Author: James Yang Jianwen

Today, one thing went viral on social media: Tesla’s market capitalization has surpassed a trillion dollars.

What does a trillion-dollar market cap mean?

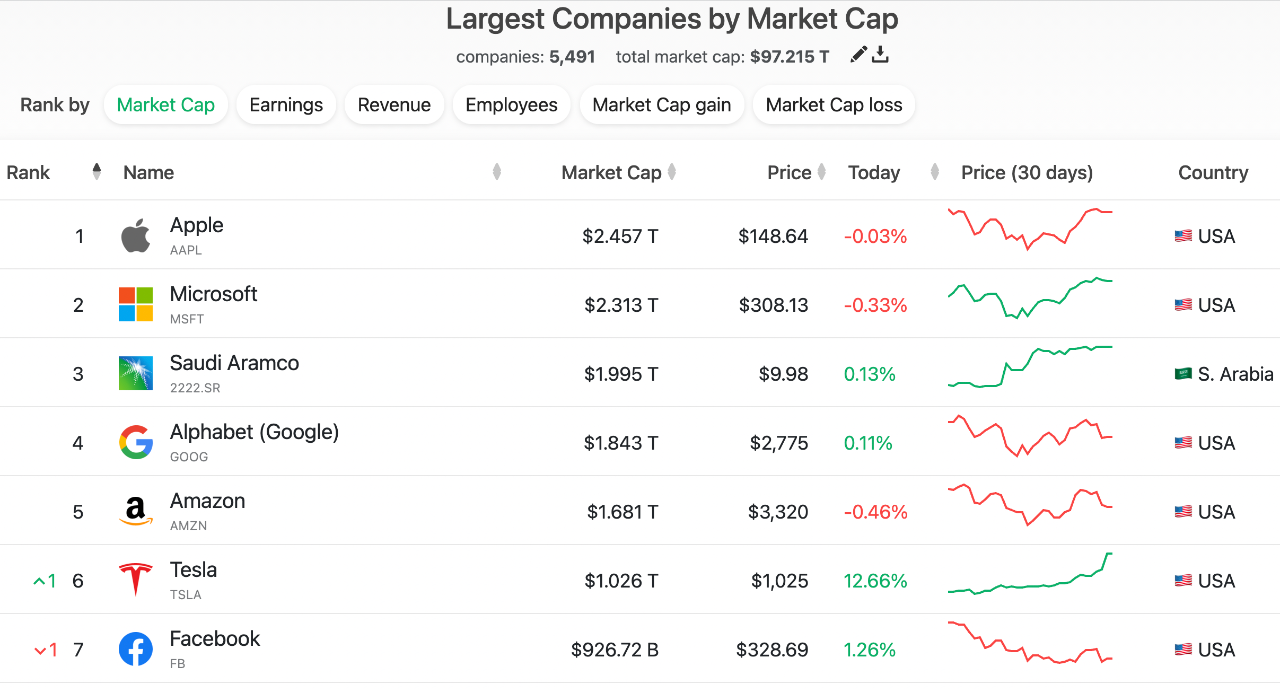

Before Tesla, only six companies in the world had a market capitalization exceeding a trillion dollars, namely Apple, Microsoft, Saudi Aramco, Alphabet (Google’s parent company), Amazon, and Facebook.

Tesla is the seventh company to achieve this landmark, and the only car company on the list.

