Author: Zhu Yulong

Starting from this month, I will outline the market situation of power battery in the “Electric Vehicle Observer” every month.

In September, on a large scale, we can see the technological transition from ternary to lithium iron phosphate, which did not provide opportunities for small battery companies. The biggest beneficiary is BYD. The layout of Company B on this technology route is still excellent and is rapidly approaching the shipment volume of Ningde era passenger cars.

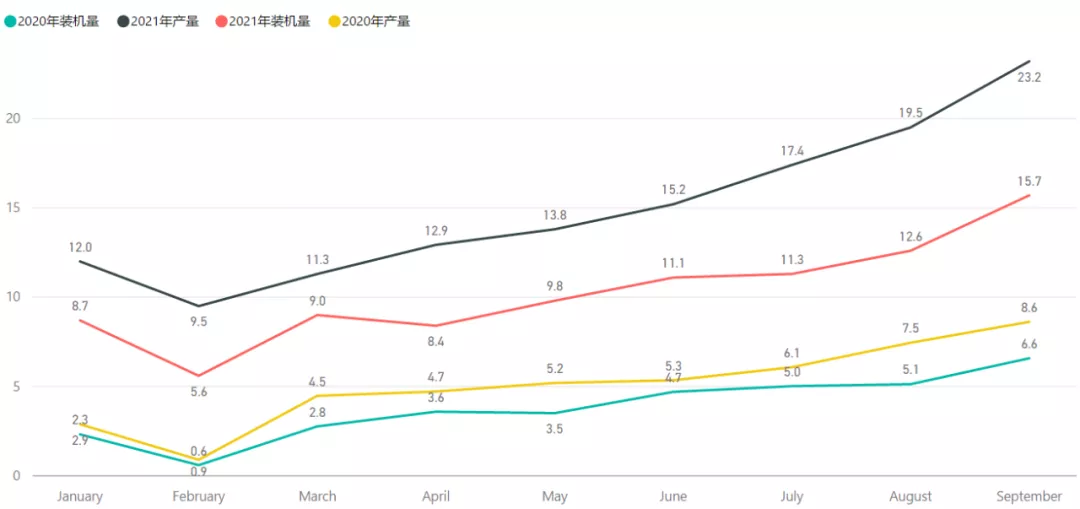

Looking forward to 2021, based on a monthly output of 24GWh, the cumulative production from January to September is 134.7GWh, which can be boosted to over 200GWh+ for the whole year. This data is really surprising. From the installed capacity perspective, the cumulative volume from January to September is 92GWh, and the chip problem is still plaguing China’s electric vehicle industry. Estimated installed capacity is about 135GWh, which is also a historical high.

1) Where does the huge gap between production and installation come from?

In September, data from the China Automobile Power Battery Industry Innovation Alliance showed that the power battery production totaled 23.2GWh, a year-on-year increase of 168.9%, and the power battery installed capacity was 15.7GWh, up 138.6% year-on-year.

The first phenomenon we observed was that the growth rate of output was faster than that of installation. Currently, there is a difference of about 7GWh per month, and the cumulative production of 42.63GWh in January-September has not been installed.

If we break it down, the difference may come from:

- Some companies report energy storage batteries together with power batteries. It is estimated that there are about 10-12GWh.

- Exported parts, according to Tesla’s export volume calculation, Tesla is approximately 100,000 units, about 5.5GWh. The other parts with whole vehicle export volume is about 4GWh. The total is about 10GWh, and the battery exported to Europe is estimated to be about 5GWh, totaling about 15GWh.

- Inventory and temporary inventory: There is a cycle from the production of battery companies to its use, so it is divided into the total inventory of battery companies and the temporary inventory held by automakers. From the current situation, I estimate that there is a delay inventory of about 10GWh. The temporary inventory of automakers is due to this year’s special chip problem, and it is currently estimated to be about 5GWh.

Note: The estimated amount of inventory and temporary inventory can also be reflected as = sales volume – installation volume = 106.8GWh-92GWh = 14.8GWh.

Through this breakdown, we can understand this difference: From January to September, the cumulative production was 134.7GWh, a YoY increase of 195.0%. From January to September, China’s power battery installed capacity cumulatively reached 92.0GWh, a YoY increase of 169.1%.

