Automotive Market in Europe in October

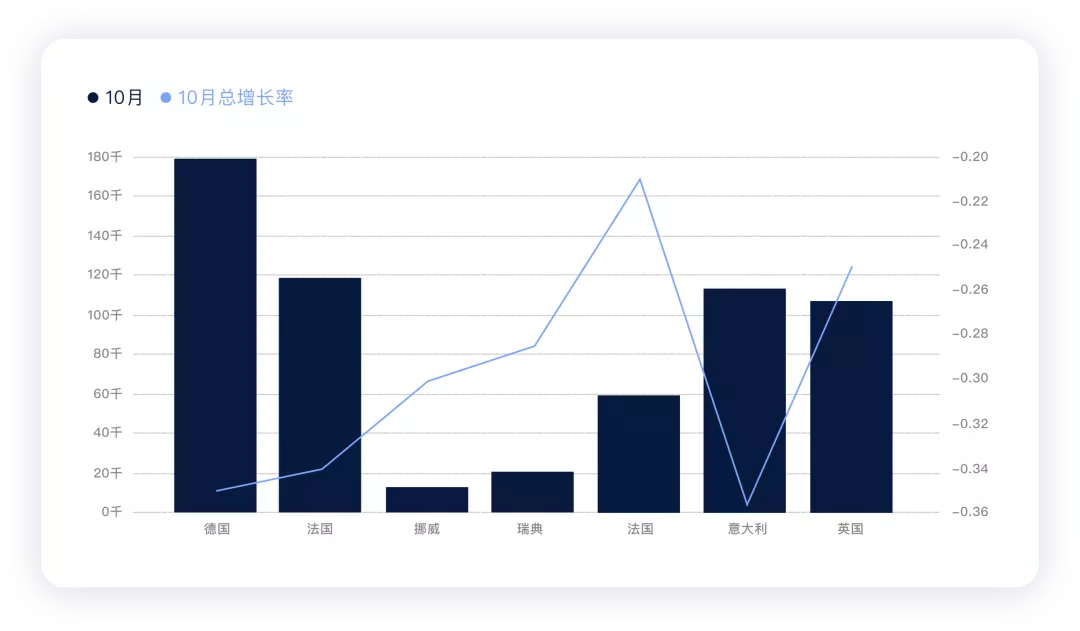

The overall situation of the automotive market in Europe in October is worth paying attention to. Due to the overseas chip shortage, several major European markets have experienced a decline in sales data (as shown in the figure below). The smallest decline is at least -20%, while the largest is 36%.

Due to the chip shortage and economic conditions, the year-on-year data for the European automotive market is not looking good. The impact of the chip shortage on the European automotive industry is particularly persistent, and combined with the current winter wave of the pandemic, the impact is very far-reaching!