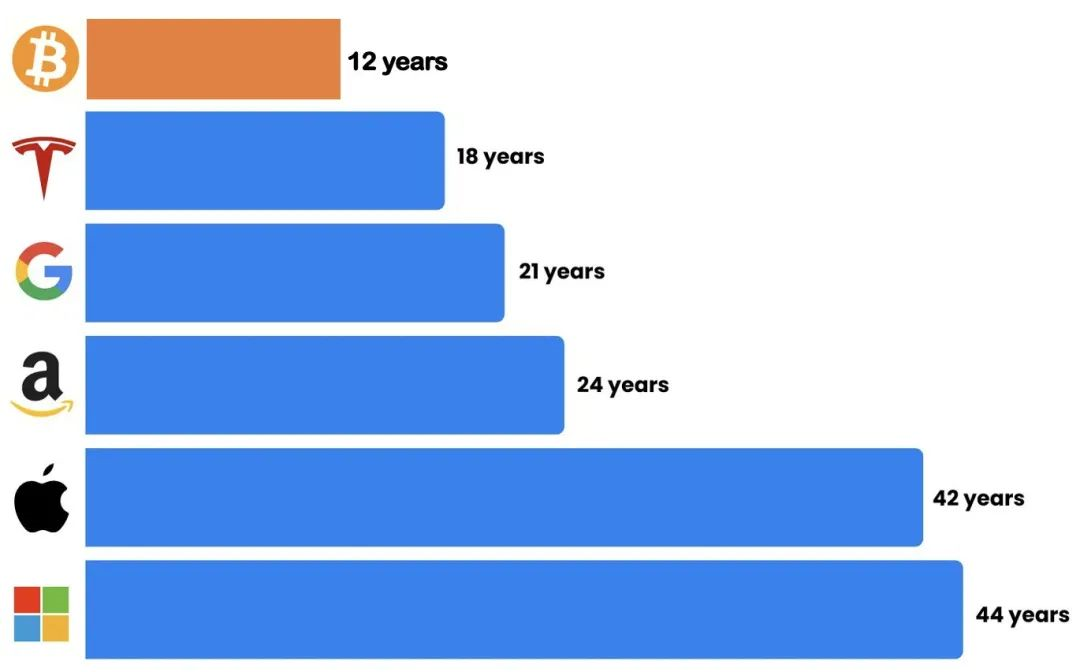

Moreover, it took Microsoft 44 years, Apple 42 years, and Google 21 years to reach a trillion-dollar market cap. By contrast, Tesla did it in just 18 years.

For the entire automotive industry, this is a momentous occasion. It may even take years for another company to replicate the feat of reaching a trillion-dollar market cap.

