Author: Leng Zelin

In March 2004, the first DARPA Challenge was held in the Mojave Desert region of the United States, and no one expected that Google’s self-driving car project, Project Chauffeur, would be born from it.

Five years later, Google’s self-driving car project officially launched under the leadership of then-Vice President Thrun, who was also the leader of the championship team in the second DARPA Challenge and the runner-up team in the third. This project later became Waymo, a currently thriving company.

To impress investors, Waymo drew three circles for Robotaxi, freight trucks, and unmanned delivery vehicles, and the first two were seen as a lifeline by a domestic search company.

However, Waymo, which holds a pioneering position in the Robotaxi field, has been developing for more than ten years, with a global road test data of 32.19 million kilometers as of March 2021, but it is still too early to say that large-scale commercial operation is feasible.

Former Department Head of Intelligent Driving Products, Su Jing, also stated that she would never do Robotaxi. “Companies that are currently doing Robotaxi are going to fail. Robotaxi is an outcome, not a commercial ambition. The taxi experience in the Chinese market is already good enough, and autonomous driving will not make it any better.”

Robotaxi is roughly equivalent to intelligent + ride-hailing. Even if the experience has not been upgraded, no ride-hail company can claim to be profitable. There is reason to believe that even if Robotaxi commercialization has an accelerating trend and no longer burns oil, it still burns money.

Looks promising

This somewhat illusory track has become crowded, with various companies entering for different purposes. There are technology companies like Baidu and Waymo, travel service companies like Didi and Uber, and companies that provide autonomous driving solutions, like WeRide and Pony.ai. In addition, many automakers are also unwilling to lose their souls and face disintegration, such as Tesla and General Motors.

Different types of companies have joined, and three different sources of transportation and operating models have emerged. The first type chooses to purchase and operate their own vehicles, the second type borrows idle vehicles from car owners like Tesla, and the third type is a joint venture where technology companies provide the technology, automakers provide the vehicle, and travel service companies provide the operation.

Perhaps the high growth potential is the main reason why companies are flocking to this field. According to CICC’s forecast, Robotaxi’s global market space will exceed $2 trillion by 2030, greatly surpassing the market for ride-hail services.

The reason institutions give Robotaxi such a high valuation is mainly due to its ability to have operational capabilities surpassing those of ride-hail services.From the perspective of labor costs, the monthly labor cost of a single driver is about 8000 yuan, and the daily service time is limited. The driverless vehicles, on the other hand, eliminate the need for driver compensation and greatly improve the efficiency of single-car operation, achieving 24-hour continuous operation. In addition, drivers are prone to fatigue driving, whereas machines do not face such issues.

But is the reality really like this? An industry insider who has worked for several companies that adopt the Robotaxi model told Photon Planet that this commercial model may seem attractive, but it is likely to be unsustainable.

“The model itself loses money, and the larger the scale, the greater the loss, because the cost is already there. The cost of transforming a car, for example, exceeds the value of the vehicle itself.” The insider said, for example, Baidu previously announced that the cost of an unmanned vehicle was 480,000 yuan, plus a safety officer, the cost of this model is already frighteningly high.

The concept of driverless vehicles is good, but at present, canceling safety officers is a pseudo-proposition from a technological perspective, and there are endless long-tail scenarios that cannot guarantee that full automatic driving can solve all extreme situations.

In addition, the law can only allow fully unmanned driving on certain routes, and for users, it is also difficult to recognize this technology in a short period of time. Companies need to conduct a lot of market education, so the hope for large-scale promotion of Robtaxi in 3-5 years is relatively small.

Looking at the development of the capital market, before achieving profitability, all current ideas are just empty talks.

Investment is a bottomless pit.

The story of the Chu people buying spears and shields is very familiar. If the advantage of Robotaxi is the sharpest spear that hits the pain point of travel, then the difficulty of commercial realization is the most solid shield that hinders the further development of Robotaxi.

