At the end of October, authoritative data on the European (ACEA) and American (Argonne) markets has been released, and I would like to analyze and process these data more deeply.

1) Europe

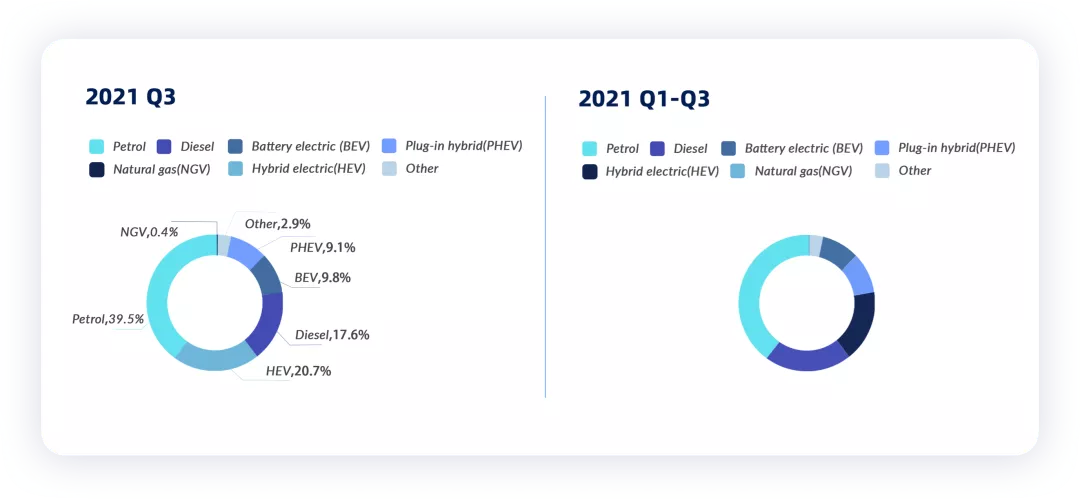

In the third quarter of 2021, the market share of electric vehicles in the EU further expanded – the sales volume of pure electric vehicles was 212,582 units, and the sales volume of plug-in hybrids was 197,300 units. From January to September, the total sales volume of pure electric vehicles and plug-in hybrid electric vehicles was 1.5887 million units, accounting for 9.8% and 9.1% of the automotive market, respectively.

At this rate, it is expected that Europe’s new energy vehicles this year will reach 2.1-2.15 million units, which is a very impressive number.