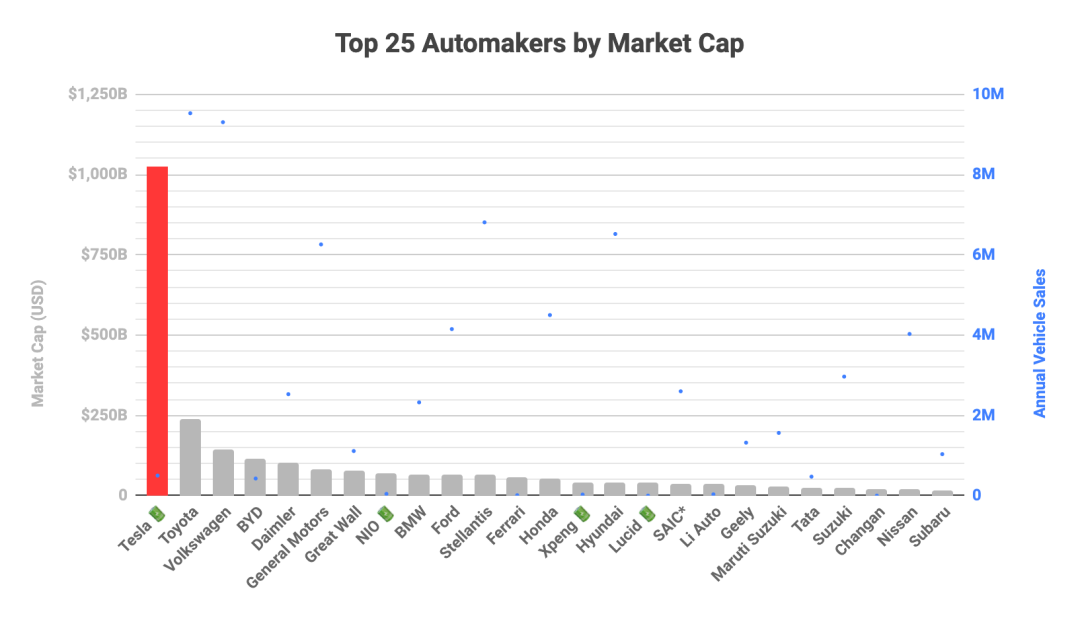

When I saw this news, I was still somewhat surprised. The last time I wrote about Tesla’s stock price was in June last year, when its market capitalization had just surpassed Toyota to become the world’s largest automaker.

Back then, many people thought that Tesla was “not deserving” of the position and that it would soon fall from grace.

Now, a year later, Tesla’s market capitalization has surpassed that of Toyota, plus the total market capitalizations of all other automakers combined.

If surpassing Toyota made Tesla a contender in the auto industry, then being in a league of its own among its peers is a reality now.

Tesla’s ascent from surpassing Toyota to surpassing the entire industry took only fifteen months, a breathtakingly fast pace.

Elon Musk shared his excitement about this accomplishment by tweeting “Wild $ T1mes!”.

Wild $ T1mes!

Every time Tesla’s stock surges, there are underlying positive factors at play. This time is no exception.

The catalyst for this upswing was Hertz, the centenarian car rental giant in the US, announcing its purchase of 100,000 Tesla Model 3 vehicles. This is the largest order Tesla has ever received, worth $4.2 billion.

I believe even Hertz did not expect to contribute this significantly, let alone to save tens of millions of marketing costs through this massive exposure. 🙂

So, what does 100,000 Model 3s mean? Simply put, from January to November 2020, Tesla delivered over 110,000 domestically produced Model 3s.

Interestingly, Musk himself stated that Hertz did not receive any discounts on the 100,000 Model 3s they purchased (well, I guess that’s what you get for being a direct sales company that doesn’t give conspiracy theorists a chance to accuse you of undercutting prices).

Even earlier, in the third quarter of 2021, Tesla announced nine consecutive quarters of profitability, with automotive gross margins surpassing 30% and net profit increasing nearly fourfold year-over-year, exceeding $1.5 billion for the first time.

This actually indicates that, by selling electric vehicles, Tesla has become self-sufficient, and is even thriving.

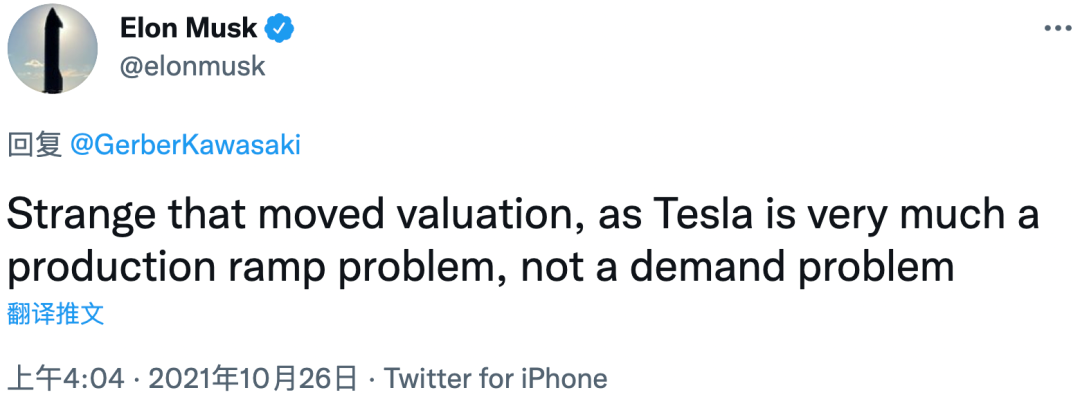

Now, Tesla’s biggest problem is no longer demand, but ramping up production capacity. (In the third quarter earnings report, Tesla stated that growth would be largely constrained by external factors.)

