Chris Zheng: NIO Unveils the Second-Generation Electric Drive System at Its XPT Plant in Nanjing

On October 19, NIO held a lecture at its Nanjing XPT plant with the second-generation electric drive system as its theme.

The core of the lecture includes NIO’s new combination of 180 kW permanent magnet motor and 300 kW induction motor in the front and rear respectively, the first application of SiC power module, and NIO’s new attempts in user experience, such as motor heating, NVH software and hardware optimization, and more.

It is worth mentioning that the development of NIO’s second-generation electric drive system began at the end of 2019 when NIO’s finances were the most strained in history. This inevitably impacted the development direction of the second-generation electric drive system, NIO’s ET7 and XPT.

Let’s take a closer look together.

Full-Stack Software and Hardware Self-Development for Freedom

Let’s start with the achievements of the second-generation electric drive system.

The most intuitive improvement is, of course, the data on paper. The comprehensive performance of NIO’s ET7 is in line with the top tier of pure electric cars worldwide, with a 180 kW permanent magnet motor in the front and a 300 kW induction motor in the rear.

Starting from 300 kW, among the high-performance motors that are about to/already in mass production, only four brands have 300 kW or above: Lucid Motors, Porsche, Tesla, and NIO.

Lucid Air Rear Motor: 493 kW

Model S Raven Rear Motor: >420 kW

Taycan Turbo S Rear Motor: 335 kW

ET7 Rear Motor: 300 kW

High performance has always been part of NIO’s brand DNA. In fact, the ES8 delivered in June 2018 already had a domestically produced motor with the highest power of 240 kW, and three years later, ET7 pushed this ceiling up again, joining the 3-second club with 0-100km/h acceleration in 3.9 seconds, and becoming NIO’s fastest accelerating model.

Of course, higher performance also brings many new problems. For example, under other conditions being equal, higher performance often means more noise and vibration, which is worse for NVH.

NIO tackled this problem from two dimensions of hardware and software, trying to solve it. For example, NIO developed an iterative optimization algorithm for harmonic suppression and compensated for harmonic voltage, reducing the overall noise of the electric drive system by 5-15 dB.In addition, NIO further optimized the NVH performance of ET7 through non-uniform air-gap balanced electromagnetic radial force, high positive rotation air-gap magnetic density optimized torque fluctuation, and micrometer-level precision machining of tooth shape and tooth direction.

There is no doubt that the above paragraph is not randomly generated characters, but rather professional terminology representing NIO’s hardware engineering capabilities in electric drivetrains.

Let’s talk about the combination of front permanent magnet and rear induction motor. The design logic is simple and clear: the permanent magnet motor is more energy-saving and suitable for daily commuting, while the induction motor has strong explosive power and is suitable for intense driving.

So far, NIO is one of the few brands that can simultaneously equip permanent magnet and induction motors on all-wheel-drive models, with Tesla being the only one that can do the same or add another motor at most.

This is thanks to NIO’s founder, William Li’s, insistence on a self-developed strategy from the very beginning. Self-development helps NIO to have greater choice flexibility. To put it more plainly, “if there are no motors that meet the needs on the market, then build a new one by ourselves.” Therefore, when NIO needs a permanent magnet and induction combination, they will choose to build a new one directly.

Multinational companies that have not yet established a systemized motor R&D capability have to adopt a dual induction or dual permanent magnet full-drive solution from suppliers.

Another advantage of self-development is to call every component from a systemic or holistic perspective to achieve the optimal solution for efficiency. Based on the two motors of ET7, NIO has made a new attempt to drive the vehicle’s movement: using the motor to generate heat to warm up the battery.

The idea of using the motor as a heat-generating module was first mass-produced in Tesla Model 3. Thanks to their self-developed ability, NIO can efficiently keep up with the trend, and has developed 6 levels of dynamic and static heating modes, up to 4 kW of heating power, to optimize the low-temperature performance of the battery.

Considering that NIO has just released its “ternary lithium” battery, which generates heat from the four corners of the motor while driving, and warms the central iron phosphate lithium battery under low-temperature conditions, it is an exquisite engineering solution that guarantees user experience.

NIO has done more work. In the front-axle position of ET7, NIO mass-produces SiC silicon carbide power modules. SiC was first mass-produced on Tesla Model 3 in 2017. In 2020, BYD Han became the second model equipped with SiC.

However, whether it’s the already-launched luxury brand Porsche Taycan, Audi e-tron, or the upcoming Mercedes-Benz EQS and BMW iX, none of them are equipped with SiC.

