Recently in our communication, there is an important turning point between 400V and 800V high-voltage platforms in the automotive industry. Two major changes have been highlighted in the battery requirements for fast charging rate and the full implementation of silicon carbide in inverters, OBCs, DC-DC, PTC, and electric compressors, which is the biggest point of transformation.

The theme of Wolfspeed’s investor conference on the 17th “Driving the transition from silicon to Silicon Carbide” has been uploaded to the knowledge planet on page 132. Here, I excerpt some interesting things for discussion.

Note: There is also valuable information in the quarterly meeting on October 27th.

1). Wolfspeed’s cooperation with General Motors:

Wolfspeed’s silicon carbide devices will provide General Motors with efficient electric vehicle drive systems for various models. My understanding is that General Motors will not only use SiC on 800V pickups but also on 400V pickups. According to Cree, the iteration speed here will be very fast by 2024.

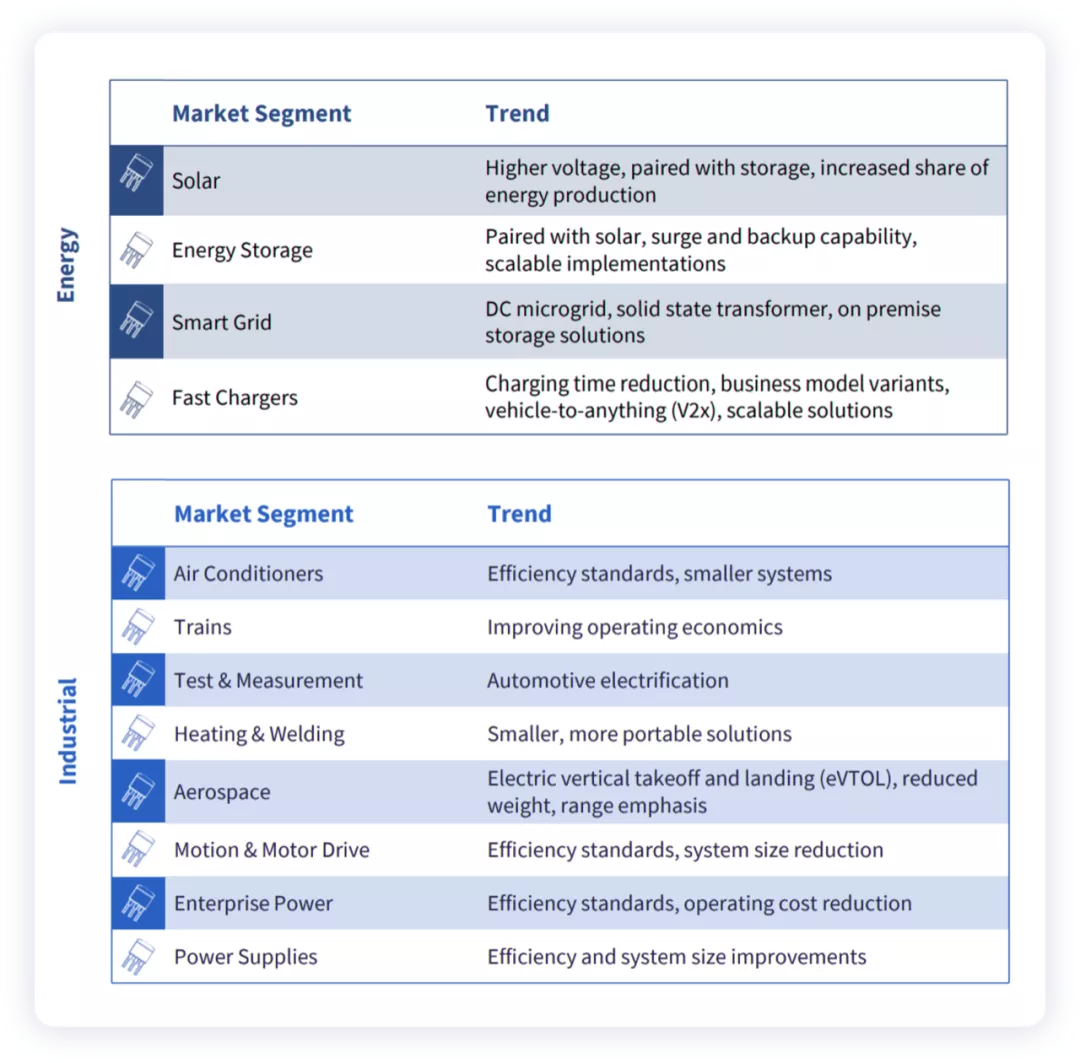

2). In addition to electric vehicles, are there other products like solar inverters, grid formation, grid inverters, and wind turbines?

Wolfspeed has over $18 billion in sales channels (over 8,200 projects), with most of them being automotive, but many are industrial applications, such as solar energy, charging equipment, and intelligent grids. From a broad industrial market perspective, many different terminal devices are turning to silicon carbide.

