Body:

1,302 words in total

Estimated reading time: 7 minutes

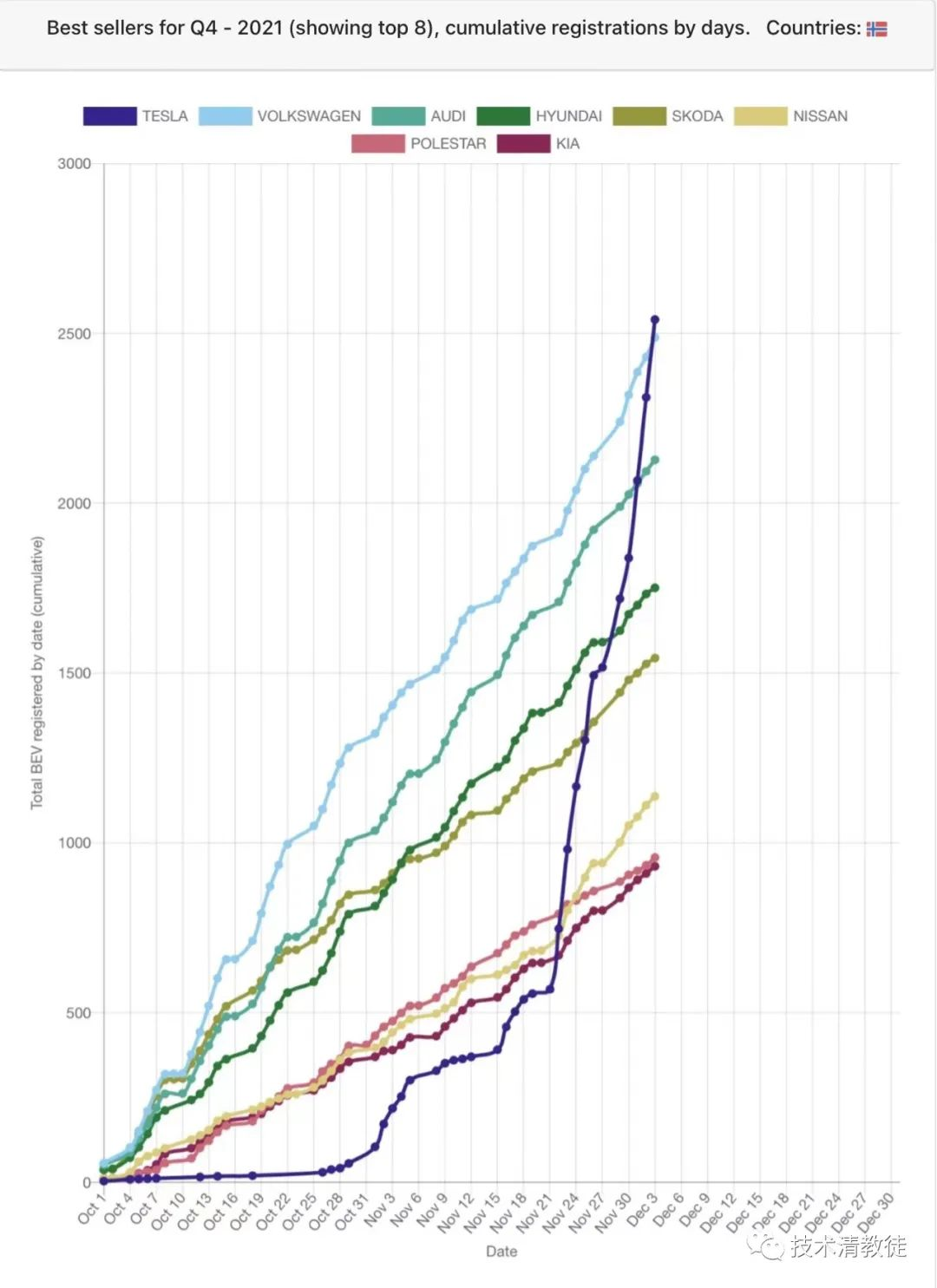

Although mainstream media often talks about Tesla, people who consider buying electric vehicles typically think of Tesla first, and they may even have one or two friends who own a Tesla. However, people who carefully examine the data will find that Tesla’s market share is not high, and may even be much lower than what we think.

