Electric Vehicle Industry Facing Supply Chain Challenges

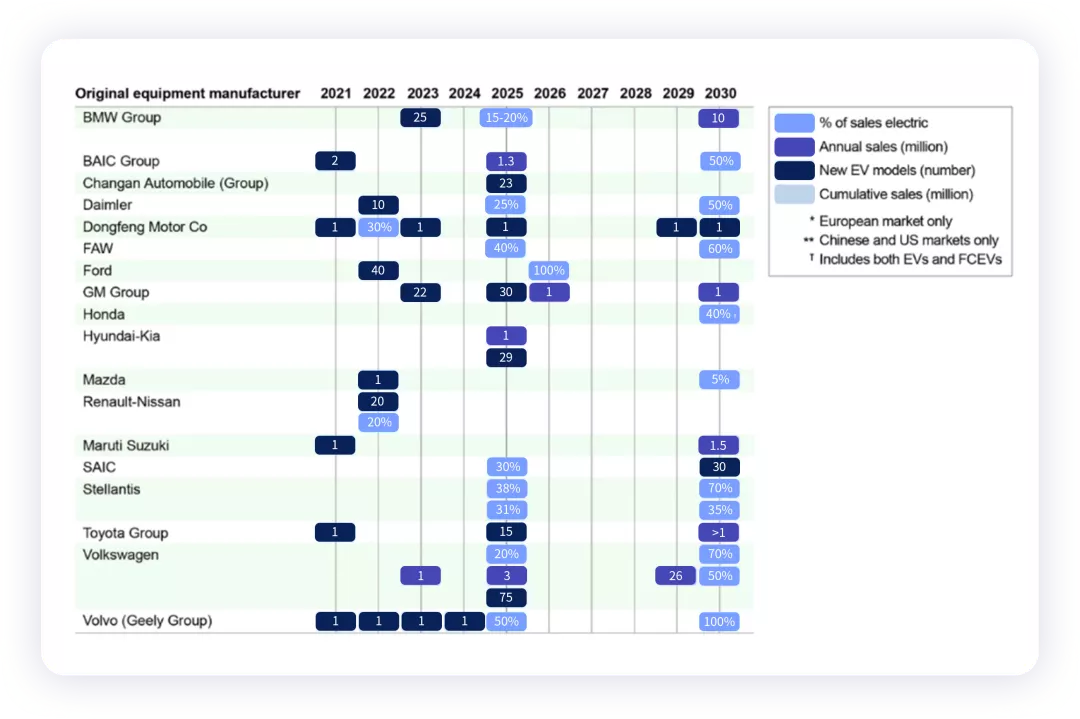

More and more automakers are setting the goal of complete electrification, but the co-founder of Tesla warned that while the goal is admirable, they need to ensure the management of the supply chain, even to the point of tracing back to mines, as they have not fully planned out.

This article explores the challenges in battery supply chain assurance under the large-scale electric vehicle plans of automakers, the measures taken by automakers, and provides some reference experience for the industry.

