Doing data analysis is when I feel happiest, as I can predict the market trend based on the latest data.

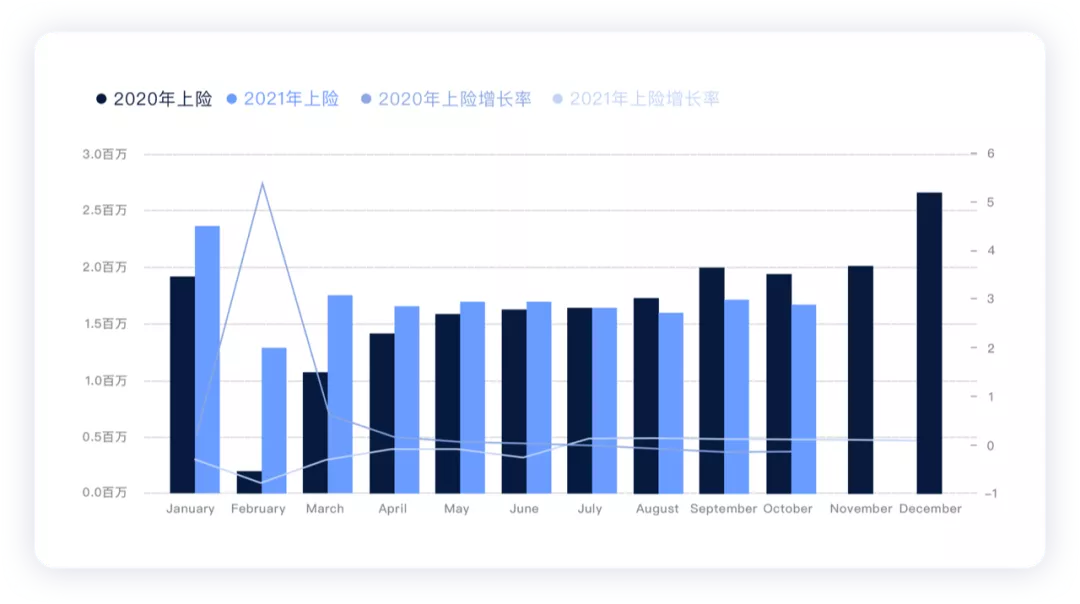

From the current situation, the shortage of chips has a significant impact on delivery. According to the data provided by the First Automotive Works (Qinghui + Yitong) team, the on-risk data for passenger cars in October was 1.6766 million units, a year-on-year decrease of 13.4% and a continuous three-month decline.

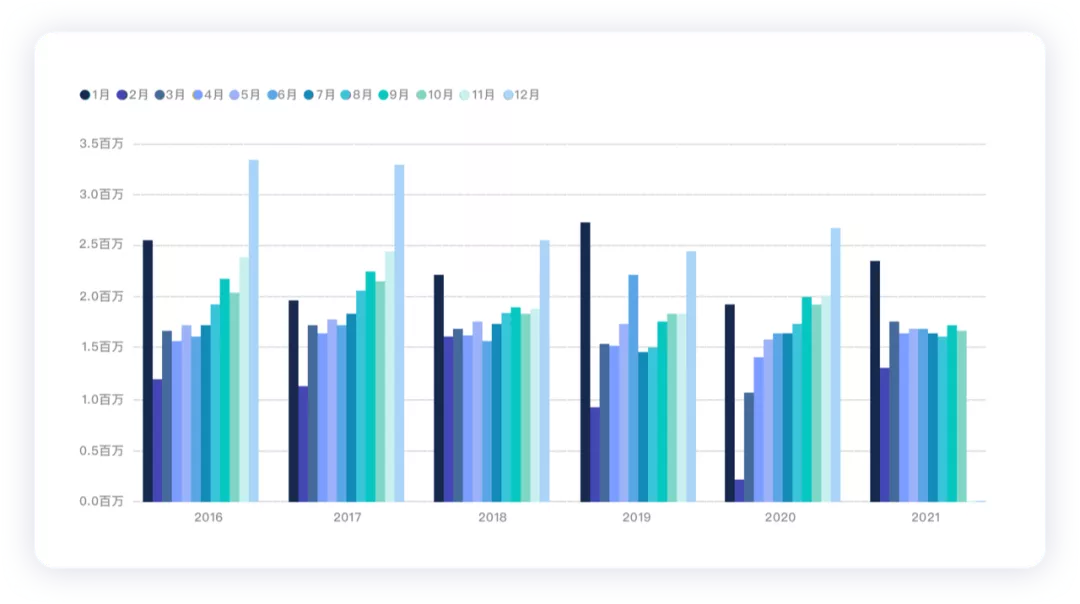

From the impact of GDP and various aspects, the automotive industry will continue to produce more vehicles (according to the China Association of Automobile Manufacturers, passenger car production and sales in October were 1.988 million and 2.007 million respectively). However, it is difficult to deliver these vehicles to end-users. 2021 will be an exceptional year compared to the previous five years.

