Body:

Word Count: 4,108

Estimated Reading Time: 15 minutes

This article was originally published by an investment firm called Holon Global Investments, written by Tim Davies in English. I spent two weekends reading it and personally found the logical thinking and factual presentation of the content to be quite complete and objective, which was very useful for me. So, I decided to translate it for myself to read again and share it with others.

The translation will adhere to the principle of being as close to the original text as possible. At the same time, since I also have some related but not necessarily mature thoughts and unscientific mathematical models, my personal opinions will be supplemented with italic text as a multi-angle reference for comparison. It is not an investment recommendation.

If you are interested in experiencing the original text, the link is provided: https://holon.investments/tesla-on-the-road-to-a-us-10-trillion-company-and-beyond/

It is necessary to emphasize again that the original intention of translating this article was purely for my own iterative learning process. I believe that more important than the conclusion is learning how to combine rationality and sensibility, and mastering the method of systematically understanding a company and its era. More important than numbers is trying to combine common sense to understand the logic and rationale behind the numbers. And this article is a good learning material for that purpose.

The full text, except for the abstract and conclusion, is divided into ten chapters:

(1) The global trend of electric vehicle electrification;

(2) How electric vehicles address the issue of greenhouse gas emissions;

(3) Tesla’s electric vehicle opportunity;

(4) Leading electric vehicle design and manufacturing;

(5) The arrival of autonomous driving in 2025;

(6) World-class energy infrastructure and storage solutions;

(7) Sharp rise in demand for raw materials;

(8) Elements of disruptive innovation;

(9) Surpassing competitors;

(10) Tesla’s financial and value projections.

Abstract

It is almost undeniable that investors and the market have divided into two extremes when it comes to how to view Tesla and its founder, Elon Musk. Some investors love Tesla so much that they pay attention to every tweet Musk posts and likes, like a kind of faith. Meanwhile, some investors, including Michael Burry (the prototype character in the movie “The Big Short”), believe that Tesla is “the biggest short opportunity in the world.”

In fact, Tesla is still one of the favorite stocks for short sellers to bet against even to this day. However, Tesla’s stock price rose by as much as 720% in 2020, hitting back hard against these criticisms and forcing many short sellers to retreat, even resulting in the forced liquidation of funds.But for many investors, one question remains: has Tesla’s stock price reached its peak or is its journey just beginning? Holon Global Investment (hereinafter referred to as “Holon”) believes that at the current price level, Tesla’s stock still has ample room for further growth, and is in a buying opportunity that is hard to come by in this era.

In the past 12 months, Holon has conducted a unique study to explore Tesla’s potential in depth, including establishing a global demand model with a time length of 30 years to better understand the thriving global transition from internal combustion engines (ICE) to electric vehicles (EV).

Combining Tesla’s advantage as a pioneer and manufacturer in the EV field with some disadvantages of its competitors, our conclusion is that Tesla’s valuation and stock price still have great room for further growth at the current level.

Based on Holon’s analysis, Tesla’s 30-year discounted cash flow (DCF) forecast model shows that Tesla’s value is approximately $3,369 per share today.

If Tesla can achieve our long-term financial forecast numbers, our DCF model shows that Tesla’s stock price will reach $6,244 per share in 2030 and further rise to $9,056 per share in 2040.

Investors who understand the conclusions drawn from this report can purchase and own what is likely to become the world’s largest company in the next 30 years. At the same time, they can also enjoy long-term excess investment returns.

-By 2050, policy orientation and developing countries will lead the demand for electric vehicles to exceed 206 million units-