1) Development Status

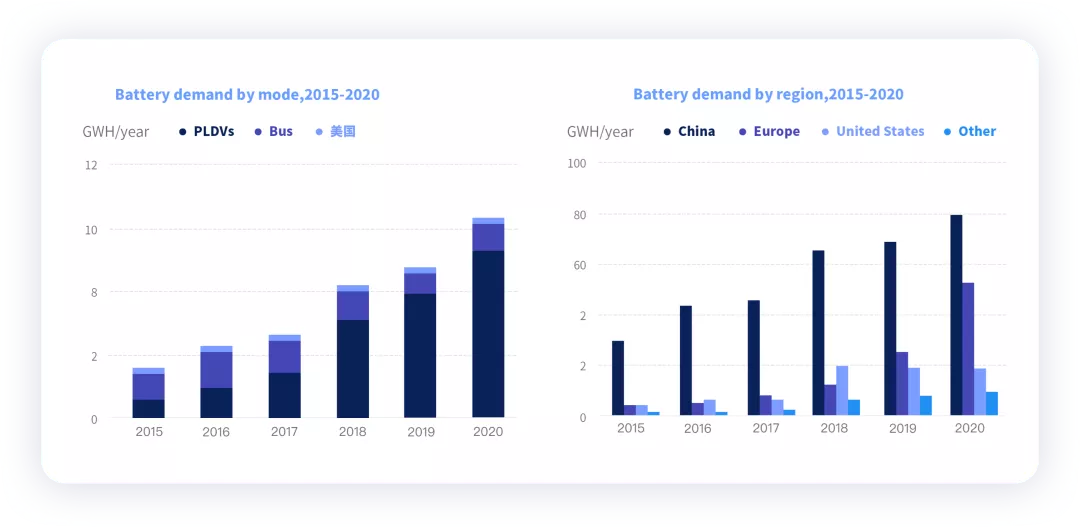

Historically, electric vehicles have been rapidly expanding globally. By the end of 2020, there were a total of 10 million electric vehicles in stock worldwide, with 5.4 million in China, 3.3 million in Europe, 1.8 million in the United States, and 0.8 million in other regions. However, starting in 2021, the annual growth rate of electric vehicles is accelerating, with 2.157 million vehicles in China, 0.4244 million vehicles in the United States, and 1.5787 million vehicles in Europe in the first three quarters, totaling 4.16 million vehicles. At this rate, there will be 5.5 million vehicles in China and a global impact of 6 million vehicles by the end of 2021, almost half of the stock of electric vehicles up to that point.

Now that all automakers consider electric vehicles as their primary development direction, the next question is whether the materials to support the batteries are adequate.

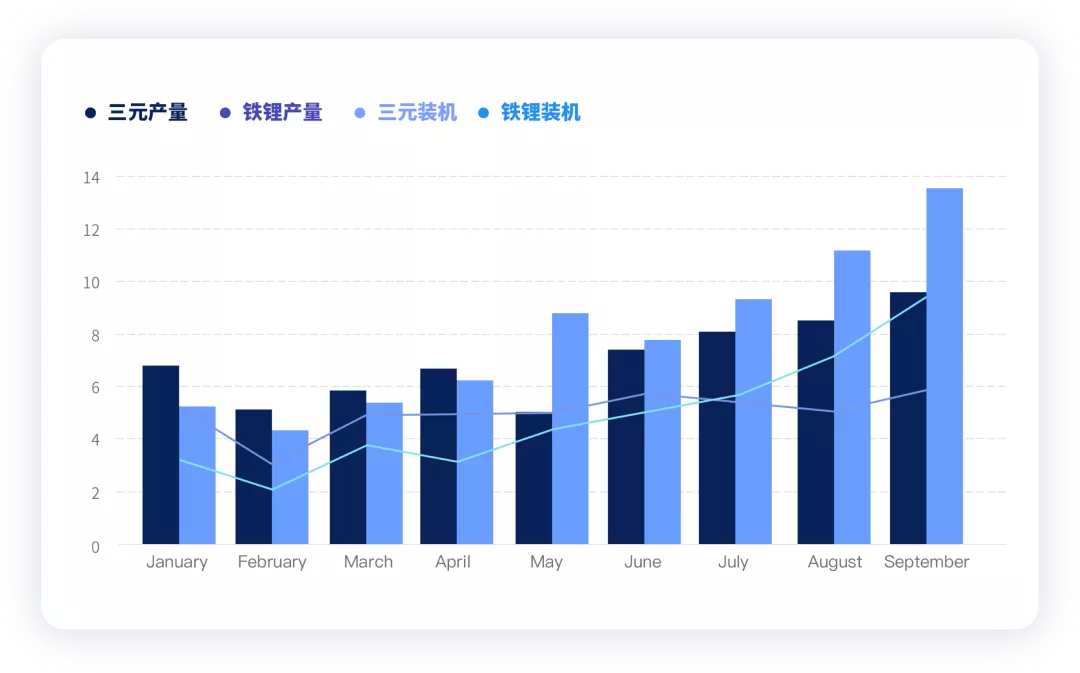

The rate of growth can be checked with data: the global battery demand was only about 150GWh in 2020, but China’s power battery production in September was a total of 23.2GWh, with a production of 134.7GWh from January to September. This is basically equivalent to the global demand for electric and hybrid vehicles in one year before. The demand for batteries is growing too fast.

