Translation

Going-to-the-hundred Media under the OutRider Group Focuses on the Evolution of the Automotive Industry Chain

Author: Roomy

Americans, Germans, and Japanese have shown very different characters in the transition to electrification.

“Elon Musk’s biggest enemy is hubris,” the Wall Street Journal once bluntly evaluated Musk, “never thinking of failure” is his character. Even when Tesla was deeply trapped in delivery and loss adversity, Musk constantly challenges the “impossible”.

Germans, who have always been admired for their rigorous label, suddenly ruptured under the impact of electrification.

The polarization of ID. models in the European and Chinese markets tore the expressionless faces of Germans. So the usually proud Germans invited the “invincible” Musk to “take a class” in the hope of finding new thinking for change.

However, this method does not work so well for Japanese people.

The perfectionism and sense of inferiority in the hearts of Japanese people often intertwine, leading to their strong sense of correction to compensate for their own shortcomings. Therefore, Japanese car companies that have experienced fracture pain are unwilling to “owe a lot of old accounts because they lack foresight.”

In the present situation of a large-scale attack on electrification, accompanied by forced growth due to reality, the Japanese are filled with contradictions and twists. Although the industry generally believes that electrification of Japanese brands has stagnated, they do not have the enthusiasm of Terry Gou, who has been poking around for 16 years.

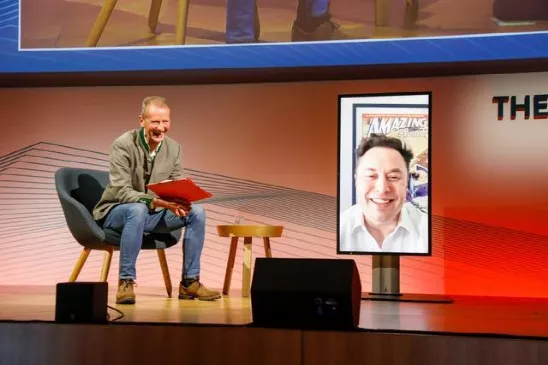

Diess Invited Musk to Teach 200 Executives

Recently, Musk stepped onto German soil, experiencing the warmth of the lingering sun of Europe’s traditional car market and the difficulty of transformation to electrification.

This time, Musk did two things on his trip to Europe. One is to make an appearance at the construction of the Gigafactory in Brandenburg, Germany, and the other is to teach a lesson online for Volkswagen Group’s 200 executives.

The German media called Tesla “a sharp knife inserted into the heart of Europe’s giant.” Of course, the largest giant in Europe is Volkswagen Group.

Volkswagen Group, which has been aggressively promoting electrification, has recently been a little lost. They released several ID. series electric cars, sold well in Europe while being “far from expectations” in China. What is the problem? Volkswagen CEO Diess, who is deeply devoted to the reform of electrification, also wants to know.

Therefore, in the name of “accelerating the transformation to electrification,” Diess invited Musk to participate in Volkswagen’s management meeting in video form. Musk lectured 200 Volkswagen executives on the direction of Volkswagen’s transformation to electric vehicles, management style, supply chain, production, and other issues.

Musk has indeed become much more dignified and learned the art of praise.

He referred to Volkswagen as a benchmark in the automotive industry, and believed that Volkswagen could successfully transition to electric cars. As for how sincere this belief is, that remains to be seen. However, the transformation to electrification does require giants like Volkswagen Group to work together to push forward. After all, Volkswagen’s global scale and manufacturing capabilities make Tesla pale in comparison.

He referred to Volkswagen as a benchmark in the automotive industry, and believed that Volkswagen could successfully transition to electric cars. As for how sincere this belief is, that remains to be seen. However, the transformation to electrification does require giants like Volkswagen Group to work together to push forward. After all, Volkswagen’s global scale and manufacturing capabilities make Tesla pale in comparison.

Musk praised Volkswagen as an “idol” and also the biggest challenger to Tesla. Diess was happy to hear this and posted on LinkedIn saying that “the strongest competitor” is a kind of compliment.

“I am glad to hear the recognition from our strongest competitor. He believes that we can successfully complete the transformation as long as we go all out,” said Diess. When asked why Tesla is more flexible than its competitors, Musk said it depends on his management style. In addition to the cars themselves, he places great importance on supply chain, logistics, and production.

Indeed, “Tesla speed” is not just talk. According to official sources, the German superfactory is basically completed and can be put into operation after approval. It can produce 50GWh of batteries per year and can produce 5,000-10,000 vehicles per week, providing about 12,000 job positions. Musk appeared at the factory and announced that the first Tesla electric cars made in Germany will be off the assembly line as early as next month.

For Volkswagen, this is not good news. Diess knows that Tesla chose Germany as its landing point in Europe for two reasons: first, Germany is the geographic center of Europe and is convenient for logistics; second, Germany has the world”s most developed automobile industry foundation.

