## Rivian, a unicorn electric vehicle manufacturer in the US, is expected to go public on NASDAQ tonight. The company plans to issue 135 million shares at a price of $78 per share, raising over $10 billion. This number is higher than the previously announced price range of $57-62 per share, which has been adjusted to $72-74 per share. After full dilution, Rivian's valuation has exceeded $77 billion.

This result far exceeds Rivian's previous expectations. According to the documents submitted by the company, its expected IPO valuation target was around $65 billion. With a market value of $77 billion, Rivian is valued at 95% of Ford's market value and 90% of General Motors' market value, making it the seventh largest IPO in US history.

## Rivian is still in the "burning money war"

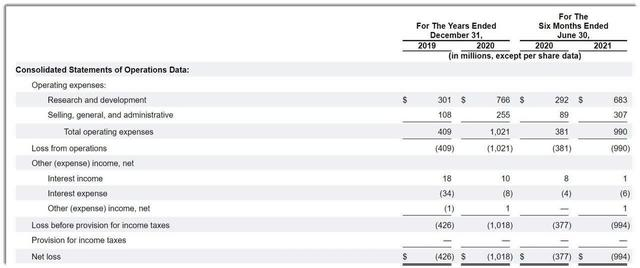

Like most new electric vehicle manufacturers, Rivian is currently burning through cash. According to its prospectus, as of June this year, Rivian's net loss in 2021 was $0.994 billion, more than twice the net loss of $0.377 billion in the first half of 2020.

In addition to huge operating costs, Rivian has also invested heavily in R&D, with R&D spending of $0.766 billion in the first half of 2020 and $0.683 billion in the first half of 2021. As Rivian's electric pickup truck R1T is about to begin mass production, the loss is expected to increase further, with a quarterly loss estimated to reach $1.28 billion.

## Confidence from investors

E-commerce giant Amazon, which owns 20% of Rivian, has also ordered 100,000 trucks for the "last mile" delivery plan. Rivian is expected to deliver its first batch of 10,000 trucks by the end of 2022.

In addition, as of October 31 of this year, Rivian has had around 55,440 orders for R1T and R1S in the US and Canada, and is expected to complete delivery by the end of 2023.

As Tesla’s market value surpasses $1 trillion, investors are eagerly anticipating the next “Tesla”. Rivian’s impressive fundraising ability reflects its outstanding innovation capability and the potential of the electric pickup truck market, giving it a strong outlook for industry growth.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.