Author: Da Yan

The acquisition of ARM by NVIDIA, worth up to $40 billion, caused a sensation last year. However, there are now numerous uncertainties surrounding the deal.

Following the launch of an antitrust investigation by the UK regulatory authority in August, the European Union’s antitrust review, originally scheduled to end on October 27th, will now be extended for another four months, even if NVIDIA is willing to raise its offer from $40 billion to $54 billion.

In addition to the UK and EU, regulatory authorities in the United States and China have not revealed much positive attitude towards NVIDIA’s acquisition of ARM. As a result, the probability of the semiconductor industry’s largest acquisition being completed is decreasing.

How important is neutral ARM?

As we all know, ARM has a pivotal position in the global semiconductor industry. As a provider of semiconductor intellectual property (IP), ARM’s architecture is used in over 95% of smartphones and tablets worldwide. Based on this, ARM has established its own ecosystem, making it difficult for other chip design companies to bypass ARM and establish their own ecosystem.

The main reason for this situation is that the core technology of chip institutions is controlled by a few companies, of which only ARM is willing to license its chip architecture to other manufacturers, which gives ARM a neutral position in the chip market.

In 2016, SoftBank, which acquired ARM, although invested in many high-tech companies, did not involve itself in chip design and manufacturing, so ARM’s neutrality was maintained. Major chip companies are not expected to have obvious concerns about this.

However, NVIDIA is completely different. On the one hand, it is already the world’s largest manufacturer of GPUs and artificial intelligence chips, with more than 80% of the independent graphics card market. Especially in the era of autonomous driving, NVIDIA has left competitors, including Mobileye, far behind.

On the other hand, ARM will be able to bridge NVIDIA’s gap in the CPU field and create a true giant in the chip industry.

If NVIDIA successfully acquires ARM, on the one hand, it will be able to restrain other companies from using ARM’s patented chip architecture. Although NVIDIA has always claimed that it will not set any obstacles for other chip companies to continue using ARM’s patented technology, this does not have the legal effect of guarantee, nor any significance for reference.

Because NVIDIA can fully monopolize ARM’s latest achievements and combine them with its GPU technology to create more powerful chips. Although NVIDIA has always claimed that it will ensure ARM’s independence, it is actually very easy to circumvent such a guarantee. The two sides can establish a joint venture company and create chips exclusively for NVIDIA. NVIDIA can recruit the company’s best talents and teams, and pay ARM enough fees to ensure that other companies cannot speak up.

Therefore, it is not just the EU and Chinese companies that have major concerns about NVIDIA’s acquisition, even US chip companies such as Qualcomm, Apple, Microsoft, and Alphabet, the parent company of Google, have expressed their opposition to the completion of this acquisition. Even Tesla, which does not use NVIDIA chips, clearly opposes NVIDIA’s acquisition of ARM.

In their minds, an ARM that is currently more neutral can dispel everyone’s concerns and ensure that their chip design business can continue smoothly.

NVIDIA’s involvement will definitely enable it to obtain the fruits of ARM’s technological innovation earlier than its competitors, rather than ARM willing to share these successes with major chip companies simultaneously. Such a potential monopoly possibility will make other companies lose the possibility of further innovation.

The only chance in NVIDIA’s life

Since ARM’s status is so important, why does SoftBank want to sell the company?

In fact, the biggest reason in the middle is that SoftBank lost 750 billion yen in last year’s financial report released in April. Therefore, SoftBank reached an agreement with NVIDIA in September last year, hoping to help itself stop the bleeding as soon as possible and stabilize the stock price and the entire company’s situation by selling ARM.

In addition, ARM’s own profitability is not good, which is also the key reason why SoftBank wants to sell it as soon as possible. With increasing technology investment, ARM’s annual profit is currently around US$300 million, which is in sharp contrast to SoftBank’s acquisition price of US$30 billion.It is precisely for these two reasons that NVIDIA CEO Jensen Huang has stated that the current acquisition of ARM is “the only chance in his lifetime.” Because missing this opportunity will make it difficult for NVIDIA to acquire ARM, whether Softbank can successfully recover, or Softbank can promote ARM’s independence or split listing.