2) Material Demand

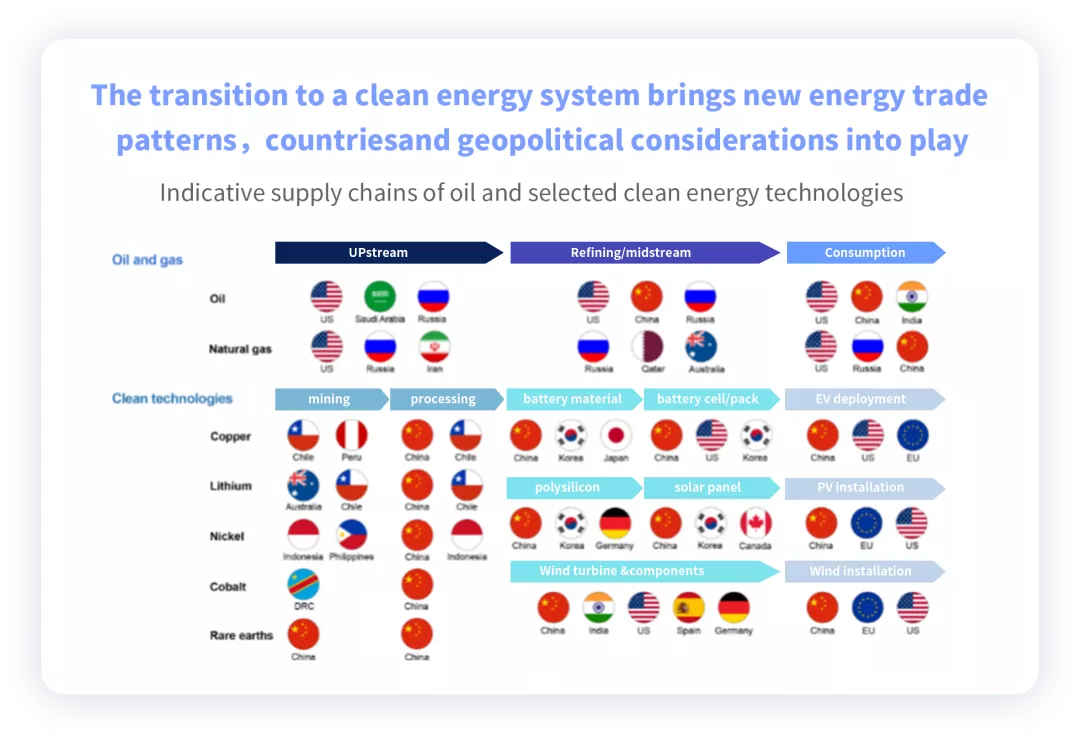

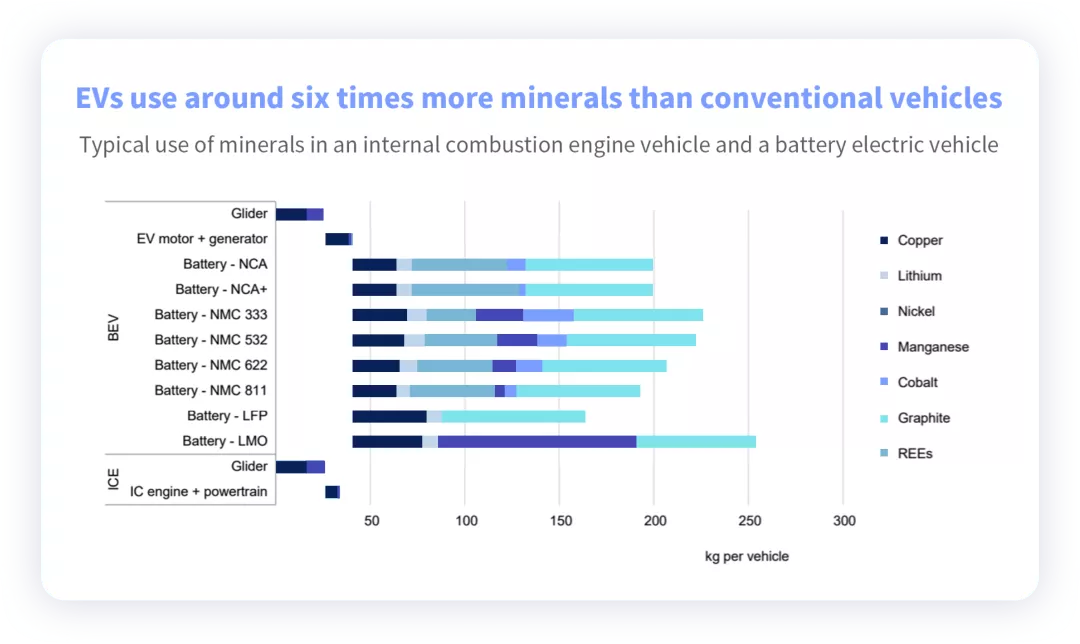

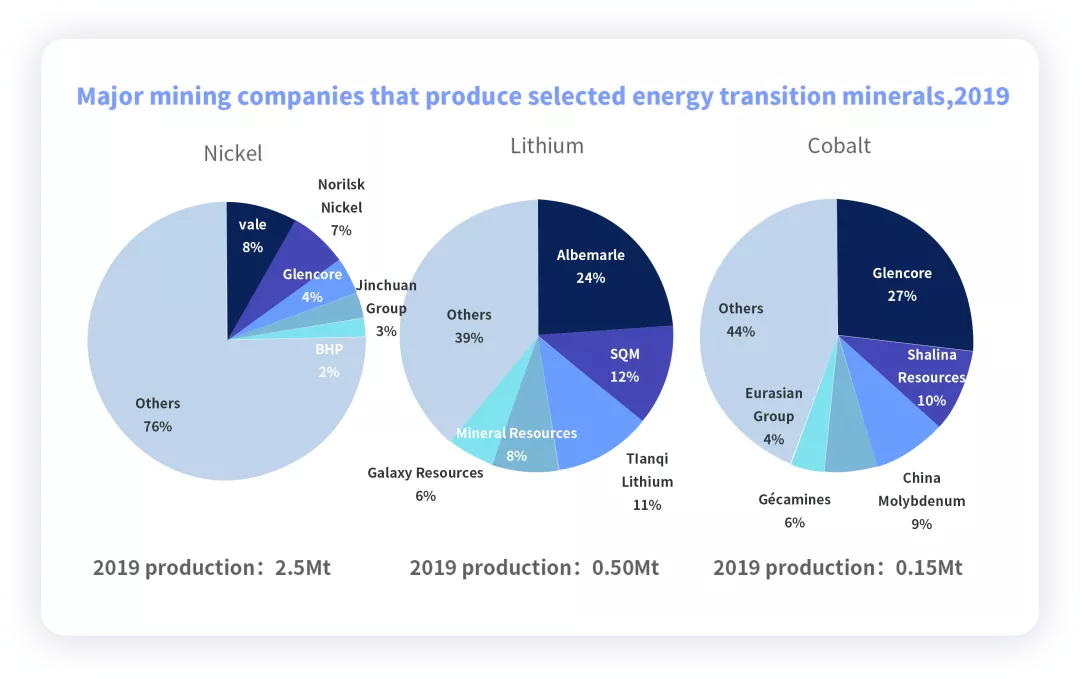

Therefore, let us trace back to the report “The Role of Critical Minerals in Clean Energy Transitions” written by IEA in May, which elaborates that lithium, nickel, cobalt, and rare earths at the upper end are all restricting the development of electric vehicles.We could discover from this chart that there is a bottleneck in the demand for upstream resources as electric cars and batteries emerge, and this problem involves long-term resource development, mainly including copper, nickel, cobalt, and rare earth, the core materials.

Based on the development of electric vehicles, we can roughly estimate the usage. The usage of lithium per vehicle is about 10 kg, nickel is about 50 kg, and cobalt is about 10 kg.