Volkswagen’s unique advantages have now been challenged, and it is difficult to change course when a ship is already heading in a certain direction. Volkswagen’s transformation progress is slower than Diess expected, and he is very anxious. He does not hesitate to praise Tesla’s impressive response to the global chip shortage and repeatedly emphasizes that “Volkswagen needs a new way of thinking to respond to new competition.”

Volkswagen spokesman Michael Manske also responded, saying that Volkswagen’s competitiveness in German factories needs to be improved, and “Tesla is setting new standards for mass production of cars in Grünheide.”

Diess once said at a meeting that in the face of new brands like Tesla entering the German market, Volkswagen Group needs to accelerate its transition to electrification. In October, as Tesla’s German factory was about to start production, Diess once again warned that if the group’s transformation to electrification is too slow, it may reduce up to 30,000 job positions.

As expected, this suggestion has elicited strong opposition from the trade unions and several Volkswagen supervisors. The Volkswagen Group’s union describes it as “groundless talk”: “The loss of 30,000 jobs means cutting a quarter of the entire group’s employees, which is baseless talk.”

No matter what kind of opposition is faced by the reform, please have Musk come to class and explain that Diess’s heart of desperate attempts at reform is about to break.

No matter what kind of opposition is faced by the reform, please have Musk come to class and explain that Diess’s heart of desperate attempts at reform is about to break.

However, the leader of Toyota, Toyota Akio, who has always been a rival in the race for global dominance, has a different attitude from Diess.

He bluntly stated, “Electric vehicles are overhyped. If the automotive industry hastily transitions to electrification, the current business model will collapse and even lead to millions of job losses.”

Japanese “sudden madness”?

There is nothing wrong with Toyota Akio’s statement from the perspective of the “gradual” and “steady” pace of development.

In recent years, he has repeatedly expressed that the enemy of “carbon neutrality” is “carbon emissions,” not “internal combustion engines,” and “electric vehicle environmental protection is a false concept. Only hydrogen fuel cell vehicles are truly environmentally friendly.”

However, these views have been countered by He XPeng, the founder of XPeng Motors, who compared Toyota to Nokia. Although Toyota has also unveiled electrification products at major auto shows, their long-standing problem of being “slow to react” is indeed a common issue for Japanese automakers.

This is also the three words that Toyota Akio least wants to hear and the past that Honda least wants to repeat. Therefore, when Honda’s new CEO, San Hoon Min, took over, he changed the previous “slow and steady” approach and decided to fully embrace electrification.

Honda is a company that is quite interesting. The change of CEO means the adjustment and reorientation of the company’s strategy.

Previously, Hachigo Takahiro, who was considered a “reformer,” corrected the expansion route of Ito Takao and prioritized adjusting excess production capacity. He proposed that Honda will reduce production costs by 10% by 2025, focusing on the US and China, and reducing the number of derivative models by 2/3.

Six years have passed, and the goal has not been achieved, but Honda’s CEO has changed.

At the inauguration press conference in April, San Hoon Min announced Honda’s latest development plan, including product and timeline planning for electrification, as well as goals for solid-state batteries and the two-wheeled segment. By 2040, Honda will increase the sales proportion of electric vehicles (EVs) and fuel cell vehicles (FCVs) to 100%.

Half a year later, Honda implemented this strategy in China. On October 13, Honda China officially launched the new pure electric car brand “e:N.” Together with “e:N,” five new models were also released.

According to the plan, the two models of the “e:N” series will be launched in the spring of 2022, respectively produced by Guangzhou Honda and Dongfeng Honda, named e:NP1 and e:NS1. The other three models are still in the concept car stage and will be produced one after another in the next five years.As a follow-up, Honda China also announced the construction of new pure electric vehicle factories in GAC Honda and Dongfeng Honda, which are planned to be put into operation in 2024. The “e:N” brand will have an exclusive factory.

It seems that Honda’s transformation pace is indeed clearer than before. However, there is still a question: “In 2040, Honda will achieve 100% electrification.” Is Honda preparing to win slowly?

After all, compared with Tesla, Volkswagen, and even General Motors, Honda’s progress is a bit slow. The new generation of pure electric vehicle models will not be launched until 2022. Under the ambitious plan of European car companies, Japanese car companies seem relatively slow in their transformation.

Nevertheless, Honda is still the first automobile manufacturer among Japanese car companies to clearly plan to completely abandon internal combustion engines. By 2030, all of Honda China’s new cars in the Chinese market will be electrified vehicles such as pure electric and hybrid vehicles, and no new fuel vehicles will be invested in.

However, this has already been called the “sudden madness” of Japanese brands.

From Honda’s transformation perspective, it is like rereading “The Chrysanthemum and the Sword”. The contradictions and stickiness in the Japanese national spirit come to the fore. At the moment when traditional fuel vehicles are being overturned by electrification, the “twisted” character of Japanese car companies is especially prominent.

