New Energy Vehicles Sales in November Breaks 400,000

Yesterday, China Association of Automobile Manufacturers (CAAM) announced that wholesale sales of new energy vehicles reached 429,000 units in November, an increase of 17.9% compared to the previous month, which saw sales of 368,000. It is expected that battery production and sales will also experience growth in November.

As CAAM said, “New energy vehicles have demonstrated a strong differentiation trend from traditional fuel vehicles, achieving the effect of replacing fuel vehicles in the market and driving the acceleration of the automotive industry towards electrification.”

This means that after several years of development, the new energy sector has finally entered a new phase of growth.

So, how can suppliers take advantage of this opportunity?

Now, CATL (Contemporary Amperex Technology Co. Limited), formerly the power battery business unit of Great Wall Motor, which became an independent new energy technology company in February 2018, has come up with an answer.

Let’s first briefly understand CATL. It is a new energy technology company specializing in R&D, trial production, testing, assembly, mass production, and raw material production of automotive power batteries.

Yesterday, they held the second Battery Day in Changzhou.

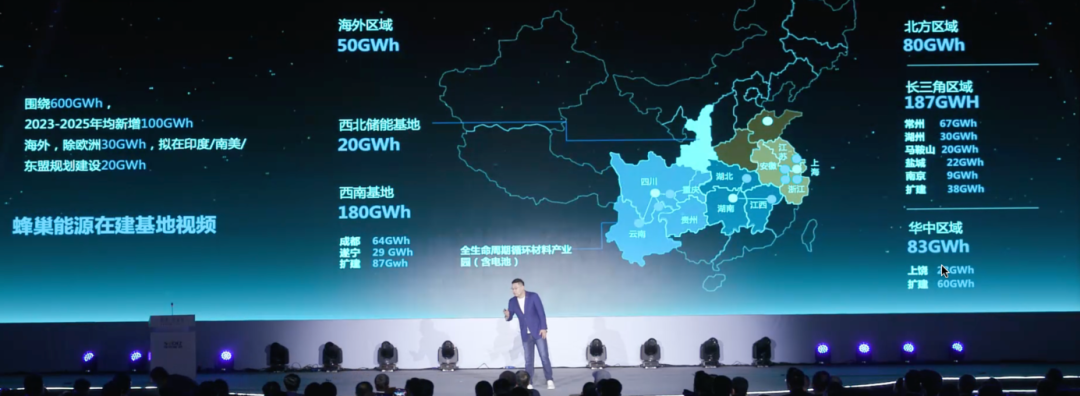

Global Production Capacity Target Raised to 600 GWh by 2025

When CATL obtained its Series A financing in February of this year, the plan given was “to achieve global production capacity of 200 GWh by 2025.”

After the Series B financing in July, CATL changed the wording to “the company’s production capacity is expected to exceed 200 GWh in 2025.”

Five months later, CATL increased its forecast threefold, to 600 GWh.

By 2025, the total demand for lithium batteries in the global transportation electrification and energy storage fields will exceed 1.8 TWh.

CATL aims to capture a 25% global market share (450 GWh), and with 75% capacity utilization, production capacity needs to reach 600 GWh.

According to CATL Chairman and CEO Robin Zeng, “In the next 5-10 years, whoever has the electric supply chain will dominate, and in the three-electric system with power batteries as the core, China already has a head start and must continue to maintain its leadership advantage and innovate technology while quickly increasing production capacity.”

Therefore, what Honeycomb needs to do now is to speed up factory construction, ramp up production lines, lay out industries, and iterate technologies.

Eight factories are under construction

In order to achieve a capacity of 600 GWh, Honeycomb is now pushing for capacity expansion at full speed.

Currently, Honeycomb has eight bases under construction (with a total capacity of 295 GWh):

Yangtze River Delta region (a total of 149 GWh): Changzhou 67 GWh, Huzhou 30 GWh, Ma’anshan 20 GWh, Yancheng 23 GWh, Nanjing 9 GWh;

Southwest region (a total of 93 GWh): Suining 29 GWh, Chengdu 64 GWh;

Central China region: Shangrao 23 GWh;

European region: Germany 30 GWh.