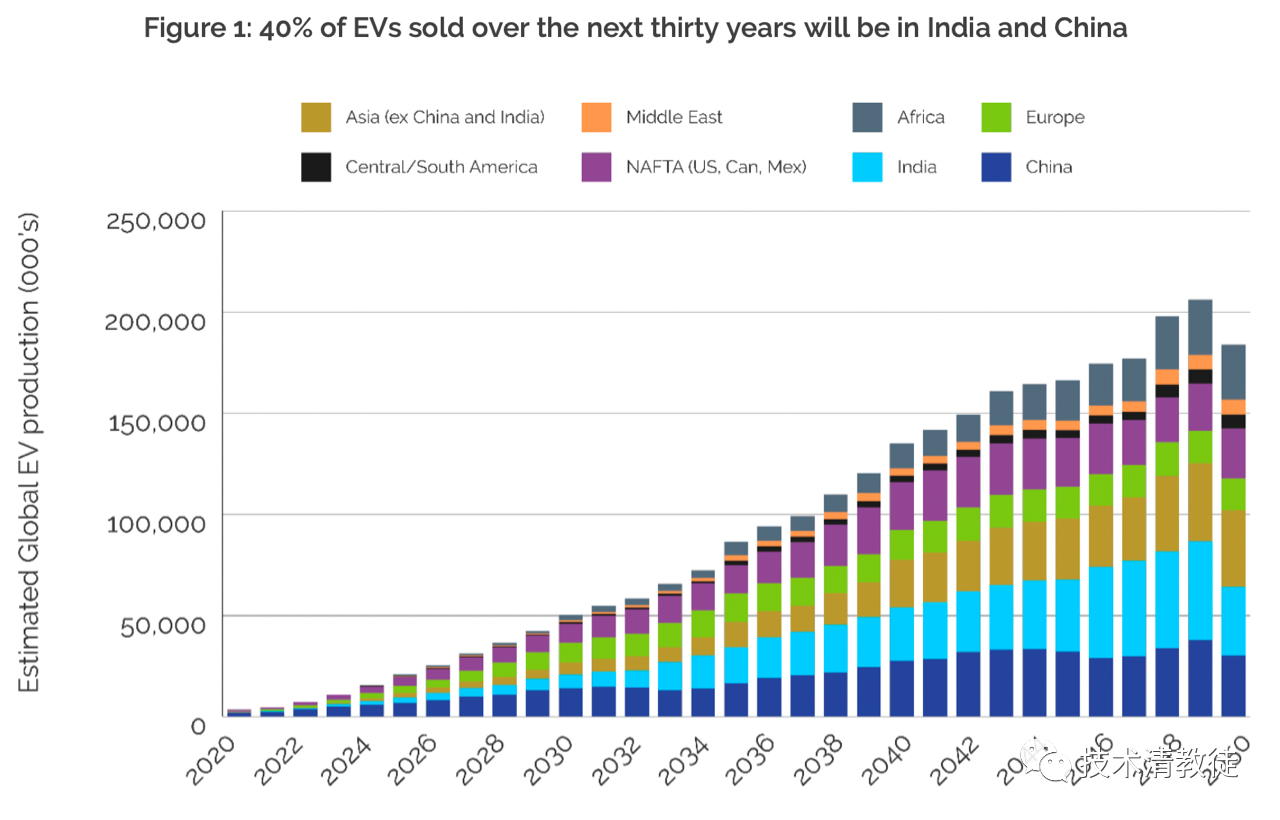

Holon believes that Tesla’s value will be fully reflected in the explosive growth of demand for electric vehicles in the next 30 years. According to our 30-year global demand model, Tesla will benefit from the rapidly growing demand for new cars. We expect that annual new car sales will reach 206 million units in 2050, which is twice that of 2021.

As countries’ governments limit greenhouse gas emissions, demand for electric vehicles will grow rapidly. We expect global governments to ban the sale of new gasoline-powered cars by 2040 (with European countries expected to implement the ban earlier, between 2030-2035). At the same time, with the elimination cycle, most regions of the world are expected to ban the use of gasoline-powered cars on the road by 2050 or earlier.

Demand from developing countries will also accelerate the growth of electric vehicle demand. Our research shows that 75% of the demand for electric vehicles in the next 30 years will come from developing countries. It is mainly expected that the increase in per capita disposable income in developing countries and the growth of population by about 40% will contribute to the first buying group of more than 1 billion people.# China and India are expected to contribute over 40% of global electric vehicle demand in 2050, with vehicle/total population penetration rates of 40% and 30% respectively (2020 vehicle/total population data: China 20%, India 2%, USA 80%, Europe 60%-80%).

Tesla’s early mover advantage over competitors will give it a 25% electric vehicle market share over the next 30 years

Tesla produced a total of 500,000 electric vehicles in 2020, giving it a significant early mover advantage over traditional automakers. Traditional automakers carry a massive and heavy net debt of around $900 billion and are still wavering in their commitment to shift towards electric vehicles.

