical stocks on A-shares had risen for three consecutive years, creating a large number of companies worth hundreds of billions of yuan, such as WuXi AppTec, Aier Eye Hospital, and other famous fund managers like Ge Lan. However, with the frequent issuance of centralized procurement policies, major pharmaceutical stocks had a very unsightly year.

If the Huawei incident were to happen again, the loss to the new energy vehicle industry would not only be the valuation of A-share new energy vehicle stocks but also the great development prospects for the industry. Among many domestic new energy vehicle companies, only BYD has the best technical depth and breadth and a high degree of self-controlled industrial chains, making it BYD’s long-standing advantage.

Wang Chuanfu has always spoken of BYD’s moat being technology, which stems from technical performance, cost, and reliability, and, more importantly, essential independent control over the core links of the industrial chain.

Vertical depth determines the safety factor.In the secondary market, technology and business models are both very abstract and concrete concepts. Take models as an example, NIO’s model can be divided into direct sales, services, charging and many other concrete factors in different ways. The integration of these factors creates a systematic competitive advantage. The logic of technology is similar to that of business models. The ultimate goal of the new energy vehicle industry is for the automotive industry to become the core carrier of energy, transportation, environment, and communication, and to form a networked ecosystem. BYD’s technology ultimately forms a systematic competitive advantage as well.

BYD’s technological advantages include both vertical and horizontal dimensions.

The so-called vertical advantage is to focus on the core technologies of the upstream and midstream around new energy vehicles, including the three-electric system and the intelligent network connection system. Other car companies are also implementing corresponding industrial chain layout, but they don’t have the accumulation and depth of BYD.

The horizontal advantage is to expand different application areas horizontally around various links in the new energy vehicle industry chain. For example, batteries can be extended to photovoltaics, energy storage, etc. If the layout of Ningde era and other car companies is a horizontal or vertical chain, then BYD’s layout is a network and can control all nodes (core technologies) of the network.

When it comes to the depth of BYD’s technology in the field of new energy vehicles, people often think of batteries and IGBT, but rarely mention other technologies. This is a mistaken understanding of BYD’s technological depth. From the perspective of enterprise development, the vertical layout of the industrial chain is not about quantity, but quality. The goal of BYD’s technological layout is to master those key nodes with technical thresholds.

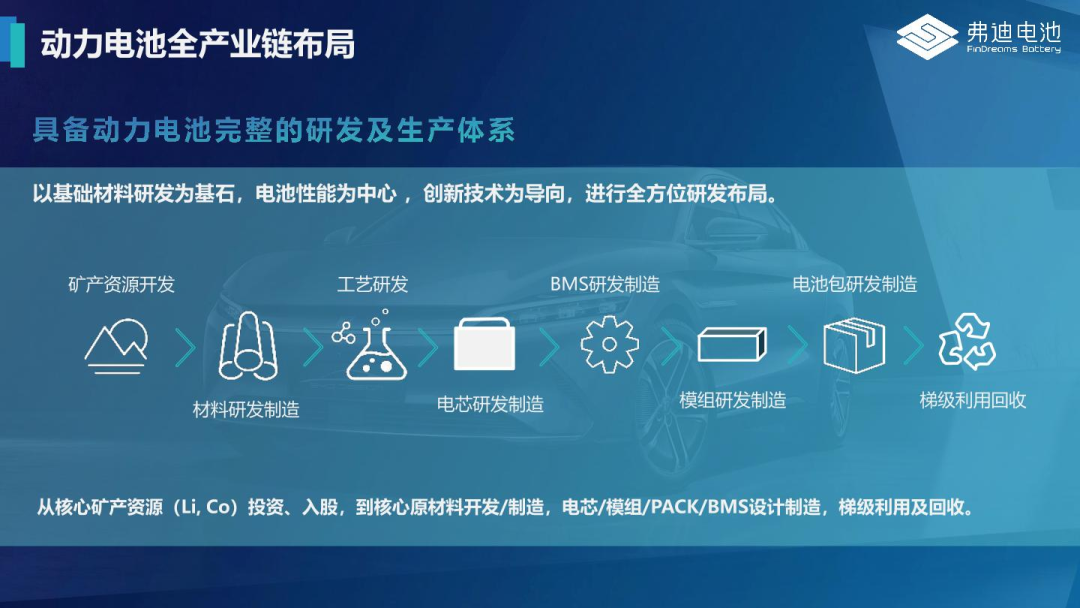

BYD has laid out the entire upstream, midstream, and downstream of the entire new energy vehicle industry chain, from raw materials of power batteries to power batteries, from IGBT, BMS to motors, electric control systems, MCU to wire control systems. BYD has laid out all the core links of the new energy vehicle industry chain. Another company that has achieved such a degree is Tesla.

