Translation:

Body:

Word Count: 2,069

Expected Reading Time: 10 minutes

The word to describe Tesla’s just-released third quarter financial report can only be described as blindingly bright.

Whether it’s the gross profit margin that once again breaks through the industry’s ceiling to reach 30.5%, or the pre-tax net profit margin that reaches 14.6%, or even the free cash flow of $1.6 billion. It can be said without exaggeration that every indicator is setting new records, all achieved in the face of rising global supply chain prices, double logistics costs, and chip shortages.

We must give a thumbs up to the Tesla team, as only with advanced technology can we hedge against the magical real world and achieve such results.

Next, let’s follow the routine of the last financial report and first analyze the data of this financial report, and then combine it with historical data to make an interpretation.

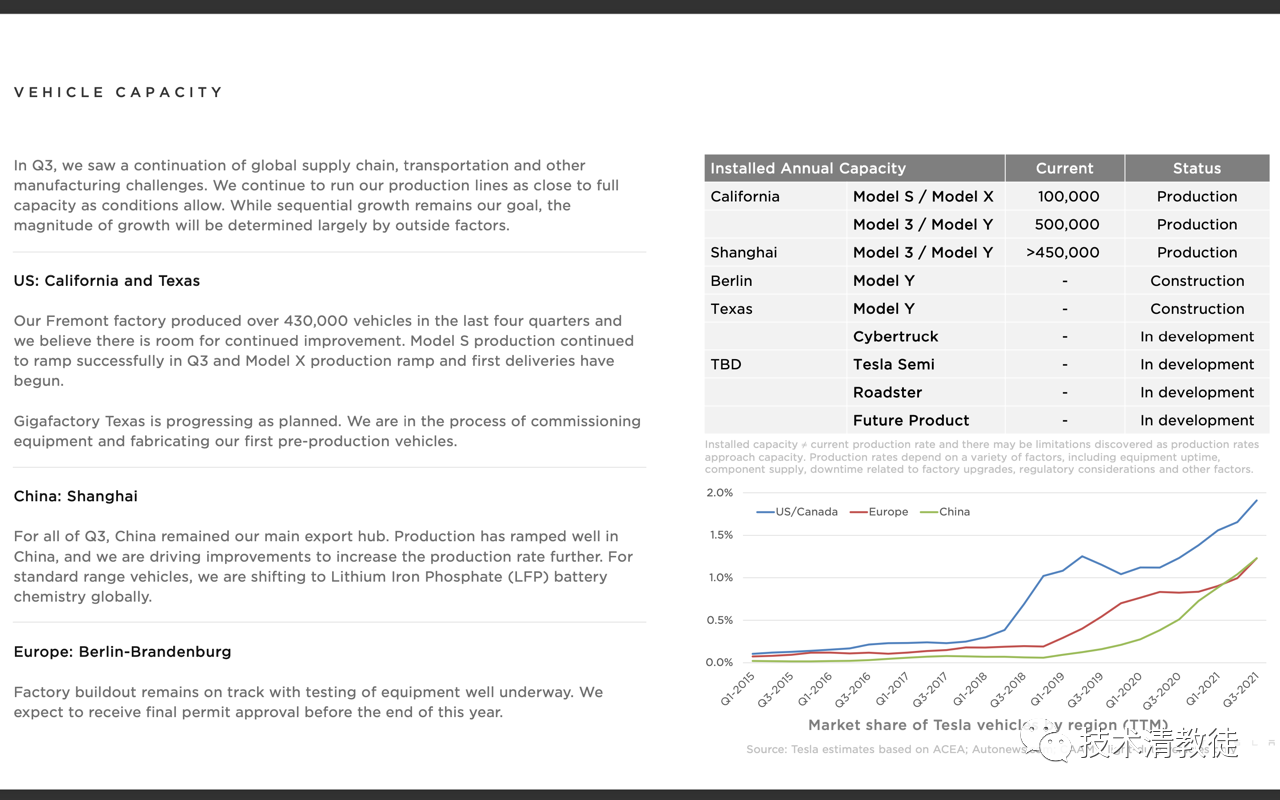

Production Capacity

In a previous article on Tesla’s Q3 sales review (2021 Q3: The Halo Behind Tesla’s Sales), I analyzed in detail that Tesla Shanghai’s current production capacity is approximately 600,000, while Tesla Fremont’s current production capacity is approximately 400,000. It can be seen that Shanghai’s production capacity far exceeds expectations, while Fremont’s production capacity, as the Tesla headquarters, is actually below expectations.

