This article is reproduced from the autocarweekly public account.

Author: Financial Street Old Li

CATL is a company that needs to be watched every week, and it is indeed worthy of its name, with changes every week.

This morning, CATL’s opening was strong and reached a historic high. Prior to this, CATL’s stock had been fluctuating for three consecutive months.

Stock prices are a comprehensive reflection of industry and capital. In the past three months, the development of the new energy vehicle market has entered a new stage, with monthly sales and penetration rates continuously increasing, and the industry side has actively improved. However, the secondary market is not optimistic. Due to the fast change of market styles in the third quarter and the large confusion brought by the quantitative trading funds in September, coupled with the high stock prices of the midstream of the lithium battery industry chain, CATL has been shaking for three consecutive months.

The fourth quarter is a critical period for the end-of-year examination of industry and capital. CATL’s stock price will have more imagination in this special period. Today, Old Li will talk to you about why CATL suddenly rose sharply on Friday? Can CATL break through new highs in Q4? Will there be any opportunity for CATL to rise next year?

Institutions Bet on Third Quarter Exceeding Expectations

October is the concentrated period for the release of enterprise third quarterly reports, and some enterprises have already disclosed relevant information. Generally speaking, if the third quarterly report performance is excellent, the company’s stock price will generally have a better performance. According to convention, CATL will disclose its third quarterly report in the second half of October.

Researching and exploring performance is the most important job of researchers. After the National Day holiday, many institutions were researching and inquiring about CATL’s third quarterly report performance, but many people did not inquire. After the first week of the holiday, the market style experienced a rapid switch, but on Friday, some institutions judged that CATL’s third quarter report is likely to exceed expectations. The market quickly surged, and then drove the midstream of the lithium battery industry to rise.

Old Li previously mentioned that for large-cap stocks with a market value of more than 20 billion, it is difficult for speculative capital to drive significant gains. Only when a single large-scale institutional capital or multiple small-scale institutional capitals are jointly promoted, a significant daily increase can be achieved. CATL is a trillion-dollar large-cap, so naturally there are tens of billions of large-scale capital buying in. After midday Friday, a part of the short-term capital took profits, so there was a slight retracement in the closing auction.