2) America

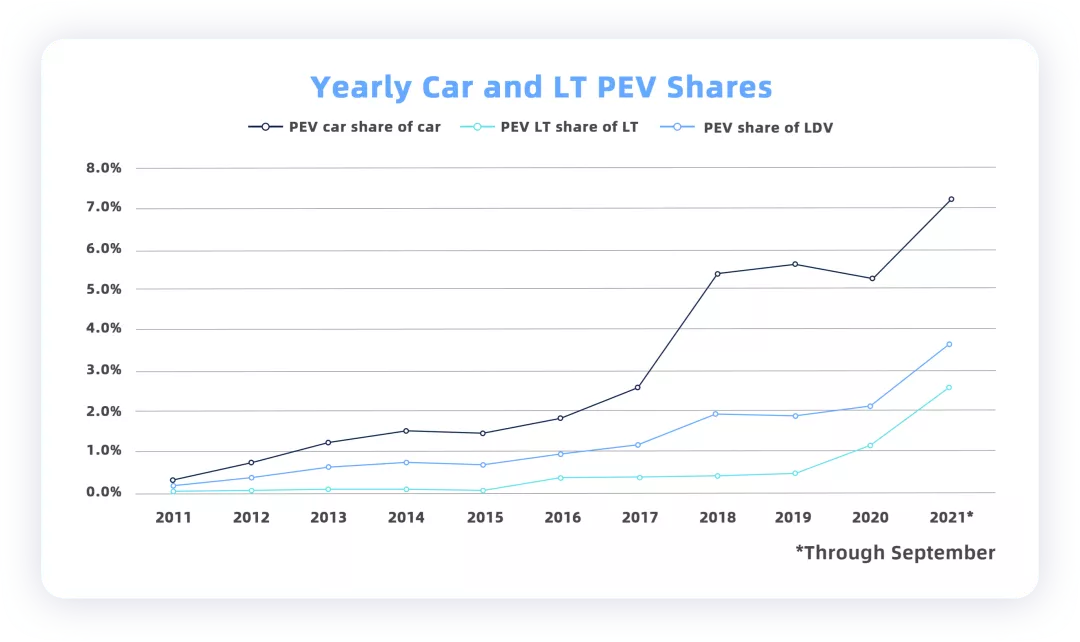

According to Argonne data in September, there were a total of 43,959 new energy vehicles in the United States (29,862 BEVs and 14,097 plug-in hybrids).

From January to September 2021, the total sales volume of new energy vehicles in the US was 424,483 units, and the total stock of new energy vehicles in the US market was 2,137,480 units.

At this rate, it is estimated that the number of new energy vehicles in the US will exceed 600,000 this year.