2) CATL leads the rise of LFP batteries

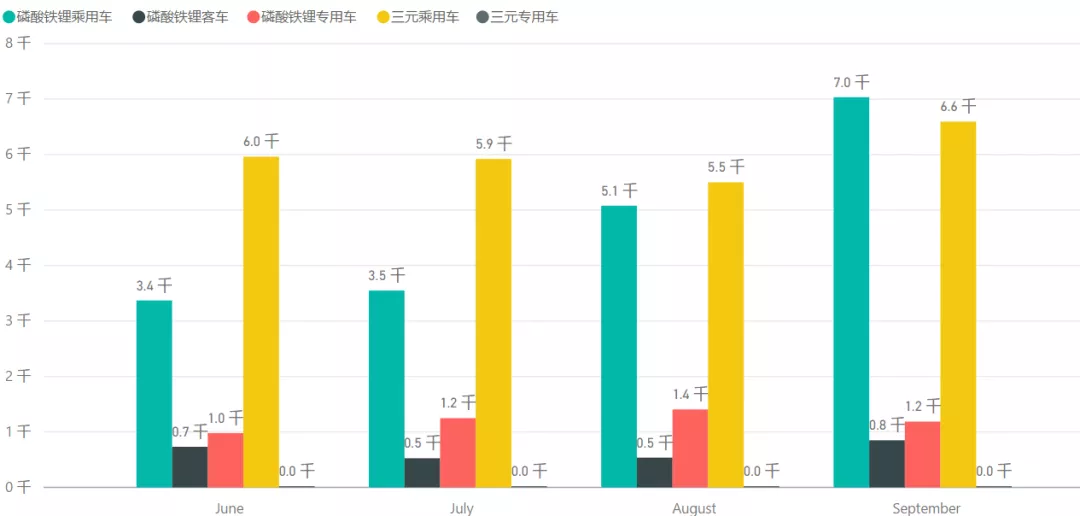

The second aspect worth our attention is that the advantage of LFP (Lithium Iron Phosphate) batteries can be reflected in both production and installation. In September, the production of LFP batteries reached 13.5 GWh, accounting for 58.3% of the total production, with a year-on-year increase of 252.0%. On the other hand, the production of ternary batteries in September was 9.6 GWh, accounting for 41.6% of the total production, with a year-on-year increase of 102.6%. Since LFP batteries surpassed ternary batteries in April, this trend will not reverse in the next few years.

From the installation volume, we can also observe the same trend. In September, the installation volume of LFP batteries reached 9.5 GWh, with a year-on-year increase of 309.3%. By comparison, the installation volume of ternary batteries was 6.1 GWh, with a year-on-year increase of 45.6%. Currently, the accumulated installation volume of ternary batteries is slightly higher than that of LFP batteries, which is 47.1 GWh versus 44.8 GWh for LFP batteries. However, next month LFP batteries will basically exceed ternary batteries completely.

To understand this change, we need to look at the overall pattern of the past few months. The core change is still the increase in the usage of LFP batteries in passenger cars, from 3.4 GWh in June to 7 GWh in September, while ternary batteries are still concentrated in the field of passenger cars.

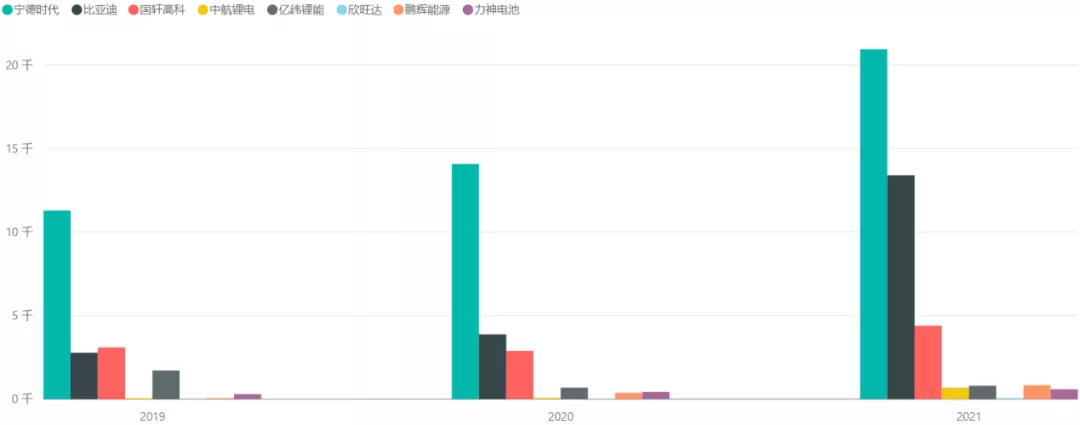

Looking at this data, we see a significant transformation: in 2019, CATL (Contemporary Amperex Technology Co) was the largest supplier of LFP batteries in China, providing 11.3 GWh; In 2020, the production increased to 14 GWh; From January to September 2021, CATL’s domestic installation volume has reached 20.9 GWh, with 5.2 GWh in September alone. The transformation is really fast. In contrast, the installation volume of ternary batteries for CATL in September was only 3.72 GWh. The leading enterprise’s shift towards LFP batteries has driven the development of LFP batteries.

Similarly, we can see that the production capacity of BYD (Build Your Dreams) is increasing rapidly: 2.8 GWh in 2019, 3.88 GWh in 2020, and now, from January to September 2021, with the introduction of blade batteries, it has risen sharply to 13.4 GWh. In this field, BYD truly has the strength to compete with CATL.