According to Honeycomb’s plan, the effective output of 600 GWh is approximately 450 GWh after disassembly, as follows:

-

340 GWh for passenger cars;

-

37 GWh for energy storage;

-

40 GWh for non-high speed cars;

-

37 GWh for commercial vehicles.

This actually means that in addition to its previous focus on passenger cars, Honeycomb Energy is beginning to explore new business lines.

And there’s more. Yang Hongxin revealed that in addition to building factories in Europe, Honeycomb is also planning battery factories in ASEAN, India, South America and North America.

“After this series of layouts is completed, Honeycomb Energy will evolve from a Chinese company to a globally renowned brand company.”

At this point, some may wonder if Honeycomb is blindly expanding.

Actually not.

Honeycomb’s installed capacity is increasing rapidly. In October of this year, Honeycomb Energy ranked seventh in domestic battery installed capacity, and its total installed capacity ranked seventh from January to October of this year.

Although there is still a gap compared to the top players like CATL and BYD, Honeycomb Energy still has great potential.

At present, FUTURECELL has obtained more than 30 sales designations from mainstream domestic and international automobile manufacturers, including Great Wall, Geely, Dongfeng, PSA, JAC, Jinkang, Skywell, and Leapmotor. 21 models loaded with FUTURECELL energy battery system have been announced. Among them, new models equipped with FUTURECELL’s cobalt-free energy battery, such as ORA Cherry Cat, are about to be put on the market in large scale production.

At present, FUTURECELL has obtained more than 30 sales designations from mainstream domestic and international automobile manufacturers, including Great Wall, Geely, Dongfeng, PSA, JAC, Jinkang, Skywell, and Leapmotor. 21 models loaded with FUTURECELL energy battery system have been announced. Among them, new models equipped with FUTURECELL’s cobalt-free energy battery, such as ORA Cherry Cat, are about to be put on the market in large scale production.

In addition, FUTURECELL has received a 16 billion yuan sales order from Stellantis, the fourth largest global automotive group (merged from the French PSA and the American Fiat Chrysler Automobiles). FUTURECELL has stated, “there will also be a European customer contract landing soon”.

Do you remember the 340GWh production capacity plan for passenger cars mentioned earlier? Yang Hongxin revealed, “we have received nearly 400 GWh of orders for 2025.”

It can be seen that orders are not lacking, and FUTURECELL has planned to expand production capacity.

Product and Technology Planning

After discussing the larger strategic level, we will need to talk about products. After all, “products are always the best spokesperson”.

FUTURECELL’s solution for the present and the future consists of: dagger batteries, jelly batteries, and a new generation of cobalt-free batteries.

Firstly, let’s talk about the dagger battery. This is a new type of battery that FUTURECELL has introduced, and they will mainly focus on the electrification of daggers. This includes whole-size dagger batteries from L300-L600, covering a universal charging range of 1.6-4C, and the usability in scenarios covering passenger cars, energy storage, commercial vehicles, construction machinery, and non-high-speed electric vehicles from the entire chemical system of cobalt-free, tri-element, and lithium iron phosphate.

Battery electric vehicle (BEV) field for passenger cars:

FUTURECELL Energy will launch two series of products, L600 LFP system, which can cover mainstream 500-600 km endurance models. Meanwhile, through jelly battery 0 heat loss technology, the L600 application field is expanded and the L600-NCM jelly system is able to achieve 800 km endurance.

Yang Hongxin revealed that the dagger battery can increase the energy density of battery volume by 30% and reduce the cost by 10%. “80% of passenger cars can use this L600 dagger, and zero heat loss can be achieved”.