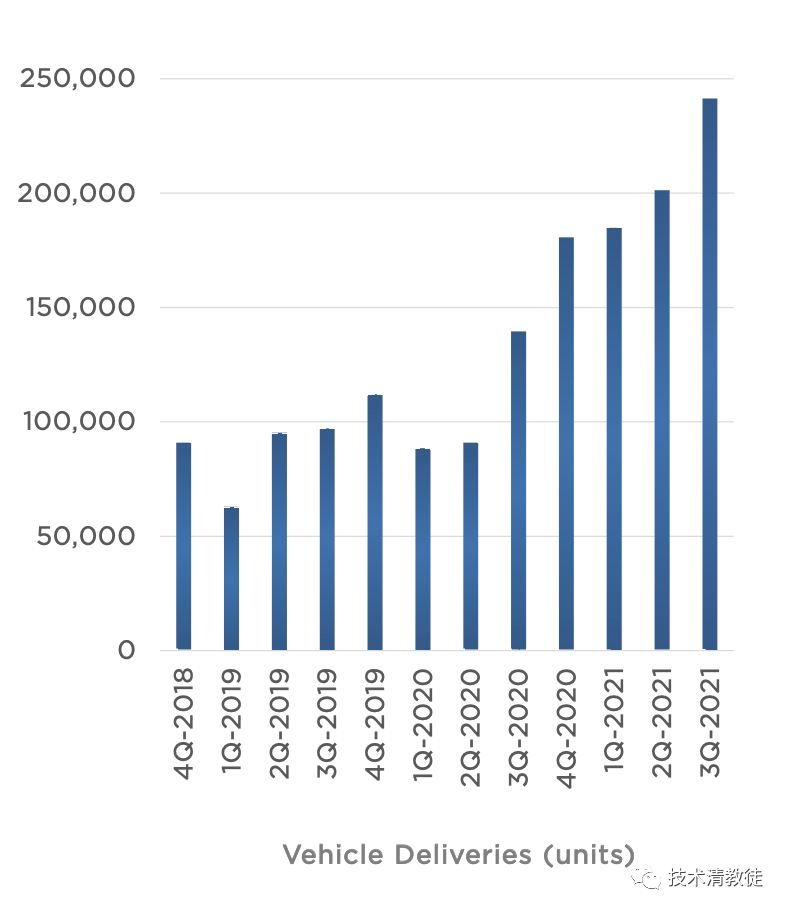

It is precisely because of the strong climbing of Shanghai’s production capacity that Tesla’s quarterly delivery curve has been so steep since 2020.

However, even though Shanghai’s production capacity has far exceeded expectations, Tesla still stated that it will continue to increase efficiency and expand the production capacity of both Shanghai and Fremont factories in the future.

Next, let’s look at the construction progress of two new factories. The Texas factory in the United States has already started trial production, and I personally expect deliveries to start at the end of November. And the Berlin factory in Germany is in the testing phase and is waiting for production approval. It is expected to receive approval before the end of the year, and I personally expect deliveries to start in January next year.

The smooth operation of these two factories is of great significance to Tesla.

Once Texas begins production, it can effectively alleviate the car delivery hell situation in North America. Currently, Model 3/Y in North America are already scheduled for delivery as far out as July 2022.# Price and Gross Profit

The Berlin factory allows Tesla to further reduce the cost of delivering vehicles in Europe, as it eliminates the costs of shipping and import tariffs that are associated with exporting vehicles from China. Lowering costs is a good thing, whether it is reflected in price competitiveness through lower prices of Model 3/Y, or in further increasing gross margins in financial reports.

