In the process of global electrification of automobiles, China’s automobile industry has taken the lead and gained some kind of first-mover advantage. To exaggerate a little bit, this global automotive revolution is actually originated from the electrification of China’s automobile industry. Currently, new energy vehicles are moving from the primary stage of development towards the medium and high stages of development. This means that we need to enter the 2.0 era, characterized mainly by networking and intelligence, from the electric 1.0 era. This was stated by Chen Qingtai, Chairman of the Electric Vehicle 100 (EV100) at the 3rd Global New Energy and Intelligent Vehicle Supply Chain Innovation Conference.

The reason why new energy and smart cars have become one of the hottest tracks today is due in large part to the dual carbon target jointly adopted by the world. “Carbon emissions” have become a buzzword constantly mentioned by major news media. In China, the carbon emissions from road traffic account for about 10% of the total carbon emissions.

A research report by the International Finance Corporation of China pointed out that “from 2008 to 2018, China’s carbon emissions from transportation increased by 580 million tons, of which 510 million tons came from road transportation, accounting for 88% of the total increase. The reason behind this is that China’s passenger car ownership increased by 557% in the past decade, which is the main driver of the growth in carbon emissions from road traffic.”

As of 2020, China’s total vehicle ownership has reached 270 million, but the number of vehicles per thousand people is only 173. Looking around the world, the United States ranks first in the world with 837 vehicles per thousand people, Japan, in a situation of extremely high population density, still has 519 vehicles per thousand people, Malaysia, which has a per capita GDP similar to China’s 10,000 US dollars, has 433 vehicles per thousand people, and Russia has 373 vehicles per thousand people.

From the perspective of the global development process, the increase in per capita GDP is positively correlated with the motorization of personal travel. With the continuous improvement of China’s per capita GDP, China’s total vehicle ownership will still be in a period of rapid growth. If the addition to vehicle ownership is still dominated by fuel-powered cars, it will cause a huge carbon emission disaster. Therefore, the electrification transformation of China’s road traffic has become urgent.

As more and more local governments start to take “concrete actions” on carbon neutrality, capital with keen sense of smell is also rushing to overturn every corner of the new energy vehicle industry chain. “The next level of the “Automotive Kingdom” is the “Parts Kingdom”, and the strength of the automotive supply chain directly decides the direction of China’s future automotive industry. With the continuous clarification of industry direction and support policies, more and more vehicle and parts companies, as well as various types of capital, are beginning to try to participate in the new energy and smart vehicle industry chain.

From 1.0 to 2.0, the only thing that remains the same is survival of the fittest.

The form of automotive power has begun to shift from traditional internal combustion engines to electric motors, leading to unprecedented changes in the supply chain system of the automotive industry. As we know, it is impossible for car manufacturers to produce all automobile parts by themselves. For more than a century since the birth of the automotive industry, the industrial structure of traditional cars has been characterized by the core technologies such as engines and chassis being mastered by car manufacturers, while other parts are procured from suppliers because of the consideration of recycling costs, research and development difficulty, patent barriers, etc.

For those high-tech, difficult to develop parts, beyond a few car manufacturers with large shipment volumes and strong voice, such as Volkswagen and Toyota, who even hold shares in auto parts suppliers, only participate in the product design of Tier 1 suppliers, such as the cooperation between Toyota and Aisin Seiki. Most car manufacturers with smaller shipment volumes have no opportunity to customize products from top-tier parts suppliers and can only make some minor adjustments within the range allowed by the parts suppliers.

Meanwhile, these parts are equipped with Electronic Control Units (ECUs), and each ECU is responsible for the normal operation of the component, known as the “black box” solution: the supplier provides the designed product, but will not open the hardware design or control software code to the car manufacturer. The car manufacturer only needs to assemble it onto the vehicle to make it work normally.

Under the aforementioned conditions and limitations, as long as it does not deviate from the development direction of the company, car manufacturers do not reject using the supplier’s “black box” solution. The reason behind this is that the previous automotive supply system provided an integrated solution of “control software + parts” by the supplier, with a deep binding of product software and hardware, which led to poor bargaining power of the car manufacturer for key parts procurement and difficulty in testing and debugging. If problems are encountered, it may greatly extend the vehicle development cycle.

