I have always believed that the United States’ development of electric vehicles is based on its own strategic considerations and often relies on the system of Japan and South Korea.

The facts have proven this to be true: after General Motors and LG Energy and Ford’s deep cooperation with SK, Stellantis also signed an MOU with LG Energy to establish a power battery joint venture company in North America, with a new factory production capacity of 40 GWh, which is expected to be put into production in the first quarter of 2024.

This matter deserves careful consideration.

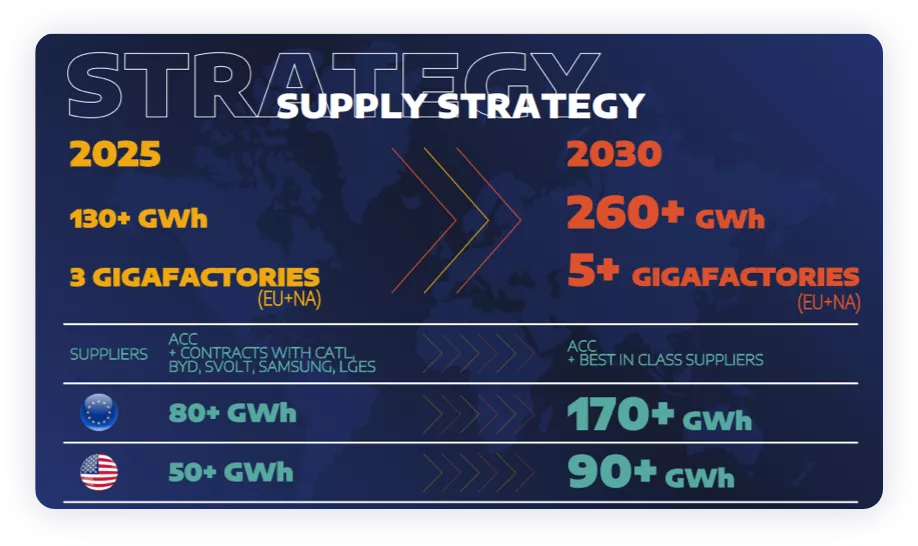

When we review Stellantis’ previous choices, we can see that Europe ensured that its joint venture factory ACC is the basic platform, and the so-called strategic suppliers CATL, BYD, Honeycomb, Samsung SDI and LG Energy are all just making surface-level competition. In essence, they still need to align with national regions. This 50 GWh basically covers all of the US’s short-term demand.

Regionalized national strategy

1) LG Energy’s layout in the United States

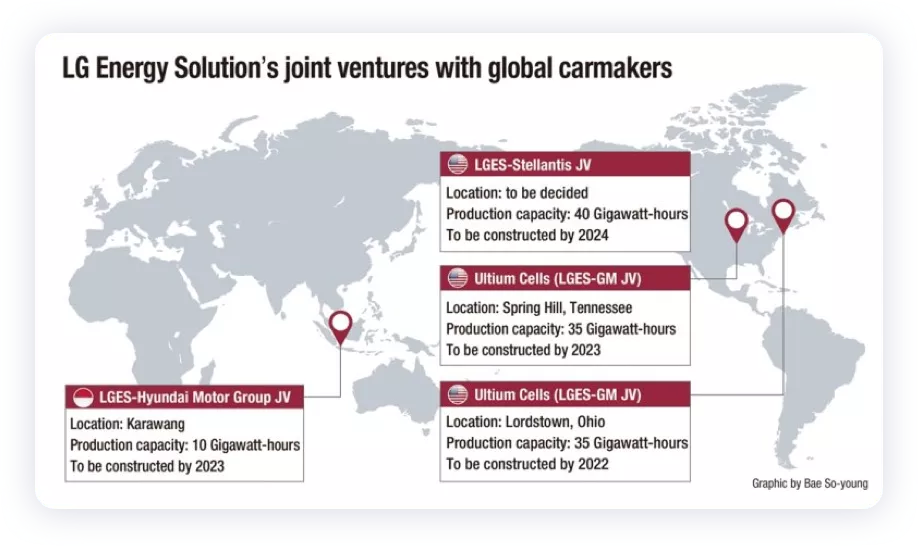

The following figure shows the overall scale of LG Energy’s joint venture companies with several automakers, as summarized by So-young:

● LG Energy GM: Two JV battery factories, each with 35 GWh, totaling 70 GWh. This basically represents all of GM’s demand for batteries in the North American market in the short term. We estimate that for passenger cars with 80 kWh and pickups with 150 kWh, there will be around 400,000+ and 200,000+ units initially.