Sales Price and Gross Profit

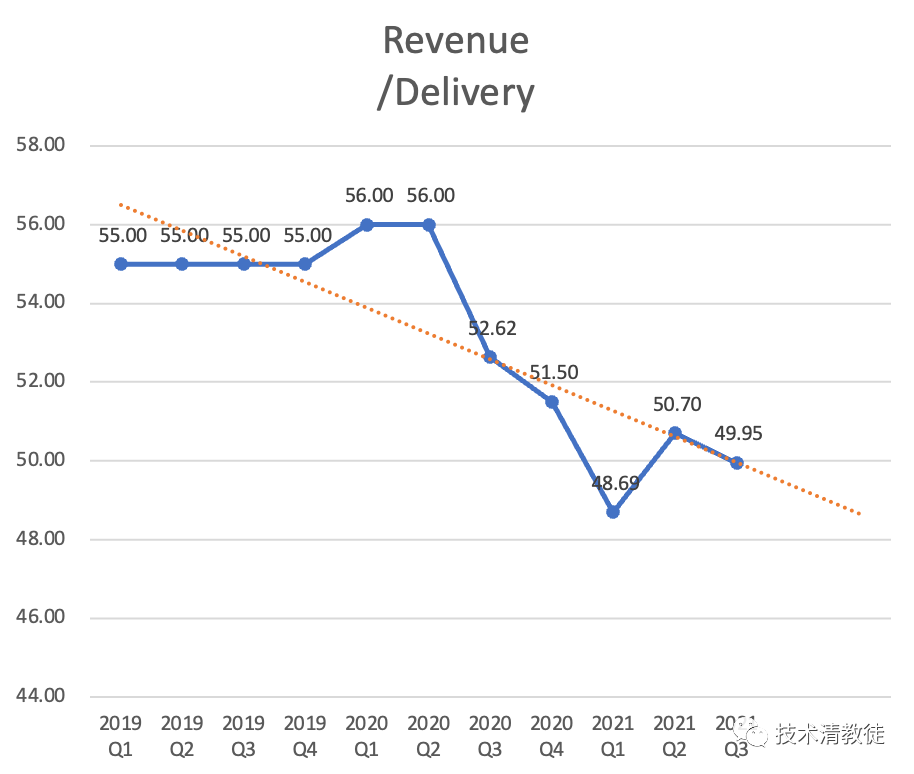

The following discussion only covers Tesla’s automotive segment data, as the revenue of Tesla’s solar and energy storage segments accounts for a small percentage, so they will not be covered temporarily.

As shown in the above figure, the average selling price per car in Q3 has decreased by about $7,000 compared to Q2, indicating that vehicle prices have once again fallen.