China’s autonomous driving industry does not want NVIDIA to dominate alone

For autonomous driving technology, the laser radar + vision-based perception technology route has been basically confirmed, and there are many mass-produced solutions. Therefore, from a hardware perspective, the last obstacle is the AI chip.

The computational power of the AI chip will directly determine whether the autonomous driving system can analyze and process massive data, and provide enough support to various execution agencies to achieve longitudinal, lateral, and even vertical adjustments. Currently, only Tesla has thrown NVIDIA aside by designing its own autonomous driving chip.

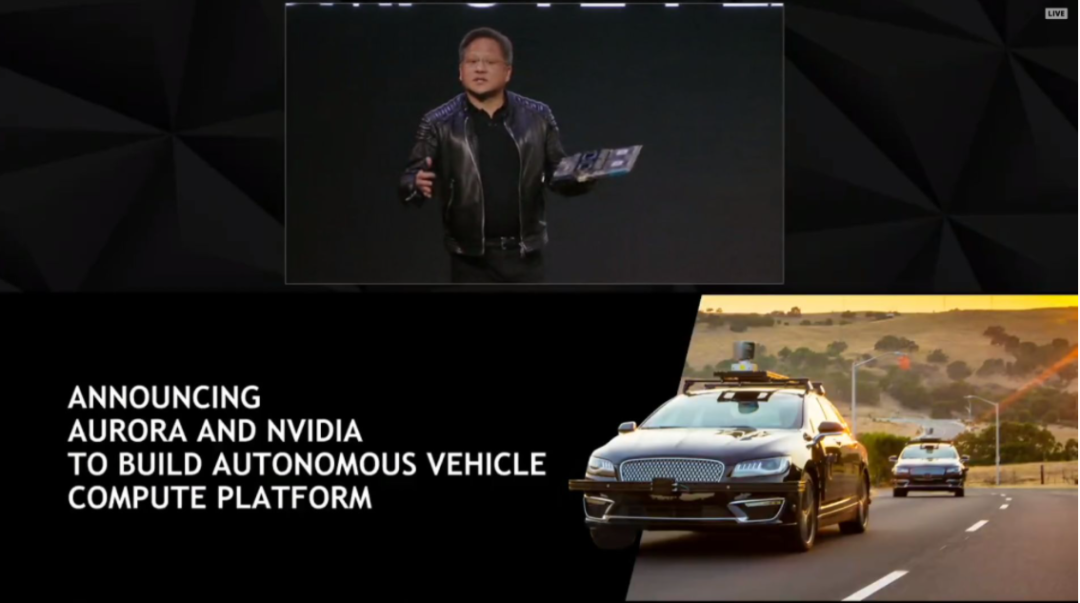

However, most other car companies still need to rely on AI chip solutions provided by companies like NVIDIA. According to relevant information, including NIO, SAIC IM, Mercedes-Benz, and Audi have established cooperative relationships with NVIDIA, so NVIDIA is already a force that cannot be ignored in the field of autonomous driving, even if it does not acquire ARM.

In the field of chip design, especially in AI chip design related to autonomous driving, a large number of chip design companies are emerging rapidly in China.

However, whether it is Huawei Hisilicon, Horizon Robotics, or Mushroom Intelligence, they all use open source ARM architecture. Therefore, once NVIDIA acquires ARM, it will inevitably have an overwhelming advantage over related chip companies.

Moreover, if NVIDIA can successfully acquire ARM, the United States will simultaneously control both the X86 and ARM chip architectures. For Chinese high-tech companies that will continue to compete head-on with American high-tech companies for a long time in the future, this is not good news.

In the future, we will likely still see an independent ARM active on the world stage, continue to open its chip architecture to other companies, and continue to improve its ecology.

From the European perspective, if a company like ARM is handed over to American companies, it will undoubtedly be a major blow to themselves in the field of chip technology. From cloud, smartphones, PCs, autonomous driving, and robotic technology to edge IoT, the role of chips will be irreplaceable.And Chinese enterprises also need more time to try to study how to get rid of the impact of ARM’s chip architecture on ourselves, and this will be a more difficult path than designing chips.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.