Author: LYNX

“Thick accumulation and thin hair, ” is often used to describe successful companies.

But in the context of today’s reality where success determines one’s status as a hero, people tend to focus only on the results and easily forget the process of “thick accumulation.”

At the beginning of the last month of 2021, there is a surge in sales of new electric vehicles from different brands: the most representative of them being “We Xiaoli,” with all three branches selling more than 10,000 units a month.

The shining sales figures convey a positive signal of a booming market, which seems to have made people forget the difficulties and challenges the domestic new energy manufacturers faced in the past years.

It’s worth noting that “new energy,” as we know it, is no longer the fledgling calf. Among Xiaoli’s three branches, Ideal Auto, which was established latest, has been in the business for six years already.

Compared with some electric vehicle brands that originated from traditional car manufacturers, they seem to deserve the title of “new” more.

For example, Polestar.

For friends who have been following “Super Charging Station” for a long time, they may not be unfamiliar with this new electric brand from Volvo Car. But when we take a closer look at the brand’s history, we’ll find that it has been around for less than four years.

During this time, Polestar has launched two products: Polestar 1 and Polestar 2.

The former is a limited edition product with a price tag of RMB 1.45 million, which is destined to shoulder the mission of improving the brand’s tone; the latter is a real sales representative, which was not officially delivered until the third quarter of 2020.

In other words, the Polestar brand has only been in the consumer market for about a year.

Looking at the sales figures, although it cannot compare with the momentum of domestic new energy manufacturers who have been working in the market for many years, it has basically won recognition from global consumers:

In 2020, Polestar’s global sales exceeded 10,000 units, and 2021 is expected to reach a global sales of about 29,000 units. In comparison, NIO delivered its first product ES8 in 2018, with a total sales volume of 11,348 units that year and 20,565 units the following year.

In the booming global market, “time waits for no one” is a common sense of every enterprise.

As the company is about to enter its fifth year, Polestar has also shouted a very loud slogan: Entering the 2.0 era.

Polestar 2.0: Increase speed and expand scale

If the Polestar 1, which was priced in millions and sold in limited quantities, established the brand, and the Polestar 2, which was benchmarked against Tesla Model 3, explored the way forward in the 1.0 era, then in the 2.0 era, Polestar’s issue will obviously be more pragmatic: expand market share and increase development speed.

Although global sales are only estimated to be 29,000 units this year, Polestar’s vision for the future can be described as ambitious: the goal is to achieve an annual global sales volume of 290,000 units by 2025.

