The following Markdown Chinese text is translated into English Markdown text in a professional manner while preserving the HTML tags within Markdown. Only output the corrections and improvements without explanations.

*This article is reproduced from the official account of autocarweekly

Author: Karakush

The NIO ET7 is scheduled for delivery in the first quarter of next year, and it cannot come soon enough.

The latest development is that the first batch of fully process-produced ET7 prototypes were produced in September.

From an outsider’s perspective, it is inevitable to worry about them not being fast enough. The electric vehicle market competition is not as friendly as the bosses extol each other. While ET7 is being produced in an orderly manner, many new products have emerged with aggressive parameters and configurations, and are claiming to be delivered next year (some within this year), making the ET7 released earlier become outdated.

Therefore, the NIO organized a study on the electric drive system technology of the ET7 a while ago. Like a rose given on a non-anniversary day, the meaning is not simple. Without a technical explanation of the actual car, the purpose is also diverse, mainly to give a friendly reminder to media teachers who boast around and users who hold their currency: I am still the coolest.

Let’s review the basic power aspects of the ET7:

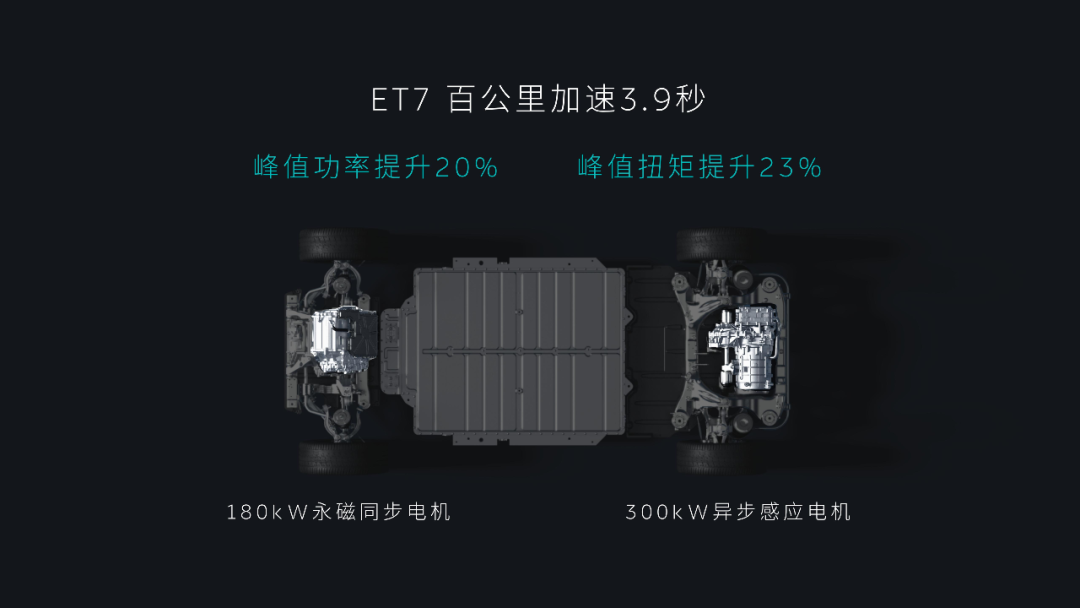

Dual-motor, front 180 kW permanent magnet synchronous motor, rear 300 kW asynchronous induction motor, with an overall peak power of 480 kW, an overall peak torque of 850 N·m, and a 0-100 km/h acceleration of 3.9 seconds. Compared with the old combination of front and rear 160/240 on ES6 and ES8, the overall peak power and peak torque of the ET7 have been increased by 20% and 23%, respectively.

To sum up in one sentence, even by next year, it is still worthy of being a high-end and enduring reliable criticism.