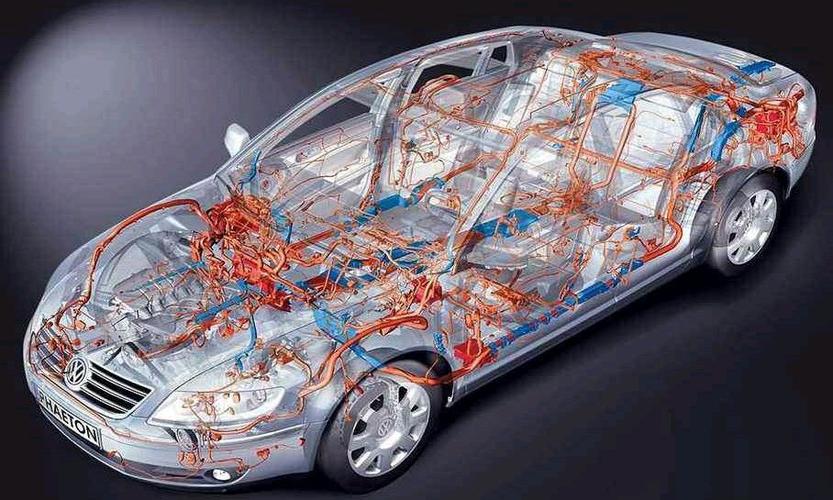

As more and more functions are added to cars, the number of ECUs used is also increasing. However, the ECUs from different suppliers do not adopt the same communication protocol, so various ECUs can only use point-to-point communication, resulting in the total length of wires connecting the ECUs can reach over a thousand meters, and the number of electrical nodes can be over a thousand as well. Meanwhile, it is difficult to directly connect ECUs to the Internet, so viewing information and modifying settings can only be done through a dedicated car diagnostic tool.

Although there were bus protocols such as CAN, LIN, and Flexray later, which were used to reduce communication costs, these protocols had significant limitations due to the technology available at the time. They were unable to achieve a balance in bandwidth, security, cost, and efficiency. Additionally, their lack of scalability meant that when consumers who had already purchased vehicles changed their requirements, waiting for a vehicle replacement was likely their only option.

Although there were bus protocols such as CAN, LIN, and Flexray later, which were used to reduce communication costs, these protocols had significant limitations due to the technology available at the time. They were unable to achieve a balance in bandwidth, security, cost, and efficiency. Additionally, their lack of scalability meant that when consumers who had already purchased vehicles changed their requirements, waiting for a vehicle replacement was likely their only option.

The fundamental reason for this situation was that some suppliers who had core technology had a higher status in the entire automotive supply chain. The essence of the supply chain is a value chain, and enterprises with higher values can occupy the upper game of the entire supply chain, set game rules, and obtain higher profits. For example, the procurement and pricing of automotive electronic components are firmly controlled by Tier 1 suppliers such as Bosch and Continental. While these Tier 1 suppliers obtain excess profits, they also adopt a highly conservative entry policy toward Tier 2 suppliers.

Currently, this vertically integrated, hierarchical supply chain model that offers both hardware and software is outdated, as consumers demand intelligent cars. However, in the early days of the automotive industry’s development, this model may have been the most reasonable choice. Any successful industry leader is an enterprise that chooses the most reasonable development path at the time. However, the industry is constantly changing. When the enterprise cannot reasonably respond to change and face new challengers, it becomes extremely painful, much like the dragon in the story of a dragon-slayer.

What is “Software-Defined Car”?

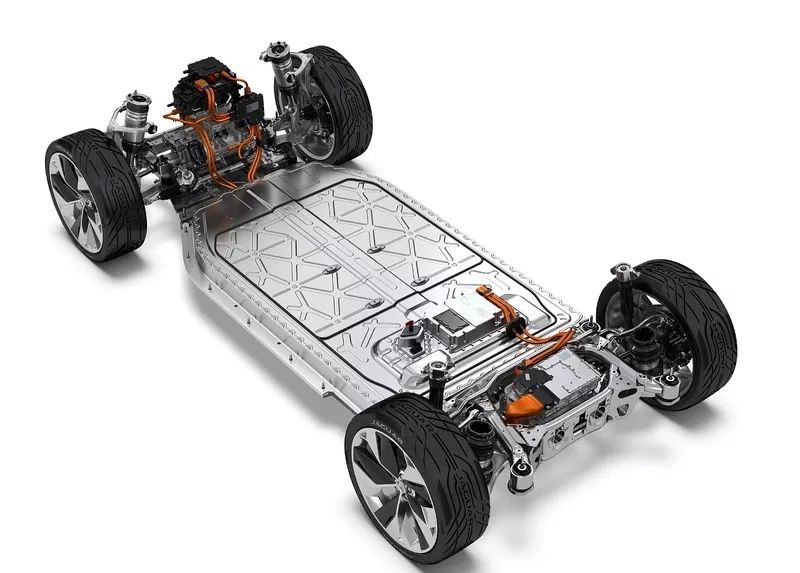

When new energy vehicles entered the networked, intelligent 2.0 era, the increase in electric and electronic products applied in cars led to a rapid increase in the number of ECUs from dozens to more than 100. In this process, the concept of “software-defined cars” was proposed. Here, “software” does not refer to the various entertainment apps you see in the car or the cool LCD instrumentation and large-screen central control. Instead, it refers to reducing the communication costs of car components and improving communication efficiency by defining centralized software transformations of the entire car’s electrical architecture, providing the vehicle with OTA capabilities (Over-the-Air download).

First and foremost, the number of ECUs must be reduced, the concept of functional domains must be introduced, domain controllers must be used, and more compatible bus protocols must be introduced. Therefore, Ethernet for the car was introduced. Its biggest advantage is that it supports continuous bandwidth growth while maintaining compatibility with previous generation standards. Its introduction added the most powerful support for the whole vehicle’s OTA applications.So why is OTA so important in the era of Internet of Vehicles and intelligence 2.0? After all, before the emergence of automotive OTA, people could upgrade software by taking their cars to 4S stores.

