Translation:

Article: 2,197 words

Estimated reading time: 8 minutes

The future of Tesla is a vertically integrated company that manufactures cars, produces energy, builds charging networks, and develops transportation technology.

Next, let’s take a look at why Tesla is an energy-producing and charging network company, and its value.

After Tesla acquired SolarCity in 2016, it began selling residential solar panels and storage systems. After installing this system, households can basically rely on solar panels to supply the electricity for the entire family’s daily life and electric vehicles. If a family has a larger roof area, it can even sell excess electricity back to the grid.

However, this business accounts for only about 5% of Tesla’s total revenue, and I have not truly understood the potential of this business.

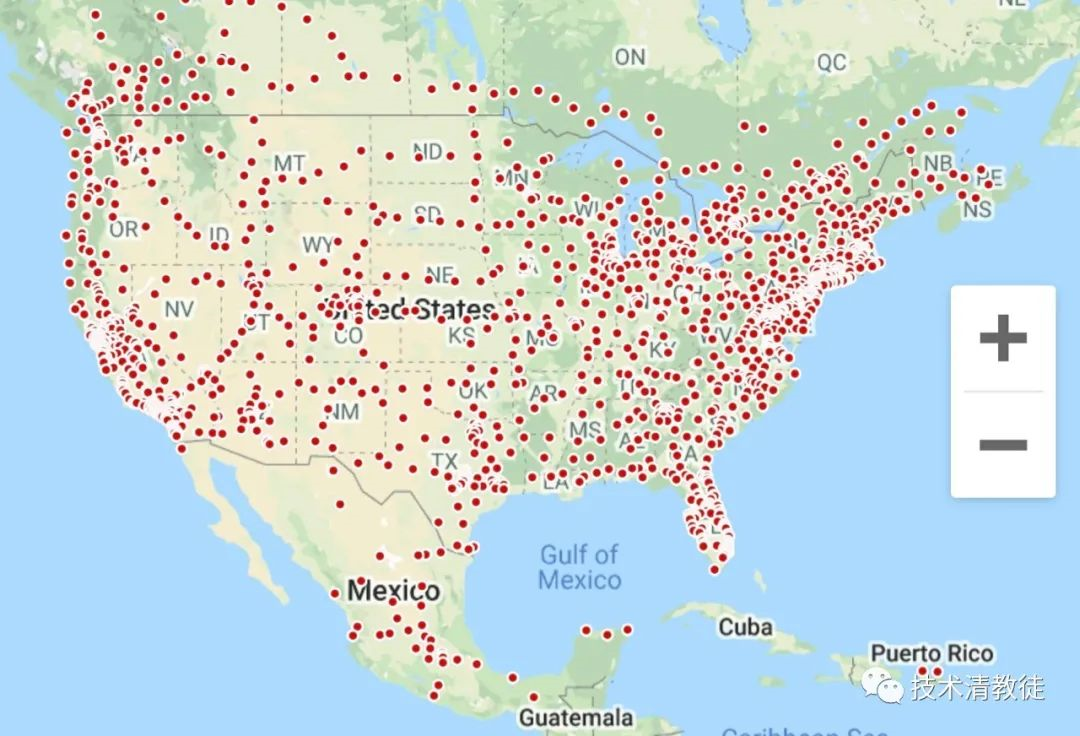

The other aspect related to the automotive business is Tesla’s supercharging network. As far as I am concerned, this business has more highlights.

Here, we will analyze the supercharging network from three aspects: the density of the charging network in China (charging convenience), the carrying capacity of the charging network in China (charging network capacity), and the value of the global supercharging network (revenue and profits).

The most realistic calculation method for measuring the density of the supercharging network is to use the urban area divided by the number of supercharging stations, and then use the area formula of a circle (S = π × r2) to calculate the average radius distance from any point to a supercharging station.

It sounds a bit complicated, but it is actually the concept in the figure below.

Let’s use Shanghai as an example to calculate. The urban area of Shanghai is 6,340 square kilometers, and there are 100 supercharging stations announced in August, so the average radius distance within a range of 4.4 kilometers will have a supercharging station. This density level is actually quite high. In Tesla’s real-world usage, even when the indicated mileage is at 0 km, there is still about 20 km of hidden energy available for driving, so it is not a problem to drive to a supercharging station in the city.

