Author: Sun Xiaoshu

On October 15th, SAIC-GM Ultium Altium Super Factory officially started production in Jinqiao, Pudong, which is the most important strategic move of General Motors in the Chinese market.

With the start of production at the Ultium Altium Shanghai plant, GM brings its advanced new energy vehicle technology to China and completes the last link of the localization of the entire new energy supply chain.

The Convergent Maker

Ultium Altium is the convergence of General Motors’ electrification expertise. The three most prominent labels are: flexible, intelligent, and safe, all of which are closely related to Ultium Altium’s black technology – the wireless battery management system (wBMS).

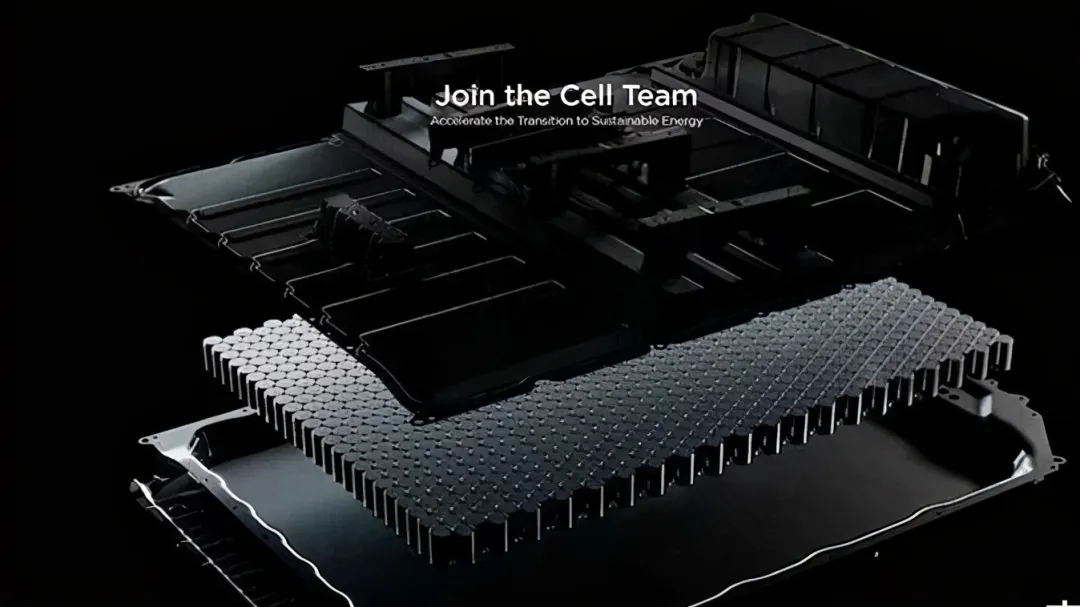

The flexibility of the Ultium Altium platform lies in its ability to be compatible with 2 types of battery cells, 2 types of modules, and 3 types of battery packs, as well as 7 drive combinations composed of 3 sets of electric drive systems (including high-integration eight-in-one front electric drive).

Compared to electric drives, the flexibility of battery arrangement is more important for Ultium Altium. It is well known that battery cells are the basic building blocks of power batteries, and there are currently three mainstream routes: square, soft pack, and cylindrical.

Each route has its fans. Tesla’s third-generation battery technology 1865, 2170, and 4680 are all cylindrical batteries, while Volkswagen’s standard battery cells released on Power Day are closer to square cells. Unlike Tesla and Volkswagen, GM didn’t choose to put all its chips on one battery cell scheme.

SAIC-GM said that the Ultium Altium platform supports various battery cell packaging forms and chemical materials, giving GM flexibility in battery cell selection.