3) BYD vs. CATL

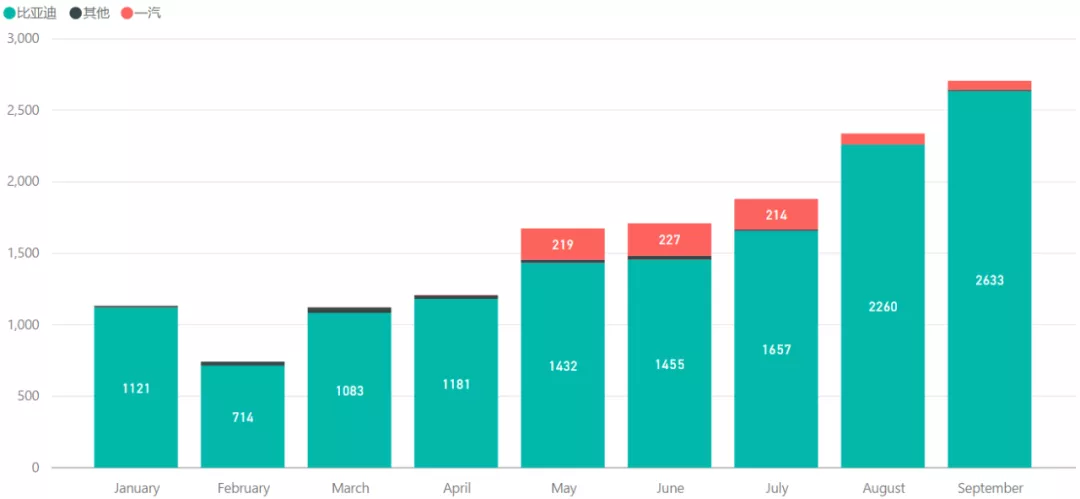

In terms of industry concentration, although 39 power battery companies achieved matching installations in the new energy vehicle market in September, the top 3, top 5, and top 10 power battery companies’ power battery installation volume accounted for 78.4%, 85.3%, and 93.2% of the total respectively. The key factor that will affect the future data is whether BYD can catch up with the pace of CATL.

BYD started to separate its battery business – its main clients for ternary batteries are Changan and Ford; while blade batteries target FAW as a customer. As shown in the following figure, the current customer distribution status of BYD batteries is still mainly centered around itself. BYD’s external supply is also heavily tilted towards foreign brand, and the proportion of domestic brand demand is relatively low in the short term. From what we can see now, BYD needs to wait for the use of foreign brands to effectively challenge CATL.

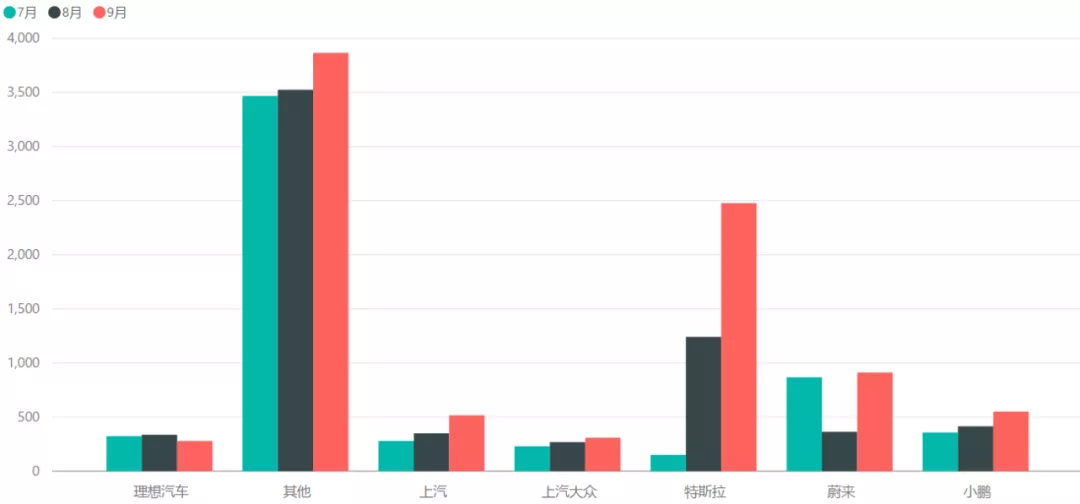

In the near future, I have sorted out the percentage of major clients of CATL, as shown in the following figure. The recent domestic incremental demand of CATL is mainly due to the installation of batteries on the iron lithium versions of Model 3 and Model Y, and its effective supply has been ongoing but not reflected in domestic demand in Europe. Other stable customers include Nio, Ideal, XPeng Motors, and North and South Volkswagen have had relatively high demand in the past few months. CATL’s other main market share is approximately 3.5GWh, which is relatively stable.

I think that in the short term, the situation of other battery companies is still quite challenging. The rapid introduction of iron lithium route requires time, and the recent rise in raw material prices has put these companies in a double-bind. On the one hand, they need to cope with unpredictable vehicle prices for themselves, and they are very sensitive to battery costs; on the other hand, they have to take into account the current supply side. If there is no long-term cooperative price endorsement, they cannot even obtain materials, which poses huge challenges for their survival and development in the next step.## Summary:

For this month’s battery update, I want to share some unique topics with you all, with a focus on Lithium Iron Phosphate batteries. Do you think there will be a resurgence of second-tier battery companies in the Lithium Iron Phosphate race?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.