The electrification transformation of Hyundai in the automotive industry has been successful, despite being the first company to recall a large number of electric vehicles globally. This issue has been settled, and we can turn the page.

Due to the shortage of chips, Hyundai’s global sales in September fell by 24% to 279,307 units. However, to meet data expectations, most of the chips were allocated to its new energy vehicles – the sales of Hyundai’s new energy vehicle models were 16,400 units (up 27% year-on-year), accounting for 5.9% of the total sales, hitting a new historical high.

Today, let’s talk about Hyundai’s sales and predictions for the future strategic direction.

Sales of Hyundai’s New Energy Vehicles

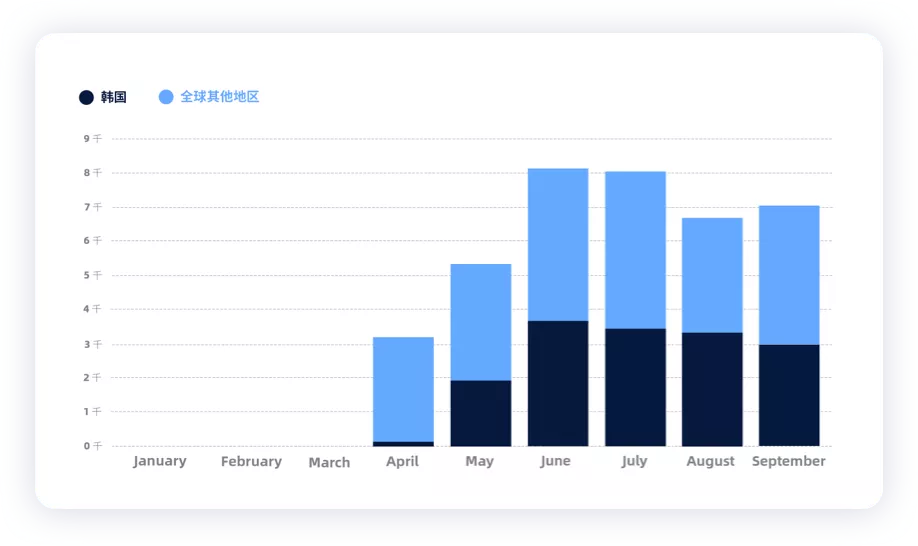

In September, Hyundai sold 16,400 new energy vehicles (up 27%), with sales exceeding 110,000 units from January to September (up 35%), accounting for 3.8% of total sales.

BEVs: 12,037 units (down 0.5%), cumulative sales of 80,700 units from January to September (up 9%).

PHEVs: 4,363 units (up 444%). This data has rebounded rapidly since 2020, and Hyundai has made some efforts in this regard, with cumulative sales of 29,894 units from January to September (up 279%).

Fuel cell vehicles: 942 units (up 84%), with cumulative sales of 7,273 units from January to September (up 38%).

The noteworthy thing is that the sales of Hyundai Ioniq 5 are still at a high level, with a monthly average of more than 7,000 units (over 5 months). After the recall, Hyundai Kona Electric sold over 4,100 units in September, and the sales of Hyundai Tucson PHEV also reached 3,100 units.

What’s worth noting is that the sales of Hyundai’s 800V models have exceeded those of Kona’s 400V, which is a historical turning point.

・Hyundai Ioniq 5: 7,067 (January to September: 38,517 units)

・Hyundai KONA EV: 4,102 (January to September: 32,762 units)

・Hyundai IONIQ Electric: 626 (January to September: 7,773 units)There is something interesting going on. Modern is also starting to deliver high-end BEV models. In September, a total of 135 Genesis G80 BEVs were delivered (327 units from January to September).

・Hyundai Tucson PHEV – 3,128 units (17,549 units from January to September)

・Hyundai Santa Fe PHEV – 886 units (6,449 units from January to September)

・Hyundai IONIQ Plug-In – 349 units (5,311 units from January to September)

・Chinese PHEVs (multiple models) – 241 units (2,140 units from January to September)

・BEV in India (Kona Electric) – 1 unit (93 units from January to September), this data is particularly funny. Selling electric vehicles in India is really tough.

Hyundai sold 2,983 Ioniq 5s in the domestic market and the remaining 4,084 were exported.

The sales of hydrogen fuel cell vehicle NEXO were 942 units (7,273 units from the beginning of the year to date), mainly in Korea (939 units and 6,401 units from the beginning of the year to date). We also noticed that there are 135 Genesis G80 BEVs (327 units from the beginning of the year to date).

