On November 29, 2021, Ideal Automotive released its 2021Q3 financial report, with the following highlights:

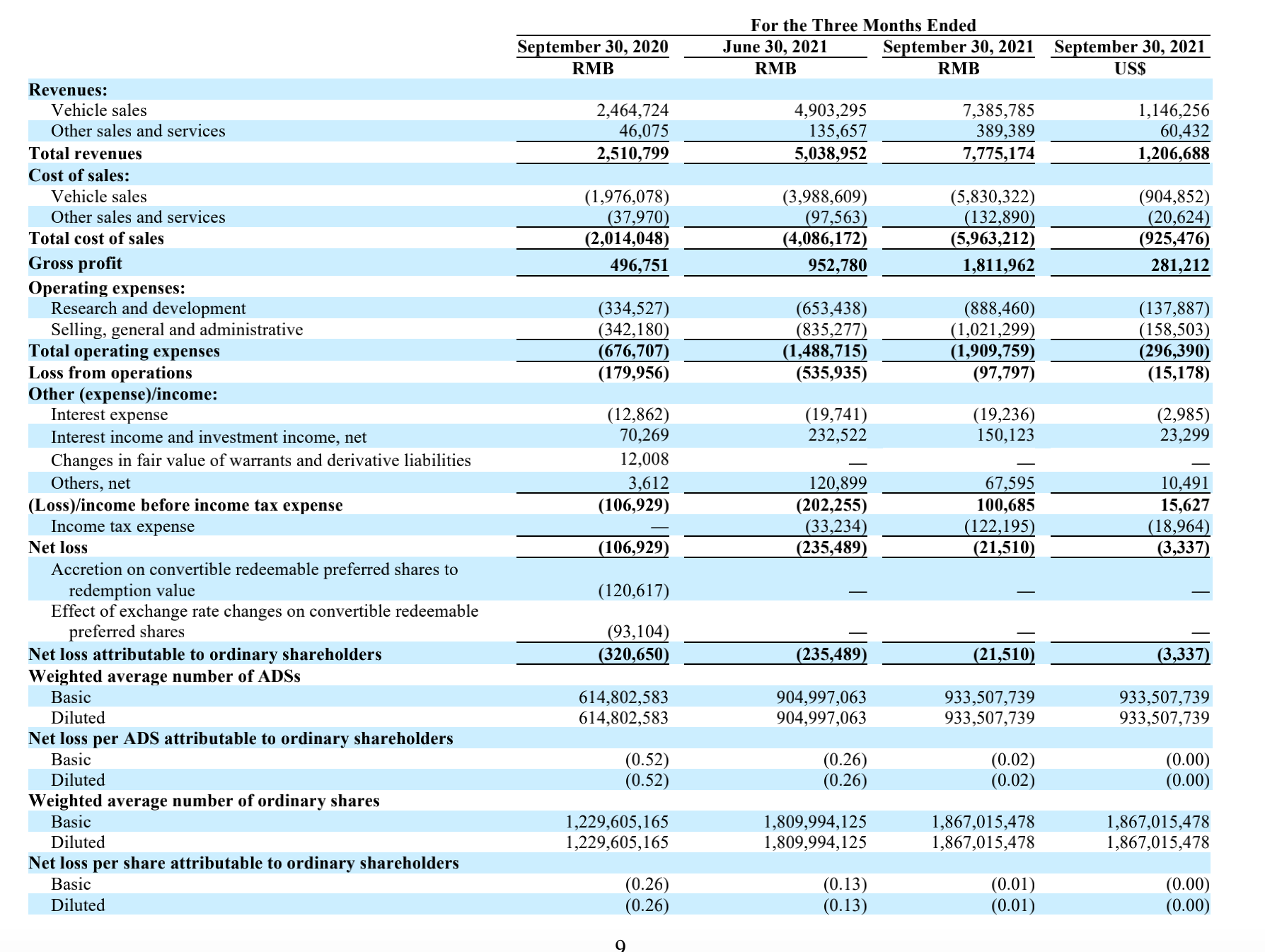

Delivery and Retail Data

In 2021Q3, Ideal delivered 25,116 vehicles, an increase of 42.9% compared to the previous quarter and a 190% increase year-over-year. The delivery data for the first two quarters of 2021 are as follows:

- In 2021Q1, Ideal delivered 12,579 vehicles

- In 2021Q2, Ideal delivered 17,575 vehicles

As of September 30, 2021, Ideal has 153 retail stores and 223 service centers in 85 cities across China. Ideal’s authorized body and spray center covers 165 cities throughout the country.