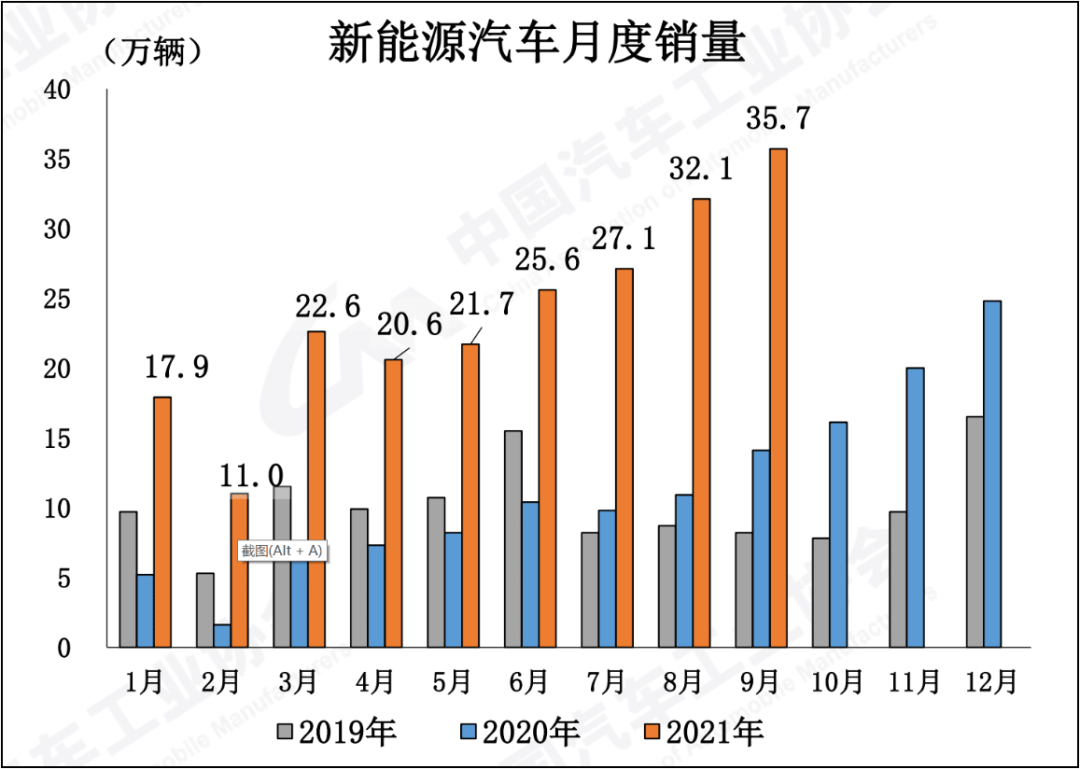

The institutional capital’s bet on CATL’s third quarterly report is not groundless. Looking at the large market of new energy vehicles, the total sales volume from Q1 to Q3 has achieved a stable state of monthly growth. The total sales volume in Q1 was about 500,000 vehicles; the total sales volume in Q2 was close to 700,000 vehicles, an increase of more than 30% month-on-month; in August, sales volume exceeded 300,000 for the first time; sales volume exceeded 350,000 in September, and the total sales volume in Q3 was nearly 950,000, with a month-on-month growth of more than 30%.

Overall, the sales of new energy vehicles maintained a high quarter-on-quarter growth rate each quarter, and accordingly, the installed capacity of power battery companies also achieved a relatively ideal level. The reason why Lao Li has always emphasized the performance of the new energy vehicle market is that the sales of new energy vehicles are the weather vane of the changes in the new energy vehicle industry market. All upstream calculations are based on this data.

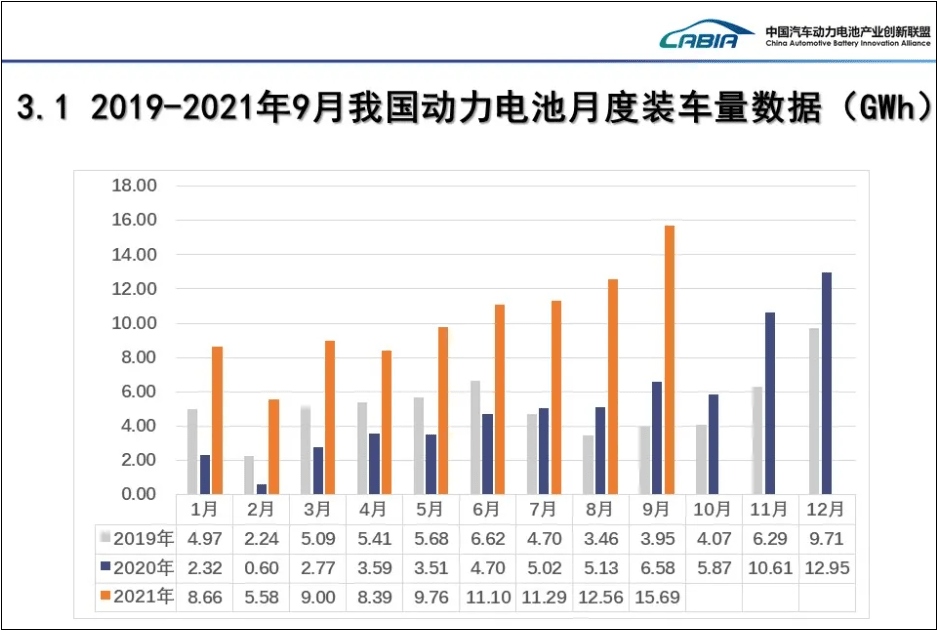

From Q2 to Q3, the installed capacity of new energy vehicles was basically positively correlated with the sales of new energy vehicles. To judge the performance of Ningde Times, we need to look at its market share. As Lao Li mentioned before, Ningde Times’ valuation password is “double-high”: high growth rate and high market share. The performance of the new energy vehicle market determines its growth rate, while Ningde Times’ customer development ability and customer sales directly affect its market share.