Situation in European countries

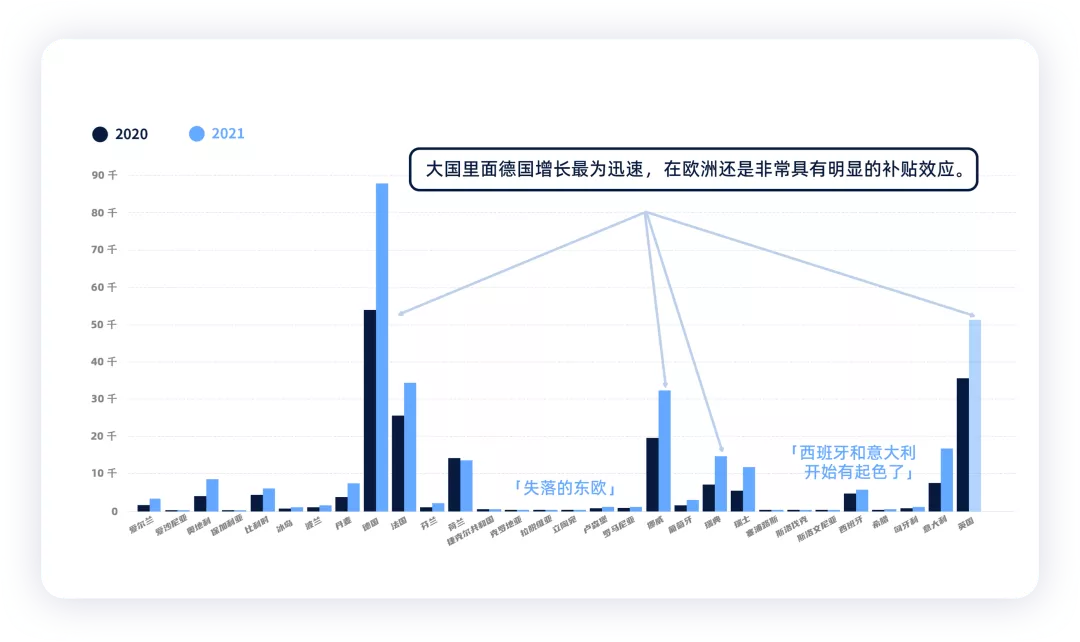

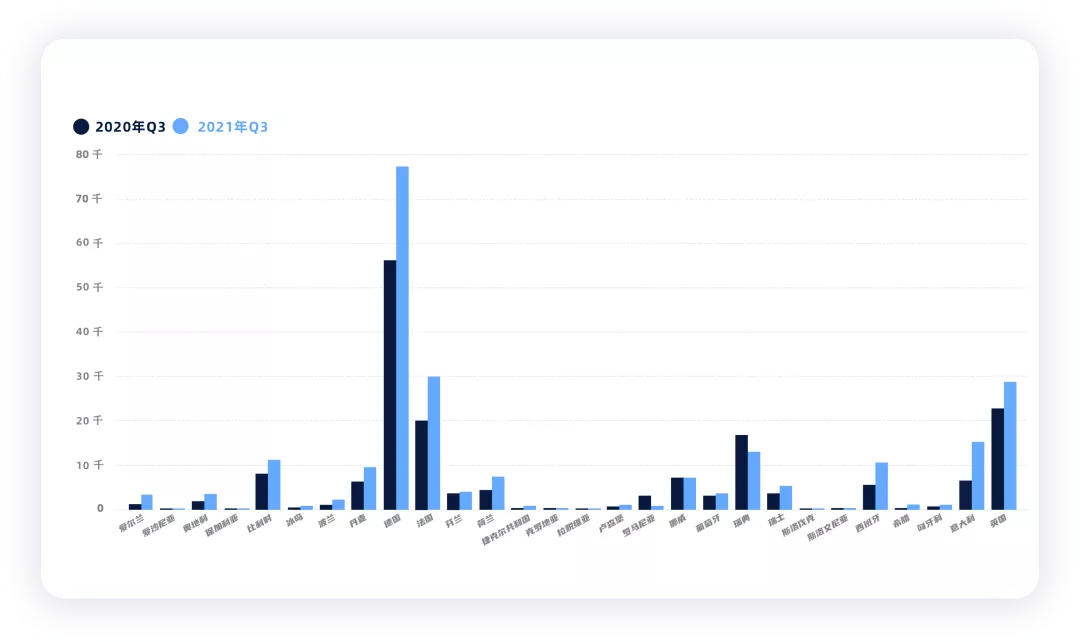

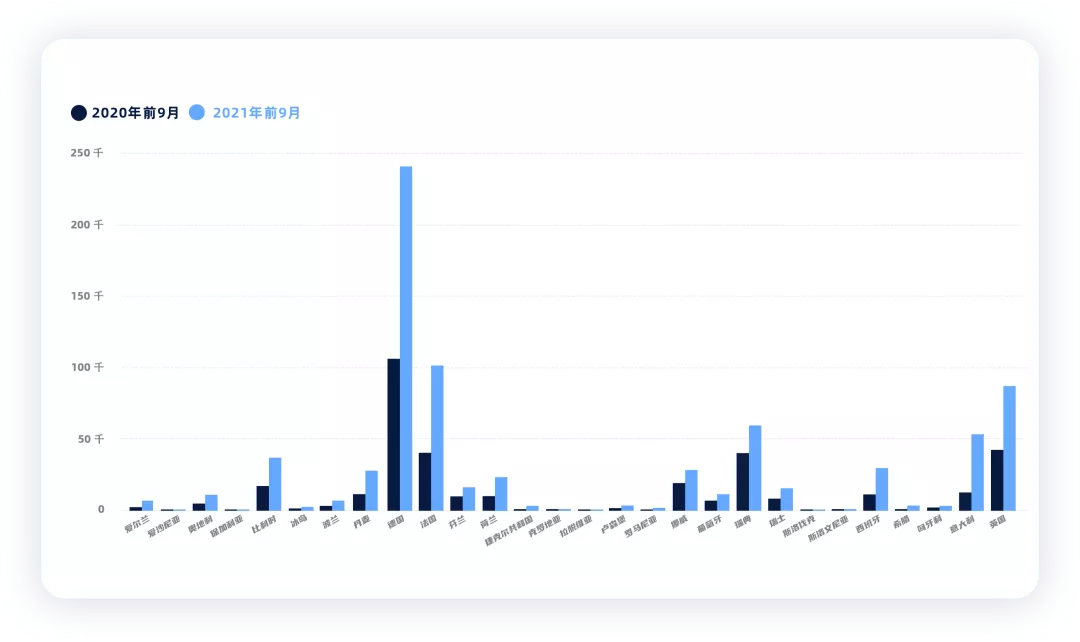

1) Pure electric vehicles

From actual data, it can be seen that the electric vehicle market in Q3 in Europe was still driven up by a few major countries, namely Germany, Norway, Italy, and the United Kingdom, with very significant sales growth.