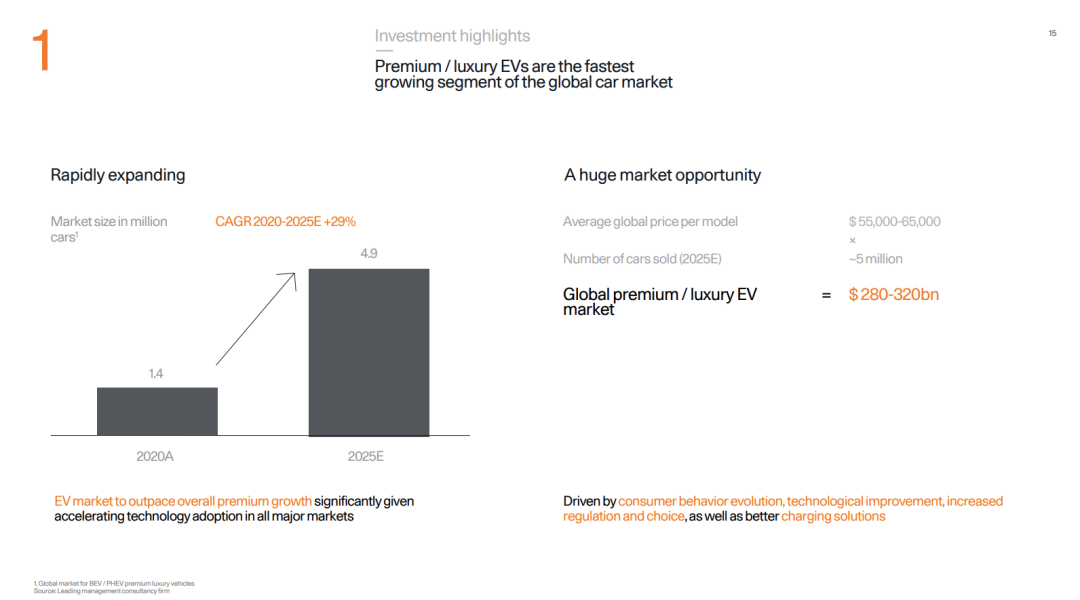

The reason for setting this goal is based on the estimate of the booming growth of the future luxury electric vehicle market:

According to predictions from relevant institutions, the global luxury electric vehicle market is expected to be around 1.4 million units in 2020. By 2025, this number will reach 4.9 million units, maintaining a compound annual growth rate of 29%.

To grab a corner of the rapidly growing market, Polestar’s strategy is quite clear: more products, clearer brand positioning, more advanced technology, and larger capital investment.

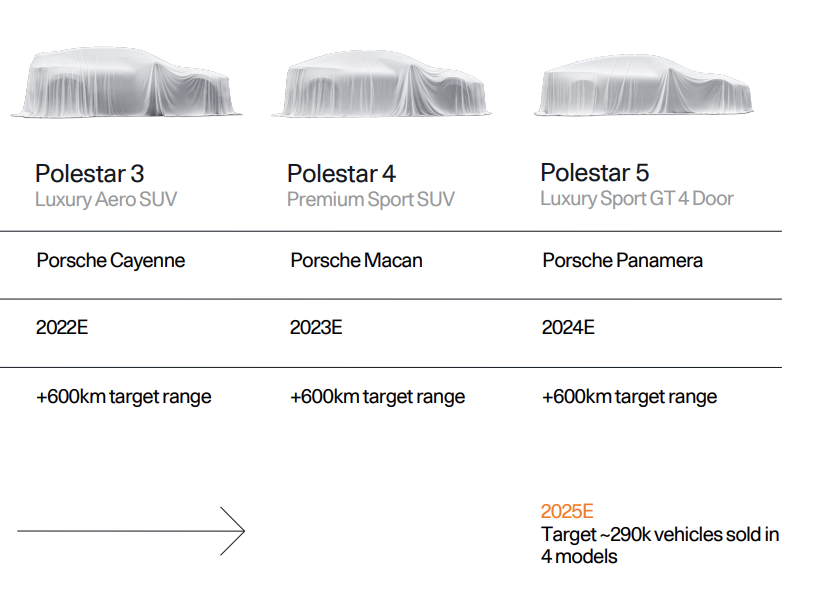

In terms of products, Polestar’s plan is very clear, that is to launch a key new car every year from 2022 to 2024.

Among them:

-

In 2022, Polestar 3 will be launched. This car will be based on the SPA2 architecture, with a size similar to that of the Volvo XC90, positioned as a large luxury pure electric SUV, benchmarked against Porsche Cayenne, and will be produced in China and the United States at the same time next year.

-

In 2023, Polestar 4 will be launched. This new car can be regarded as the SUV version of the Polestar 2 model on sale, but it will be developed using the Geely SEA platform, positioned as a luxurious sports pure electric SUV, benchmarked against Porsche Macan.- In 2024, the production version of the Polestar Precept concept car, the Polestar 5, will be launched. As a four-door all-electric luxury sports GT, its competitors are Porsche Panamera.

-

As the beginning of the 2.0 era, Polestar 3 released a teaser image of its new car as the year 2021 comes to an end.

-

Although the new car is heavily disguised, we can still see the “Thunder Hammer” and other design language of the Polestar family continue from the images.