Thanks to the good market performance of downstream customers such as NIO and XPeng, the market share of Ningde Times began to rise in Q3. In September of this year, its market share reached as high as 56%, exceeding the average market share of 50% from January to September, and far surpassed the market share of the second-ranked BYD. Under the condition of high market share, the market believes that Ningde Times’ Q3 revenue will exceed expectations, which is reasonable.

From specific financial indicators, due to the rise in upstream material prices, the gross profit margin of Ningde Times in Q3 may still show a downward trend, most likely to be maintained between 20% and 25%, while its net profit margin is expected to continue to remain stable, at around 10%.

In the past, the industry has been worried that after the market matures, the gross profit of Ningde Times will continue to decline, and the net profit may also decrease. However, in the past two years, Ningde Times has maintained its expenses at a relatively low level through business optimization. Despite the decline in gross profit margin, its net profit margin remains at a relatively stable and high level.

This means that as long as the installed capacity of Ningde Times maintains a high level, its net profit will increase exponentially. This is also the most important reason why institutions dared to increase their positions in Ningde Times when the market style switched rapidly, and its stock price rise is reasonable.

Can the stock price reach a new high in Q4?

On the weekend, Lao Li also discussed the future trend of Ningde Times with researchers. To be frank, they did not reach a conclusion. For companies like Ningde Times, maintaining patience is more important than reaching a new high, because reaching a new high is certain, but when is uncertain.Many institutions believe that the penetration rate of electric vehicles will accelerate in the next 10 years, and the market will move away from the “S-shaped” growth curve. As NINGDE Times has entered the global mainstream automobile manufacturers’ supply chain and has mostly obtained the main supply position, its growth space will be the largest among all power battery companies. In terms of specific data, some institutions predict that NINGDE Times’ battery shipment volume is expected to reach 600 GWh by 2025, with a compound annual growth rate of 40%-50%.

From a long-term perspective, this judgment is beyond doubt. Therefore, many institutions are willing to overweight NINGDE Times, and some friends also like to call NINGDE Times “holding shares”. Buying NINGDE Times now feels like buying Kweichow Moutai three years ago when everyone thought it had reached its peak, but Kweichow Moutai continued to climb.

Therefore, Lao Li believes that if you are a long-term investor, buying NINGDE Times does not require too much skill, just continue to add positions, and NINGDE Times will definitely continue to create new highs in the quarterly cycle.

Subdividing the time granularity to Q4, what will be the trend of NINGDE Times? Lao Li believes that the Q4 trend will be easier to judge than Q3. Q3 does not have the constraint of year-end exams, and the market randomness is greater. Whether NINGDE Times can set new highs in Q4 is fundamentally determined by its performance. There are two external driving forces for NINGDE Times’ stock price to reach new highs in the secondary market in Q4: first, whether the installed capacity of Q4 can exceed expectations, and second, the “spring market” in the market.

The installed capacity is determined by the market and customers. In Q4, NINGDE Times’ key customers, such as NIO, XPENG, and Geely, must have excellent market performance. Lao Li gives you an indicator: NINGDE Times’ installed capacity in Q3 was 25.6 GWh. If NINGDE Times’ installed capacity in Q4 can increase by 30% to 33.28 GWh, regardless of the market situation in Q4, institutions will definitely give NINGDE Times a more optimistic price.

Last year’s spring market was impressive, from January to early March, the market had good performance, and leading stocks could have good market performance regardless of whether the industry performance was in line with expectations.

Recently, the secondary market has also been hyping the “spring market”. Many sellers believe that the market will be relatively stable in October and November, and since the Spring Festival is earlier next year, the spring market will come early from December. If NINGDE’s performance cannot be achieved, the market will also have upward opportunities.

Based on current information, until December, no matter how NINGDE Times’ performance is, it will usher in an upward opportunity and reach a new height.In general, the market capitalization of leading stocks in the automotive industry does not increase monotonically, but appears in a “staircase pattern”. This means that when the stock price consolidates oscillations within a certain price range, and then rises to a new price range, it will again consolidate oscillations.