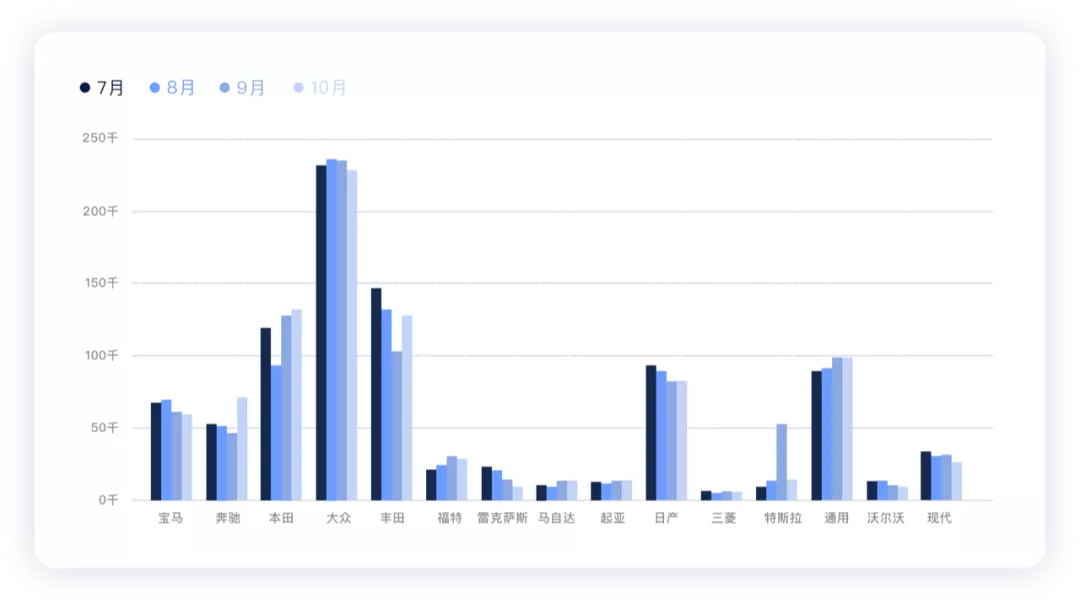

Situation for Major Car Companies

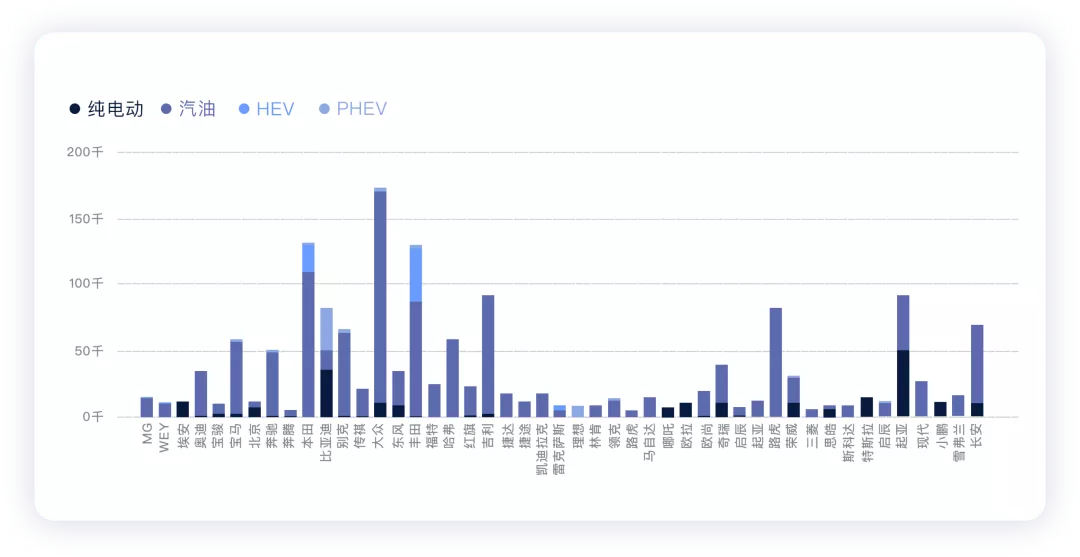

At present, the chip shortage still affects the operation of joint venture companies, and as shown in the figure below, the data of major joint venture car companies has been limited for the past four months.