At the same time, around the two major trends of “environmental protection” and “intelligence” for electric vehicles, Polestar officially stated that Polestar 3 will use a large amount of environmentally friendly materials and use renewable energy in the production process, making it the most environmentally friendly model ever.

-

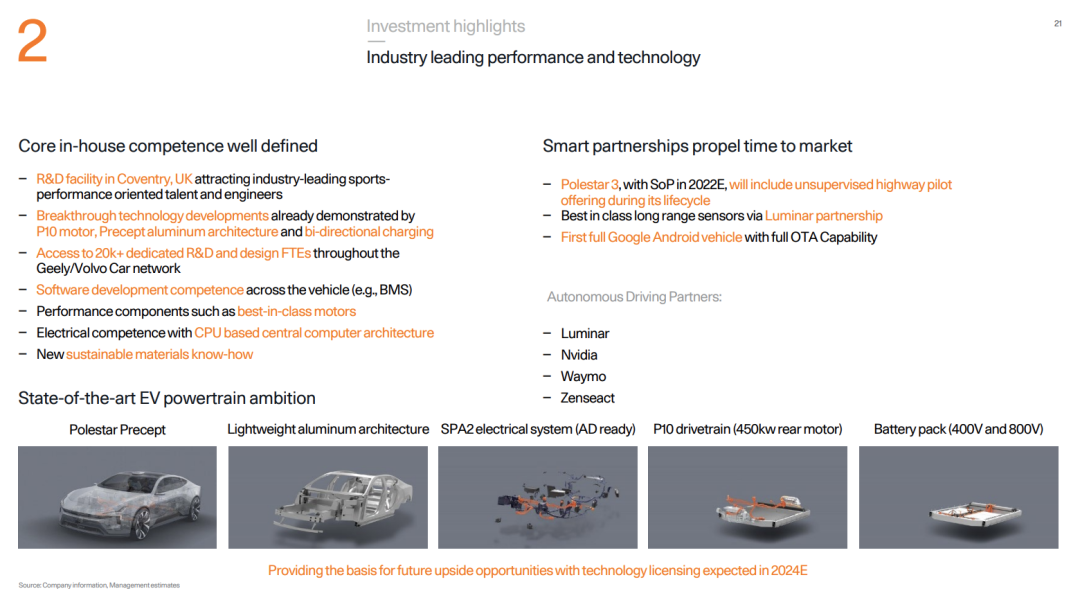

As for intelligence, the new car will be equipped with NVIDIA’s most advanced autonomous driving chip + Luminar lidar to further improve intelligent driving assistance capabilities.