Akio Toyoda’s “blasting electric vehicles” also partly demonstrates the strong Japanese thinking of “flowers are cherry blossoms, and people are samurai”. Under the global trend of electrification, Japanese car companies that insist on “working slowly to achieve delicacy” can no longer maintain a calm attitude.

BMI predicts that 2025 will be a critical year for the electric vehicle market. The report says: “2025 will be an important year to test the success or failure of major car companies’ goals, and it may even become the turning point we are looking for.” The next wave of competition will peak in 2025, and it is almost a battle to decide life and death. Japanese car companies do not want to miss it anymore.

In the field of electric vehicles, Toyota is also actively developing solid state batteries and is expected to release the first prototype vehicle with a charging time of 10 minutes and a mileage of 1000 kilometers in 2021.

Nevertheless, in traditional car manufacturing, Japanese car companies are still “dying to adhere” to the ultimate car manufacturing concept, hoping to maintain their final persistence without betraying themselves too much.

Let’s bet, how long will Terry Gou’s enthusiasm for car manufacturing last?

After describing the twist of “flowers are cherry blossoms, and people are samurai” retained by Japanese car companies in the transformation of electrification, looking at Foxconn’s car manufacturing also deeply engraves Terry Gou’s twisted character. Terry Gou has a strong “determination”, but often lacks persistence.He once said, “If we can make iPhones, why can’t we make electric cars? It’s just an iPhone with four wheels.” As an ex-Foxconn employee put it, “Making cars is just a waste of time. He hasn’t made any progress in all these years.”

Of course, Foxconn’s announcement of making cars was not a sudden decision. The decreasing profits of the assembly business have become a painful issue for Mr. Guo. In addition, technological transformation is also an urgent matter for Foxconn and its parent company, Hon Hai Precision Industry.

Two years ago, Mr. Guo appointed Liu Yangwei to succeed him. He hoped that Liu Yangwei could accomplish two great tasks: one was the semiconductor and chip business, and the other was making cars.

It is well-known that Mr. Guo is rich and likes to “buy, buy, buy”. In the semiconductor business, Mr. Guo went to Japan and made a wave, causing Japanese media to tremble in fear. In car making, Mr. Guo hopes to replicate the familiar Foxconn model.

Speaking of which, Mr. Guo is also a “predecessor” in cross-border car making.

He started the project in 2005, and after years of trying, it took him 16 years to accomplish a lot. He got into the supply chains of Tesla, Mercedes-Benz, BMW, and other manufacturers in 2013. In 2016, he invested in Didi and entered the ride-hailing industry. In 2017, he invested in CATL and entered the battery field.

He has tried various tracks, but after 16 years of planning, he only got some marginal results. In terms of “soft power” for car networking and autonomous driving, people generally didn’t associate Foxconn with them. However, intelligence and technology cannot be avoided in making cars this time.

Therefore, Mr. Guo replicated the familiar path again, “I don’t have it, it’s okay, others have it, that’s enough.”

After announcing the plan to make cars, Mr. Guo has been seeking allies. After forming a joint venture with Geely, he established joint ventures with Stellantis Group, PTT Public Company Limited, and signed an agreement with US electric vehicle manufacturer Fisker to produce electric cars.

In addition, Foxconn also announced the pure electric chassis platform MIH with 1,600 companies joining. Unlike the independent car makers like “We Xiaoli”, Foxconn’s car-making model, with both contract manufacturing and joint ventures, aims to create an electric car version of Android through the MIH electric modular platform.

The goal is not to confront the new forces head-on, but to explore the possibility of entering the electric vehicle manufacturing industry. The industry feels that Mr. Guo’s move is not reliable, and it doesn’t look like he is “seriously making cars”.After Foxconn’s return to BYTON, there has been no significant progress. Recently, the only news is that the cooperation project between Foxconn and BYTON has been shelved, mainly due to BYTON’s worsening financial situation. To respond to the doubts, Foxconn’s car-making plan has taken a new direction.

Before the 2021 Hon Hai Technology Day, Foxconn Group released a teaser video on social media. The video showed three different car models, including a sedan, an SUV, and an electric bus. It can be seen that the new car has the “Foxtron” logo on the front.

In terms of appearance, the new car will adopt a design style similar to that of a sleek hatchback. The fully enclosed front grille is paired with a through-style front headlight, and the front of the car is marked with the word “FOXTRON”.

In terms of performance, Foxconn will introduce battery packs with capacities of 93, 100, and 116kWh. The output power of the front electric motor of the released models is 95kW, 150kW, and 200kW, and the output power of the rear motor is 150kW, 200kW, 240kW, and 340kW.

The new car will debut at Hon Hai Technology Day on October 18. Well, that’s today.

Shall we bet on how long Foxconn and Terry Gou’s car-making passion will last from today?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.