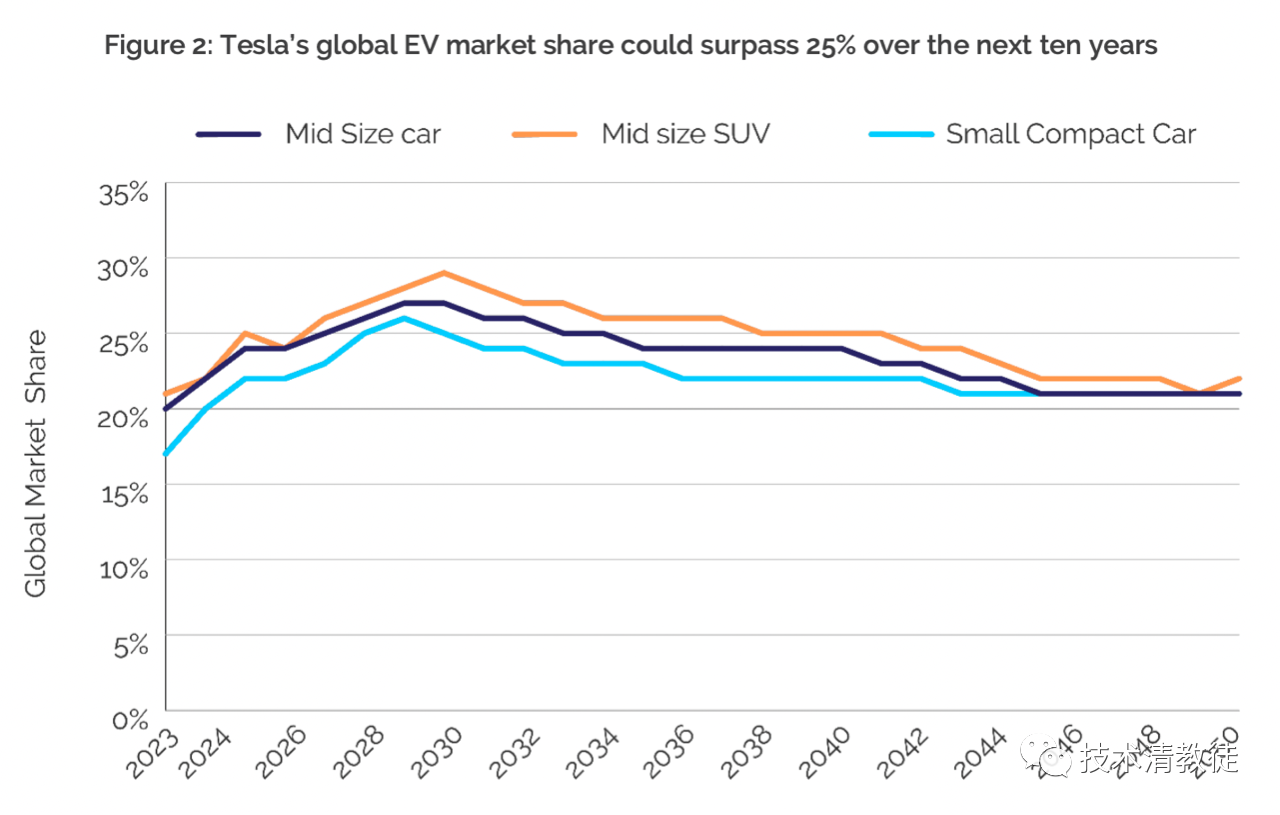

Holon believes that Tesla will be able to produce nearly 5.5 million vehicles annually by 2025 and will continue to hold 25% of the global electric vehicle market share over the next decade (see Figure 2).

Holon analyzed the competitive landscape in the electric vehicle field over the next few decades and believes that only a few companies have the financial strength and product line to challenge Tesla.