● Volkswagen: The data for the past four months, including the Audi brand, fluctuate around 220,000–230,000, which is actually quite low.

● General Motors and Nissan: Both are stuck at around 100,000 units.

● Toyota and Honda: Both Japanese companies are also stuck at around 120,000 units, and Lexus has been declining all the way due to a lack of chips in Japan.

● BMW and Mercedes-Benz: Luxury car manufacturers are also struggling with the current chip shortage, and their sales have fluctuated between 50,000 and 70,000 units.

In my opinion, it will be difficult for joint venture companies to make significant progress in the next 2-3 years.

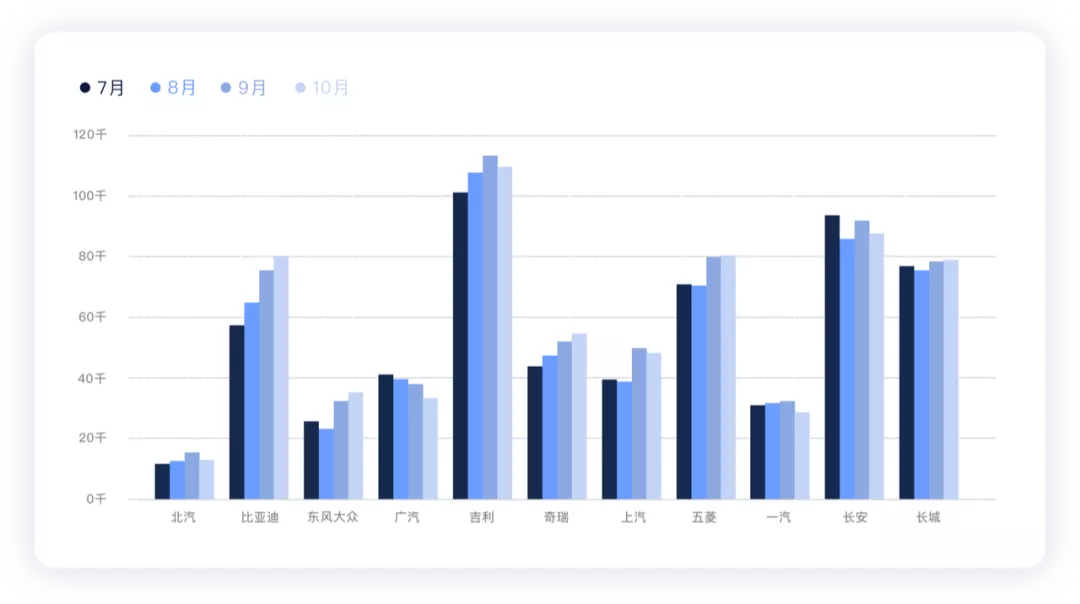

As shown in the figure below, independent brands have also experienced a round of differentiation. The number of brands we need to focus on is actually limited. BYD is the only one that has been steadily increasing over the past four months. At present, monthly sales of 80,000 to 100,000 units include Geely, Great Wall, Changan, BYD, and Wuling. With the differentiation next year, the order of these five companies will also change significantly.

The classification of these many cars into gasoline and electric vehicles is also a huge challenge.