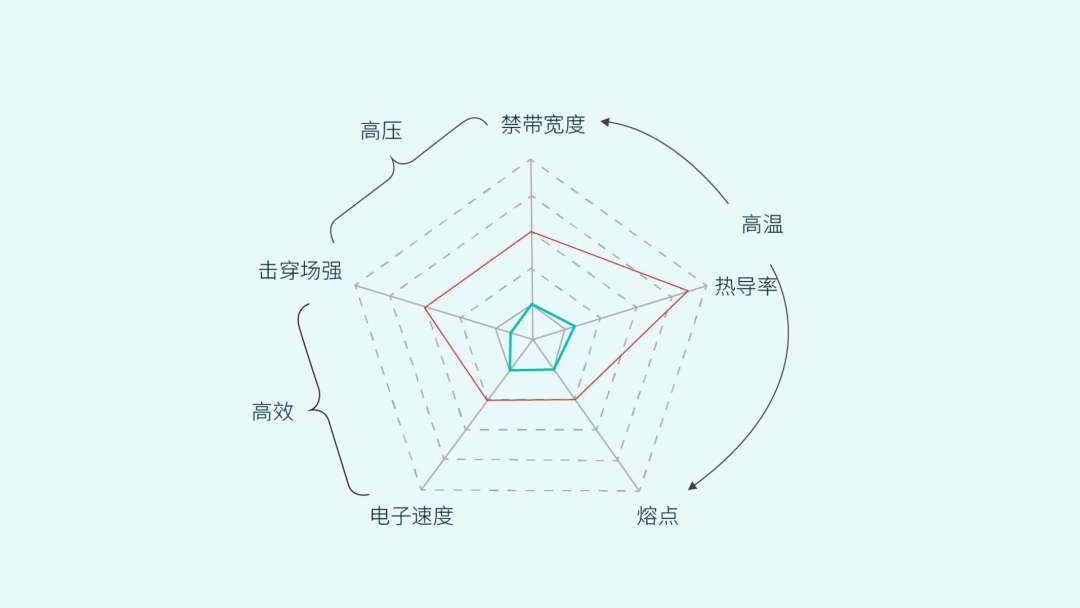

The biggest technical highlight is that the 180 kW permanent magnet synchronous motor uses silicon carbide, a semiconductor material used as a power module in motor controllers. It is currently a magical tool in the industry. Compared with the mainstream IGBT, it can achieve multipoint gains, such as fast switching speed, high turn-off voltage, strong heat resistance, and a maximum current capacity increase of 30% under the same volume, which significantly improves the motor’s efficiency.

Taking the 180 kW motor as an example, its comprehensive working condition power reaches 91.5%, while the general IGBT three-in-one system in the industry is only about 88%, 89%. This translates into better driving range.Two methods can roughly increase the endurance of a vehicle. The direct approach is to increase the battery capacity. For example, the ET7 has expanded the battery pack to three options: 75 kW (ternary lithium), 100 kW, and 150 kW (semi-solid-state battery), which correspond to a range of 500-1000 km. However, endless addition is not feasible, and the subtraction method is to reduce consumption.

From a technical perspective, silicon carbide module has a fast switching speed, resulting in lower power consumption during switching. In low-load scenarios, such as city driving, the conduction loss of silicon carbide is also smaller. Therefore, after applying the technology, the comprehensive loss of the electric control system can be reduced by 4%-6%.

However, every hyped advantage comes with a cost. Silicon carbide is an expensive material, typically 3-5 times the cost of IGBT. Besides, it is currently imported, and there is no domestic industry chain. For NIO, the top-level substrate material is from Cree, which makes wafers in Korea, modules in Malaysia, and then ships them to XPT factory in Nanjing for assembly.

For general car manufacturers, the cost saved by using silicon carbide on batteries may have to be returned to the motor supplier, which is too much of a loss. Therefore, only a few EV companies, such as Tesla and BYD, which have their mature research and development and production systems, can lead in applying silicon carbide technology. Of course, NIO and Leap Motor are also in the list.

Many people may still think that electric drive does not have a technical threshold; otherwise, how could the domestic industry pick this low-hanging fruit to overtake the foreign competitors? However, there are differences in strength among manufacturers. Some EVs are not fast, noisy, weak in acceleration, or bulky after prolonged use. Manufacturers may tell you that it is based on positioning, but essentially it is because they cannot afford the cost of demanding technologies.

“Everyone always emphasizes NIO’s excellent service,” said Chengshuang Zeng, NIO’s senior vice president, at a communication meeting, “but I want to take this opportunity to say that our technical foundation is solid.”

What makes Zeng proud is that NIO’s entire electric vehicle core technology is developed in-house. For the small motor alone, NIO has applied for 215 patents, including 81 invention patents.