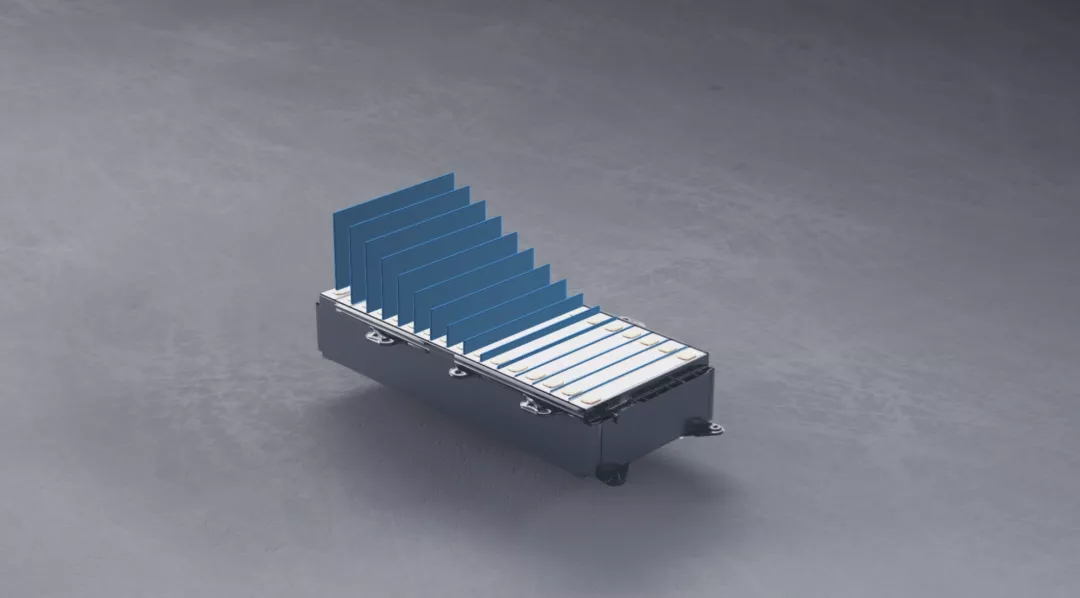

Currently, the Ultium Altium platform can support two types of battery cell packaging: square and soft pack. In addition to being able to load high-density NCM811 high-nickel three-element lithium batteries, the square battery of Ultium Altium can also be compatible with lithium iron phosphate because of its cost advantage.

Meanwhile, LG’s new energy innovative NCMA ternary battery is also expected to be installed in GM’s Hummer brand electric vehicle models in soft pack form (size: 580mm×113mm).

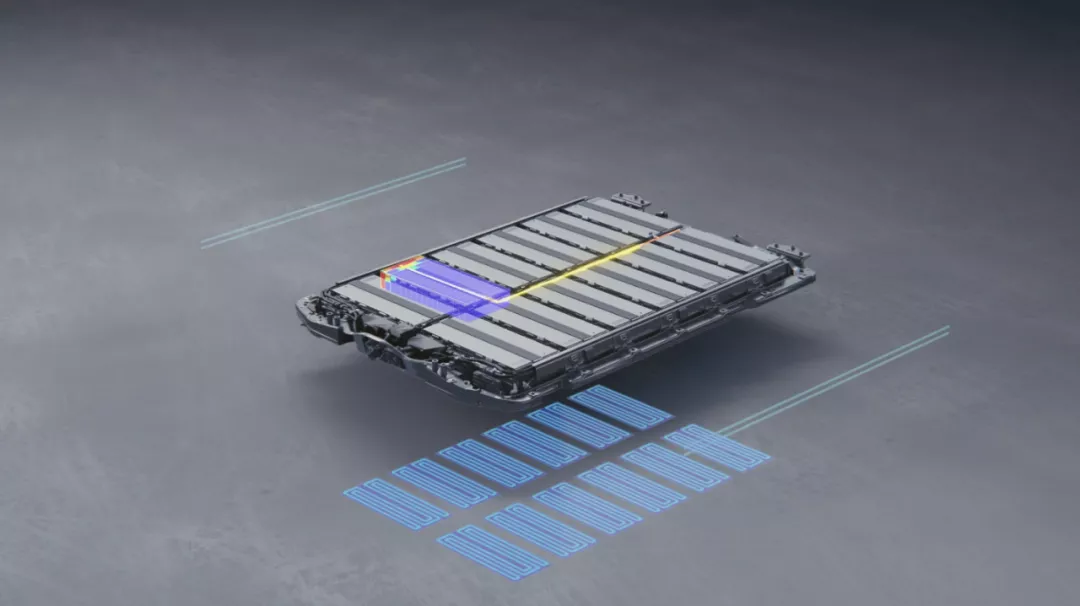

The flexibility of battery arrangement on the Ultium platform relies heavily on the wireless battery management system (wBMS), a universal battery management technology. wBMS is also the most significant breakthrough in the intelligence aspect of the Ultium platform.