Tesla’s major manufacturing advantage over traditional auto manufacturers and its new electric vehicle brand will allow it to achieve higher profit margins and build a large cash reserve to continuously develop new technologies

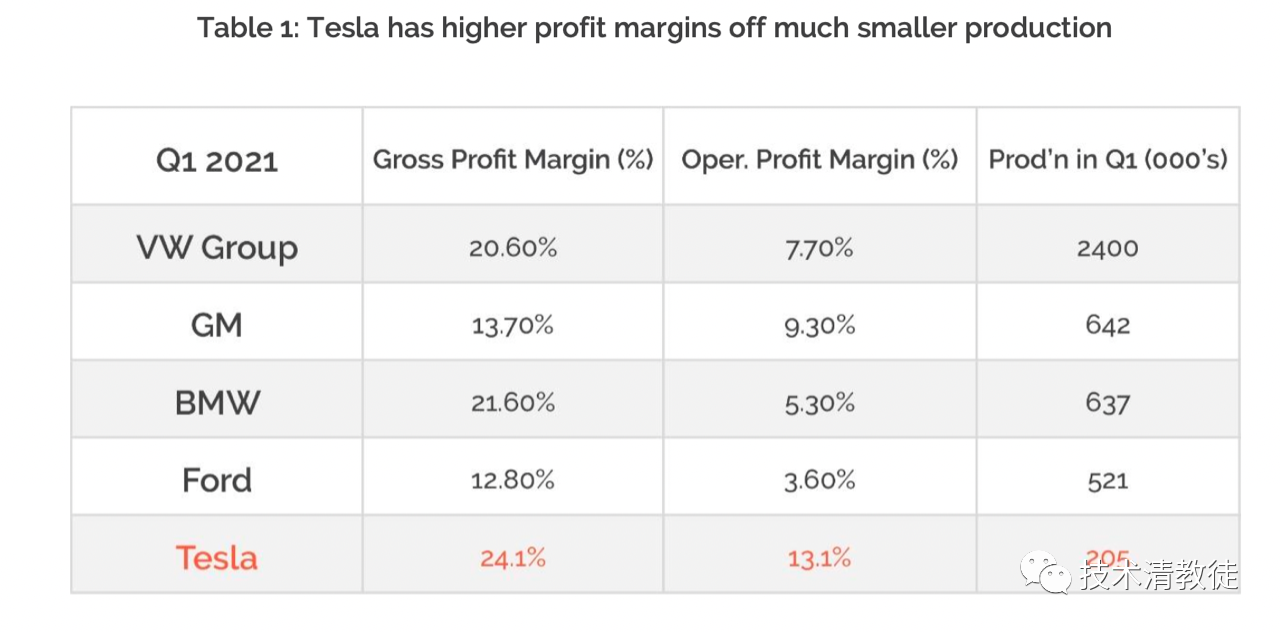

Only a few investors know how difficult it is to transition from producing gasoline-powered cars to producing electric vehicles. Tesla has highly automated the vehicle production process, which has resulted in a much higher gross profit margin for Tesla vehicles than for those of traditional automakers.

Tesla’s Q2 2021 gross margin rate of 24% has already exceeded that of many larger competitors. (see Table 1)

The Wright’s Law, which predicts that production costs will decrease by 15% when production volume doubles, suggests that Tesla’s gross margin rate will continue to increase over the next 30 years.In the field of autonomous driving, Tesla is also ahead of its competitors. While many voices in the market are criticizing Tesla for failing to achieve full self-driving (FSD) in 2020 as promised, Tesla remains the company with the fastest iteration of FSD, having collected over 5 billion miles of driving data as early as the beginning of 2020. Its closest competitor, Waymo (a subsidiary of Google), collected only 2 million miles of data in two years.

Thanks to Tesla’s huge net cash reserves and long-term investment portfolio, its net cash is expected to reach $118 billion by 2025 and $600 billion by 2030. This will enable Tesla to have sufficient budget to invest heavily in research and development, as well as to increase its production capacity flexibly, which may even result in producing more vehicles than the previously estimated 25% market share of Holon.

Tesla’s gross profit advantage and direct sales network (Internet style) also allow it to continuously reduce the price of electric vehicles and hence squeeze the profit margins of its competitors, as compared to the traditional dealer model used by traditional car manufacturers.

A vertically integrated energy production and storage solution gives Tesla a competitive edge over its competitors

Tesla’s vertically integrated and integrated energy production, storage, and transportation solutions are a huge competitive advantage over traditional car manufacturers.

As the cost of electricity generated by new solar panels drops to 1/5 of the cost of fossil fuels (coal), both power companies and homeowners can invest in solar energy and battery storage solutions and maintain a growth rate of 40%-50% over the next decade.