Many car manufacturers boast of self-development, but not all self-development can be genuinely called Tresor milk. Many companies’ “self-development” is just verification in the later stage of product development. Genuine full-stack self-research means whether your software is self-written, your circuit boards are self-developed, and your chips are self-selected… which implies long-term and large-scale investment.# NIO Invests ¥250 Million in EV Drive Team and Vehicle Development

NIO formed its electric drive team in 2015 and has since invested roughly CNY 250 million ($37.73 million) in the related R&D, with a higher portion dedicated to testing, vehicle development, and validation, outsourced testing costing about CNY 130 million ($19.7 million), equipment including benches and stands about CNY 96 million ($14.5 million), and various software tools about CNY 30 million ($4.53 million).

In addition, NIO has independently contracted manufacturing in its own plant in the XPT facility in Nanjing, with a capacity of 300,000 motor production per year, which doubles with vehicle quantity every year. NIO is able to produce both induction and permanent magnet motors, boasting self-made stacks of equipment, a rare find in the industry, and is the “only company in the world to have such production capabilities.”

This model was initially not looked upon favorably by the industry, as most automakers sought supply sources for high-power drives instead of trying to independently develop their own. However, given the high requirements for electric drives in creating high-end, high-performance electric vehicles, it isn’t easy to simply purchase mature products. This became more apparent with the recent chip shortage and battery scarcity, which highlighted the scarcity of high-quality resources in the supply chain. As such, if NIO were to rely on external parties, it would be difficult to ensure the engineering resources needed to meet development deadlines.

By developing its own complete capabilities, NIO possesses greater flexibility in supply chains and product design transformation, leading to accelerated product development and improved product advantages and launch timelines. For instance, in 2018, NIO launched the first triple-output electric drive product in the Chinese electric vehicle market, and a year later, it was the first to launch flat wire motors in production. With regards to silicon carbide modules, if NIO wasn’t developing it independently, it most likely would’ve had to wait for others to develop it before making a purchase, but given NIO’s independent research and devotion, it was available up to half a year to a year earlier than some competitors.This is not just about showcasing prestige, it’s also about fulfilling promises to users. An important experience for high-end electric vehicle brands is to stay a step ahead in the application of new technology. A lackluster product and a product with compelling publicity but delayed delivery and technical issues are both unable to support brand value.

Having a solid technology foundation is crucial to the stories we enjoy.

No pains, no gains in R&D

NIO understands this well.

The ET7 electric drive system development started in the second half of 2019, when NIO was at its poorest. “Thanks to our management,” said Bi Lu, head of the electric drive system and integration department. “At that time, we adhered to a principle that we could not tolerate bitter times in research and development, and started the development of the 180 kW product with limited funds.”

Every project has its own strategy, and for the new electric motor, the strategy is to make it look no different from the old one on the outside, while ensuring maximum physical compatibility with the production line and maintaining the same installation interface as the whole vehicle, and improving efficiency by optimizing the electromagnetic and speed ratio. In theory, this motor can also be used in NIO’s older products, such as ES8 and ES6.

By the second quarter of 2020, NIO’s financials improved and the research and development accelerated. The project to develop silicon carbide was officially launched. Time was the biggest challenge, and within the first two months, selection, hardware and software design, and all evaluations had to be completed. “All chip manufacturers in the world who make silicon carbide modules want to communicate with us, want us to evaluate them, and will not accept it if we don’t. What qualifies us to deny them this opportunity?”

No pains, no gains in R&D. However, the evaluation process is not just about communicating with chip manufacturers about their respective technical routes, solutions and performance, but also about testing, developing circuit boards and related software to lock in the best and most reliable option in the market now and in the future.

During the process, NIO independently defined a set of evaluation indicators and application specifications, which are said to have been taken by partners to promote the technology – giving it a higher purpose in the industry. Now, NIO is definitely one of the top three automakers in terms of immediate production of silicon carbide. For the landing of new technology industrialization, it is always a difficult road ahead and shared prosperity in the end.

The main performance indicators for silicon carbide are excellent conductivity, which determines power loss, and thermal resistance. It is industry-leading with a conductivity of 1.7 and a thermal resistance of 0.1 degrees per watt, providing a 20% improvement in heat dissipation. The ET7 is of course powered by “the highest-level and most advanced module in the industry as of now.”The selection is just the beginning. As for how to apply it and optimize it in software and hardware, it also reflects the superiority of systematic thinking and design. NIO adopts a variable frequency plus discrete PWM scheme to reduce switch loss. Different modulation optimization strategies will be used in different driving conditions, such as low speed, high speed and heavy load. In addition, it is also necessary to consider the voltage resistance, service life, electromagnetic compatibility and motor insulation of the introduced module and other issues in the whole system.

