The new energy vehicle subsidy policy is coming to an end

The influence of the new energy vehicle subsidy policy on the industry landscape is difficult to estimate. Looking back at the policy, it is clear that it has brought about a significant watershed for battery technology. The key factor is the requirement for energy density. The higher the energy density, the higher the subsidy.

As a result:

Before the policy’s requirement for energy density, lithium iron phosphate batteries were the mainstream in the market;

After the requirement for energy density, ternary batteries took absolute advantage;

After the policy’s substantial decline, lithium iron phosphate regained its dominant position and market share continues to grow.

The technical route switched back and forth from lithium iron phosphate to ternary.

The changes in the technical route have had a further impact on the overall market structure. In this process, some companies flourished while others missed opportunities.

One cannot help but wonder: If there had been no policy guidance on energy density, would ternary batteries still be the mainstream in the market? Will companies that stick to the lithium iron phosphate route have even greater market share than they have today?

Lithium iron phosphate regains dominance

It seems that lithium iron phosphate has once again surpassed ternary.

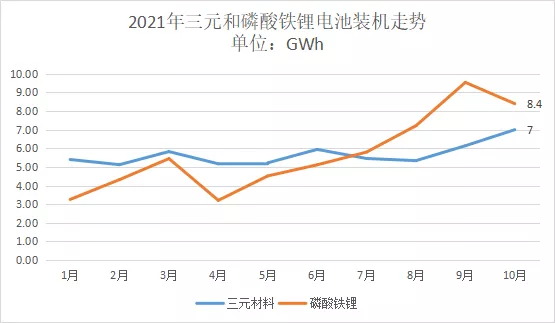

Since July 2021, the installed capacity of lithium iron phosphate batteries has once again exceeded that of ternary batteries, becoming the mainstream in the market. The gap between the two has been expanding month by month, from 0.34GWh in July to 3.4GWh in September. Although the gap is narrower in October, it is still over 1GWh.

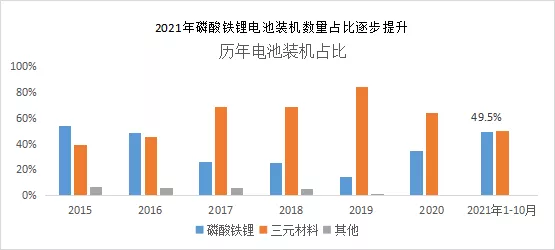

The reason for saying it has surpassed again is that lithium iron phosphate batteries were the mainstream of the market before 2017, occupying half of the market share.

(1) The rise of ternary batteries due to policy

From 2016 to 2017, with the deepening of electrification, passenger cars gradually became the main force for promoting new energy vehicles. In order to quickly open up the passenger car market sensitive to cruising range, the new energy vehicle subsidy policy proposed in 2016 for the first time a minimum threshold for battery energy density, and the subsidy amount increases as the density increases.The specific requirement for battery energy density at the time was: the mass energy density of the power battery system for pure electric passenger vehicles is not less than 90 Wh/kg, and those above 120 Wh/kg will receive a subsidy of 1.1 times. The energy density of the battery system for non-fast-charging pure electric buses needs to be higher than 85 Wh/kg. The mass energy density of the power battery system for special vehicle loading must not be less than 90 Wh/kg.

Also in that year, the dominant position of lithium iron phosphate batteries was shaken. At that time, the energy density of most lithium iron phosphate battery systems on the market was around 70-80 Wh/kg, and 90 Wh/kg was a relatively low threshold, which was achievable through improvement by most lithium iron phosphate batteries, but it was quite difficult to reach 120 Wh/kg.

The energy density of ternary lithium batteries is much higher, generally exceeding the threshold of 90 Wh/kg, and can reach 130 Wh/kg with good quality. This means that using ternary batteries is the first choice for obtaining higher subsidies.

This motivates automakers to switch to ternary batteries, even BYD, a faithful supporter of lithium iron phosphate batteries, has begun to switch to large-scale ternary batteries.

In 2017, the market for ternary and lithium iron phosphate batteries completely changed, and the market share of ternary batteries has far exceeded lithium iron phosphate batteries. After 2018, most of the new models launched by BYD used ternary battery technology.

(2) Subsidies decline, iron returns

This pattern continued until 2019 when the ternary battery installation quantity exceeded that of lithium iron phosphate batteries by more than two times.

However, the situation began to change again. On June 26, 2019, the national subsidy standard for new energy vehicles was reduced by about 50%, and local subsidies were withdrawn directly. The comprehensive subsidy decline in 2019 exceeded 70%.

The decline in subsidies greatly exceeded expectations. Even with the use of ternary batteries without raising prices, it is difficult to cover costs, so reducing costs has become the main goal of automakers. The fastest way to reduce costs is to switch batteries.

At the same time, lithium iron phosphate batteries at this time were no longer the same as they were initially – companies represented by CATL had already achieved an energy density of 210 Wh/kg, more than double the energy density; BYD also launched a blade battery, which improves the energy density of the battery system at the system level.

Driven by dual technological advances, the energy density of the lithium iron phosphate battery system is even higher than that of the ternary battery at the time.

In addition to the increase in energy density, vehicles equipped with high-nickel ternary batteries frequently caught fire, and the consecutive spontaneous combustion incidents touched sensitive nerves, leading to a wave of consumers demanding risk-reducing measures such as battery replacement and battery locking. This resulted in dissatisfaction with automakers and even lawsuits.