Of course, Shanghai is Tesla’s stronghold in China, and its supercharging density is definitely the highest in the country. Next, let’s calculate the density level of first-tier cities in China (Beijing, Shanghai, Guangzhou, Shenzhen, and Hangzhou). The total area of these five cities is 40,188 square kilometers, and assuming that 30% (i.e., 300) of China’s 1,000 supercharging stations are located in these cities, the average radius distance within the city range will have a supercharging station at about 11 kilometers, which is relatively convenient.But if you want to go on a long trip with your Tesla, you need to plan ahead, as there is only one Supercharger station within approximately 50 kilometers according to the current national average density. Also, based on real-world experience, it is still necessary to do some route planning beforehand, and it cannot be done on a whim.

Let’s take a look at the carrying capacity of Tesla Supercharger network, that is, whether the current Supercharger network is sufficient to support the entire Tesla fleet for charging, and whether there will be queuing situations.

Roughly estimated, there are about 500,000 Tesla vehicles in China. This includes about 80,000 vehicles sold before 2020 (when Tesla had not yet been produced domestically), 150,000 vehicles actually delivered in 2020, and an estimated 270,000 deliveries in 2021.

A Supercharger station can have anywhere from 8 to 72 supercharging stalls, with 10 stalls as the basis for calculation. Therefore, there are approximately 10,000 charging stalls at 1,000 Supercharger stations in total.

A full charge can give a range of about 450 km, and people generally go to charge when there is about 20% battery left (i.e. when there is 100 km left), which means that most people go to charge after driving 350 km. Most people drive about 70 km/day, which means that most people need to charge once every five days.

In actual usage scenarios, some people can use slow charging stalls, such as their own garage-installed slow charging stalls or public slow charging stalls. Let’s assume that this proportion is 30%, which means that the remaining 70% of vehicles need to use Tesla Supercharger stations for charging.

Taking into account the understanding of the actual usage scenario described above, we can calculate the carrying capacity of the Supercharger network. With 10,000 Supercharger stalls, 350,000 vehicles need to be charged once every 5 days. Therefore, each Supercharger stall needs to serve 7 vehicles per day, and the charging time for each vehicle ranges from 30 minutes to 60 minutes, depending on whether there are other vehicles charging nearby. Calculated according to the longest 60-minute charging time, each Supercharger stall is occupied for 7 hours per day.

What does the number “7 hours” specifically represent in terms of carrying capacity? Will there be charging queues?

Simply put, we usually only go to Supercharger stations for charging between 9:00 and 22:00 in our daily lives (either because we can’t get up early in the morning or it’s too late in the evening), so other times are considered invalid. That means, during the 13-hour time period of “suitable for driving to charge” each day, 7 hours are occupied by charging. In other words, the occupancy rate is about 55%, indicating that there should not be any congestion or queuing situations. At least in China, the carrying capacity is sufficient to meet demand.

Finally, let’s take a look at the value of the Supercharger network in terms of revenue and profit. This can be calculated on a global scale.Tesla currently has approximately 2,000,000 vehicles in circulation worldwide. Assuming each vehicle drives an average of 15,000km/year and requires 2400 kWh/year, and assuming 70% of the Tesla vehicles use the Supercharging network, the network would consume 3,360,000,000 kWh (33.6 billion kWh) annually. Supercharging cost ranges from 0.28-0.35 USD/kWh, depending on the pricing in China and the US.

Therefore, Tesla’s annual revenue from the Supercharging network is approximately 1.176 billion USD.

Assuming the previous article’s prediction of Tesla selling 18 million vehicles annually in 2031 holds true, with 70% of those vehicles utilizing the Supercharging network and an average lifespan of 7 years, the network’s revenue would be roughly 38 billion USD annually.

Lastly, we need to calculate the profit of the Supercharging network by analyzing two factors: depreciation cost of the chargers and the base electricity cost.

The cost of a single Supercharger, including associated equipment (distribution cabinets, installation, etc.), is approximately 30,000 USD. The lifespan of a charger is 7 years, equaling a depreciation of approximately 0.32 USD/kWh. The total depreciation cost adds up to 5.5 billion USD. Electricity is priced at approximately 0.094 USD/kWh, resulting in a cost of roughly 10.2 billion USD.

Therefore, by 2031, the net profit of Tesla’s Supercharging network stands at approximately 22.3 billion USD.

Although this may seem small when compared to Tesla’s manufacturing sector, which is expected to generate a net profit of 120 billion USD by 2031, it is important to note that the Supercharging network’s profit will increase as demand for the electric grid grows. Examples include Hertz’s recent purchase of Tesla vehicles, Uber’s announcement of providing Tesla vehicles to drivers, and Tesla’s upcoming energy-consuming vehicles, such as the Semi Truck and Cyber Truck. Additionally, Tesla is gradually opening up their Supercharging network to other brands, with double the charging fees for non-Tesla car owners.

In summary, Tesla’s Supercharging network acts as a brokerage firm: the more customers use it, the more revenue is generated.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.