3). The bus voltage of electric vehicles includes 400v and 800v. Wolfspeed mainly offers 750V (for 400V applications) or 1200V (for 800V applications). Wolfspeed has found that many automotive customers are migrating and transitioning from 400v bus voltage to 800v bus voltage.

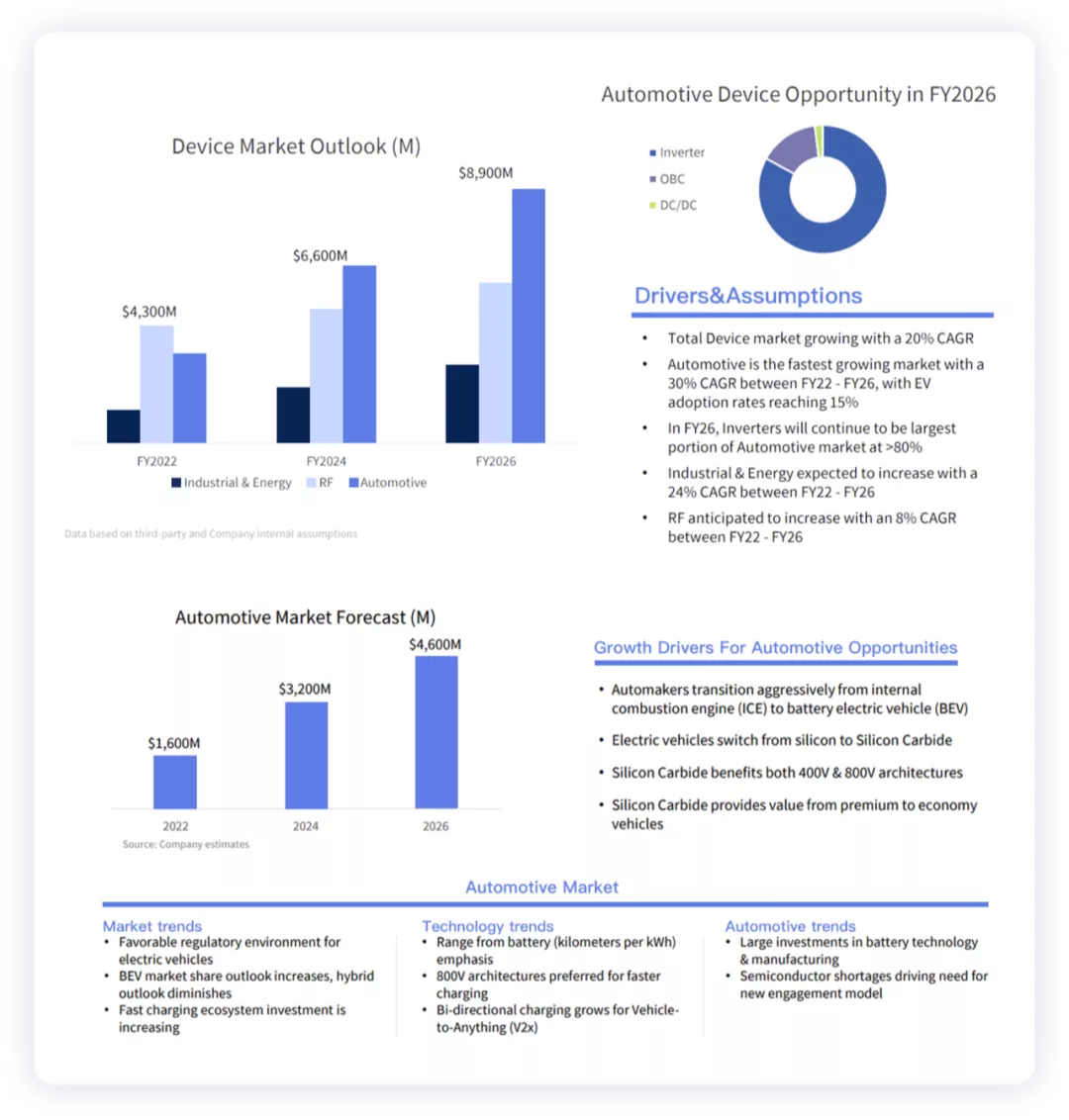

Market Forecast

The most important part of the investor conference is the market forecast. From WolfSpeed’s order and market growth expectations, the curve is steep. It is estimated that in 2022, there will be $1.6 billion, doubling to $3.2 billion in 2024 and $4.6 billion in 2026. Overall, the demand for inverters accounts for 80% (mainly due to higher power and concentration).