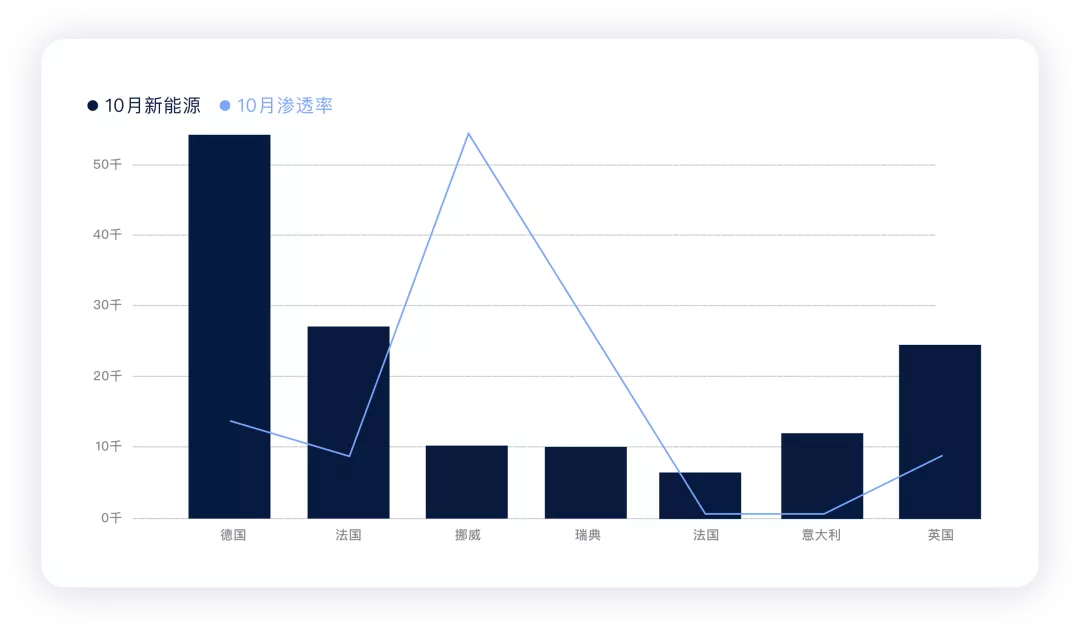

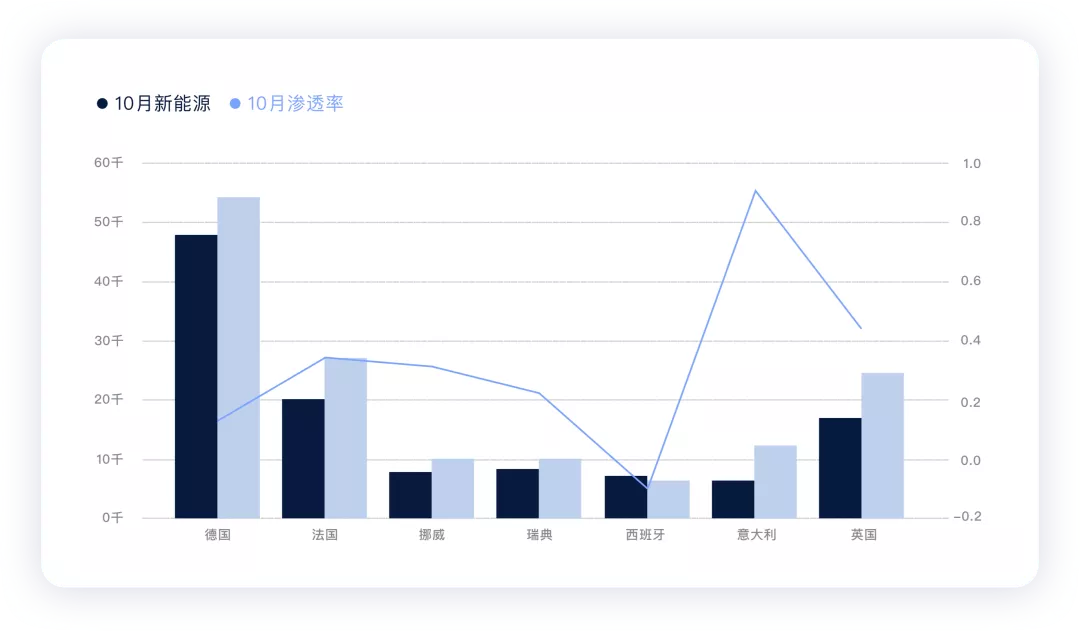

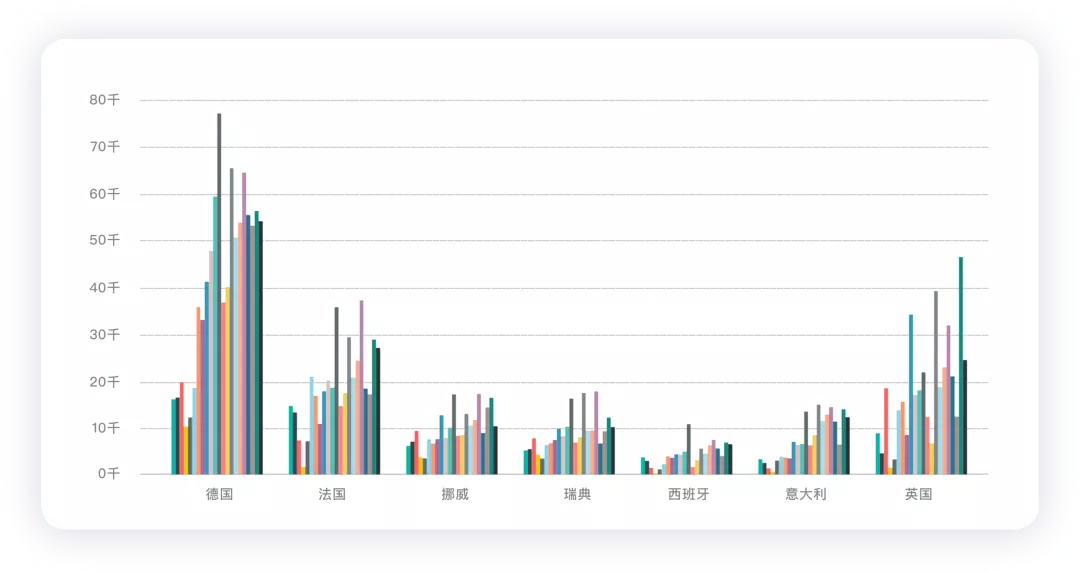

Based on this, Europe and China have started to prioritize the supply of new energy vehicles. Germany, Norway, Sweden, France, Italy, the UK, and Spain are the more typical countries (accounting for more than 80% of new energy vehicles in Europe).

In October, the total sales of new energy vehicles were 145,000, a decrease compared to the previous month (mainly due to Tesla’s supply fluctuations). Let’s analyze the data here in more detail.

Analysis of the overall situation in Europe in October

1) Overall situation in Europe in October

The data for October is similar to that of August. The sales of cars in the main European countries have declined in the range of -20% to -36%. In contrast, new energy vehicles have continued to make significant progress based on last year’s figures, thus achieving a very high penetration rate.

Norway has basically completed electrification, and the penetration rate of new energy vehicles remains around 90%, basically phasing out conventional fuel vehicles.

Of course, we can also see that the current European market is still driven by subsidies. Under the condition of chip shortage, new energy vehicles may not be able to sustain high growth, especially from Germany’s data, which shows that there may be a year-on-year decline in December 2021 for the first time because of an exceptional peak in December 2020.

The following chart clearly shows the difference between October 2021 and last year, and the overall growth rate is still limited. Italy stands out mainly because the base last year was relatively low.

From the current situation, it is likely that the pace this year will be different from last year.