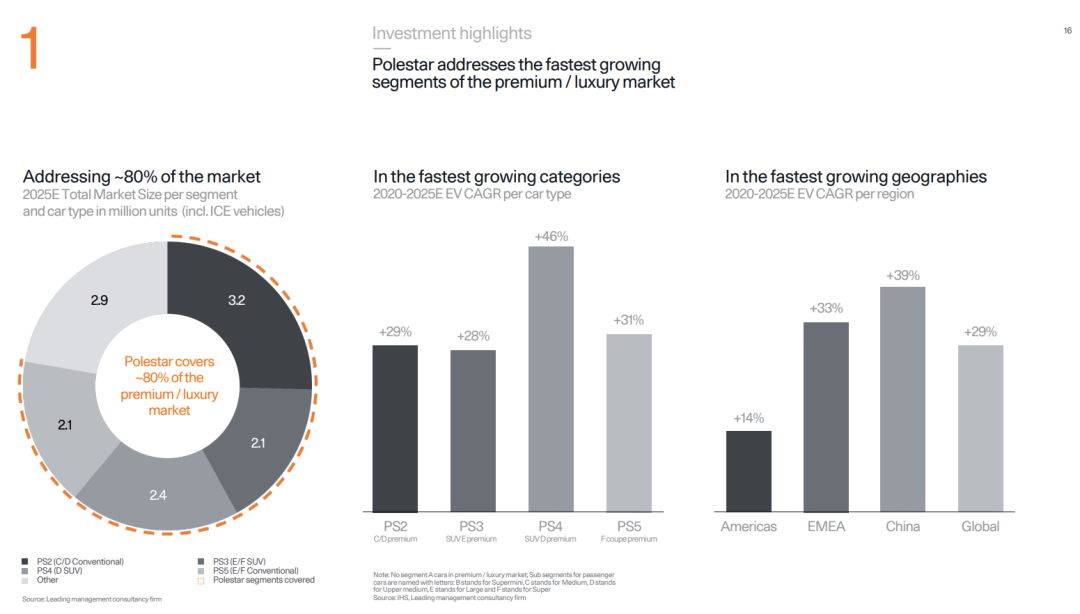

From the Polestar 3, which will be launched next year, to the five Polestar products all being launched and forming a complete model matrix in 2024, these products will cover 80% of the segmented markets in the automobile industry.

Internationalization and high-end luxury

-

Of course, the product matrix is only the basic part of the company’s huge system strength. Polestar has also found its brand positioning in order to achieve its sales target by 2025.

Two key words are “internationalization” and “high-end luxury”.

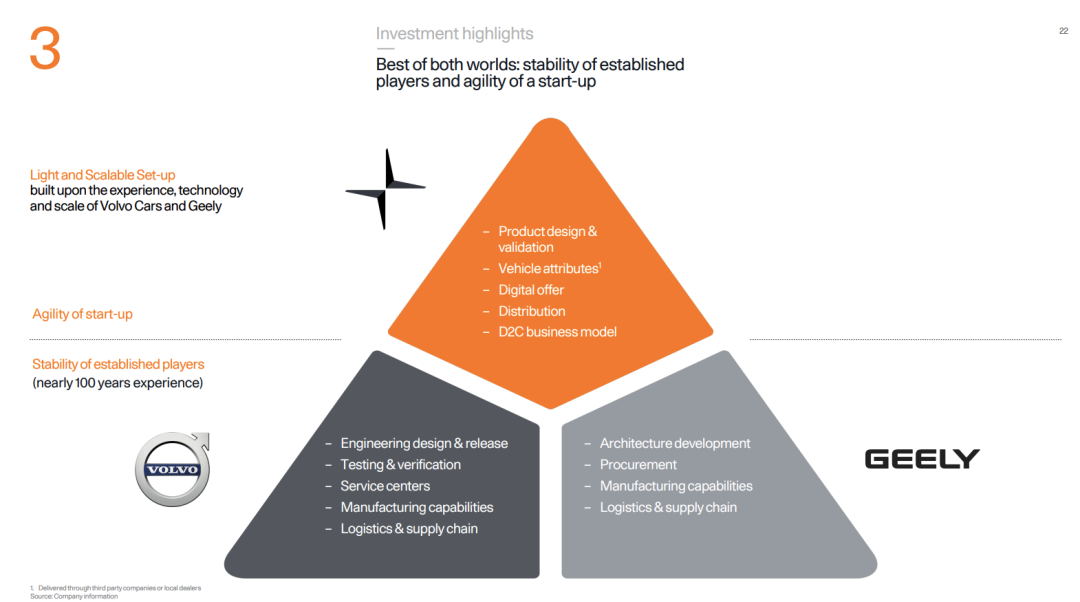

“Internationalization” needs no further explanation. Polestar is backed by Volvo and Geely. Its technological research and development and production will naturally receive support from these two international giants, and subsequent products will have global supply chains and production capacity.

Compared with domestic new energy vehicle brands that are still dreaming of “going global”, Polestar has the unique advantage of being able to stand on the shoulders of giants and rapidly deploy global sales channels:In 2021, Polestar will double its global sales market from 9 to 18 markets, and is expected to expand to 30 markets worldwide by the end of 2022, covering regions including China, Europe, the United States, and the Middle East.