● LG Energy Stellantis: 40GWh, covering all of Stellantis’ demand in North America by 2025. Currently, Stellantis in North America mainly supplies LG Energy with PHEV, which are formerly FCA’s.

● LG Energy Hyundai: 10GWh. This is more like Hyundai’s diversified strategy, and it has taken a diversified approach with SK and LG Energy. Previously, Korean reports indicated that CATL had secured most of the orders in EMP’s iteration plan. Overall, Hyundai’s choices can be monitored and reviewed.

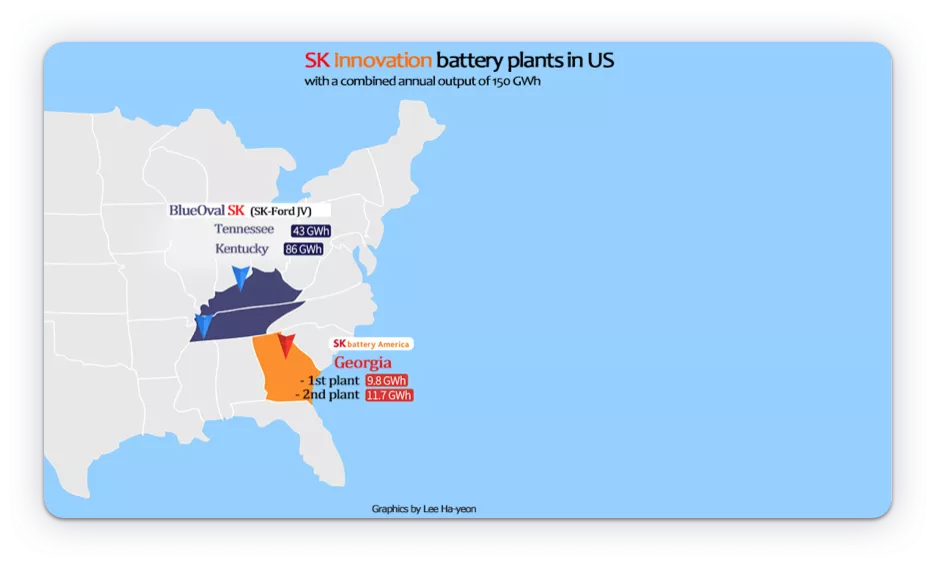

2) SK’s layout in North America

SK Innovation’s investment in Ford is huge from the beginning, with the first factory planned for 43 GWh and the second for 86 GWh, the key reason being Ford’s acceleration of electrification and decision to double SK Innovation’s supply of EV batteries for its electric pickup and other cars. SK’s two existing factories in the United States have a total capacity of 9.8GWh and 11.7GWh. Overall, SK’s cumulative orders have exceeded 1 TWh.

SK’s two independent factories mainly serve Volkswagen and Ford.

Now, SDI is the only one without investment in a factory in the United States, which is a bit puzzling. If they were to establish a factory, there are not many partners they could cooperate with. I guess they might have some possibilities with GM or BMW. But overall, except for Tesla, American carmakers and Korean battery companies have basically formed all the binding relationships in the US market. From the perspective of strategic competition, this is a very certain thing.

Tesla is a unique case. With the gradual improvement of the 4680 battery in the Berlin factory, coupled with the increased investment in 4680 by Panasonic, LG, and SDI, Tesla still has enough diversified choices in the US market. In addition, the import of lithium iron phosphate modules to the US, only Tesla chooses to supply batteries to the US market from China.