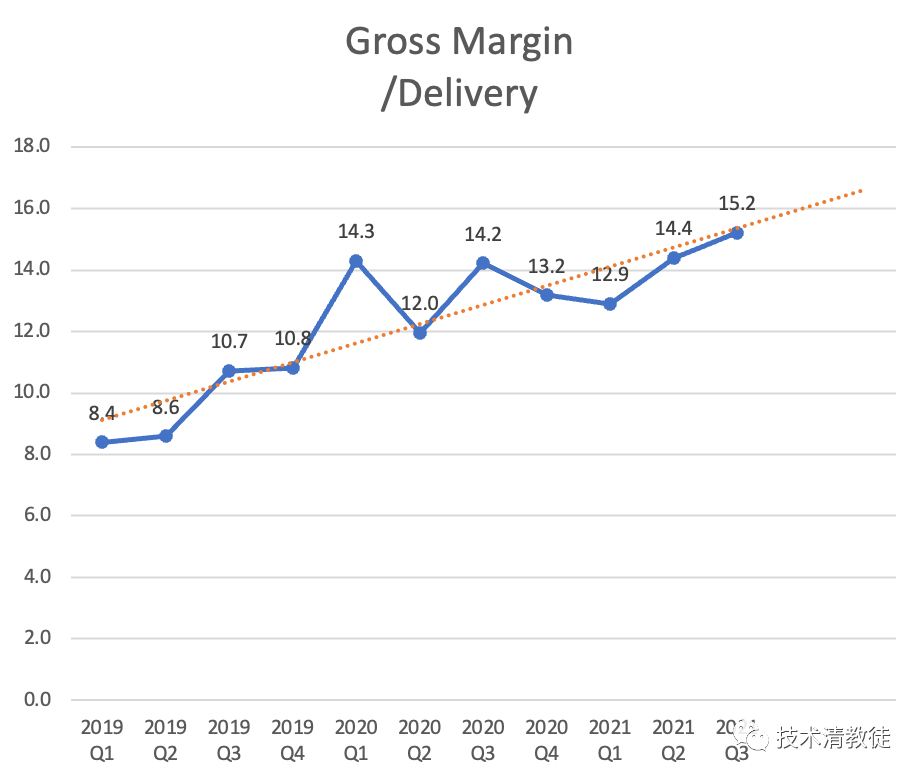

However, at the same time, the gross profit earned for each car sold has reached a historical high, reaching $15,000 per car.

The two sets of data combined showed that, although the selling price of Tesla vehicles has decreased, gross profit has increased. It is worth emphasizing again that this was achieved against the backdrop of rising commodity prices worldwide, doubling shipping and logistics costs, and extremely tight chip supply.

From a larger perspective, Tesla’s ability to control lean manufacturing and supply chain is very strong.

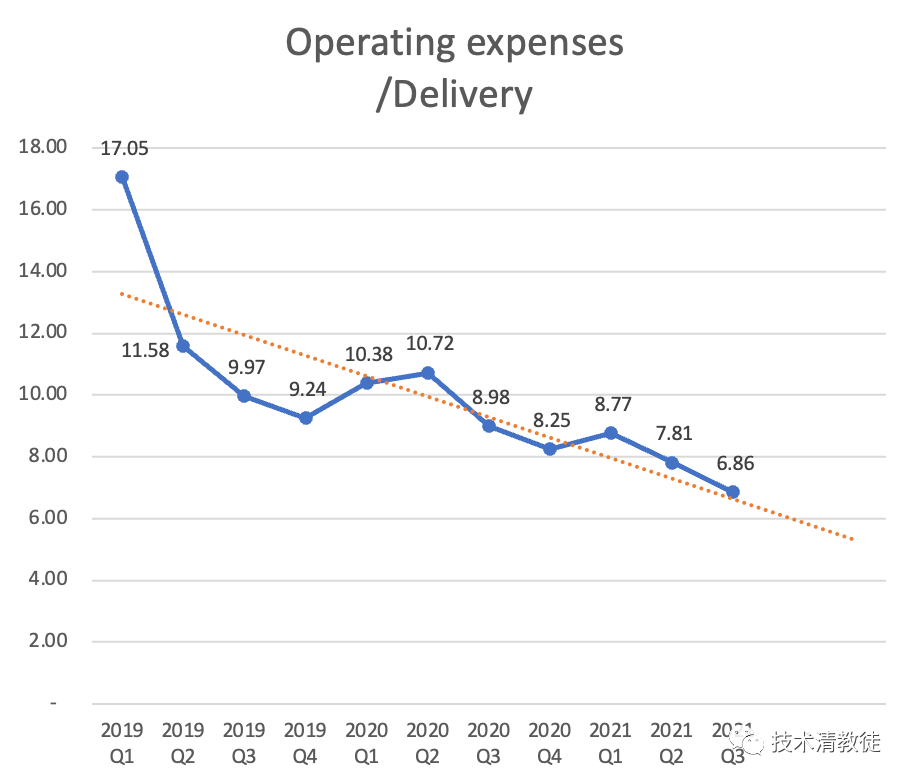

Operating Expenses

Next, let’s talk about operating expenses.