When it comes to product development, all teams are working beyond the normal level. “We don’t call it overtime even on Saturdays, it’s just ordinary work.” Because in 2019, NIO was too poor and the progress was indeed delayed, so NIO had to catch up in the later stage. For example, the winter ice and snow testing of the ET7 was completed in New Zealand in August.

Compared with time, the boss is a bigger challenge. Li Bin’s requirement to the team is to do more subtraction on the premise of meeting user needs. The entire project is repeatedly balanced and optimized among multiple goals.

Efficiency is a top priority, but increasing power and torque will bring negative effects of electromagnetic force to NVH. The R&D team finally reduced the overall noise by 5-15dB, and the peak value was only 80dB. It is worth mentioning that in the electric drive system, optimizing from 100dB to 85dB is relatively simple, but it is very difficult to go down from 85dB, even if it is only a few dB.

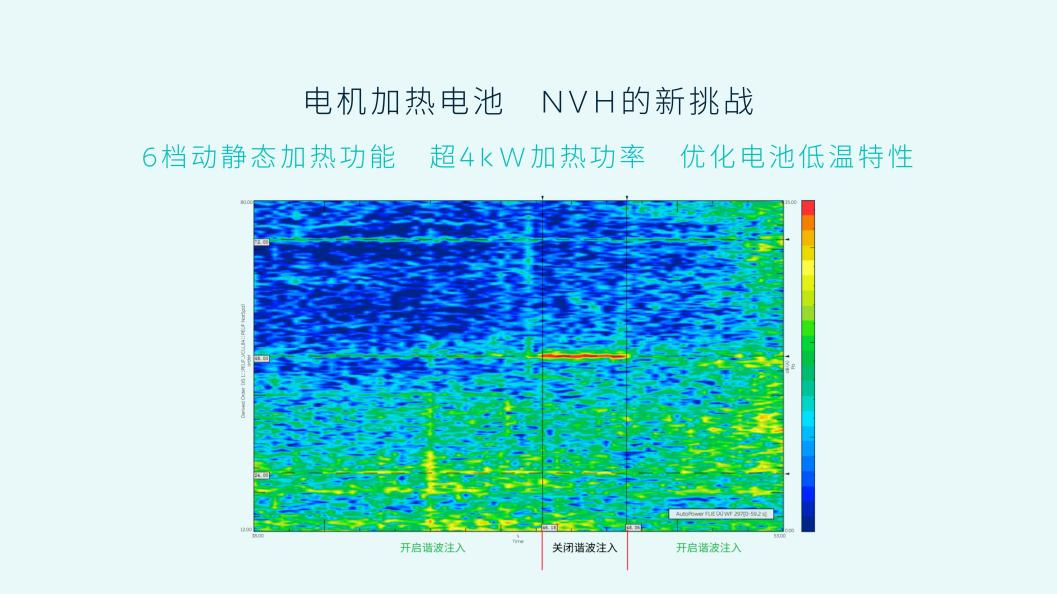

Not only the small account but also the large account need to be considered. For example, the newly released 75-degree ternary lithium battery by NIO is equipped with a special heating function developed for the electric drive system. It chooses different heating levels based on the SoC status and battery temperature, with a total of 6 levels and a maximum heating power of 4 kW, to ensure the battery performance under low temperature.

The difficulty is that heating injection will bring new current and noise, and the new current is a different type from the actual operating current, because heating does not generate additional torque and is not the current under normal control logic. Therefore, other torque and NVH characteristics should also be considered. Some vehicle models make a lot of noise during charging, which neglects these experiential details.NIO injects a harmonic at startup to suppress noise. The feature has been developed and it is easy to apply to 160 kW and 240 kW; it is said to be introduced in future models.

YYDS?

The mass-produced ET7 must achieve higher efficiency while also being quieter.

Many may still consider the ET7 a product produced by throwing money at it, as high-end products naturally have the price space to show off compared to mass-market products. However, it is obvious that there are two completely different levels between stacking actively and blindly stacking.

NIO is not following the trend of technology. They have developed their own judgment standards on whether to introduce new technology: first, whether it can improve functionality; second, whether the efficiency of the development process system can be improved; and third, the actual cost advantage, not just the unit cost, emphasizes the entire lifecycle cost.