In China, Tesla’s market share in the electric vehicle market is 10%, and in Europe it is even lower at only 7%. Only in the United States is it as high as 80%.

For me, at least based on my observations in China, this is somewhat counterintuitive. However, the data is certainly correct, and my observations may be just a selection bias.

Next, I want to analyze whether Tesla’s market share in China and Europe will continue to stay the same or decrease, or whether it will rise.

My answer is that it will rise. Why? Let’s analyze the specific reasons that led me to this conclusion.

Any enterprise is an enterprise of its time, so we must first take a look at the current environment. Whether it’s the frequent news about monetary policy easing or the scarcity of supplies caused by the pandemic leading to a tight production capacity, or the huge demand for battery chips due to the transformation of the automotive industry to electric, all of these have led to rising raw material prices and relatively scarce production capacity of parts, breaking the previous supply-demand balance. This further transfers to car companies, causing the cost of manufacturing entire cars to rise.

Therefore, it can be foreseen that the manufacturing cost of electric vehicles will rise in the foreseeable future. Based on this big background, let’s analyze the trend of market share.

The rise of manufacturing costs is an absolute concept, while market share is a relative concept. Here is a brief explanation: the rise of manufacturing costs is a severe test that all electric vehicle companies will face, and there is no question of whether you will raise prices or not. Therefore, it is an absolute concept. And market share is the proportion of the total market that you and I occupy, so if I rise, you must fall, which is a relative concept.

However, there are also relative concepts within the cycle of rising costs. Those with a larger scale have advantages over those with a smaller scale; those with stable demand have advantages over those with unstable demand; those with better payment terms have advantages over those with average payment terms; those with strong iterative manufacturing process capabilities have advantages over those with weak capabilities; those with their own factories have advantages over those that outsource to others; those with self-developed products have advantages over those that buy from others.

Tesla can be said to belong to the former group in almost all of these conditions, while other players either belong to some of the former and some of the latter, or almost all of them belong to the latter group.Overall, the impression of Tesla constantly lowering prices in the past has led to many potential car buyers who were not in a hurry to purchase from being reluctant to do so because they believe they can get a better deal if they wait. The phrase “wait and see” is often heard, but this pattern will see significant improvement in the future. As we can see from Tesla’s situation in the United States, with the price of the Model N increasing, the number of pre-orders is also increasing with delivery already scheduled for December 2022. The core logic behind the phenomenon of “fire and ice” is that people tend to buy when prices are rising but avoid buying when prices are falling. Tesla’s policy is also relatively friendly: the actual payment is based on the price at the time of ordering. If the price goes up afterwards, the customer doesn’t need to pay more, but if it goes down, the customer pays less.

At the same time, this will bring about a fundamental difference for all players in the industry in the near future. They must and will inevitably be affected by rising costs, and therefore, they will have to gradually raise their prices. Tesla has more room to increase their prices slowly due to their advantage, but other manufacturers with less room will have to increase their prices faster.

Rising prices will ultimately impact buying decisions, which is the norm. If we assume that the current market share and price is the reasonable choice for customers, then when other manufacturers raise their prices faster and more frequently than Tesla, while Tesla raises their prices at a slower rate, naturally, a significant proportion of buyers will turn to Tesla. Therefore, Tesla’s market share will continue to increase during this long period of cost increase.

Additionally, as previously mentioned, the gradual shift from the stereotype that Tesla always lowers prices to the reality that early booking means better pricing, combined with the factors mentioned above, will further drive market share.

During this period of rising costs, the industry will need to fight hard. Tesla’s core competitive advantage is their manufacturing capabilities based on a culture of fast innovation and a first-principles thinking approach, and manufacturing happens to be the biggest cost optimization challenge. This is also what Elon Musk said: “Tesla’s core competence will be manufacturing”.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.