At the end of 2020, Elon Musk tweeted, ” All employees must work hard to continuously reduce operating expenses. Any suggestions to streamline expenses are very welcome. Otherwise, the market will take a big hammer to Tesla’s market value.”

This year, Tesla’s average operating expenses per car sold have dropped from $8,700 in Q1 to $7,800 in Q2, and further down to $6,800 in Q3.

It can be seen that Tesla is indeed making a very strong effort to control operating expenses.

So, what does this operating expense specifically include?

“All rental expenses for office buildings (excluding factories), sales store rentals, and R&D expenses. Generally, there are also advertising expenses, but Tesla does not advertise, so this is not included.”

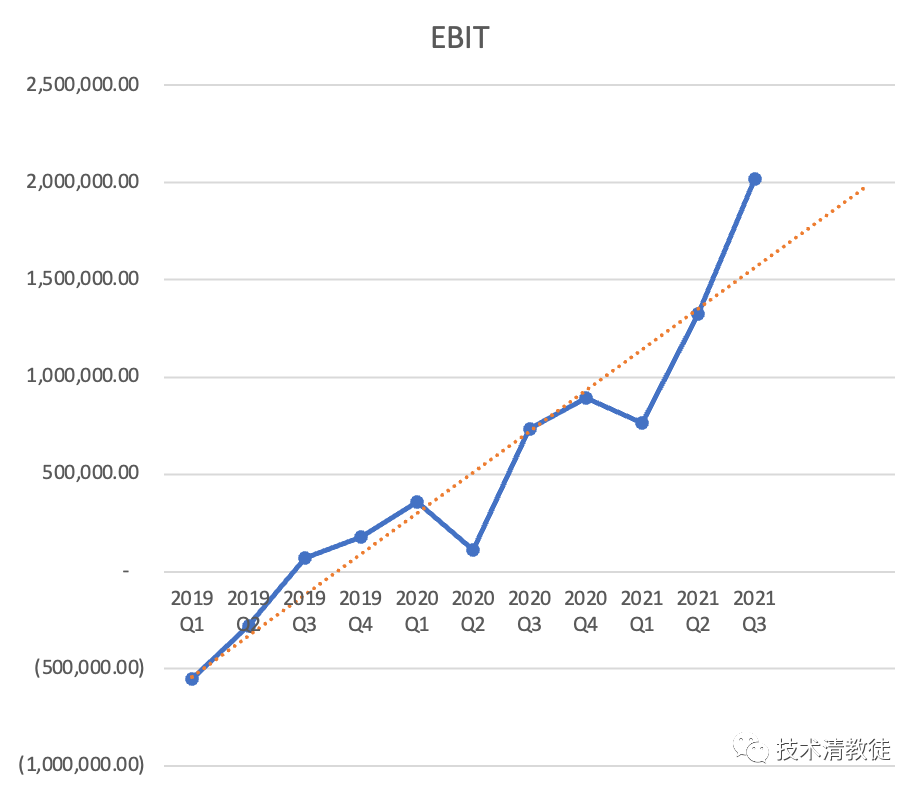

ProfitProfit can be simply understood as the difference between gross profit and operating expenses. The Earnings Before Interest and Taxes (EBIT) curve of Tesla, shown below, is very steep, illustrating the results of Elon Musk’s emphasis on streamlined operating costs.

However, there are many ways to calculate profit. The EBIT in the above graph does not include interest and taxes, while the Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is calculated based on EBIT without including depreciation and amortization.

On this basis, US listed companies usually have two accounting principles: GAAP and Non-GAAP. The former includes equity incentive costs, while the latter does not.

Why are there so many ways to calculate profit?

“This is mainly because depreciation, amortization, and equity incentives are not cash expenditures for the current period. Therefore, using different statistical methods to calculate profit can reflect the real operating conditions from different perspectives.”

Next, we will specifically discuss these non-cash expenditures.

