Translation:

Article by Winslow Zhou

Introduction:

Word count: 597

Estimated Reading Time: 3 minutes

Future of Tesla: A Vertically Integrated Automotive, Energy, and Transportation Technology Company

Thus far, we have analyzed the business and value of Tesla’s manufacturing, supercharging, and smart/autonomous driving sectors.

Assuming Tesla can achieve its goal of selling 18 million vehicles per year by 2031 or earlier, the company’s net profit for 2031 will be close to the following figures (in fact, Elon Musk’s goal is to sell 20 million vehicles per year by 2030, which is also Tesla’s official goal):

- Manufacturing sector: $129.6 billion

- Supercharging sector: $22.8 billion

- Smart/autonomous driving sector: $35.1 billion / $552.9 billion

Tesla’s net profit for this year is expected to be around $6 billion, which means it will increase to $187.5 billion in ten years (when considering commercial autonomous driving), with a compound annual growth rate of 41%.

If we consider commercial autonomous driving, Tesla’s net profit in ten years will be $705.3 billion, with a compound annual growth rate of 61%.

This power of compound interest exhibits the notion that a 20% difference each year results in a nearly quadruple difference after ten years, demonstrating the strength of gradual improvement.

If Tesla has a net profit of $187.5 billion in 2031, what would its corresponding valuation be?

The estimation of a company’s value in the capital market has many methods. Here, we only use one method: PEG ratio, which refers to the ratio of PE/Growth. The PEG ratio for large technology companies is maintained at around 2.0, therefore we also take 2.0 as a calculate basis.

The calculation shows that the market capitalization in ten years will be: $187.5 x (41 x 2.0) = $15.375 trillion.

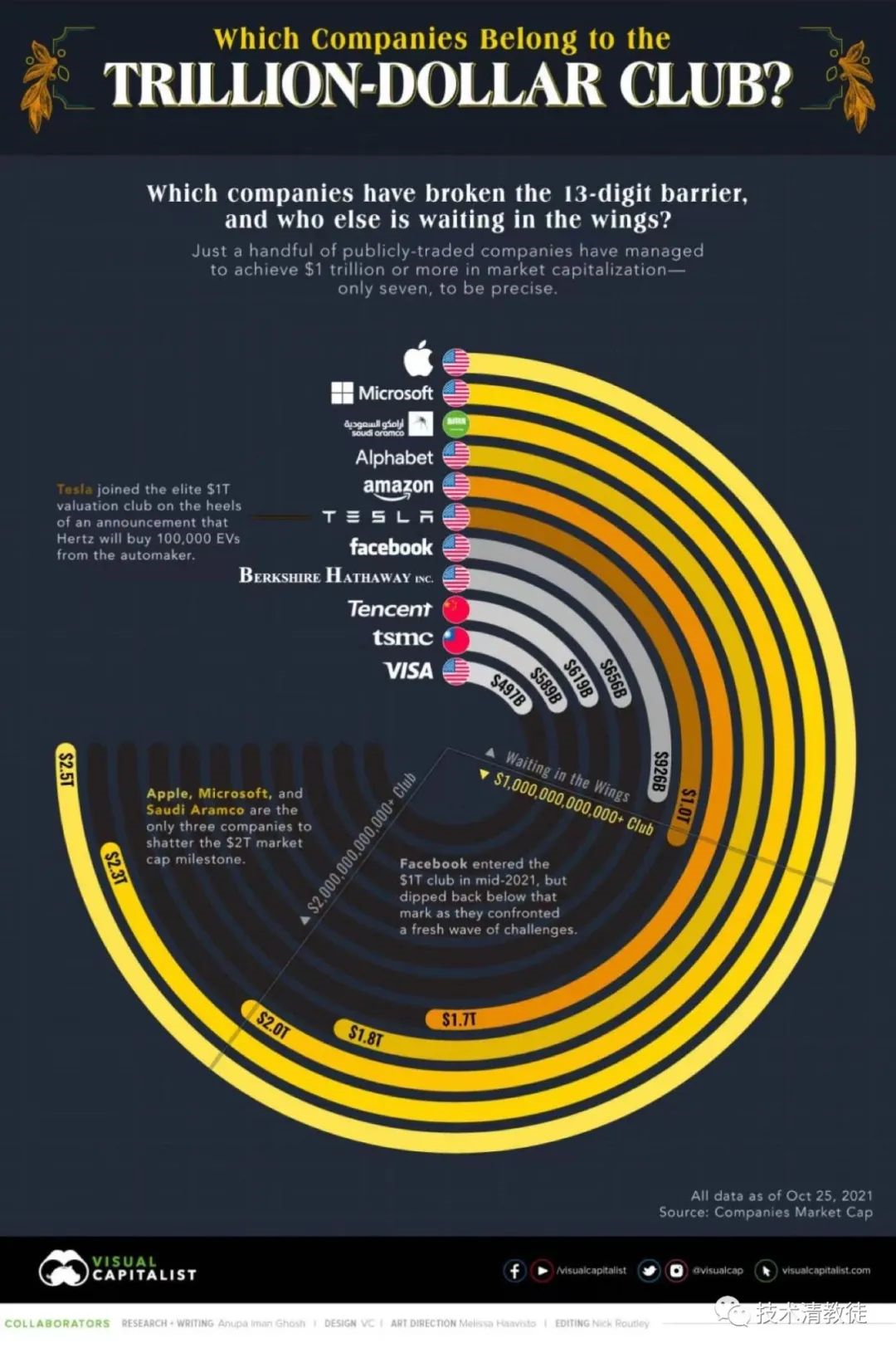

It is worth noting that Tesla’s current stock price, which appears to be already sky-high, is just over $1 trillion.

What if we add commercial autonomous driving into the equation? The result will be $705.3 x (61 x 2) = $86.0466 trillion.

Here, we only provide a way of thinking, encouraging readers to understand the numbers, respect common sense, and think independently.

In the following sections, we will discuss each sector’s net profit and its corresponding pros and cons based on our knowledge of Tesla.

(to be continued)

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.