Of course, in this historic moment of great significance, there is also a wonderful collective psychology at work, with shareholders pushing Tesla into the trillion-dollar club.

The Trillion-Dollar Revelation

A “car seller” has achieved a market value that exceeds one trillion dollars, which is something many car companies dare not even dream of.

Ultimately, this is still due to the assistance of the times.

Demographic Dividends

In 2021, the direction of development towards electrification and intelligence has already been determined, and the giants of the auto industry in China, the United States, and Europe have all released policies or strategies for transformation.

Even Musk was invited by his “good buddy” Herbert Diess, Chairman of the Management Board of Volkswagen AG, to attend a high-level internal meeting of the Volkswagen Group (probably to share his experience in car manufacturing).

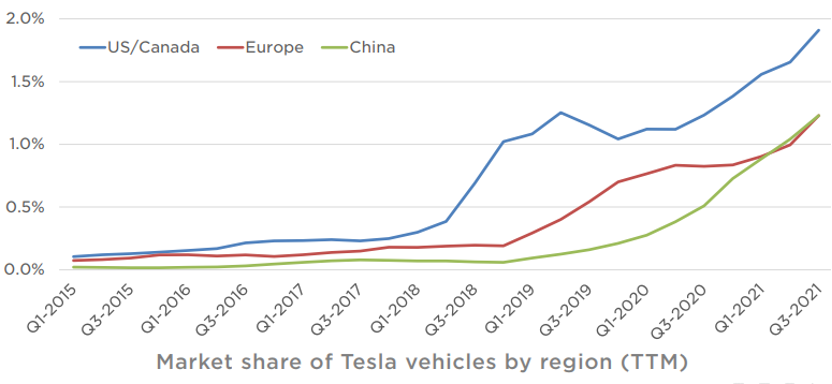

Moreover, new energy vehicles are becoming more and more widely accepted by consumers. In China, for example, the penetration rate of new energy vehicles exceeded 20% in September of this year.

In summary, the general environment is becoming increasingly favorable for electric vehicles.

In this context, as a pioneer, Tesla naturally benefited from the first and largest wave of dividends.### “Transformation of Components”

In addition, Tesla has changed its genetic makeup. From a superficial perspective, Tesla is just a car company, but in reality, it’s a technology company.

If we carefully observe the members of the trillion dollar club: Apple, Microsoft, Google, Facebook… most of them are technology companies.

The ecosystem of electrification and intelligence has changed the valuation system of the automotive industry; this is the reason why Tesla’s market value can surpass Toyota.

During Tesla’s recent AI Day, not only did they bring their supercomputer Dojo, the D1 chip, but they also brought the Tesla Bot (which may launch its first prototype next year).

Musk has shifted Tesla’s focus from just cars to more life-related robots, making the story even bigger.

This move has officially elevated Tesla’s scope from an automotive company to an AI and technology company.

At that time, Tesla’s valuation was still fluctuating around $700, but now it has broken $1000+.

This is the power of mindset…

Expanding and Enhancing to Create New Heights

For the entire industry, Tesla’s success is a model, something that is not easily achievable in the short term.

But it is only with such a sample that one can appreciate the magnitude of imagination in the intelligent new energy automotive industry.

After breaking the trillion dollar mark, you can also realize some things: why do traditional automakers need to leverage new resources? Why have technology companies such as Xiaomi and Baidu ventured into carmaking? Why does manufacturing giant Foxconn insist on squeezing into this field?

Even more so, you may no longer doubt Apple’s resolve to enter the car market because, for Apple, creating a car can recreate Apple itself.

For domestic independent brands, with Tesla as a benchmark, they can confidently continue to “go down one path to the end.”From the current trend of development, the attacks from traditional giants will become increasingly fierce, thus independent brands must act faster, faster, and even faster.

Lastly, let me ask a small question: Have you bought any Tesla stocks? 🙂

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.