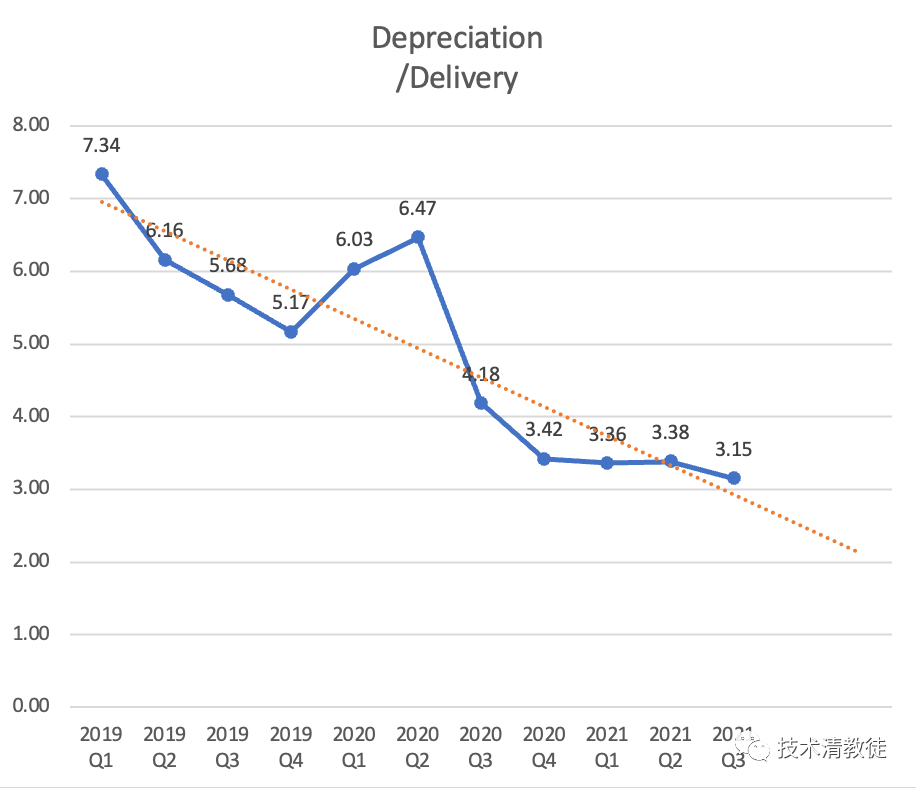

Production Asset Efficiency

For any industrial company, the profit and loss statement will have a large section of “expenses,” which is the depreciation and amortization of production plants and tools. The reason why “expenses” is in quotation marks is that depreciation and amortization are not cash expenditures for the current period.

Simply put, when the company initially invested in the construction of the plant, the cash was already spent. However, the plant and machinery can be used for 10 years. Therefore, the investment in building the plant should be amortized over 10 years and allocated to each period’s production activities. The amount of amortization is reflected in the financial report’s profit and loss statement as depreciation and amortization.

This accounting rule helps to more realistically reflect the operating conditions of production-based enterprises, accurately reflecting the current production and operating efficiency, and reflecting whether this upfront investment is worth it.

At the beginning of 2019, Tesla had a per-car amortization level of $7,300, which has now dropped to $3,100.

Which assets need to be depreciated and amortized?

“These mainly include production plants, machinery, and office equipment directly owned by the company.”

At first glance, the Shanghai factory’s unexpected production capacity reduced the overall per-car depreciation and amortization, but the deeper reason is that Tesla’s new generation of production lines can quickly increase production capacity without adding substantial investment, greatly improving the efficiency of production assets.Next, with the production of the Texas and Berlin factories, the depreciation and amortization of the bikes are likely to increase. This is mainly due to the introduction of new factories and the ramp-up of production capacity, which both require some time. Looking back at the Shanghai factory in Q1 2020, when it was just put into operation, the averaged depreciation and amortization also increased.

However, since Tesla’s Shanghai factory can achieve such an extreme level of production efficiency, and the Texas and Berlin factories are the next generation of more advanced super factories, we look forward to Tesla breaking its own records again. Then, the money saved from the iterative production process can be returned to consumers through price reductions.

This is a powerful and conscientious company, isn’t it?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.