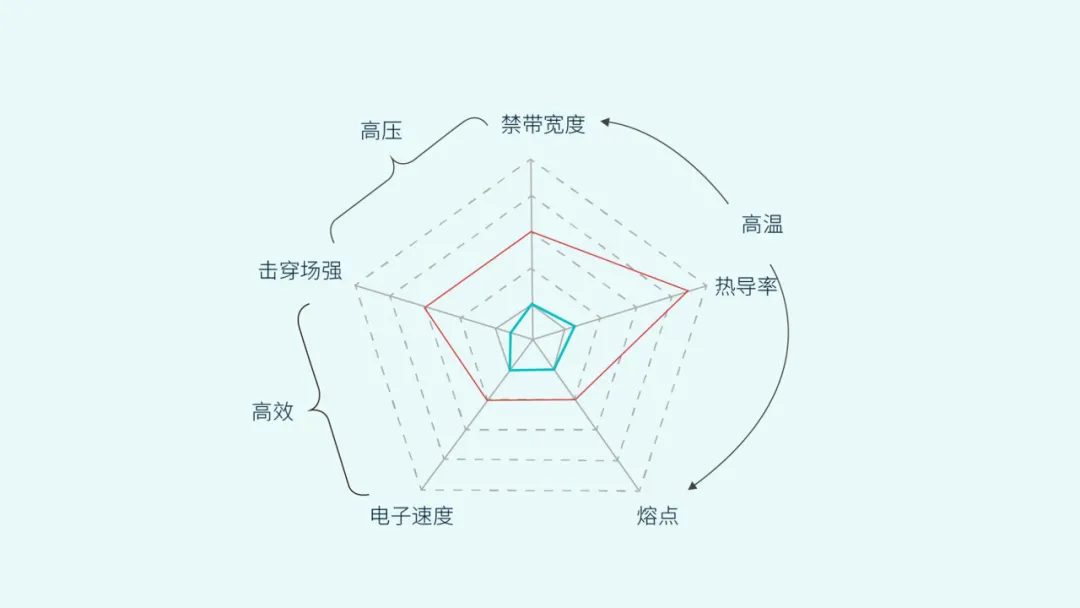

Compared to previous technologies, SiC has achieved superior performance in almost all indicators such as bandgap, thermal conductivity, melting point, electron velocity and breakdown field strength. However, why are multinational car companies indifferent? That’s because there are also factors such as the maturity of the industrial chain, yield rate, and most importantly, cost.

According to NIO data, benefiting from the use of SiC motors, the comprehensive loss of the ET7 electronic control system has been reduced by 4%-6%, and the efficiency of the main driving motor under CLTC working conditions is ≥ 91.5%. In comparison, the efficiency of the IGBT electronic control system is approximately between 88%-89%.

The above is all the work done by NIO based on the second-generation electric drive system. The common points of higher performance and efficiency, better NVH, and a brand-new motor heating scheme all rely on the collaborative optimization of self-developed hardware and software engineering.

Self-Research, why not?

After discussing the technology, let us talk about the higher-level part: the self-research strategy itself.

Li Bin has always talked about NIO’s continuous investment in self-research strategies at various occasions, but on the other hand, outsiders have always had some opinions on the financial pressure caused by NIO’s self-research strategy.

Should start-ups develop electric drive systems on their own? From NIO, we can give a completely affirmative answer: yes.

First of all, self-research has created huge differentiation advantages for NIO, which continue to this day.

For example, NIO has become the first Chinese brand to mass-produce three-in-one electric drive products and the first Chinese brand to produce flat wire motors on a large scale. So far, NIO has formed an annual motor production capacity of 320,000 units, which can synchronously support permanent magnet motors ranging from 100-200 kW and induction motors ranging from 240 kW-300 kW.

In addition, NIO and Tesla are the only car companies in the world that independently complete motor assembly, motor winding, and process controller production.

In the mass production of cutting-edge technology, self-research is especially proactive.

Zeng Shuxiang, Senior Vice President of NIO’s Electric Drive System, introduced that in the second half of 2019, NIO initiated the development of a 180 kW motor with limited funds, but due to financial pressure, it was not until Q2 2020 that NIO began to significantly accelerate the development of other components including SiC.

In July 2020, NIO and SiC chip companies from almost all around the world conducted exchange evaluations. After working overtime abnormally for two months, AnSen Microelectronics was finally determined.ET7’s SiC top substrate material is manufactured into wafers in the Ansenmi factory in South Korea, modules in Malaysia, and finally assembled in the XPT factory of NIO in Nanjing, China.

Through independent research and development, NIO has achieved mass production of SiC controllers 6-12 months ahead of most competitors except for Tesla and BYD, which is a key differentiation advantage.

In fact, not only the second-generation motor, but also the development of the NIO ET7 itself was limited by financial pressure and experienced a process of deceleration and then acceleration in R&D.

Since its release on January 9th, in order to catch up with the 2022 first-quarter SOP milestone, NIO ET7 has carried out high altitude tests in New Zealand for the first time in August of this year to recover the progress, followed by high temperature and high altitude tests respectively in Sanya and the Sichuan-Tibet line.

So, is NIO’s financial pressure caused by self-developed electric drive systems? The answer is no.

According to Zeng Shuxiang, the cumulative R&D investment of NIO XPT from 2015 to now is 250 million RMB (excluding R&D salaries and site costs), including about 130 million R&D outsourcing for vehicle matching and development validation, about 96 million for test bench equipment, and nearly 30 million for various software tool costs.

In contrast, Li Bin emphasized in multiple occasions including the financial report conference in 2021 that NIO plans to spend RMB 5 billion on R&D in 2021.

Looking at this comparison, even before NIO had any revenue before June 2018, the cumulative R&D investment of 250 million is only considered to have burned a little bit of money.

Looking at it from a global perspective, NIO XPT is already very good, but not good enough. We must have higher expectations for NIO XPT and hope that it can make more breakthroughs that will remove the adjective “Chinese market” as soon as possible.

As for those mainstream car companies that have not yet established systematic motor R&D capabilities, you need to speed up.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.