Although Polestar’s performance in the Chinese market is not impressive, it has performed well in the European market.

Up to now, Polestar 2 has sold more than 10,000 units in nearly 10 European countries, and ranks among the top three in pure electric vehicle sales in Norway, the UK, and Sweden, achieving a 1.5% pure electric market share in the European market.

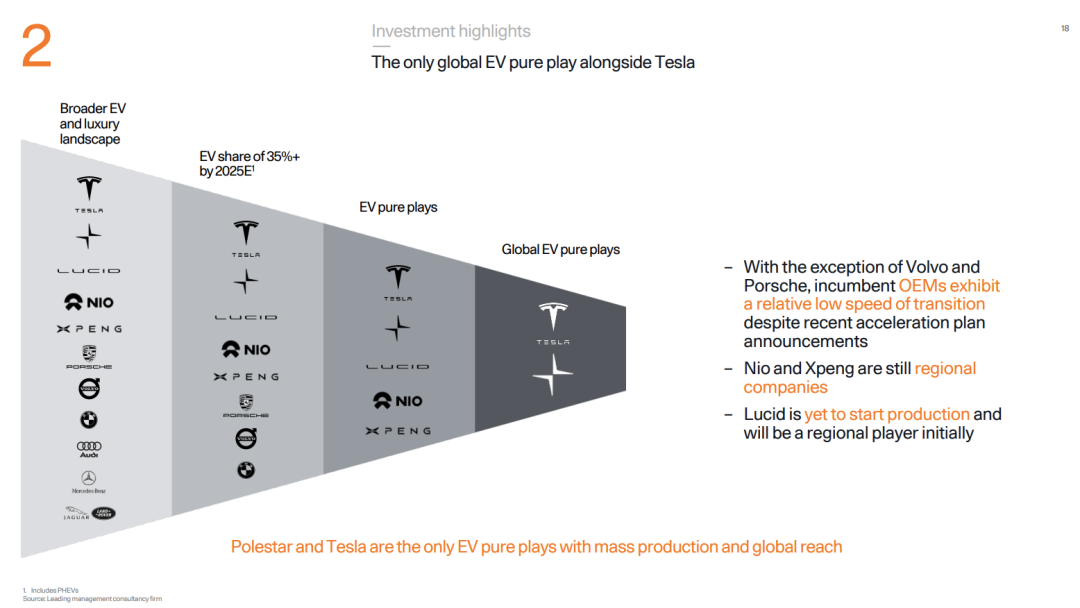

This is the confidence for Polestar to claim itself as “currently the only globalized electric car brand”. Of course, the “only two” in this statement refers to Tesla.

While Tesla is aiming to be the “Volkswagen of the electric era” by selling its electric cars all over the world with entry-level products, Polestar defines its brand positioning as “the Porsche of the electric era”.

As a high-performance brand under Volvo during the era of gasoline-powered cars, Polestar is logically targeted at Porsche, which also has a racing pedigree.

Apart from the historical narrative, Polestar’s confidence in targeting Porsche comes from solid technological accumulation and brand characteristics.

For example, the planned range of the next three new Polestar models will exceed 600 kilometers, which is not achieved at the expense of performance: the P10 rear motor being developed by Polestar has a maximum power of 450 kW and is paired with dual motors, which can provide a maximum output of 650 kW and have a more compact power layout.

In comparison, the two benchmarks for pure electric performance cars, the Porsche Taycan and the Tesla Model S Plaid, have a peak power of 300 kW and 375 kW for the rear motor, respectively.

In addition to the powerful electric drive system, Polestar will also deploy an 800V ultra-high voltage platform and a 103 kWh ultra-high voltage battery pack in the field of three-electrics, which will support the model to complete 0-80% fast charging in 20 minutes.

It is worth mentioning that, in the current trend of “software-defined cars”, the Polestar models will also have the potential to improve power through software OTA updates.

