Power Battery Data for October Released

The power battery data for October is out, showing that lithium iron phosphate (LFP) continues to expand its leading edge, while demand for ternary batteries remains relatively sluggish. The release of Tesla’s 4680 battery also accelerated the iteration of power batteries from the nickel-cobalt-manganese route to the high-nickel route. CTC also showed us the potential for technological progress.

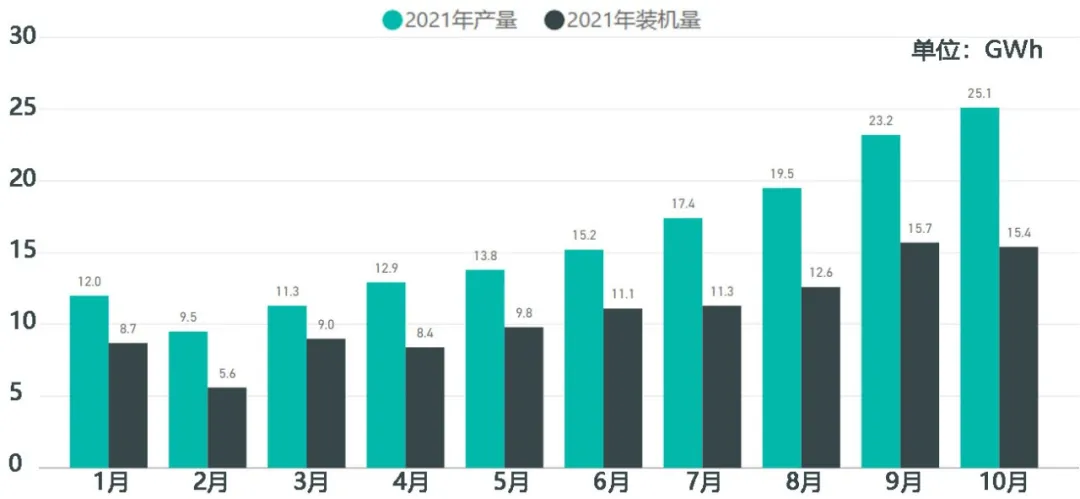

With only two months left in 2021, and based on a monthly output of 25.1 GWh, breaking through 200 GWh for the whole year on the basis of 159.8 GWh from January to October is a very certain fact.

In terms of installed capacity, the amount for January to October has reached 107.5 GWh. There is a huge gap between production and installation capacity, 52.3 GWh. From the positive side, this gap indicates the potential for sustained growth in the future, but from the negative side, if demand does not open up, it represents a certain degree of overcapacity.

1. How is the overall situation of power batteries?

In October, the production of power batteries reached a total of 25.1 GWh, an increase of 191.6% year-on-year and 8.4% month-on-month. The installed capacity of power batteries was 15.4 GWh, up 162.8% year-on-year and down 1.8% month-on-month.

Personally, I judge that the growth momentum of new energy vehicles in China in 2022 is weaker than that in foreign countries. Because the United States has a low base, and some European regions are gradually expanding, the European and American markets will maintain a relatively high growth rate next year. However, the current round of growth in China is objectively driven by companies bearing losses and having to boost their data. In 2022, with rising costs, slightly declining subsidies, and the devaluation of points due to the rise in penetration rates, it is unrealistic to replicate the growth miracle of 2021.

Therefore, from the perspective of power batteries, next year, power batteries for export and those accompanying vehicle exports will have higher growth rates among various automakers. The output summarized by the China Automotive Power Battery Industry Innovation Alliance can better reflect the industry’s prosperity, while the domestically installed capacity, which is subject to internal factors, may not have a high growth rate. This is also reflected in the trend of the following figure: the output is still rising as usual, while the installation capacity showed some decline month-on-month in October. The growing gap between production and installation capacity is becoming increasingly difficult to explain.