Is Didi’s moat in the technology field? No, for ride-hailing, the biggest moat lies in the number of registered drivers, which translates to the number of vehicles deployed for Robotaxi.

Ride-hailing and Robotaxi have some differences in their business models. Didi belongs to a light-asset model, where drivers use their own cars to pick up passengers, and Didi provides operational services. While Robotaxi requires companies to deploy a large number of driverless vehicles, which is a heavy-asset model and more like a shared bicycle form. Although the economy of scale brings about a decline in single-car cost, under a heavy-asset model, the larger the scale, the higher the operating costs.”We can take Robotaxi as a typical model of a two-sided platform economy. Without sufficient autonomous vehicles, the waiting time for users will be long, making it difficult to attract users to the platform. Conversely, without enough users, the layout cost is also very high. Therefore, it is essential to invest enough operational vehicles to have sufficient market competitiveness. Since Didi holds the majority of the ride-hailing market, autonomous driving is icing on the cake. If large-scale operations are not carried out, it can also serve as a supplement or high-end experience branch, while other companies are difficult to solve the problem of massive vehicle investment in the early stage.

Ignoring the decrease in unit cost, according to Baidu’s previously released cost of about 480,000 yuan for Apollo Moon, to achieve the head level of the ride-hailing market, the cost of investing in vehicles in the early stage is at the level of hundreds of billions, not including the apportionment of development costs in the early stage.

For autonomous driving, there are generally two approaches. One emphasizes the intelligence of single vehicles, such as Tesla, NIO, and XPeng Motors, which are all adopting this method to achieve intelligent driving, but mainly staying at the L2 level of automatic driving. The other requires involvement in road reconstruction to achieve vehicle-road coordination.

According to the information released by various companies, most of the companies doing Robotaxi can solve more than 90% of driving scenarios. Still, the remaining 10% or even 1% requires much more time and capital investment than the first 90%, and a large amount of data collection is still needed to improve.

This leads to the problem of “which came first, the chicken or the egg?” It is impossible to ensure safe driving without large-scale operation, and without scale, it is impossible to obtain the ability to collect a large amount of data to improve processing capabilities for the long-tail scenario(s), which means it is difficult to achieve commercialization in a short time.

In a previous video released by a Robotaxi company, we found that its speed during the driving process was slow, basically staying below 30 mph. In the game of missed calls (i.e., when two drivers each assume that the other will give way), autonomous vehicles cannot communicate via lights or language like ordinary drivers, nor can they make unconventional actions such as driving up onto the sidewalk.

There is no consensus on how many miles of road tests are needed to achieve L4-level automated driving. However, Li Shufu previously suggested that “10 billion kilometers” of testing are needed to prove the safety of autonomous driving. As of March this year, Waymo, the company with the longest global road test mileage, has only 32.19 million kilometers of data, with a completion rate of only 3%.

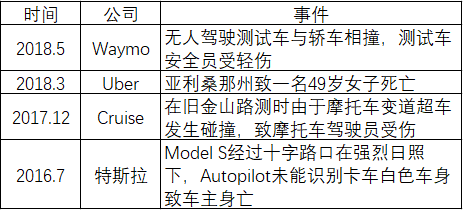

It is not easy to realize the level of intelligence in a single vehicle that is similar to that of a human being. Single-vehicle intelligence can always only process data according to the preset code, so there have been many security problems in recent years. A few examples are:”

Therefore, many companies are also seeking ways to achieve unmanned driving through car-road coordination, in order to balance the cost of automated driving suites with driving safety issues, which simply means transferring the cost of cars to road infrastructure. However, there are also difficulties that are difficult to solve, and large-scale road network upgrades are difficult for enterprises to complete on their own. Often, policy and regulatory support is needed, and the early stage is both costly and time-consuming.

Even if the laws are perfect, there are ethical issues that are difficult to solve. In the event of an emergency, should passenger safety or pedestrian safety be given priority? “Saving the bigger one and sacrificing the smaller one” seems to be not just a problem for men.

