Author: Kou Mikou

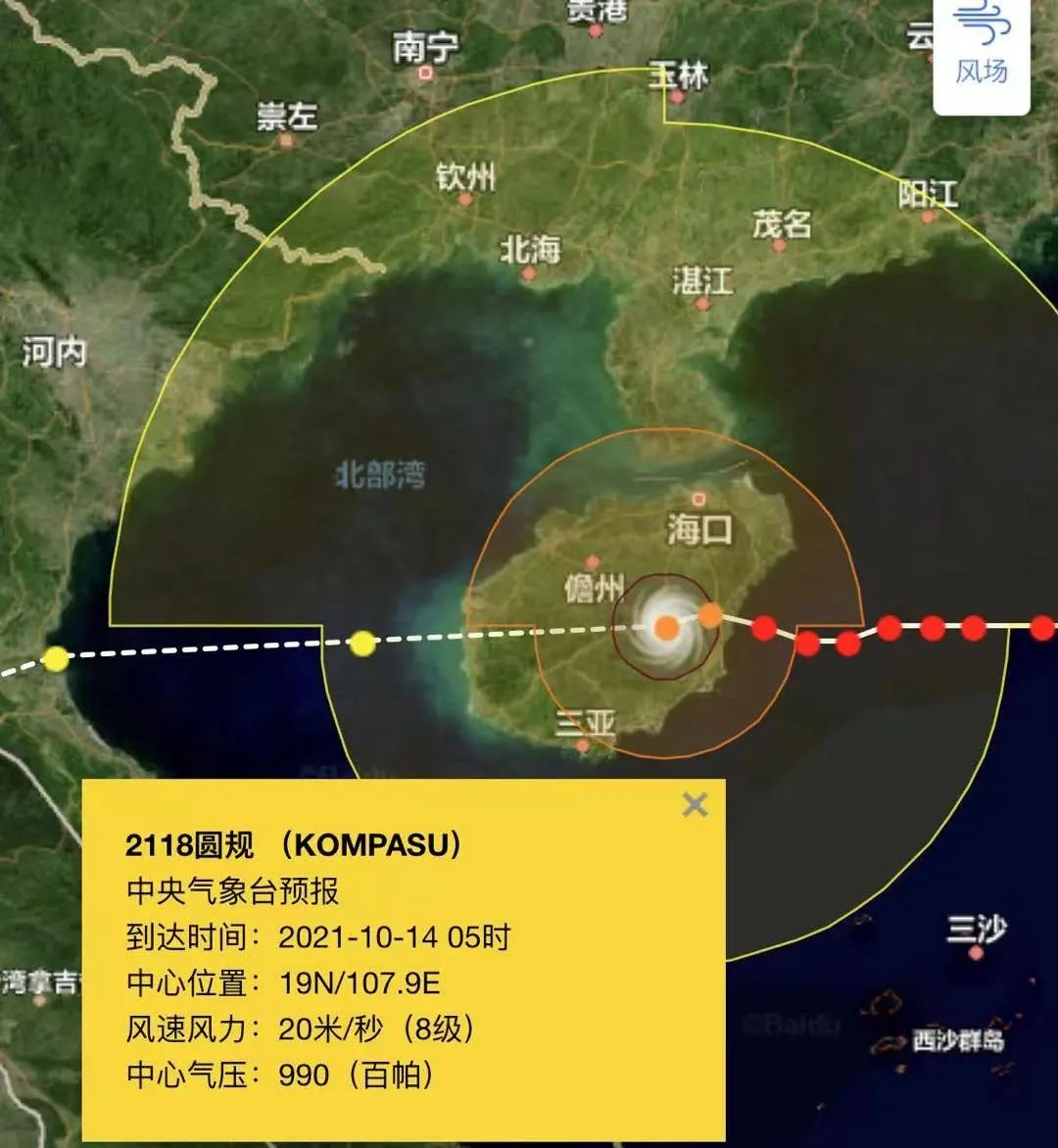

Not thanking for the invitation (since no one invited me), I am currently in Hainan and preparing to board a plane.

These past few days, I believe many people’s phones have been flooded with news about “round rules.” Many places have suspended work and classes, and coastal fishing boats have also returned to port and are now on standby, not venturing out to sea. Unfortunately (but not that unfortunate), I happen to be in Hainan and I am also stranded here due to the arrival of “round rules.” But it’s not a big problem, as long as we can connect to the internet, we can continue to update.

Today, let’s talk about sales. The sales performance of various manufacturers in September was unexpected, with some experiencing explosive sales growth after two months of silence, while others finally broke ten thousand in monthly sales after months of effort. Of course, there were also manufacturers with declining sales, as the overall auto market sales were not as ideal. So if there were increases, there would inevitably be decreases.

How is the overall situation?

First, let’s take a look at the overall situation. In September, the wholesale volume of passenger cars was 1.737 million units, a year-on-year decrease of 16%, and the retail volume was 1.582 million units, a year-on-year decrease of 17.3%. However, the cumulative wholesale volume and retail volume from January to September reached 14.603 million and 14.486 million units, respectively, a year-on-year increase of 11.3% and 12%. Friends who are familiar with the auto market may have heard of the saying “Golden September and Silver October.” Generally speaking, September and October are the two best months for auto market sales. However, the situation of cumulative sales growth and a decline in September sales is enough to indicate that the auto market in September had some problems.

I think the biggest reason for this is the chip shortage problem. Now, new cars are equipped with more and more chips, including power systems, entertainment systems, and driving assist systems, among others. A shortage of chips will naturally impact auto production capacity, resulting in lower sales.