Differences in Europe and America

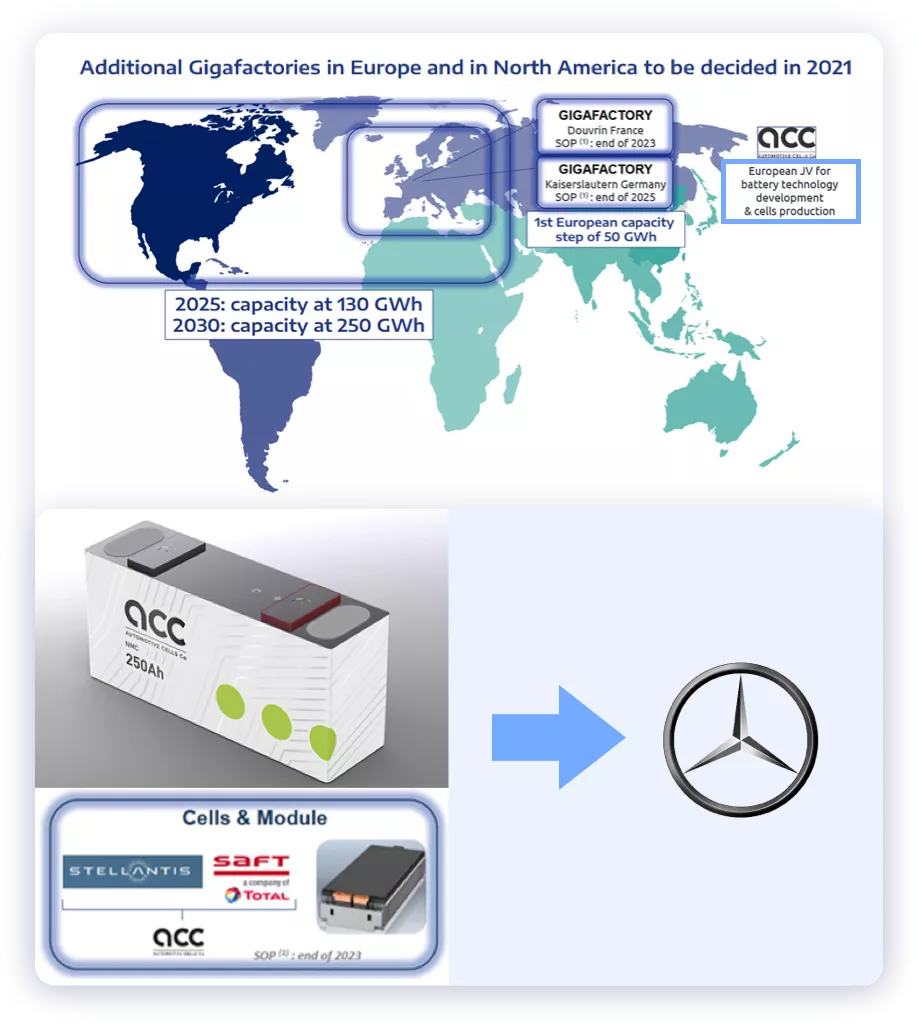

At this point, I think the logic is still very clear. European carmakers are also cultivating their own battery supply systems. Stellantis mainly collaborates with ACC, which makes sense along with Daimler.

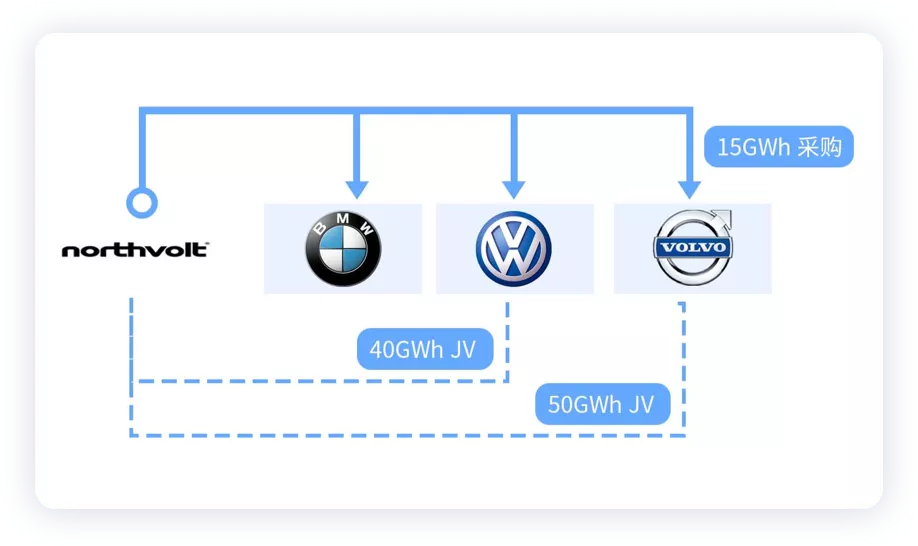

From the strategies of Volkswagen, BMW, and Volvo regarding Northvolt, it can be seen that European carmakers are basically starting to cooperate on battery technology in their own countries. The big logic is that the battery factories built locally have European elements.

Summary: Based on the logic indicated by Company C’s release of the 2022 guideline, it appears that the trend for power batteries may evolve into a decentralized market with regional units. Next, in terms of the logic of energy storage and the industry’s penetration, it may be more in line with Chinese battery companies —— the ceiling for opening up markets in the United States and Europe is not high. High growth is still tied to the country’s energy infrastructure.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.