Looking for ammunition to survive

Just like making cars, autonomous driving is also an endurance race. Who has better technology and experience may not be the main issue that Robotaxis need to consider at this stage. Who can survive longer and raise more ammunition is the goal of various companies.

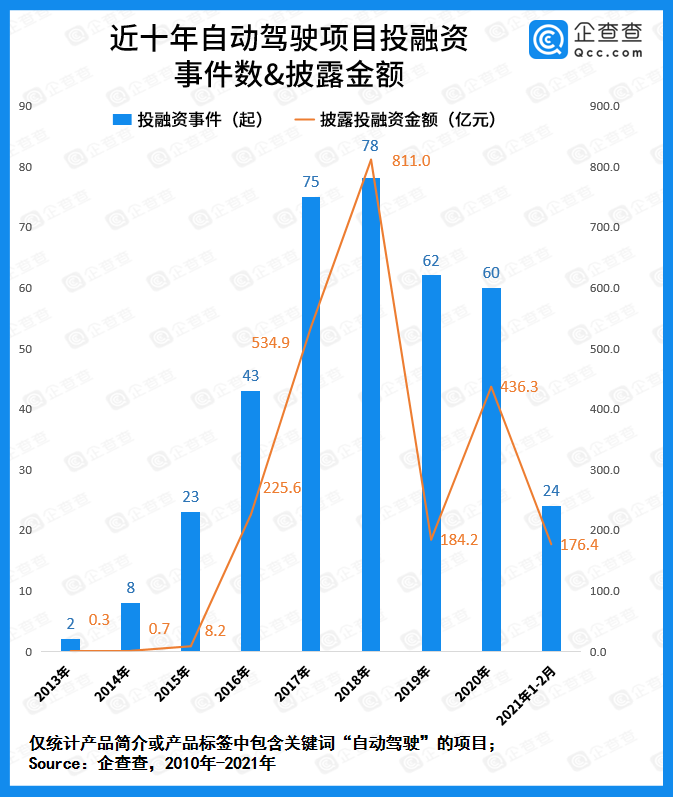

According to data from Qichacha, the financing peak of autonomous driving-related projects occurred in 2018, and after a year of coldness, it began to pick up.

Since this year, due to the obstruction of the US IPO, related companies have also begun to seek funding frequently.

Momenta has raised more than US $1 billion in two rounds of financing, Didi’s autonomous driving has completed two strategic financings totaling US $600 million, Wenyan Zhixing has completed B+ and C rounds of financing totaling US $420 million, and Pony.ai has also had two rounds of financing. According to reports, it plans to raise 500 million to 1 billion US dollars in the latest round of financing.

However, how long can Robotaxis survive in the face of burning money without the ability to generate income?

According to our statistics, Pony.ai has raised 8 rounds of financing, of which the disclosed financing amount exceeds US $1.1 billion. However, there have been significant recent changes internally, such as media reports that its car-making plan has stalled.

An industry insider analyzed that among the three commercial models of autonomous driving, commercial trucks in relatively closed scenes such as ports, mines, or trunk logistics are easier to land, but they are very To-B and it is difficult to win the favor of investors. So it’s understandable why Baidu always talks about “carrots running fast” and doesn’t mention their unmanned mining trucks in Inner Mongolia, as well as the truck new power brand, DeepWay, incubated by them.

Due to the high unit price of trucks themselves, if an automatic driving function can be installed with only two to three hundred thousand yuan for a truck that costs millions of yuan, it is more acceptable for enterprises. At the same time, there is also a shortage of truck drivers in China, and they often suffer from fatigue driving.But due to the limited inventory of trucks, the story ceiling in this field is low and its creative space may not satisfy the appetite of the capital market. Currently, institutions that are heavily investing are paying for their own beliefs, and it takes a long wait to obtain investment returns.

Just like VR or metaverse, people don’t deny that RoboTaxi may really come one day, but everyone knows it won’t come tomorrow or next year.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.