Hyundai’s Strategic Estimate

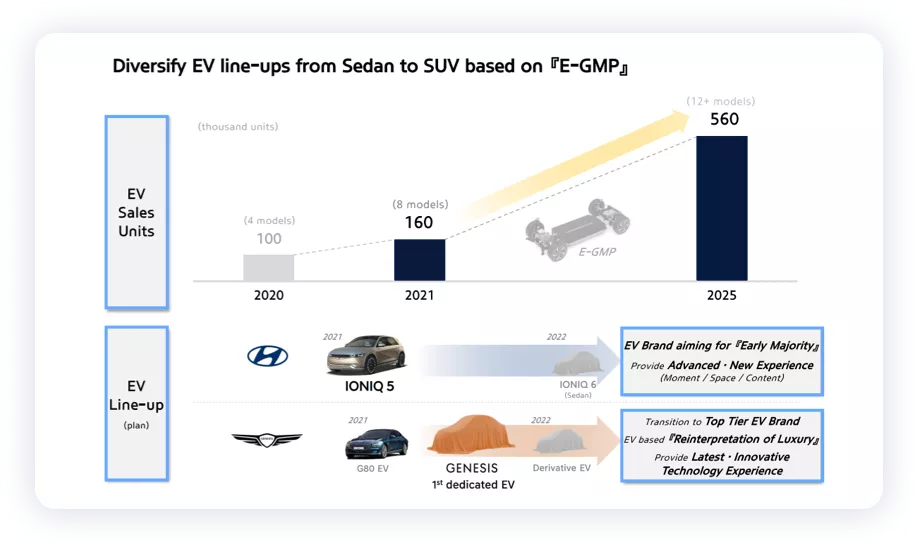

As shown in the figure below, there were some illogical parts in the electric vehicle strategy Hyundai was pursuing earlier.

As of now, the sales of new energy vehicles in January-September 2021 reached 110,000 units, including 80,000 BEVs and 30,000 PHEVs. The preliminary target for 2021 is 150,000 units. According to the current pace, the sales of BEVs in 2021 can reach around 110-120,000 units-even without sales data from China, as they only entered the European and American markets, it’s still acceptable overall but of course there is still a ways to go to reach their target of 160,000 units.

In 2022, sales in the United States, Europe, and Korea are expected to exceed 200,000 units.

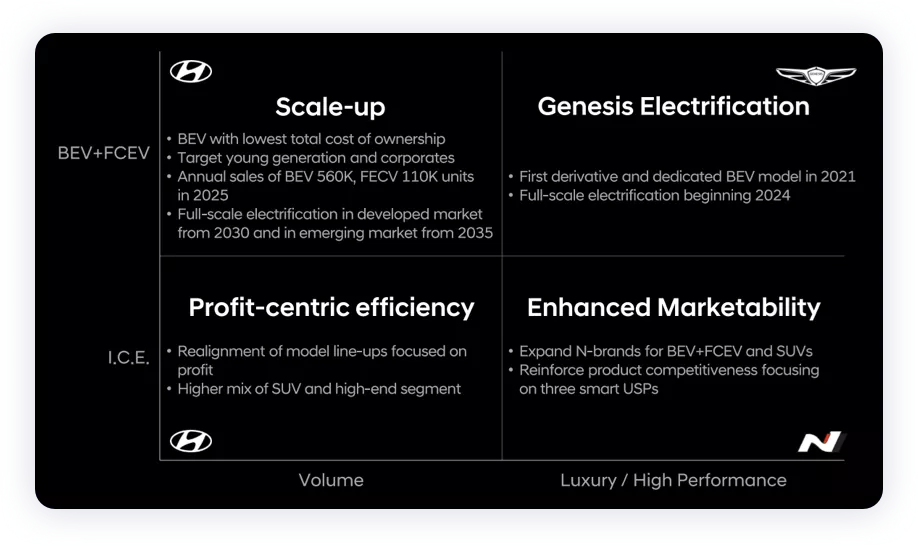

Hyundai’s strategy is very similar to that of Tesla. They are both aiming to build their core components through modern mobility. Interestingly, they are also working on logic chips that could potentially be used in cars – this was stated by Jose Munoz, Global COO of Hyundai. Judging from their path, Hyundai may need to start with simpler chip technologies such as power semiconductors, system-on-chips (SoCs), and advanced driver assistance system (ADAS) chips.

Conclusion: I think Hyundai still faces significant challenges in its development in China. However, their positive response to electrification strategies and their all-in approach to a 800V system have achieved good results.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.