At this point, the high safety, low cost, and significantly improved system energy density of lithium iron phosphate batteries have become the natural choice for automakers.From 2019 onward, more and more car manufacturers have been applying for models with lithium iron phosphate batteries. In 2020, the number of models with lithium iron phosphate batteries increased significantly, along with a substantial increase in installation quantity.

Technological Advancements Alter Market Competitive Landscape

As technological advancements continue to reshape the market, some companies grow while others shrink or even drop out of the mainstream market.

Before 2016, BYD was the China-based company with the largest power battery shipments.

Prior to 2019, BYD had held the title of global new energy vehicle sales champion for four years in a row. BYD leveraged robust sales of new energy vehicles to clinch the championship consistently for years by relying on its own installed power battery capacity, and its main product was then lithium iron phosphate.

(1) With Subsidy Policies, CATL Rises to Prominence

In 2012, CATL secured the first large order from BMW, which was somewhat of a milestone for the company. To win the order, CATL studied the 800-page German production standard provided by BMW, and mastered the entire process from power battery research and development to design, development, certification, and testing. Two years later, CATL was again included in the list of suppliers for another pure electric vehicle, the BMW 530Le.

The company became a household name.

CATL did not choose the same technological path for different markets. It mainly chose higher-density ternary batteries in the field of passenger cars, where range was especially important, and primarily uses lithium iron phosphate batteries in the commercial vehicle sector.

This strategic move turned out to be fortuitous. After 2016, subsidy policies were introduced with energy density requirements, and it was difficult for lithium iron phosphate to meet the technical requirements. Ternary battery companies, represented by CATL, seized the opportunity to expand rapidly.

In 2017, CATL’s power battery supply covered 390 models and 64 suppliers. With the help of the subsidy policy, it rose rapidly to become the global leader in shipment volume, surpassing former champion BYD.

At the same time, other companies, such as EVE Energy and Funeng Technology, also rose rapidly with the wind of ternary batteries.

(2) BYD Loses Top Spot

BYD, which had been the leader in the lithium iron phosphate battery era, gradually fell off the TOP10 list.From 2015, BYD’s new models began to be equipped with ternary batteries to receive more subsidies. The mainstream models, Tang 100 PHEV, Qin 100 PHEV, Song EV300 and Qin EV300, launched in 2017 also adopt ternary batteries. Since 2018, BYD’s new models basically employ ternary battery technology.

However, one of the significant reasons why BYD’s ranking has fallen is not supplying batteries to other companies. After 2016, the growth rate of new energy vehicles has been rapid, with passenger cars becoming the main driving force. More and more passenger car companies have entered the market. BYD may maintain the champion sales of new energy vehicles but cannot change the trend of declining market share due to more competitors. Once enjoying the monopoly life as it did is gone forever.

At this time, the downside of self-supplied power batteries will be exposed, that is, the market share of power batteries is also declining with the decrease of its market share.

In 2017, there were only 2 companies among 78 models of BYD battery powered cars. Believing in the “vertical integration mode,” BYD did not open the supply of power batteries to the public before 2018, and only supplied new energy vehicles under its own brand, which gave Ningde Times plenty of developing space.

If BYD could quickly spin off its battery business and realize external supply, it would not be easy for Ningde Times to raise its market share.

It can be seen that policies have brought about the redistribution of market cake. Ningde Times seized the opportunity of ternary batteries development quickly through the experience and endorsement of BMW, achieving a leapfrog growth.

To adapt to market development, companies such as BYD, Lishen, and Guoxuan High-tech, which previously focused on lithium iron phosphate batteries, have all launched strategies for both lithium iron phosphate and ternary battery.

The facts have proved that the two-line strategy is correct. Because Ningde Times has sufficient technology reserves and catches the opportunity of ternary batteries, its dominant position remains unshaken even after the return of lithium iron phosphate battery technology.

In addition, although Japanese and Korean companies have already laid out the ternary battery technology route, the regulatory authorities have also implemented the power battery white list system, essentially excluding foreign power batteries from subsidy policies, ensuring that domestic power batteries benefit from subsidy policies. After the return of lithium iron phosphate, many Japanese and Korean power battery companies have also announced the launch of lithium iron phosphate power batteries.

Therefore, we cannot help but think: if there were no energy density requirements in the subsidy policy, would there still be the technological change of lithium iron phosphate and ternary battery routes, as well as the change of market status of battery companies?The pursuit of battery energy density by the automotive industry is eternal. If the progress of lithium iron phosphate battery technology cannot keep up with market demand, ternary batteries may once again become mainstream, or perhaps there will be new batteries as alternatives. So how should the new energy vehicle policy choose in the future?

One thing is clear, the policy should still take a technology-neutral attitude and let the market decide the technical route.

Tesla’s power battery route choice is quite inspiring: at first, it used cobalt acid lithium, later switched to ternary, and now, the entry-level and economical models are basically switched to lithium iron phosphate, while high-end models remain ternary. Tesla’s supplier for lithium iron phosphate is CATL, and the rumored next entry-level model is BYD’s lithium iron phosphate battery.

Tesla’s choice is completely the enterprise’s own free choice. The low cost, high safety, and relatively acceptable energy density of lithium iron phosphate make it an important battery route.

There is no “if” in history. As Zhang Ruimin, chairman of the Haier Group, said, “There are no successful companies, only companies of the times.” In the progress of the times, what companies can do is to go with the flow, seize opportunities, and react quickly, only in this way can they stand undefeated.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.