Following this trend, the performance of CATL (Contemporary Amperex Technology Co. Limited), also known as Ningde Times, is in line with expectations: In Q3, Ningde Times was in a reasonable oscillation range. In Q4, the market performance of new energy vehicles and the performance of Ningde Times are crucial. When these two triggering points are met, along with the arrival of the spring heat, and without external interference, Ningde Times’ stock price will inevitably break through the current oscillation range, experience a rally, and then oscillate again.

Is there any room for imagination next year?

Next year, the main factor that will affect Ningde Times’ stock price is not the power battery, but the energy storage battery.

Ningde Times has two main business sectors: power batteries and energy storage batteries. The power battery mainly serves the new energy vehicle industry, which is the most important part of Ningde Times’ revenue and the most influencing factor of its performance. Currently, it is in a steady growth phase, and its market space is predictable. The market has given the power battery a relatively reasonable valuation.

The main application scenario of the energy storage battery is electrochemical energy storage, which is a new power source for the growth of Ningde Times, and is still in the early development stage, similar to the new energy vehicle industry ten years ago.

The government is also implementing policies to promote the development of energy storage batteries. On July 15, 2021, the National Development and Reform Commission and the National Energy Administration issued the “Guiding Opinions on Accelerating the Development of New Energy Storage”, which clearly states that the installed capacity of new energy storage will reach more than 30 GW by 2025. In the next five years, new energy storage will shift from the initial commercialization to large-scale production, and by 2030, new energy storage will achieve comprehensive market-oriented development.

Compared with the national plan, institutions are more optimistic about the prospects of energy storage, with composite growth rate of China’s electrochemical energy storage predicted to be above 50% over the next five years by the Zhongguancun Energy Storage Industry Technology Alliance. This growth rate far exceeds the critical point of 30% for “high growth rate” in the secondary market.

In terms of the overall market space, although some institutions have made predictions, there is no particularly clear space for energy storage batteries. Here’s a reference indicator: according to the research report by QDYN, a research institution, the demand scale for energy storage batteries in China from 2021 to 2023 will be 21.6 GWh, 34.5 GWh, and 48.2 GWh, respectively.Ningde Times has an early layout in the energy storage field, and currently occupies a large market share. If calculated according to an 80% market share, its energy storage battery shipments will reach 38.56 GWh by 2023, which is a figure beyond everyone’s expectations. It is worth knowing that Ningde Times’ total shipments in 2020 were only 34 GWh.

In the past three years, institutions have been paying close attention to Ningde Times’ financial performance in the energy storage sector. In 2018, the revenue of Ningde Times’ energy storage system was only 189 million yuan, accounting for 1.33% of the revenue, but it increased by 221.95% compared to the previous year. In 2019, revenue reached 610 million yuan, accounting for 1.33% of the revenue, but it increased by 218.56% compared to the previous year. Meanwhile, in the first half of this year, Ningde Times’ energy storage system business achieved a major breakthrough, with revenue reaching 4.693 billion yuan, accounting for 10.65% of the revenue, and an increase of 727.36% compared to the previous year.

In 2018, Ningde Times established an independent energy storage division and planned and layouted several energy storage projects, such as the Huxi project, the Cheliwan project, the Jiangsu Liyang project, the era Geely project, the Zhaoqing project, and others in just three years.

The automotive industry has been emphasizing that 2020 is the year of the outbreak of new energy vehicles, and similarly, the energy storage industry believes that 2021 will be the year of the outbreak of the energy storage industry. Ningde Times’ energy storage business has already made its mark this year, and the secondary market will enter a warming-up phase next year.

In the past, institutions were most concerned about the installed capacity of power batteries of Ningde Times, then the installed capacity of overseas markets, and now most institutions are most concerned with the installed capacity of energy storage batteries.

At the 125th anniversary of Shanghai Jiaotong University, Ningde Times Chairman Zeng Yuqun talked about three directions for the development of Ningde Times. First, they hope to make power batteries the core and replace mobile fossil energy. Second, they hope to combine the fields of energy storage, power generation, and especially new types of solar cells to replace fixed fossil energy. Third, they hope to cooperate in specific areas of intelligentization and electrification.

Ningde Times has already achieved results in direction one and will achieve results in direction two next year. As for direction three, Ningde Times has already made many plans, and its imagination of valuation will be realized in a longer-term period.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.