The overall data from January to September 2021 is similar to that of the third quarter.

From the data, it can be seen that several countries in Europe, such as Germany, France, Sweden, Italy, and Spain have an urgent need to promote the transformation of new energy vehicles.

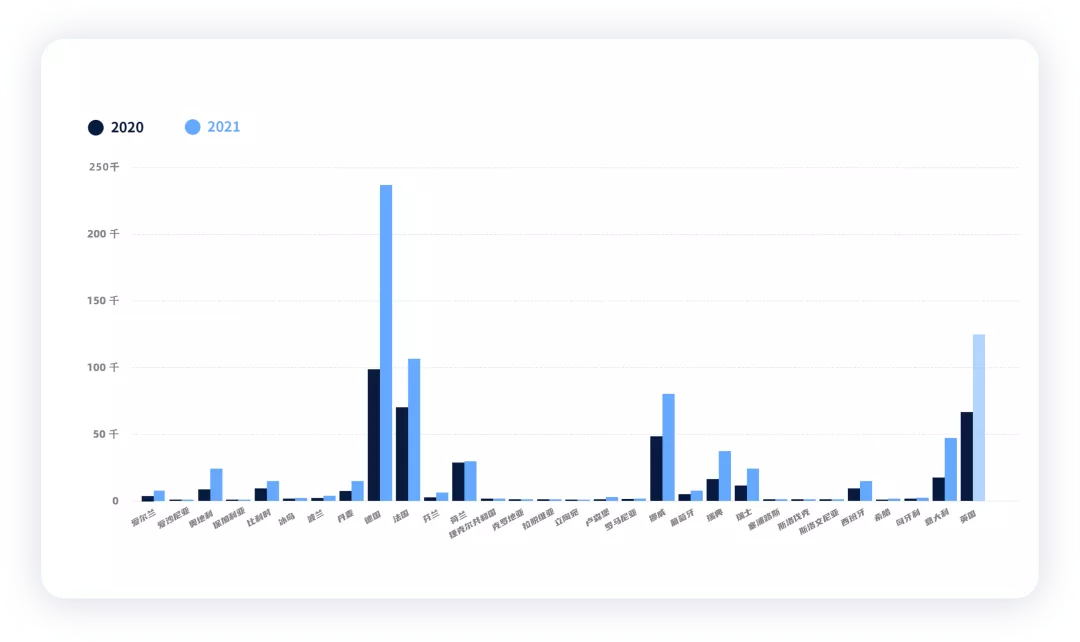

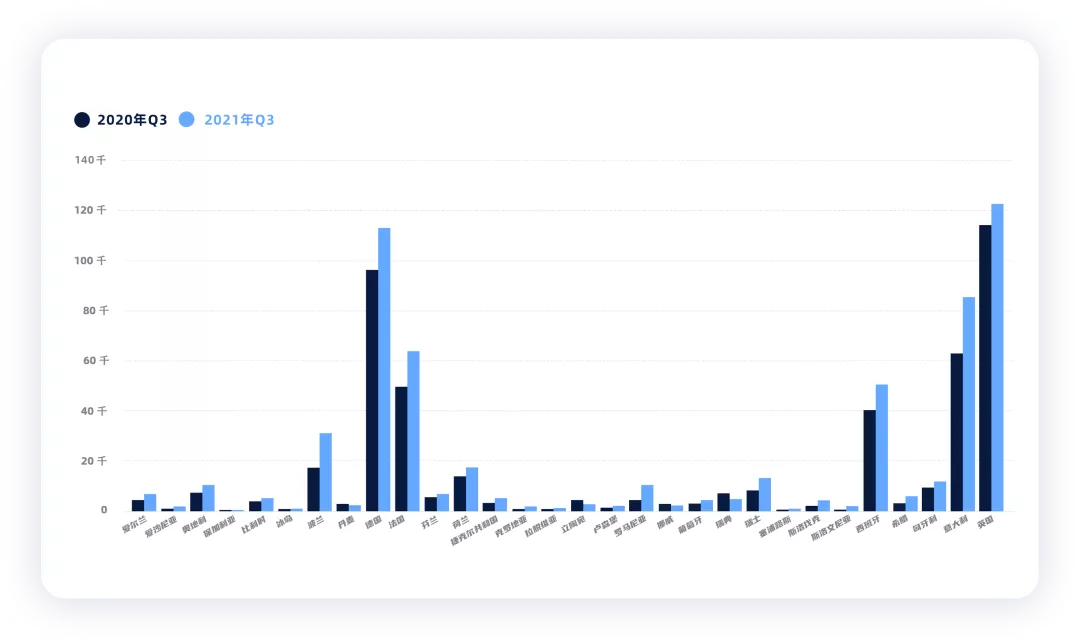

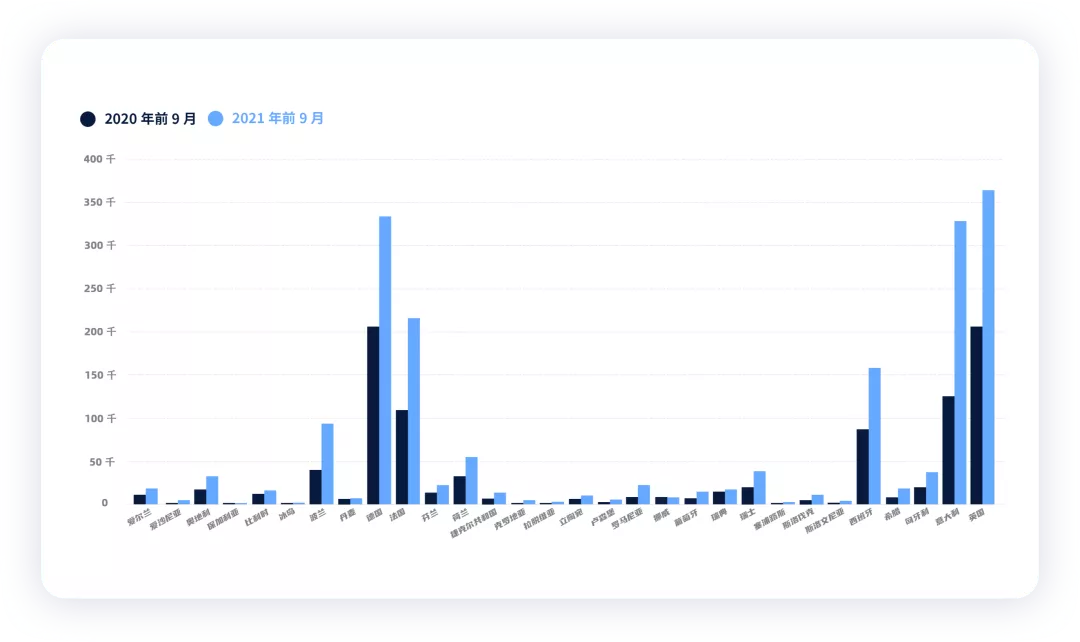

2)PHEV

As mentioned in previous analysis, the growth rate of plug-in hybrid electric vehicles in Europe was greatly slowed down due to chip shortage.

As shown in the figure below, the growth of plug-in hybrids in Germany, France and the United Kingdom has encountered significant obstacles, and even in Sweden, the sales volume of plug-in hybrids has declined year-on-year.

From the first nine months of 2021, the sales of PHEVs in Europe have shown significant growth, which is largely due to the low base in the first half of 2020. In addition, European automakers have made great efforts to promote PHEVs in the first half of this year.