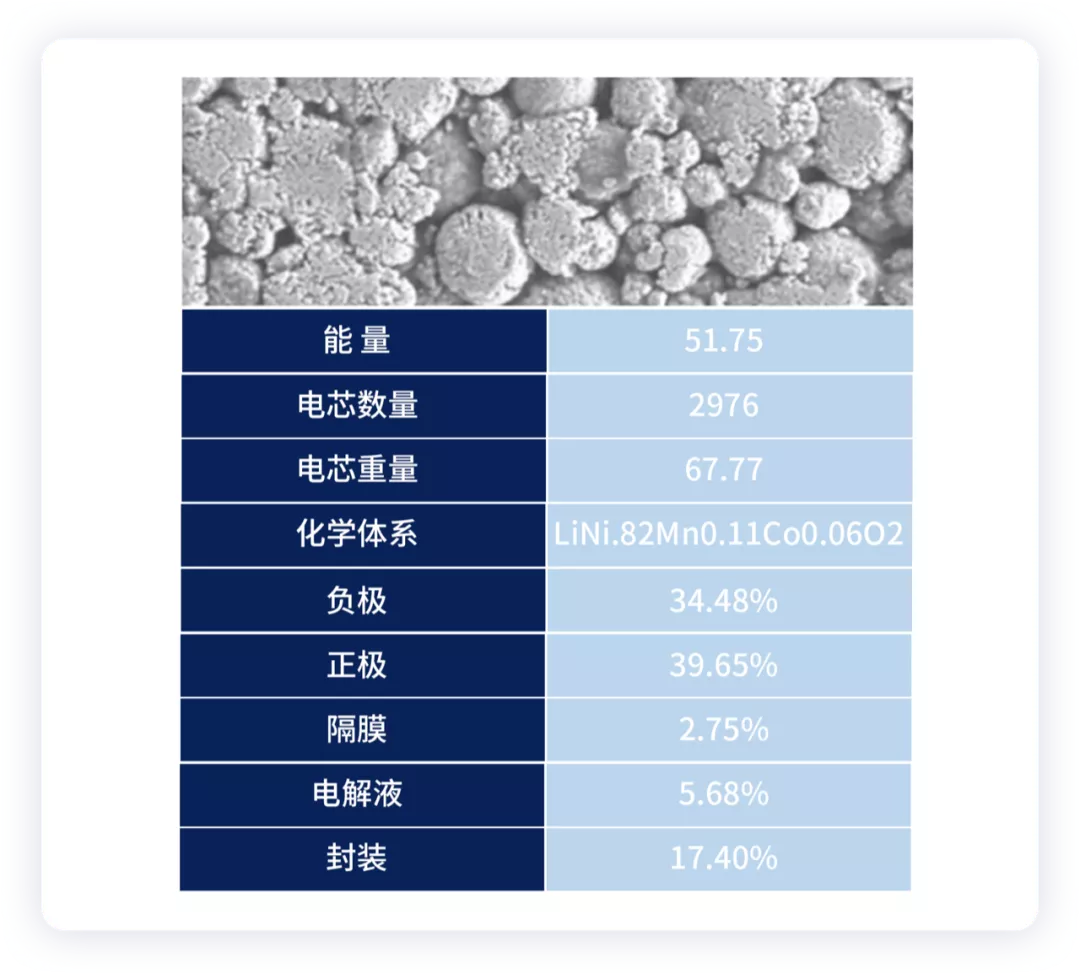

As for the breakdown of materials from the disassembly of battery cells, we can take the products used by Tesla’s LG as an example. The materials can be broken down into: 51.75 kWh, with a weight of 201.68 kg for the battery cell. The corresponding weight of the positive electrode material is 80 kg, the weight of nickel is 65.57 kg, and the weight of cobalt is 4.8 kg.

If we take the 51.75 kWh of the ternary version as the benchmark, 1 million units of Model 3 ternary version (51 GWh) require 65,000 tons of nickel and 4,800 tons of cobalt. The global cobalt production in 2020 was about 140,000 tons.

If we approach it from a relatively macroscopic angle and refer to the data from the “Global Evaluation Report of Lithium, Cobalt, Nickel, Tin, and Potash Mineral Resources Reserves (2021)” released by the Global Mineral Resource Strategy Research Center of the China Geological Survey:

The global lithium (carbonate lithium) reserves are 128 million tons, and the resources are 349 million tons, mainly distributed in countries such as Chile, Australia, Argentina, and Bolivia.