Currently, NIO has begun the development of the next platform, and R&D resources have increased by nearly 100% this year. If we include process and quality teams, the entire R&D resources have increased by 50%. “The release of our new platform motor will definitely be industry-leading,” said Jack Cheng.

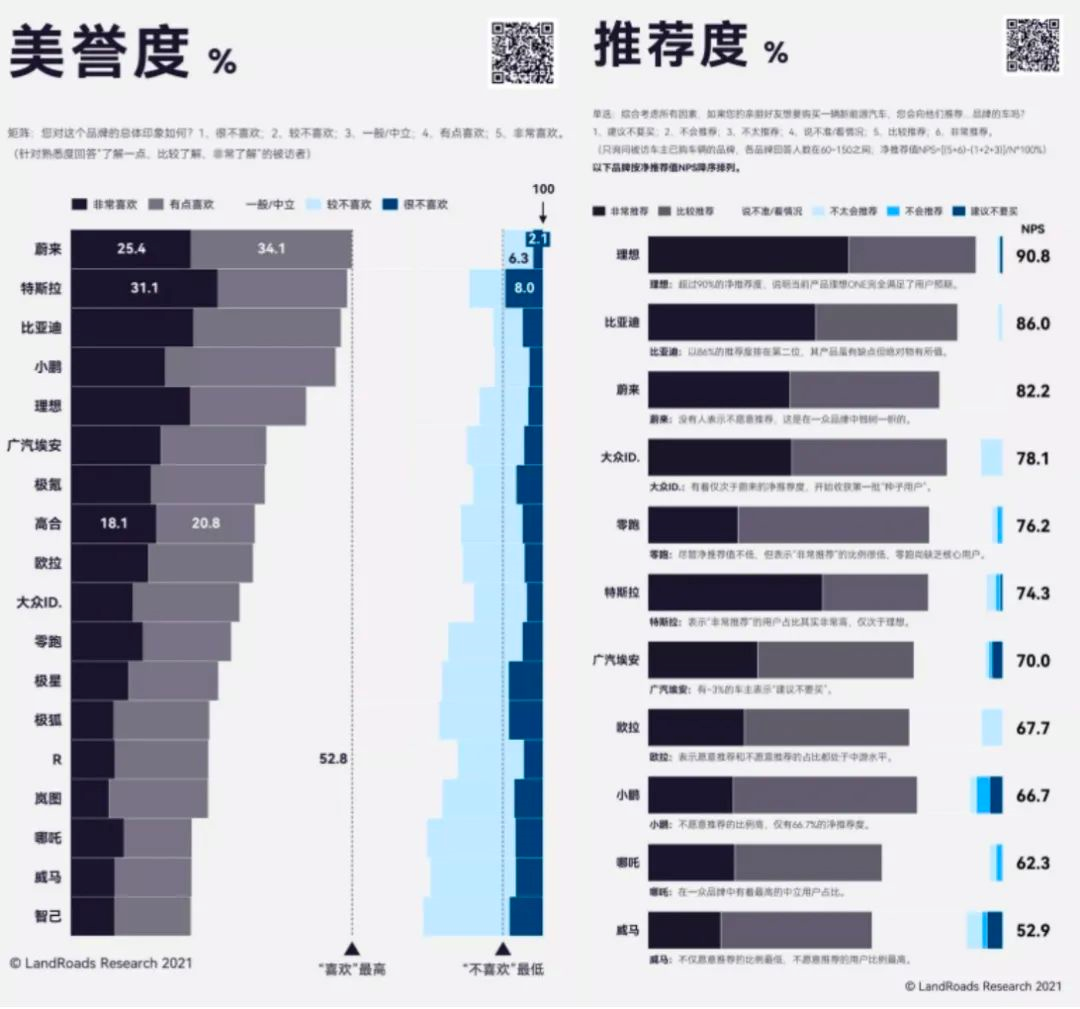

The other day, I saw a small sample of an electric vehicle user consulting report, in which several values about NIO are worth noting. Its reputation is very high, with the most users who like it, and the least who dislike it. Although it is not the highest in recommendation, no car owner expresses “unwilling to recommend,” which is the only one among various electric vehicle brands.

No one knows better than car owners that NIO has many faults. In fact, its experience peak is often after product problems occur and after-sales service provides exceptional care. But even if ignoring these, there is still a point that cannot be refuted–it tries to give solid conscience and is thoughtful, and tries not to make product compromises.

It is expensive, but even if you peel away the superficial layer, you can always find the reason for its high price.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.