3)HEV

The year-on-year growth rate of HEVs this year is relatively low. The sales volume in Q3 was 588,429 units, compared to 467,000 units in the same period last year, with a growth rate of 25.9%.

In 2021, the sales volume of HEVs in Europe is considerable, with a total of 1.871 million units sold, a year-on-year increase of 90.7% compared to 981,300 in the first nine months of 2020. We can understand that both HEVs and PHEVs are limited by chip shortage.

The data in the figure below objectively reflects the chip shortage situation this year.

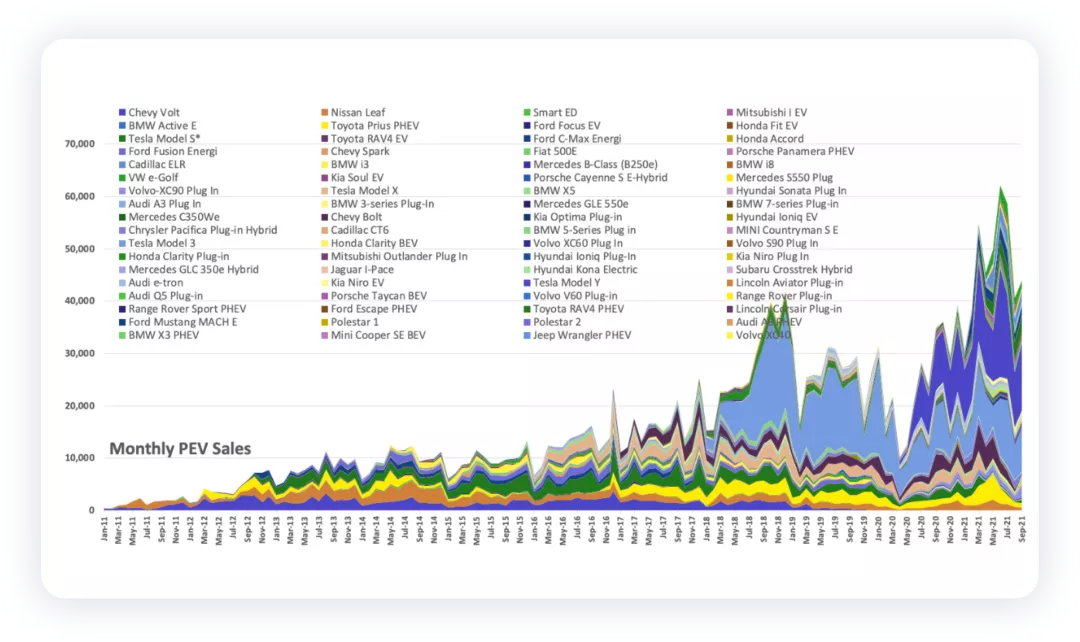

US MarketThe specific data for each model is only shown in the graph below. It can be seen that the market is still mainly dominated by Model 3 and Model Y, with Model Y selling slightly better than Model 3 in that month.

In September 2021, 60,850 HEVs (18,877 sedans and 41,973 light vehicles) were sold in the United States, an increase of 40.6% year-on-year, of which Toyota accounted for 63.4%.

In September, 482 fuel cell vehicles were sold, and a total of 2,743 fuel cell vehicles were sold in 2021, with a total of 11,684 fuel cell vehicles sold in the United States.

Summary: These data are not significantly different from the data previously tracked. At the end of 2020, there were a total of 10 million electric vehicles in stock worldwide (5.4 million in China, 3.3 million in Europe, 1.8 million in the United States, and 0.8 million in other regions).

However, starting from 2021, the number of electric vehicles is accelerating, with 2.157 million in China, 0.4244 million in the United States, and 1.5787 million in Europe from January to September. The top three markets have 4.16 million vehicles in the first three quarters, which will be 5.5 million for the entire year according to this growth rate. This is almost half of the stock of electric vehicles we had previously.

We cannot be too conservative about the future!

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.