Ideal 2021Q3 Financial Data

- Total revenue was RMB 7.78 billion, an increase of 54.3% compared to 2021Q2’s RMB 5.04 billion.

- Automotive sales revenue was RMB 7.39 billion, an increase of 50.6% compared to 2021Q2’s RMB 4.90 billion. The increase in auto sales revenue was mainly due to an increase in delivery volume.

- Gross profit was RMB 1.81 billion, an increase of 90.2% compared to 2021Q2’s RMB 0.953 billion, and a 264.8% increase year-over-year.

- Vehicle gross margin was 21.1%, an increase from 18.7% in 2021Q2, mainly due to higher per-vehicle transaction prices of the 2021 Ideal ONE model.

- Overall gross margin was 23.3% (18.9% in 2021Q2), mainly due to an increase in vehicle gross margin.

- Sales cost was RMB 5.96 billion, an increase of 45.9% compared to 2021Q2’s RMB 4.09 billion, mainly due to an increase in vehicle delivery quantity.

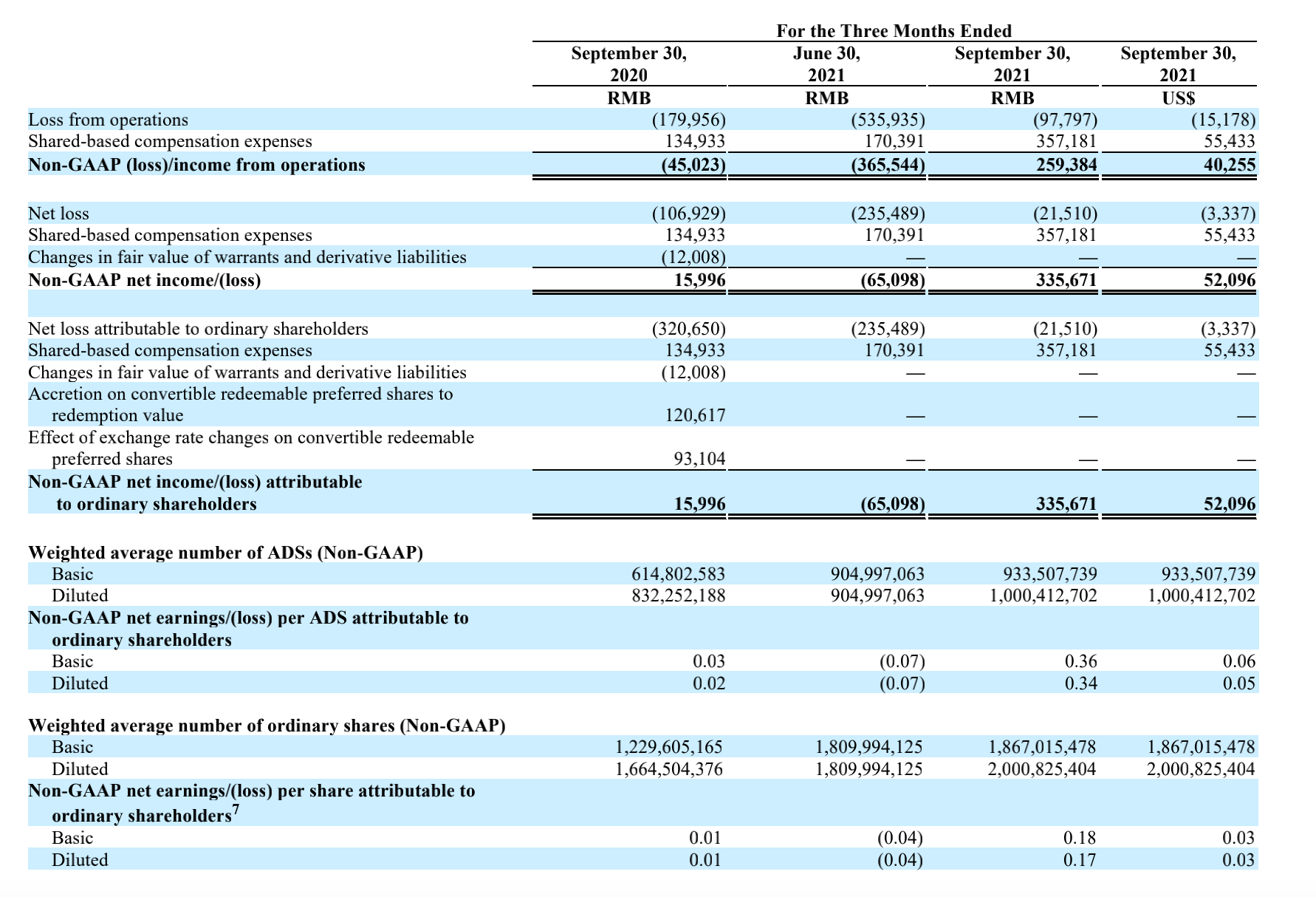

- Net loss was RMB 0.215 billion, a 90% reduction compared to a net loss of RMB 2.35 billion in 2021Q2.