2) Situation of PHEV and BEV

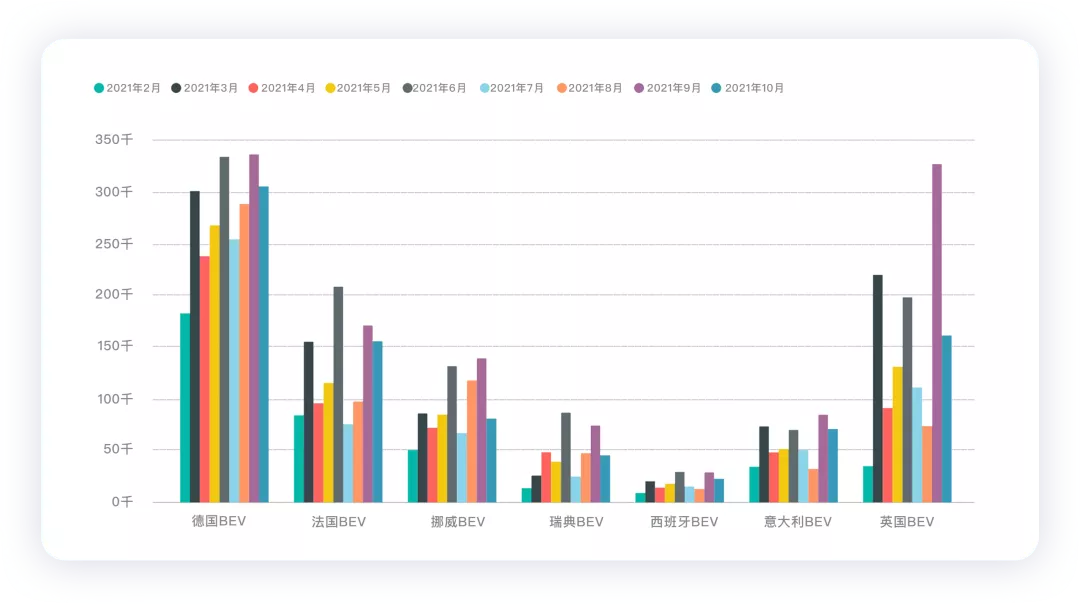

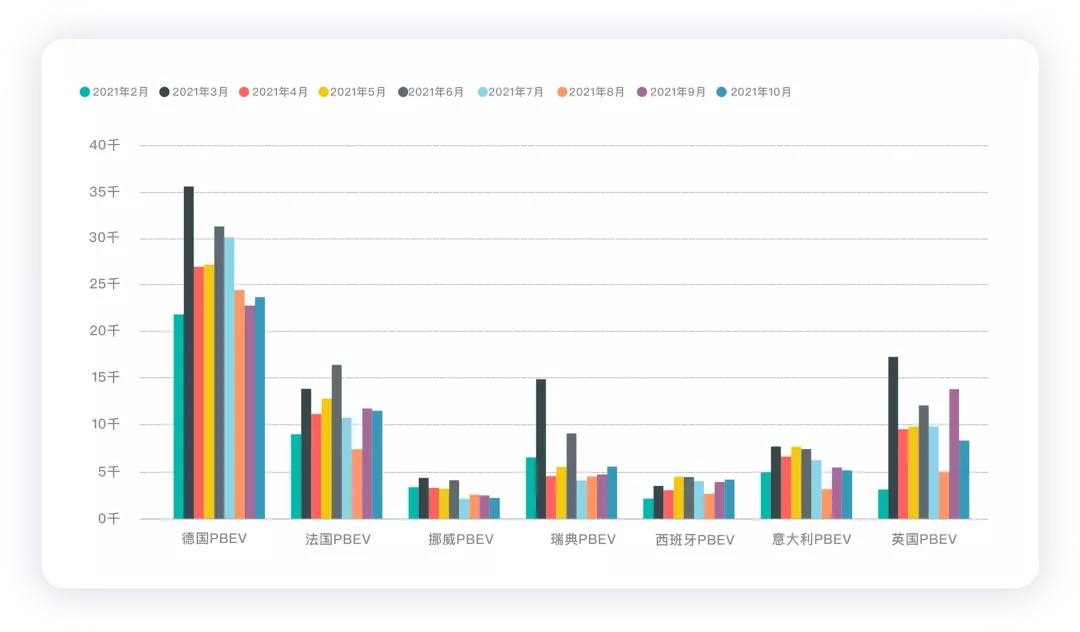

The impact of chip shortage can be most acutely felt in the difference between BEV and PHEV (as shown in the figure below).

The sales of BEV in major European countries are still very stable in the overall structure. Although the sales of BEV in most major countries declined slightly in October compared to last month, the decline was limited. The fluctuations in the UK can be attributed to the end-of-quarter surge in Q3.

PHEV sales remained stable this month and overall, it performed better than expected.

Summary: Today’s time is quite tight, so I’ll stop here for now and add data for each country later. I think this round of European subsidies has had a significant effect, but we are reaching the point of diminishing returns. In Europe, the driving force for new energy vehicles still lies in product capability. If European car companies do not work harder next year, with the exacerbating “halo effect” of Tesla’s Berlin factory, the impact will be significant. I will analyze the situation of specific car companies and models tomorrow, especially the situation of several Chinese car companies going overseas.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.