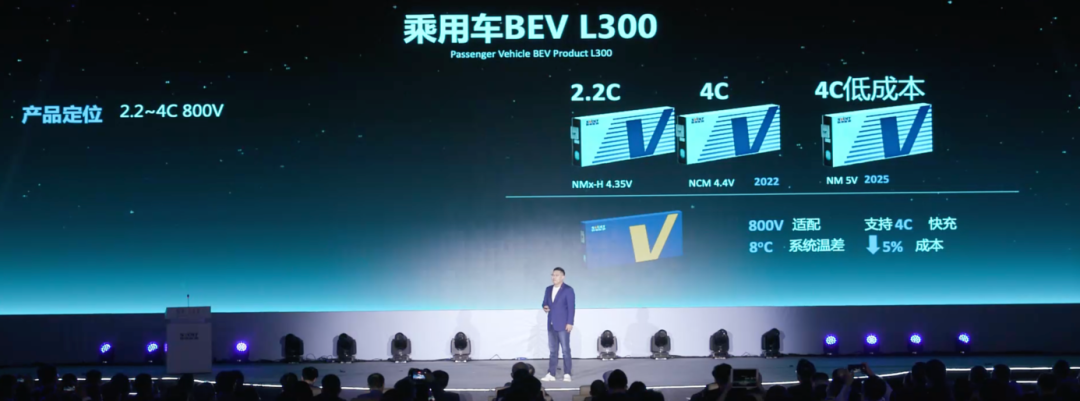

The L300 product is mainly targeted to the 2.2-4C fast charging system and is suitable for 800V high-end models. Currently, it is mainly composed of tri-element, but the low nickel, high manganese 5V spinel system can effectively improve safety and reduce costs in the future.

Currently, the second generation L600 short blade lithium iron phosphate battery from Hivenergy has been developed and is expected to achieve mass production in Q3 2022. The specifications of the Hivenergy second generation short blade lithium iron phosphate battery are the same as the first generation, but the single-cell capacity has been increased to 196 Ah, with an energy density exceeding 185 Wh/kg and a volume energy density exceeding 430 Wh/L.

In the field of PHEV passenger vehicles:

Hivenergy will launch the L400 series products that focus on PHEV long-range and low-cost (with a range of 150-200 kilometers) and adopt the LFP system that balances energy and power. This product will be mass-produced at the end of 2022, with a cost significantly lower than that of ternary materials and a 40% increase in space utilization.

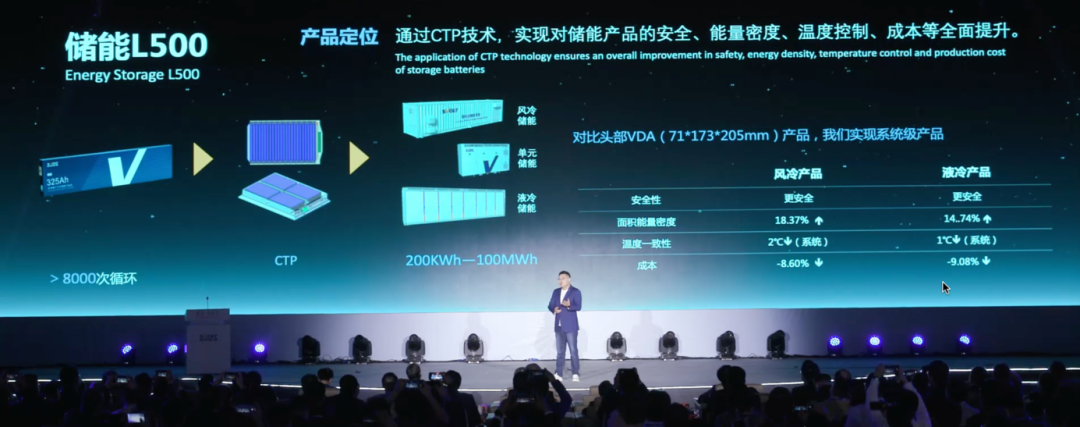

In the field of energy storage:

Hivenergy will launch the L500 series products to comprehensively improve the safety, energy density, temperature control, and cost of energy storage products through CTP technology.