- As of September 30, 2021, Ideal’s cash reserves (including cash and cash equivalents, restricted cash, and balances of deposits and short-term investments) totaled RMB 48.83 billion, up from RMB 36.53 billion in the second quarter.

- Ideal’s R&D expenses for Q3 2021 totaled RMB 8.885 billion, a 36.0% increase compared to RMB 6.534 billion in 2021Q2.Sales, general and administrative expenses were RMB 1.02 billion, an increase of 22.3% from RMB 835.3 million in Q2 2021, and an increase of 198.5% year-over-year.

Free cash flow was RMB 1.16 billion, an increase of 18.6% from RMB 0.9821 billion in Q2 2021, and an increase of 55.4% quarter-over-quarter.

Factory and production capacity status

Beijing factory: The Ideal Automobile announced in October 2021 that the Beijing factory will be officially put into production in 2023, producing luxury pure electric products under the company. The new plant will have high flexibility in production and can realize the production of four models on one line. The planned annual production capacity of the first phase is 100,000 units.

Changzhou factory: Ideal Automobile acquired 100% of the equity of the Changzhou factory in November 2021, increasing the company’s control over the Changzhou manufacturing base.

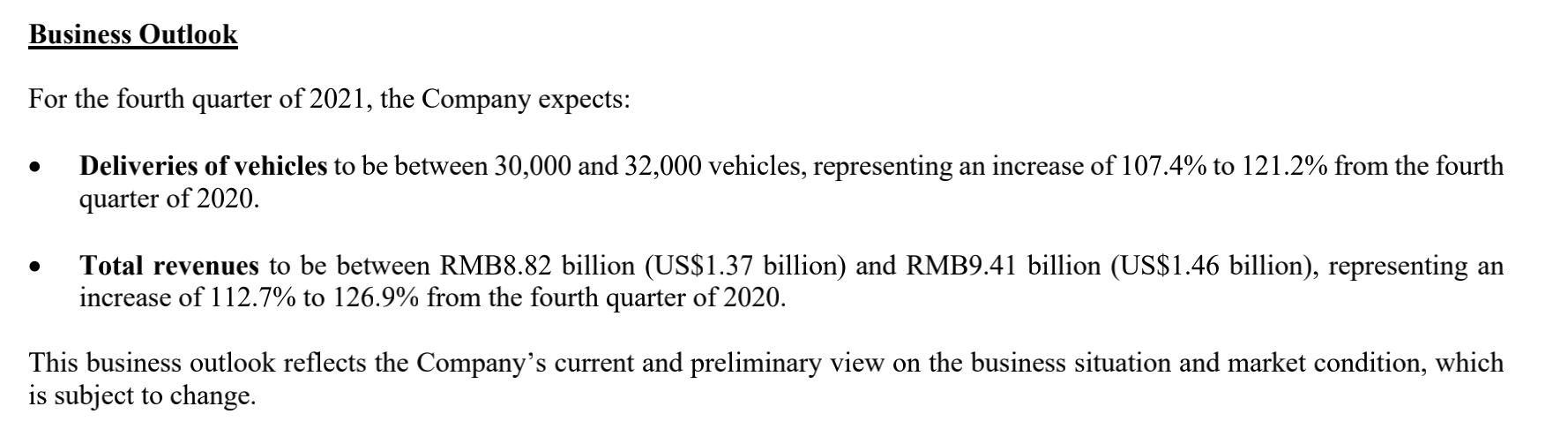

Business forecast for Q4 2021

Vehicle delivery: 30,000 to 32,000 vehicles, an increase of approximately 107.4% to 121.2% from Q4 2020.

Total revenue: RMB 8.82 to 9.41 billion, an increase of approximately 112.7% to 126.9% from Q4 2020.

Summary

Overall, the Q3 2021 financial report of Ideal Automobile meets expectations, with the sales growth brought by the 2021 Ideal ONE reflected in various financial data, also helping the company to set a new record for single-quarter deliveries, as well as higher unit transaction prices leading to higher unit and overall gross profit.

With the release of new vehicle models coming closer, R&D investment in Q3 has increased significantly. In addition, considering the delivery of 7,649 Ideal cars in October and the Q4 delivery guidance in the financial report, it can be estimated that the delivery volume of Ideal in November and December will be between 22,351 and 24,351.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.