2. Where did the power batteries go?

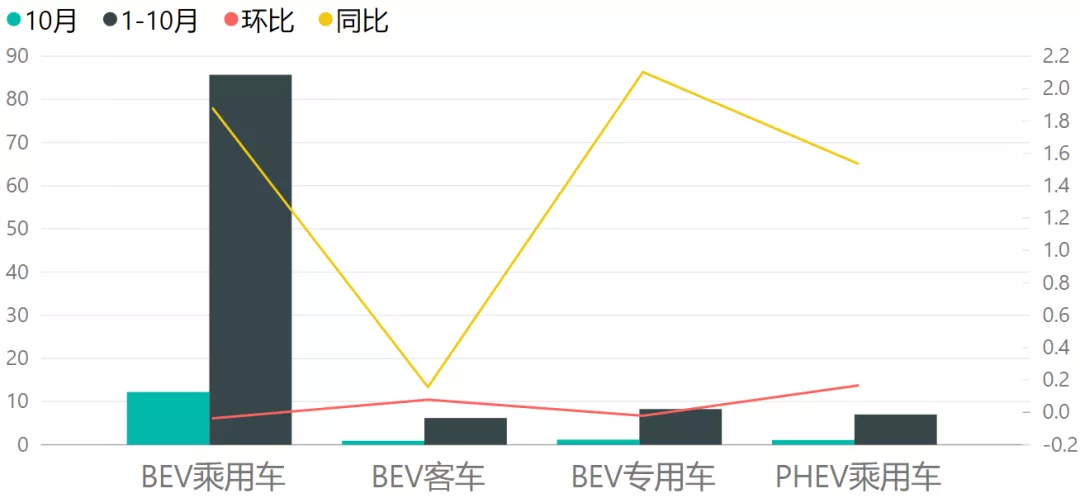

Looking at the overall usage scenario from the two charts for October and January to October, we can see that the largest usage in October still went to pure electric passenger vehicles, with an installed capacity of 12.219 GWh, accounting for 79.26%. The usage of plug-in hybrid vehicles with a single vehicle capacity of 10-30 kWh also reached 1.092 GWh in October, fully reflecting the growth rate of this segment market, and maintaining a 16% month-on-month growth rate.

Looking at the period from January to October, the installed capacity of the passenger car market in 2021 was only 6.188GWh, which is only an increase of 15.6% compared to the impact of the epidemic in 2020, and has been surpassed by the 8.264GWh of pure electric vehicles and 7GWh of plug-in hybrids. The passenger car market is becoming less and less important.

3) What is the situation with ternary and lithium iron phosphate batteries?

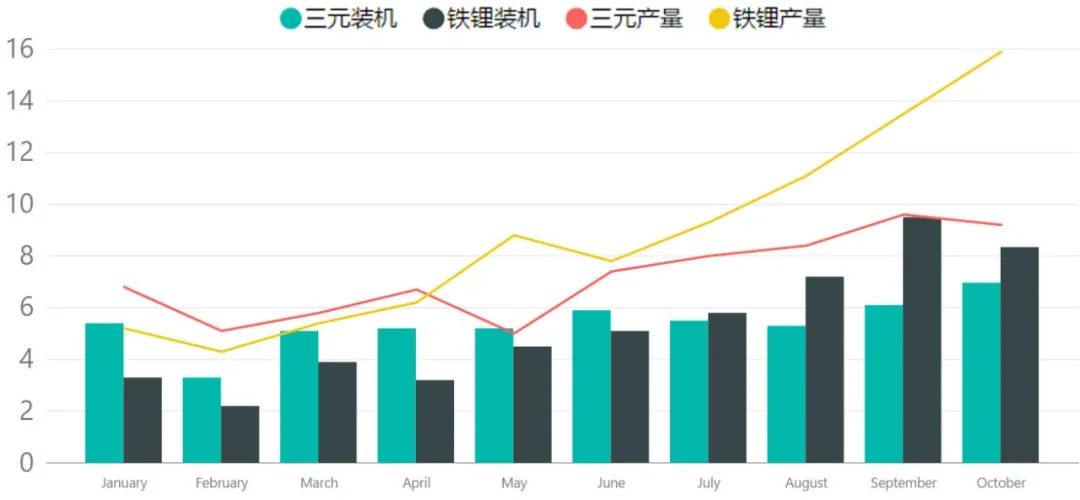

Similar to last month’s situation, lithium iron phosphate batteries have fully surpassed ternary batteries in terms of production and installation.

In terms of production, the production of ternary batteries is 9.2GWh, accounting for 36.6% of the total production, a year-on-year growth of 93.5%, and a month-on-month decrease of 4.5%. It should be noted that this suggests that the demand for ternary batteries in China has reached its peak in the short term. The production of lithium iron phosphate batteries is 15.9GWh, accounting for 63.3% of the total production, with a year-on-year growth of 314.0% and a month-on-month growth of 17.6%. This represents that in terms of global demand, China’s lithium iron phosphate batteries have continuous growth potential.