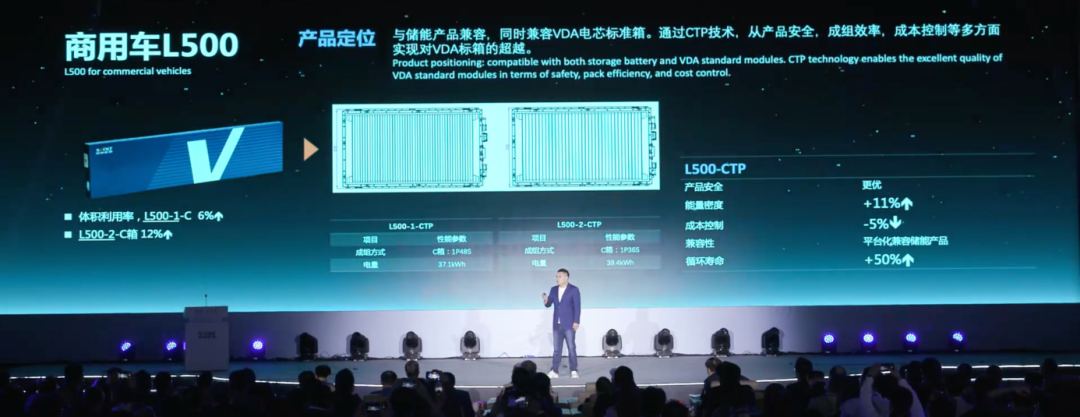

In the field of commercial vehicles:

Hivenergy will launch the L500 series products compatible with the VDA battery cell standard box. After blade shortening, the energy density can be increased by 11%, and the cost can be reduced by 5%. Moreover, it can also be produced in line with the energy storage production line.

In the field of non-high-speed vehicles:

Hivenergy will launch the L300 and L400, which share the mature LFP and cobalt-free E-platform systems of passenger vehicles and use the quality standards of the vehicle-grade to provide the non-high-speed electric vehicle field with a high-standard system solution with a price advantage.

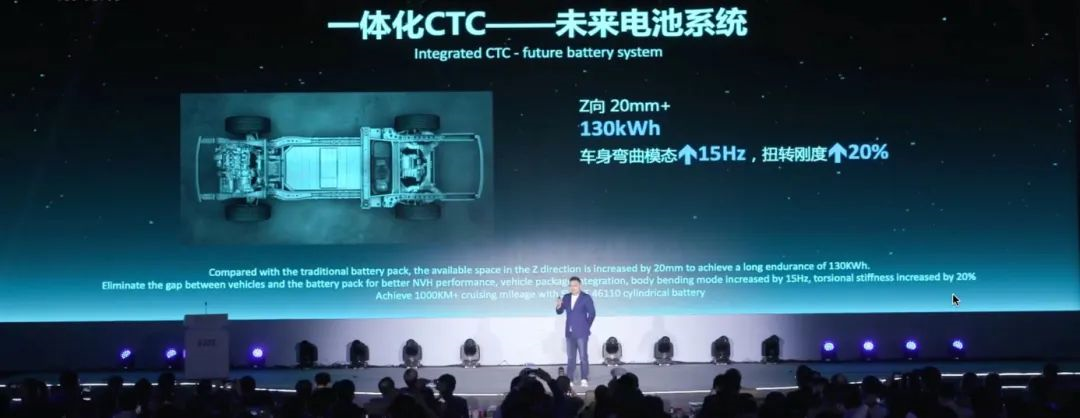

In addition to the above, Hivenergy is developing an integrated CTC battery system based on the short blade battery, which integrates the battery directly into the chassis and has a battery capacity of up to 130 kWh, supporting a range of 1000 kilometers.

In Q4 2022, CATL will release a ternary fast-charging battery with an energy density of up to 240 Wh/kg and supporting 4C charging rate. It only takes 10 minutes to charge from 20% to 80%, and the fast charging cycle can exceed 1300 times.

In Q4 2022, CATL will release a ternary fast-charging battery with an energy density of up to 240 Wh/kg and supporting 4C charging rate. It only takes 10 minutes to charge from 20% to 80%, and the fast charging cycle can exceed 1300 times.