I believe that the emergence of ADAS has brought absolute necessity to the deployment of full-vehicle OTA. In the traditional automotive development process, the development of ADAS functions must be placed at the end of the cycle because calibration, tuning, and testing cannot begin until the chassis, power, and other components are determined.

This means that when an automaker needs to develop a car with ADAS functions, the development cycle will be much longer than that of a car model without ADAS. Moreover, due to its nascent nature and deep learning algorithm-based features, ADAS functions inherently require more development time, and function optimization is a long-term process.

The emergence of full-vehicle OTA ensures that the development of ADAS functions will not excessively slow down the overall vehicle development progress. People can choose to buy a car first and wait for ADAS function upgrades during use. Even if they change the hardware supplier, as long as the hardware performance is roughly the same, it will not significantly affect the deployment of software functions.

At the same time, ADAS is a function that requires close coordination among various vehicle systems, which means that the previous pattern of each component supplier having its own turf has been broken.

The New Model of Vertical Procurement

In this major upheaval of the automotive industry and supply chain, Tesla is undoubtedly the biggest “instigator”. Musk, who has always emphasized cost control, learned Apple’s supply chain strategy, which is “independent design + vertical procurement”. Tesla basically adopts independent design + outsourcing for core components, firmly grasping the dominance of the supply chain, breaking the original automotive supply system, and continuously reducing costs through economies of scale.

At the same time, vertical procurement also provides emerging component manufacturers with an opportunity to enter the supply chain of international brands. Over the years, Tesla’s supplier base has continued to grow from over 200 to over 600, greatly reducing costs. Of course, vertical procurement not only reduces purchasing costs for the entire vehicle manufacturer, but also increases its own gross profit by eliminating channel manufacturers.

Global automotive supply chain restructuring brings new opportunities to the Chinese component industryIt is well known that since its release, the iPhone has led the development of smart phones, and Apple, with its high industry status, has almost single-handedly rewritten the global mobile phone supply chain. Whether it is Foxconn, BYD, Luxshare Precision, still in the supply chain, or Bluesky Technology, OFILM, and so on, already exited from the supply chain, they have benefited from Apple’s large shipping volume and high product requirements during the time of supplying to Apple, and have grown into leading players in their respective industries.

Among these companies, there are many Chinese component manufacturers who were originally excluded from the global high-end supply chain. At that time, Chinese electronic component manufacturers were always seen as “copycats who only produce low-end goods,” and it was difficult for them to enter the international supply chain system. However, because the assembly of iPhone smartphones landed in China, these component manufacturers “took advantage of the geographic proximity for an opportunity”, and got a chance to compete with their counterparts in other countries and regions.

_20211015182652.jpeg)

Apple has given China’s electronic manufacturing industry an equal opportunity to compete, and Chinese companies have seized it. The case of Apple’s industrial chain has proven that Chinese suppliers are not “copycats who only produce low-end goods”. In 2020, among the top 200 Apple suppliers, there were 86 Chinese companies, accounting for a high proportion of 43%.

The landing of Apple’s supply chain in China has helped China cultivate a large number of high-quality production factories and engineers, and has also brought advanced management experience and product standards, which is one of the reasons why China’s mobile phone industry can lead the world today.

“The development of an industrial chain is not created out of thin air, but rather through project after project, constantly accumulating talents and technology, can it be developed.”

China once invested over 100 billion yuan in new energy subsidies, which not only failed to help the development of the new energy automobile industry chain, but also made the new energy automobile industry at that time a breeding ground for subsidy fraudsters. According to the Tesla Shanghai factory gambling agreement, Tesla needs to complete a 100% localization rate of its product parts by the end of the year, which will bring an unprecedented opportunity to China’s local automobile parts manufacturers.

The Tesla industrial chain involves power, charging, chassis, body, central control, interior and exterior decoration, etc. Among the core hardware suppliers of the power system, Chinese suppliers are free from the restrictions of layered patents in the era of internal combustion engines, reducing the difficulty of competition.Currently, the electric cars produced by the Shanghai Super Factory are not only available in the Chinese market, but also exported overseas. For Chinese suppliers who have entered Tesla’s supply chain, as Tesla’s sales continue to climb and localization continues to strengthen, their global market influence will be further expanded.

For example, after entering Tesla’s supply chain, Sanhua Intelligent Control, which provides thermal management components for Tesla, soon won orders worth a total of 14 billion yuan from new energy vehicle manufacturers such as Volkswagen and General Motors. Its market value even once reached 90 billion yuan.

In the fields of the three-electric system and automotive electronics, Chinese suppliers still have certain disadvantages compared to international competitors. However, with the huge consumer energy in the Chinese market and a series of policy preferences, a number of outstanding companies have emerged and began to challenge into high-profit niche markets.

As a consumer who has always fancied the takeoff of Chinese automotive industry, I believe that this is the best opportunity for Chinese automotive industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.