“`

“`

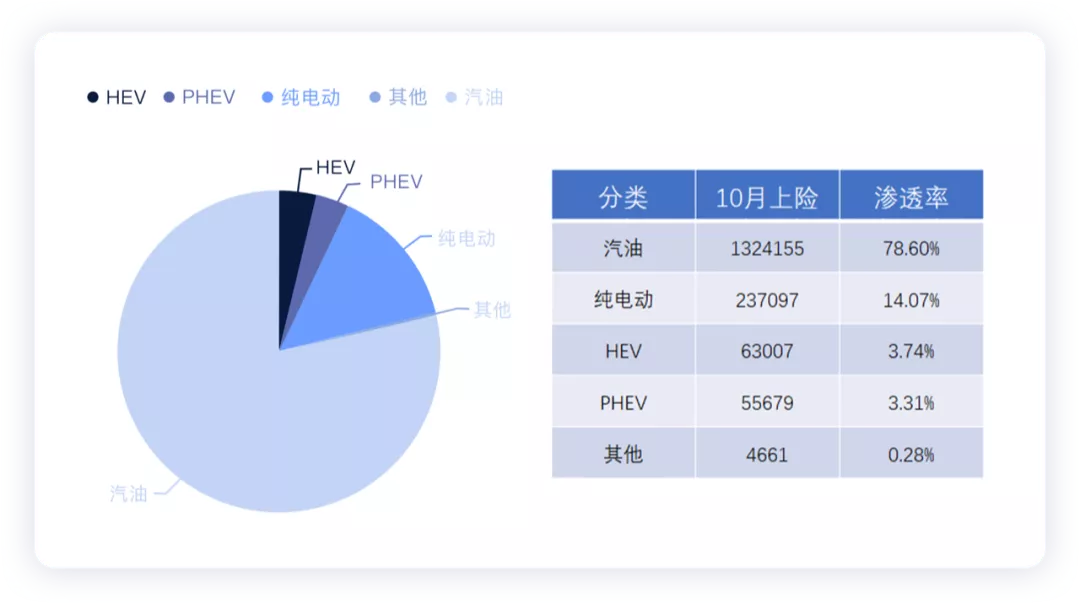

In terms of penetration rate, I have made a table. The penetration rate of BEVs is 14%, and the penetration rate of PHEVs is 3.31%.

If we look at the situation of each brand, the following figure is clearer. Wuling and BYD are the enterprises that have effectively completed the electrification transformation among large-scale automakers, and other enterprises need to make efforts.

Discussion by Type

Discussion by Type

I roughly sort out the situations in the BEV and PHEV tracks.

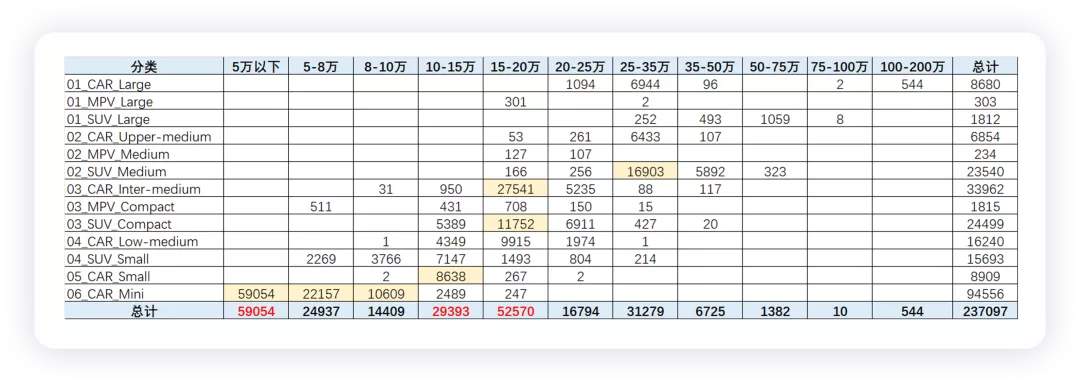

1)BEV

In October, there were 237,000 new insured BEVs. From the level and price segment, we can still see some clues. I will analyze why there was a breakthrough in the 150,000-200,000 RMB price range later. The most important models are Aion S 6,872 units, Fengshen E70 5,851 units, and Yidong nearly 2,000 units.

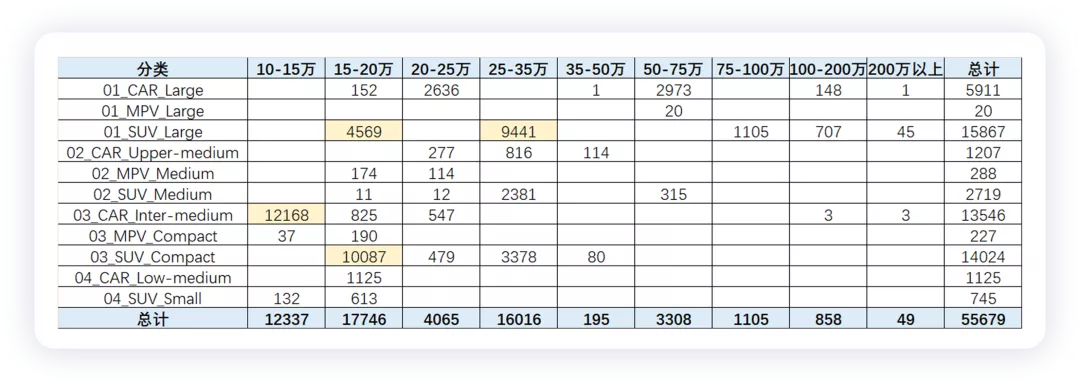

2)PHEV

Currently, I will briefly describe the increase of PHEVs, mainly a few models of brand vehicles. The highlighted data in the table can also tell which models are discussed.

3)Overall Ranking

Here, I give a ranking based on the total amount of new energy vehicles, for everyone’s reference of the position of various automakers in the new energy market in October. It’s worth noting that Volkswagen has been performing well in this period.

“`Summary: Recently, there have been a lot of things going on. As things progress, I need to speed up my learning and thinking.

When writing data analysis, sometimes I can consider and analyze problems from more perspectives, which is particularly exciting.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.