The wireless battery management system communicates wirelessly with every battery module through an internal wireless communication module that is pre-installed in the battery pack. This communication allows for real-time monitoring and control of every battery in the module.

The most evident advantage of the wireless battery management system is the simplification of battery pack structure. With the industry’s first wireless communication technology, the Ultium platform can reduce the wiring harness in the battery pack by 90%, significantly improving the utilization of space.

For electric vehicles, higher utilization of the battery pack means more batteries can be used, resulting in a longer range. Again, thanks to the simplified structure brought by the wireless battery management system, Ultium can achieve flexible battery arrangement.

Moreover, the additional space in the battery pack can be used to improve safety and reliability. GM has chosen to use stronger crossbeams to create a “well” structure for the battery pack, increasing overall torsion stiffness by about 45.8%.

Another advantage of the wireless battery management system is its compatibility with General Motors’ new vehicle intelligence platform (VIP) electronic architecture, which supports more refined system management and OTA upgrades. Additionally, because there are no wiring harnesses, maintenance and replacement of battery modules are much more convenient.

The significance of wireless battery management system in the manufacturing end lies in improving production efficiency. SAIC-GM Ultium Ott Nominal Super Factory and GM North America Factory are the first factories to adopt wireless communication technology on battery production lines. By using wireless communication technology to detect battery performance, the damage caused by joint insertion and disconnection in traditional battery testing can be avoided. As a result, the assembly quality and production efficiency of Ultium Ott Nominal Super Factory are improved.

The significance of wireless battery management system in the manufacturing end lies in improving production efficiency. SAIC-GM Ultium Ott Nominal Super Factory and GM North America Factory are the first factories to adopt wireless communication technology on battery production lines. By using wireless communication technology to detect battery performance, the damage caused by joint insertion and disconnection in traditional battery testing can be avoided. As a result, the assembly quality and production efficiency of Ultium Ott Nominal Super Factory are improved.

Wireless battery management system is still a cutting-edge technology. As the first manufacturer to adopt this technology, General Motors uses the wireless battery management solution of NXP. In addition to NXP, suppliers such as Infineon, Texas Instruments and other companies are actively researching and promoting this technology. Among them, Infineon recently announced that the well-known sports car brand, Lotus, plans to adopt its wireless battery management system in the next generation of electric vehicles.

As for safety, in addition to the “well” type battery shell previously mentioned, the Ultium Ott platform provides seven levels of protection, including a real-time intelligent monitoring system, nano-level aerospace material aerogel, patented designs of safety valves and exhaust channels, anti-arc designs, integrated independent liquid cooling system, and aerogel fire blanket.

The flexible, intelligent, and safe Ultium Ott platform represents the highest level of new energy manufacturing of General Motors. Bringing it to China means that General Motors has opened the prelude to its attack on the world’s largest new energy market.

Full-Chain Localization

The Chinese new energy market has begun to show signs of an imminent explosion. In September, when the overall sales volume fell by 17.3% year-on-year, the sales of new energy vehicles reached a historical new high of 334,000 units, with a year-on-year increase of 184%.

At the same time, the penetration rate of new energy vehicles has historically exceeded 20%, reaching 21.1%. However, compared with the penetration rate of 36.1% of domestic brands, the penetration rate of 3.5% of joint venture brands is particularly worrying, and it is almost entirely supported by the ID. series of Volkswagen and SAIC-GM Wuling.

The wind of new energy is rising, and joint venture brands need to speed up. The American camp has already taken action. Ford officially launched the first batch of production models of its locally manufactured Mustang Mach-E today and started accepting pre-orders, with delivery expected by the end of the year.# Production of SAIC GM Ultium Plant: A Complete Local New Energy Capacity

The production of SAIC GM Ultium plant not only means that GM brings the most advanced new energy vehicle manufacturing technologies to China, but also announces the completion of SAIC GM’s local new energy capability in the full chain.

Before the production of Ultium OTEC Super Plant, SAIC GM had already laid out the Pan-Asian New Energy Experimental Building, established a new energy R&D system (in fact, SAIC GM and Pan Asia Automotive Technical Center also participated in the design and development of the Ultium OTEC platform), set up the Guangde Battery Safety Test Lab to supplement new energy testing capacity, and connected the parts procurement process to achieve a localization rate of more than 95% of parts.

