I want to estimate the use of SiC in vehicles this weekend. With this data, we can roughly evaluate the future usage. The estimation is relatively simple, mainly to make some deductions from this data.

I believe that the three basic elements of intelligent electric vehicle hardware are battery cells, power chips, and high-performance computing chips. These are the three most basic pillars. Following this line of thought, we can make some judgments on several companies, such as Infineon, ON Semiconductor, and Wolfspeed.

Current EV manufacturers and vehicles using SiC

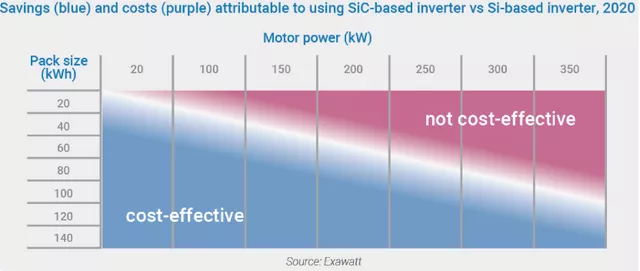

The reason why SiC devices are used as the core of inverters is mainly related to battery and motor power. In the article “Silicon Carbide in the UK Electric Vehicles and Beyond,” there is such a chart.

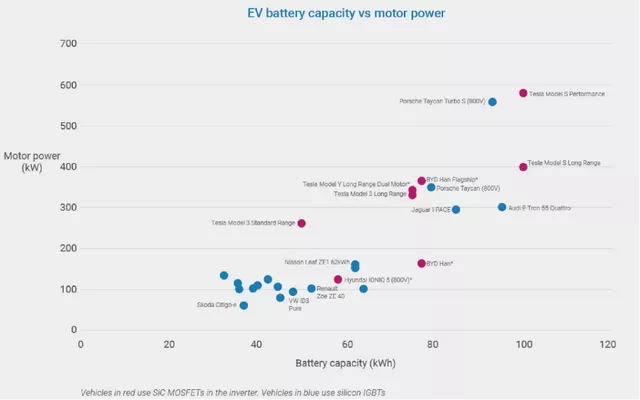

Currently, SiC devices are mainly used in the following areas globally:

Tesla: All models come with 650V SiC devices based on the 400V voltage system.

Hyundai-Kia: Hyundai’s Ioniq 5 and Kia’s EV6, and the Genesis G80 BEV will follow.

BYD: BYD’s four-wheel-drive version uses silicon carbide.

According to the current situation, the following EV models have used SiC devices in their inverters from January to September 2021:

Tesla: 627,000 units have been delivered so far in 2021. Based on this trend, another 280,000 units are expected in Q4, reaching around 900,000 units this year.

Hyundai-Kia: Deliveries of Hyundai’s Ioniq 5 reached 38,517 in 2021. Based on this trend, Hyundai is expected to deliver about 65,000 to 70,000 units, and Kia’s EV6 has delivered 7,508 units. Based on the current trend, they will deliver 18,000 to 20,000 units in 2021. Genesis G80 BEV delivered 327 units from January to September, and 1,000 units are expected to be delivered in 2021. Together, these vehicles will total around 84,000 to 91,000 units.

BYD: The number of four-wheel-drive models is roughly 16,000 units, with roughly 1,500 units per month. It is estimated that 20,000 units will be delivered this year.

According to this calculation, it is expected that 1.011 million units of pure electric vehicles will adopt SiC main inverters this year, and the overall scale mainly expands with Tesla’s demand.

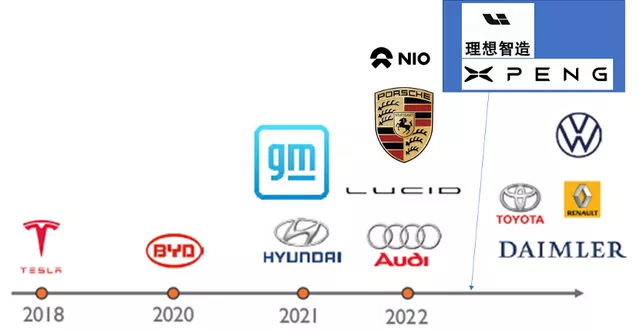

According to Infineon’s latest data (shown in the figure below), Infineon is the main supplier of modern EMP series SiC; among US car companies, it is speculated that General Motors may be the first to import SiC, as Wolfspeed previously announced a strategic supply agreement with General Motors to provide silicon carbide for General Motors’ future electric vehicles. The Asian OEMs in the figure may be Korean car companies. XPeng Motors is the first to explicitly launch an 800V SiC platform.

Starting in 2022, we can estimate the overall usage:

Tesla: Estimated to increase significantly in 2022 due to the upgrades of the factories in Texas and Berlin, from 900,000 in 2021 to 1.4-1.5 million.

GM: According to General Motor’s style, it is estimated that 10-20k 800V systems will be sold in 2022.

Hyundai: Approximately 160k 800V SiC-equipped cars may be produced in 2022.

Kia: 80-100k 800V SiC-equipped cars may be produced in 2022.

Nio: It is estimated that 10-15k ET7 vehicles will be delivered in 2022.

BYD: By the same logic, it may increase to 100k vehicles in 2022.

Audi and Porsche: The new PPE platform is expected to produce 50-100k vehicles, but it is not known how the actual production will progress.

XPeng Motors: It is estimated that 10-20k 800V vehicles will be delivered in Q4 2022.

As far as I know, the development of high-power fast charging in the new car industry is accelerating, and this wave of SiC belongs to strong demand. The total amount in 2022 is not much, but it will explode domestically in 2023.

Conclusion: Although 800V has posed challenges to overall insulation, it has become a platform for high-end car challenges. The situation in the future may be that 400V cannot hold its head up in front of 800V – at least the positioning of 800V is already in the high-end segment, with its main advantages being the efficiency difference under high power and the difference in fast charging compared to 400V.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.