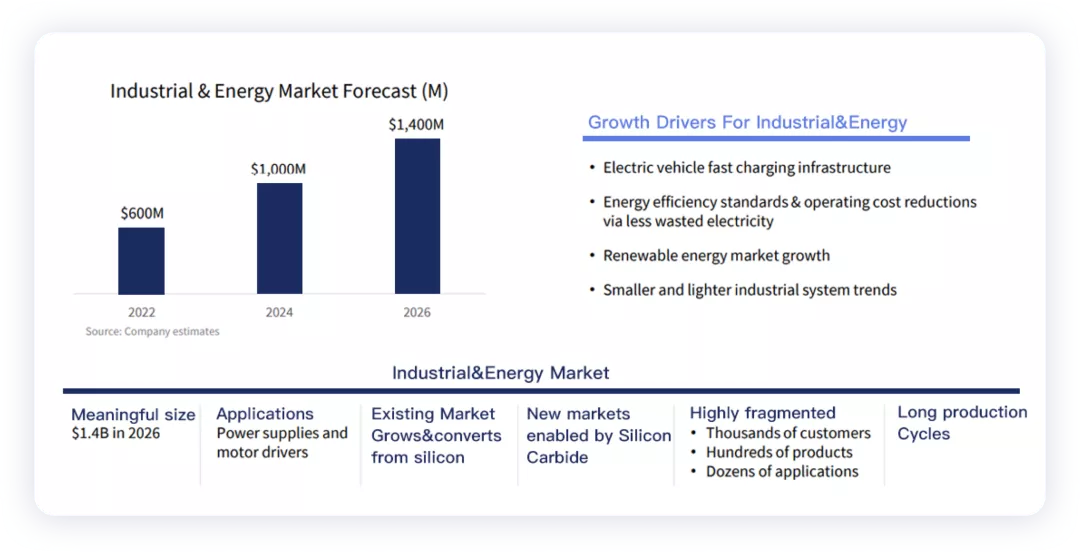

From the perspective of growth rate, the demand for SiC in charging infrastructure and renewable energy has also been continuously increasing, with an estimated value of $600 million in 2021, $1 billion in 2024, and $1.4 billion in 2026.

In this rapidly growing market, Chinese companies seem to have no presence in SiC wafer, with WolfSpeed being the main player (mostly signed deals with Tesla).

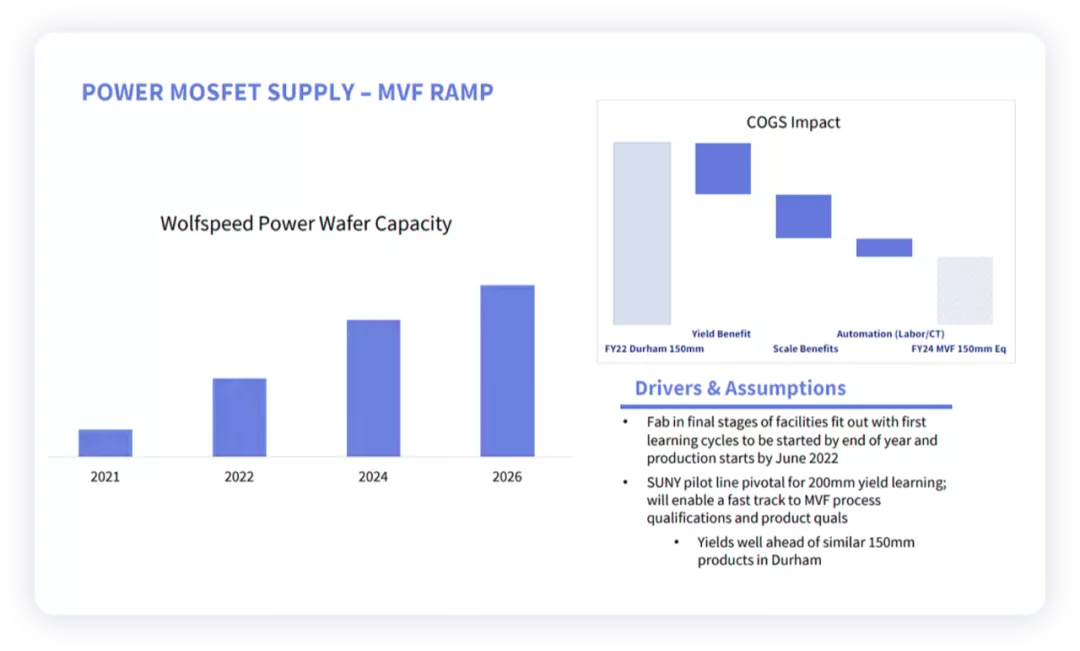

In response to this demand, WolfSpeed’s power wafer capacity is also rapidly increasing, and in this sense, the increase in demand drives the increase in capacity. SiC’s long-term cost has an expected value, and leading companies are constantly expanding their production capacity (estimated market share will also decline as funds are heavily invested).

Technical Overview

Due to time constraints, I have extracted what I feel is important. Xiao Guangshi used Cree’s chips to package SiC modules, and at present, it is relatively difficult for companies that want to use discrete packaging to make inverters. Most of them still need to be made into SiC modules. From the perspective of power density, SiC is indeed directly related to high power output.

#### Summary:

#### Summary:

I am currently at the auto show, I will update later. I will go through the Power Semiconductor thoroughly and provide a well-organized reference later.

Note: HTML tags retained for professional purposes.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.