With the production of Ultium OTEC Super Plant, the localization production process of GM’s new energy has also been connected, and GM has established the full-chain local new energy capability of R&D, testing, procurement, and production in the Chinese market.

Moreover, the Ultium OTEC Super Plant is a very important part of GM’s localization capability. As mentioned above, wireless communication technology for batteries increases efficiency in production, and improvement in manufacturing efficiency means an increase in output capacity and a reduction in costs, which is critical in the rapidly expanding electric vehicle market.

Tesla, as a leader in the new energy field, has many auras endorsing it, but its strong engineering capabilities are often overlooked by the public, despite the many accolades. For example, Tesla’s Shanghai plant can produce a Model 3 car in less than 10 hours, while VW needs 30 hours to produce an ID.3, which is one of the reasons why Model 3 has a cost advantage over its competitors.

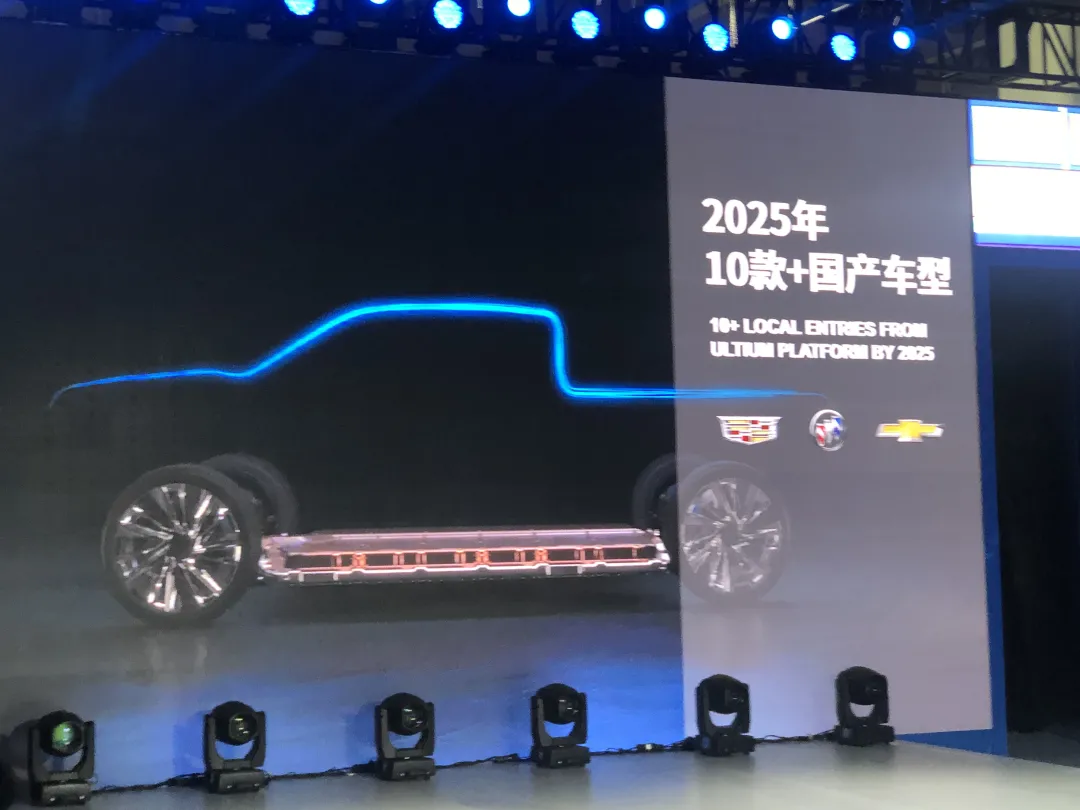

The manufacturing efficiency of Ultium OTEC Super Plant also to a certain extent determines SAIC GM’s market decisions and performance.The Cadillac LYRIQ will start delivery in 2022, and SAIC-GM plans to produce more than 10 domestically-made electric vehicle models (including Cadillac, Buick, and Chevrolet brands) by 2025. Behind this plan, SAIC-GM has laid the foundation for accelerating expansion by connecting the entire chain of local new energy capabilities, and there is no doubt that it will further accelerate its development in the future.

The fierce competition in China’s new energy market is still ongoing, with American companies also accelerating their entry, making the competition even more exciting. However, on the eve of the market turning point, a new round of reshuffling is also underway, and a new pattern is bound to emerge, leaving little time for other players.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.