In terms of upstream layout, BYD has laid out colored metal reserves such as manganese, nickel, and lithium cobalt oxide, and completely controls the positive electrode materials, electrolyte, and diaphragm that account for more than 70% of the cost of the battery cell. Moreover, BYD has established a systematic ability of “battery cell-PACK-whole package-application-recycling utilization”. In terms of motors and electric control, BYD’s self-developed electric control system covers motor controller, vehicle controller, and BMS. Even the thermal management system that Tesla has been outsourcing is self-sufficient at BYD.Here is a set of data provided by Mr. Li for your reference: BYD has the second largest market share in domestic power battery, the first largest market share in electric motor, electronic control, and BMS, the second largest market share in IGBT and silicon carbide.

BYD’s supply chain has its origin in its various business units, each of which carries out independent business R&D. If in the past BYD’s technology was comprehensive, now it is specialized, focused, and innovative. BYD is developing solid-state batteries and hub motors and has established its own blade battery production line and silicon carbide production line. Under the trend of electrification, the importance of components such as power battery, automotive semiconductors, and wire-controlled chassis has risen. BYD has established independent businesses for these components and set up the “Fudi Series” component company.

From being behind the scenes to appearing on the front stage, from producing for internal use only to external supply, BYD’s technological depth can be described in one sentence: China’s leading new energy vehicle electrification technology service provider.

Horizontal Capability Determines Valuation Space

Although they are all core technologies, BYD’s vertical and horizontal capabilities are completely different development strategies. Its vertical capability is the self-conquering and iteration of technology, which is a pre-set strategy in the early stage of the industry. In contrast, its horizontal capability is strung together by chance in different development periods, and through strategic adjustments, it has achieved certain results.

Over the past 20 years, BYD has created an integrated ecological chain of “battery – mobile phone – car – photovoltaic – monorail”. Looking at the timeline, BYD started with consumer batteries. In 1998, BYD occupied 40% of the global nickel-cadmium battery market with a semi-manual and semi-automatic production mode, mainly used in consumer products such as mobile phones. Starting from 2002, based on existing customer advantages, BYD expanded its business from mobile phone batteries to manufacturing mobile phones, which was BYD’s early basic business.

Starting in 2003, with the advantage of battery technology, BYD entered the automotive field and positioned itself ahead of its time in the layout of new energy vehicles. In 2008, it launched its first new energy vehicle F3DM, a year ahead of the national “Ten Cities and Thousands of Vehicles” plan in 2009.

In 2007, BYD planned to enter the photovoltaic industry and applied automotive body panel technology to photovoltaics. Now it has expanded to more than 100 countries such as Brazil and South Africa. In 2016, BYD began to develop monorails and expanded at home and abroad. It has expanded to the Philippines, Brazil, Morocco, and other places. Now, BYD’s various businesses cooperate with each other and have established an ecological industrial chain.

Byd has 23 business units and 5 industrial groups under its umbrella. In the early days, it relied on the vertical integration strategy to gain significant cost advantages and a rich technical reserve. Wang Chuanfu used the 1.0 and 2.0 strategies to describe the market of Byd’s technology.

Market 1.0 strategy is to split the component business and develop the motor, battery, and powertrain businesses independently in the form of business units to compete with peers. Lao Li believes that the best part of Byd’s horizontal advantage is openness, from within the Byd system to outside the Byd system, from the automotive industry to other industries.

From a business perspective, if the relevant technology only meets Byd’s vehicle manufacturing needs, its value cannot be fully realized. Instead, supplying or splitting subsidiaries with competitive business lines can enhance the overall brand image and operational vitality. For example, its batteries are not only used in Byd but also in Changan, Hongqi, and even Toyota. They are also applied in the energy field’s “light storage” integration.

Market 1.0 is about selling products, while 2.0 is about selling the enterprise itself to achieve recognition by the capital market. In Lao Li’s view, the current A-share market value of Byd is more of a reflection of the new energy vehicle sector, and the valuations of its other industries have not yet been fully demonstrated.

Many secondary market friends communicated last year, and they unanimously believed that within 5 years, Byd is likely to split into 4-5 independent listed companies. Byd Electronics and Byd Co., Ltd. have already been listed, Byd Semiconductor is on the way to being listed, and Fudi Battery and other components are likely to become the fourth and fifth independent listed sectors. In the future, Byd’s market value will be the sum of the market values of all listed companies. According to the current peer valuation reference, 2-3 hundred billion yuan companies will emerge in the split sectors.

The first half of this round of competition in the automotive industry is electrification, and the second half is intelligence. Byd has taken the lead in electrification in the first half, but it is slightly behind in the second half, although it has deployed core technologies such as chips and 5G. Its advantage is not enough compared to its competitors. Lao Li finds it hard to evaluate the depth of Byd’s intelligence strategy. Only time will tell.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.