Using a typical four-person household in Sydney as an example, changing from grid electricity to solar power and battery power and buying an electric vehicle (charged with solar power) can save about AUD 70,000 after a 25-year discounted cash flow. This saved money can be used to buy another Tesla Model 3 to replace the first car (assuming a car life of 12 years).

Holon believes that this significant cost savings will accelerate demand for electric vehicles and energy products, which we predict will account for 30% of Tesla’s revenue in 2050.

Tesla’s cost reduction of lithium-ion batteries can greatly reduce the operating costs of electric vehicles.According to Holon’s analysis, the demand for battery raw materials in producing electric vehicles will significantly increase by 2030. The most critical supply bottleneck is likely to be lithium (which will grow by approximately 298% from 2019 to 2030), cobalt (145%), nickel (44%), and graphite (198%). Many mines that correspond to these raw materials have been discovered globally but have not been exploited. To maintain relative stability in raw material prices (as insufficient supply can easily lead to price imbalances), sufficient supply and a certain mining speed need to be maintained, which will require a substantial capital investment.

Tesla is researching how to redesign the lithium-ion battery production process. This will include replacing or adjusting the proportion of relatively expensive raw materials in existing lithium-ion batteries, such as cobalt and nickel. If successful, Tesla believes it can reduce battery costs by over 50% in the next three years, which will significantly reduce the life-cycle operating costs of electric vehicles and make them completely lose their cost advantage over gasoline-powered vehicles.

Tesla’s main competitors are suffering from massive debt burdens

There is currently more than $900 billion in net debt on the financial statements of global automakers. Of this, approximately 50%, or $450 billion, is direct loans from the German automotive giants (Volkswagen, BMW, and Daimler) to purchasing customers. This is done to maintain sales.

American automakers GM and Ford also have $230 billion in debt, while Japan’s Toyota has $150 billion in debt. Employee relief and pension obligations have become a heavy burden for these companies, and it takes a significant amount of cash flow to maintain these obligations. These will make it difficult for these companies’ remaining critical cash flows to support and accelerate capital expenditures related to the transition to electric vehicles.

Compared to American and European automakers, Chinese automakers are in strong financial conditions. China’s six major automakers together have nearly $20 billion in net cash on their books. Chinese automakers do not need to use a large amount of debt to meet the demands of the world’s largest automotive market (China’s car sales are 50% more than those of the United States), which is an impressive achievement. These companies are actually in a good financial position to face the future competition environment of electric vehicles.

Financial and Value Predictions

If Tesla achieves Holon’s growth predictions over the next few decades, we believe that Tesla will become the world’s largest company.

We expect Tesla’s electric vehicle production capacity to reach 34.2 million units/year by 2040. The total revenue from electric vehicle sales, software upgrades, vehicle services, and energy products will reach $2 trillion/year by 2039 and $3 trillion/year by 2047.Meanwhile, Holon expects that Tesla’s free cash flow will reach $500 billion per year in 2037 and surpass $1 trillion per year in 2047. This massive cash accumulation will provide Tesla with opportunities to develop new businesses beyond electric vehicles and energy industries.

Tesla can also use this cash for distributing dividends or initiating stock repurchases. At the moment, we choose to allocate 60%-70% of the free cash flow starting from 2028 to “long-term investments” and calculate it at an annual rate of return of 5%. By 2050, this portion of cash will increase to $10.5 trillion.

We calculated Tesla’s present discounted value (DCF) as $3,369 using cash flow discounting (DCF) method. This method calculated the net present value of Tesla’s cumulative net cash flow from 2020 to 2050. If Tesla can achieve our forecast, our DCF valuation will increase to $6,244 in 2030 and $9,056 in 2040.

Conclusion

In the past 12 months, Holon’s unique research focused primarily on the big transformation of global internal combustion engines (ICE) towards zero-emission electric vehicles (EV) over the next thirty years. We believe that Tesla has a first-mover advantage and financial strength, and no other competitor in the current automotive industry has similar advantages.

Holon’s cash flow discounting financial model yields $3,369, indicating that Tesla is undervalued. In conclusion, we believe that Tesla should be a core asset in any investment portfolio.

(to be continued)

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.