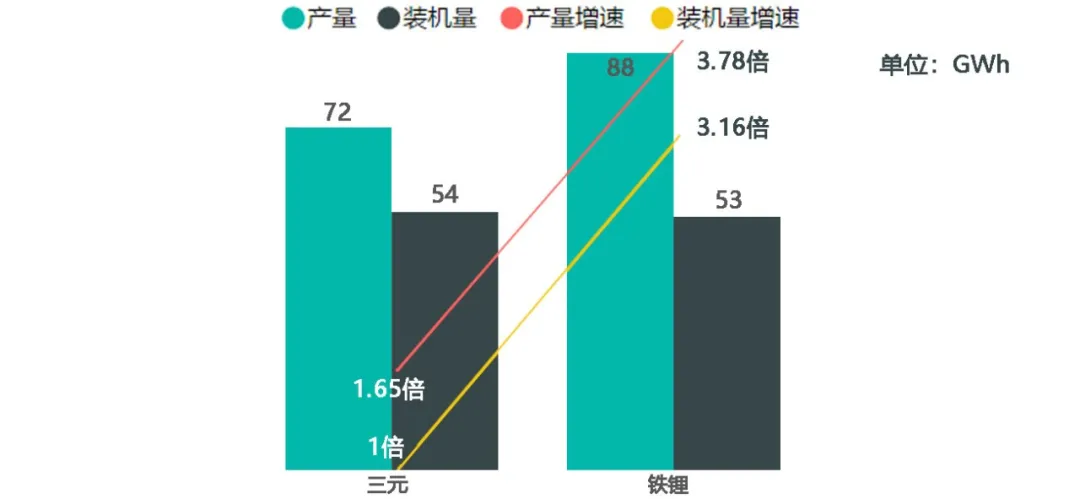

From January to October, the cumulative production of ternary batteries was 72.0GWh, accounting for 45.1% of the total production, with a year-on-year cumulative growth of 165.0%; the cumulative production of lithium iron phosphate batteries was 87.5Wh, accounting for 54.8% of the total production with year-on-year cumulative growth of 378.2%. From the year-on-year growth rate of the cumulative growth and the proportion, it can be seen that lithium iron phosphate is still the protagonist in China.

In terms of installation volume, in October, the installation volume of ternary batteries was a total of 7.0GWh, a year-on-year increase of 104.3% and a month-on-month increase of 13.5%; the installation volume of lithium iron phosphate batteries was a total of 8.4GWh, a year-on-year increase of 249.5%, and a month-on-month decrease of 11.6%. How to understand the fluctuation of lithium iron phosphate installation volume above? It is mainly because Tesla exports some cars and sells some domestically. In September, they were all sent to the domestic market, while in October, 40,000 cars were exported, causing fluctuations in domestic lithium iron phosphate installation volume.

From January to October, the cumulative ternary battery installation volume was 54.1GWh, accounting for 50.3% of the total installation volume, with a year-on-year cumulative increase of 100.1%; the cumulative installation volume of lithium iron phosphate batteries was 53.2GWh, accounting for 49.5% of the total installation volume, with a year-on-year cumulative increase of 316.4%. The difference in growth rate here can still reflect the trend.