Recently, Polestar 2 on sale has launched a high-performance upgrade software. After the car owner pays to upgrade on demand, the vehicle can get an additional 50 kW power upgrade.

This seems to also indicate that in the future, in addition to the popular “subscription services” for autonomous driving assistive features, paid software upgrades in the performance field will also become a trend for new electric vehicles.

In addition to the foundation laid by high-performance hard power, in terms of brand tonality, Polestar’s two key words that they want to bring to the consumers’ minds are: design and environmental protection.

Polestar claims to be a designer brand, due to having a top designer as CEO.

Polestar CEO, Thomas Ingenlath, graduated from the Royal College of Art (RCA) in the UK, and has held senior design management positions at Volvo car, Volkswagen Design Center, and other places.

He led the design of the new generation of Volvo car products, laying the foundation for Volvo’s current design language, including the well-known Volvo Concept XC Coupe and Volvo Concept Coupe.

And Polestar’s design genes, the cold and harsh winds blowing across the Scandinavian Peninsula, have already made people familiar with the Nordic minimalist design concept of cold colors, simplicity, and sharp lines.

As for environmental protection, the story of carbon neutrality has long been told by various car companies, and elements such as green energy and environmentally friendly materials are not absent from Polestar’s emphasis on environmental protection.

The interesting thing is that the currently most popular blockchain technology also appears in Polestar’s supply chain procurement system: tracking the mining source of battery raw materials through blockchain technology.

Friends familiar with battery technology know that the cobalt element in ternary lithium batteries has long been a moral controversy: not only is it expensive, but also because the global cobalt mining is concentrated in the Congo, local wars and abuse of child labor issues frequently appear in media reports.

This has also given rise to a popular topic in the battery industry in recent years: cobalt-free batteries.

While cobalt-free batteries have not yet been widely adopted, Polestar’s measures appear to be more practical: using blockchain technology to trace the origin of raw materials and ensure that the battery materials for every electric vehicle delivered to customers come from responsible supply chain procurement.

The Challenges of IPO in the US Market

To sum up, three new cars in three years, tenfold increase in annual sales, and benchmarking against Porsche are the flags set by Polestar for its 2.0 era.

To achieve this grand goal, of course, sufficient supplies and resources are needed.

In April of this year, Polestar raised USD 550 million, all from long-term capital investors, including Chongqing Chengxing Equity Investment Fund Partnership Enterprise (Limited Partnership), Zibo City Financial Holding Co., Ltd., Zibo High-tech Industrial Investment Co., Ltd., and South Korea’s SK Group.

In September, Polestar announced a merger agreement with Gores Guggenheim, Inc., and the two will go public on NASDAQ next year in the form of a Special Purpose Acquisition Company (SPAC), with the stock code “PSNY.”

In this merger and IPO process, Polestar will receive about USD 800 million in cash and USD 250 million in private equity funds, and the company’s valuation is estimated to be about USD 20 billion after going public.

In addition, Polestar’s investors include well-known names such as Li Shufu, chairman of Geely, and famous actor Leonardo DiCaprio.

However, all the plans for the future remain in beautiful imaginations. From the emerging domestic new forces that have already stood out in fierce competition, we can get a lesson:

Making good cars is just the first step, and the thousand-headed work of sales channels, marketing, service systems, and charging networks are indispensable boards for water buckets.

If the 1.0 era was just feeling one’s way, then for Polestar in the 2.0 era, in addition to new cars, the above work is indispensable.

If the 1.0 era was just feeling one’s way, then for Polestar in the 2.0 era, in addition to new cars, the above work is indispensable.

Although the global new energy vehicle market is thriving, competition among enterprises is becoming increasingly fierce. Moreover, Polestar has chosen the most difficult path for itself: to become a global luxury electric brand.

With high positioning, high product quality, and high sales volume, it seems good, but there are many internal contradictions. How will Polestar resolve these contradictions and achieve its ambitious goals in the 2.0 era?

Fortunately, the answer to the problem is not far from us.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.