At the same time, CATL is also working on gel batteries with ternary materials. They have passed the needle piercing experiment for not producing smoke or fire. However, CATL did not specify the time for mass production.

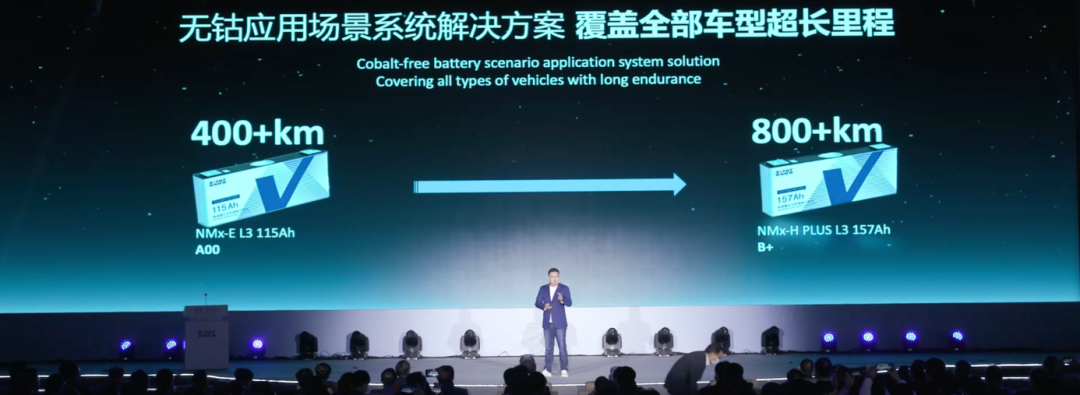

In July of this year, CATL launched its first cobalt-free battery with a capacity of 82 kWh, achieving over 600 km of mileage.

Yang Hongxin revealed that the next generation of cobalt-free batteries will support 800V architecture, achieving 800 km of mileage.

In addition, CATL is developing cobalt-free Super-5V batteries, which have a 40% increase in system energy density and a 30% reduction in system cost compared with lithium iron phosphate batteries. Currently, A-sample development has been completed.

CATL and Great Wall Motors have jointly developed the Dayu battery, which has been applied to 15 models, including nine ternary, three cobalt-free, and three lithium iron phosphate batteries. This technology will be fully applied to Great Wall Motors vehicles in 2022, with the first model being the Salon Mech Dragon.

In a word, CATL’s product layout in the battery field is quite extensive. In order to support the huge projects and technologies, CATL needs to create a powerful R&D system.

In the past few years, CATL has invested more than 5 billion yuan in R&D expenses. Yang Hongxin disclosed that in the next five years, it will invest another 25 billion yuan ($3.9 billion) in R&D, which is 5 billion yuan ($780 million) per year.

CATL will adopt a “1 headquarters + 10 R&D centers” layout plan to make the most of local resource advantages.

When it comes to talent, currently, Honeycomb Energy has 2,700 employees, with 1,800 of them engaged in basic research. Yang Hongxin stated that in the future, the R&D team would exceed 5,000 people.

When it comes to talent, currently, Honeycomb Energy has 2,700 employees, with 1,800 of them engaged in basic research. Yang Hongxin stated that in the future, the R&D team would exceed 5,000 people.

Catching the Wind

There is an ancient saying: “Build walls wide, accumulate grain slowly, become king gradually.” This sentence fits perfectly with Honeycomb Energy of today.

Industry experts predict that by 2030, the total demand for lithium batteries in the electric transportation and power storage sectors will exceed 7 TWh.

For power battery suppliers like Honeycomb Energy, this is an unmissable opportunity.

Lei Jun once said at a forum, “Standing at the windward side, even pigs can fly,” but in fact, there is a second half to this sentence: “Growing a small pair of wings can make you fly even higher.”

At present, what Honeycomb Energy is doing is to make its wings harder, in order to fly higher.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.