4) BYD vs. CATL

4) BYD vs. CATL

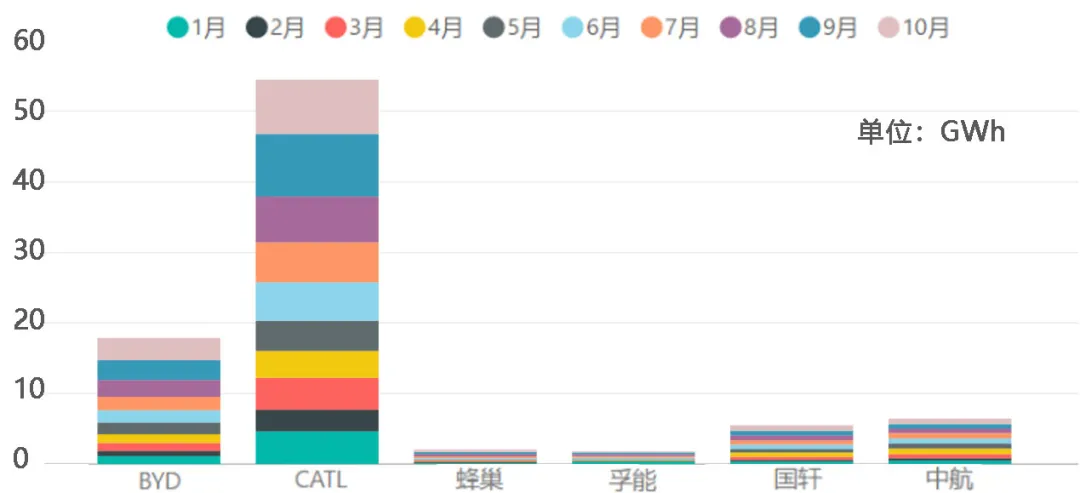

In terms of industrial concentration, in October 2021, a total of 39 power battery companies in China’s new energy vehicle market achieved matching with vehicle production, an increase of 2 from the same period last year. The top three, top five, and top ten power battery companies in terms of vehicle production were 11.6 GWh, 12.9 GWh, and 14.3 GWh, accounting for 75.5%, 83.6%, and 92.9% of the total vehicle production, respectively.

From the perspective of the overall industry growth rate, the leading enterprises have indeed opened up a big gap. Due to the rapid growth of the global market, small battery companies have gradually fallen behind. This year, it is difficult to buy materials, and it is basically impossible to buy cheap materials. Therefore, it is mainly a few large companies that are making power batteries at present.

5) Differentiation brought by 4680

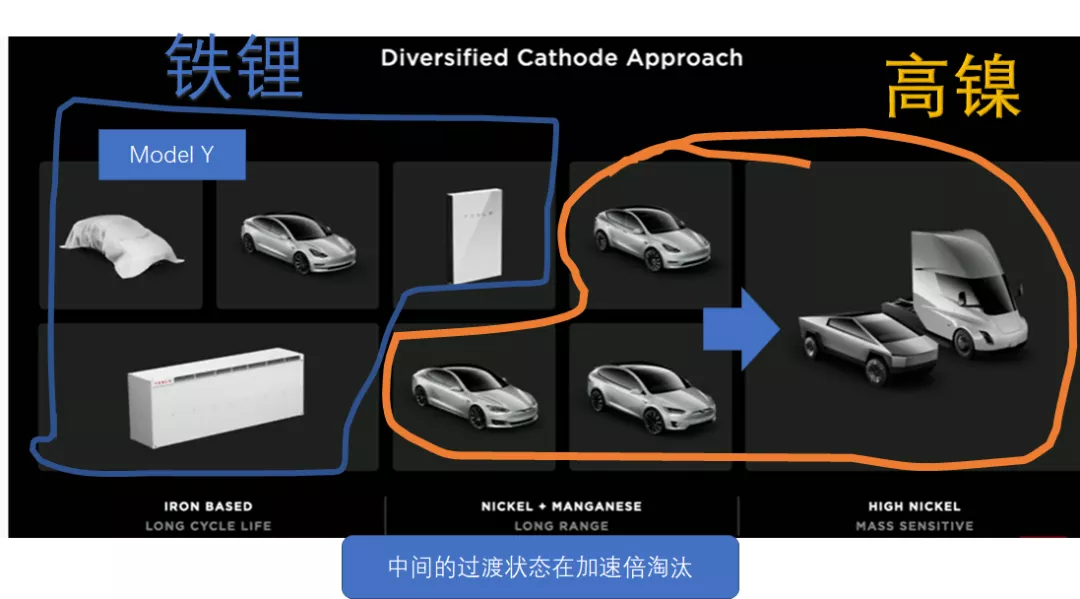

I think Tesla has the clearest understanding of this industry and is always making choices and adjustments based on both self-developed and externally sourced products.

1) Long cycle life: This is the entry-level product and energy storage station planned by Tesla. Service life (number of charge and discharge cycles) is prioritized, and the battery will mainly consider the use of lithium iron phosphate batteries. It is foreseeable that lithium iron phosphate batteries will be the battery choice for Tesla’s entry-level model, which is the $25,000 car.

2) Long range (mid-range product): According to customer needs, Tesla prioritizes the length of range, and the battery requires higher energy density. Currently, nickel and manganese-based cobalt-free batteries are used.

3) Weight-sensitive products (high-end products): In the field of pickup trucks and heavy trucks, performance is prioritized due to the need to consider carrying capacity. High-nickel batteries need to be used, which is also an important area of independent development for Tesla.

With Tesla’s strategic updates, we can see that the application of lithium iron phosphate has quickly surpassed the existing Powerwall and Model Y. Currently, long-range models are also moving towards higher-nickel batteries.

Summary: I think power batteries will indeed differentiate into two roads, high-nickel and lithium iron phosphate, which is an inevitable trend. Solid-state batteries, which are subject to changes, may gradually land in 2025, bringing some changes and vitality to the industry, but their market is not visible in the short term.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.