The cobalt ore reserves are 6.68 million tons, and the resources are 23.44 million tons, with the most enrichment in countries such as Congo (Kinshasa), Indonesia, and Australia. The nickel ore reserves are 90.63 million tons, and the resources are 260 million tons, with Indonesia ranking first in global reserves, and Russia and Australia with abundant resources.

From the perspective of consumption, the global lithium (lithium carbonate) consumption in 2020 was about 400,000 tons, cobalt about 170,000 tons, and nickel about 2.4 million tons. Compared with the existing reserves, the global lithium, nickel, and potassium salt resources are relatively secure, while the security level of cobalt is relatively low. Based on the current situation, if China or the world will adopt a large-scale use of lithium iron phosphate as the entry-level solution for electric vehicles, the overall demand for batteries can be guaranteed.

3) What is the universal technical route?

It can be said that it is precisely because China chose the more universal lithium iron phosphate as the mainstream solution instead of ternary, that the overall price of lithium carbonate soared during this period while the core reason for the lack of significant increase in cobalt price. Data showed that in September, the dynamic power battery installation data in China showed that the ternary battery installed 6.14GWh and the lithium iron phosphate battery installed a total of 9.54Wh, leading the ternary battery in terms of installation volume for three consecutive months. In terms of output, in September, the production of ternary battery was 9.63GWh, accounting for 41.56% of the total production, and the production of lithium iron phosphate battery was 13.51GWh, accounting for 58.31% of the total production. This is the fifth consecutive month that the production of lithium iron phosphate batteries has exceeded that of ternary batteries. China has taken exploratory experiments ahead of the rest of the world to confirm the technical route change.

4) Actions of battery and vehicle enterprises on the resource end

Layout of key resources such as lithium, cobalt, and nickel has become the main means of battery companies. In the face of huge demand and price increase, Chinese battery companies have become the basic content.

・Take CATL as an example:

In March 2018, it held 43.59% of the shares of North American Lithium through a wholly-owned subsidiary Canadian Times;

In April 2018, it participated in North American Nickel through Canadian Times and held 25.38% of its shares;

In September 2019, it subscribed 183 million shares of Pilbara Minerals, an Australian lithium mining company, through Hong Kong Times, accounting for 8.5% of the total share capital;

In September 2021, it announced plans to establish a lithium battery production base in Yichun City, Jiangxi Province, and Yichun is known as the “Asian Lithium Capital”.The joint battery factory, developed by LG Chem and Modern Motors in Indonesia, which focuses on high-nickel technology, started construction and plans to start production in 2024. A joint venture with a mining company is planned to improve the purchasing capabilities of metal for battery cathode precursor.

For major automotive companies around the world, in order to ensure the supply of raw materials for core components such as batteries and motors, automakers directly lock the supply of resources from mining companies through long-term procurement agreements.

・As an example, for Tesla:

In June 2020, Tesla purchased cobalt materials from the world’s largest metal miner, Glencore, who will supply 6,000 tons of cobalt to Tesla each year according to their long-term cooperation agreement;

In September 2020, Piedmont Lithium, an Australian lithium mine producer, announced that it had signed a five-year cooperation agreement with Tesla, to supply high-purity lithium ore mined in North Carolina;

In June 2021, Tesla signed a nickel supply agreement with global mining giant BHP.

From the current perspective, once demand increases, it will undoubtedly be necessary to ensure the supply of battery raw materials on a global scale.

5) Recycling layout?

I think the batteries in electric vehicles can be understood as artificially used urban ore. Redwood Materials, a company co-founded by JB Straubel, co-founder of Tesla, is still valuable. By recycling batteries and downstream battery materials, a recycling system can be constructed.

By establishing a recycling system for battery production and recycling, materials are recovered from scrapped vehicles and batteries, and batteries are produced. This can greatly reduce the extraction of raw materials such as nickel, copper, and cobalt over the next few decades, while also reducing the loss of scrap batteries during production.

In fact, the ultimate goal of the development of electric vehicles is to fundamentally impact the sustainable development of global resources through battery recycling and battery material production.

Summary: I personally believe that resource constraints are temporary in the development of electric vehicles. As the circular economy is applied to the electric vehicle industry, the future of electric vehicles will be even brighter.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.