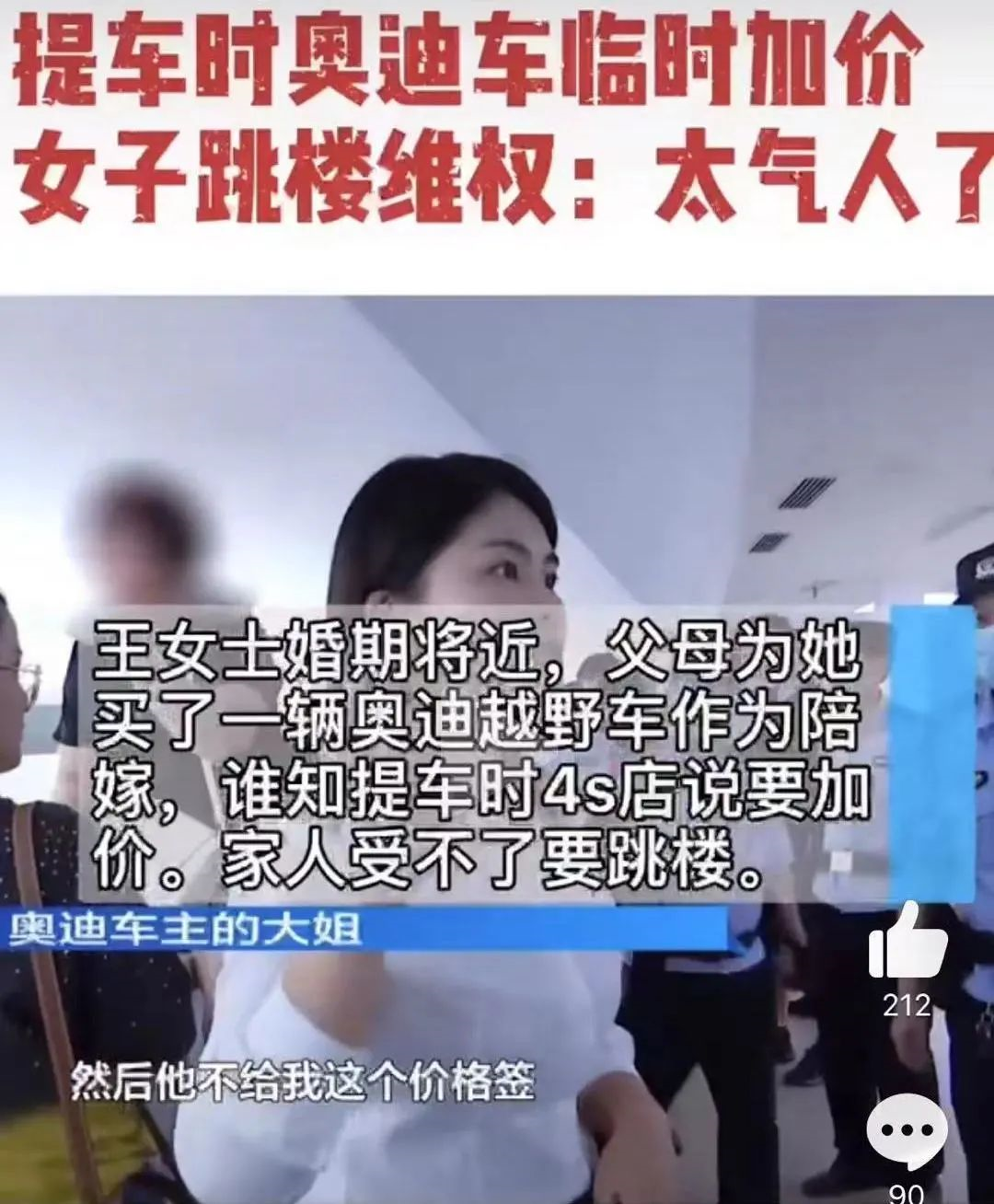

Moreover, at this time, I really don’t think it’s a good time to buy a car, because the current auto market can really be called a “seller’s market.” Terminal prices are rising, and individuals have no bargaining power (although they may not have had much bargaining power before), and there is also a waiting period for cars. Many such reports can be seen on the internet, and there have even been cases of dealers raising prices unexpectedly after negotiating a price with consumers.

The price increase caused by chip shortage is understandable, but it does not rule out the possibility that some merchants take advantage of the situation to make excessive profits. Therefore, if you are not really in a hurry to buy a car, it is better to take your time. After the chip shortage is alleviated, these models that are currently retracting discounts will still have to offer discounts (including used cars whose prices have now gone up).

The price increase caused by chip shortage is understandable, but it does not rule out the possibility that some merchants take advantage of the situation to make excessive profits. Therefore, if you are not really in a hurry to buy a car, it is better to take your time. After the chip shortage is alleviated, these models that are currently retracting discounts will still have to offer discounts (including used cars whose prices have now gone up).

But interestingly, the sales of new energy vehicles in September actually increased to 357,000 units, a year-on-year increase of 148.4%, setting a new monthly sales record for new energy vehicles. It can be said that more and more people are accepting new energy vehicles now.

Let’s talk about some interesting brands

If you have to pick one brand that performed best in September, there is no doubt that it is BYD.

Although BYD’s sales volume in September was not the highest, the sales volume of BYD’s new energy vehicles was 70,022 units, accounting for 88.59% of the total sales volume. Among these 70,000 units, plug-in hybrid and pure electric vehicles can be said to be evenly split, with sales of plug-in hybrid vehicles at 33,716 units and pure electric vehicles at 36,306 units.

If you have no concept of this sales volume, then you can put it this way: the total sales volume of the top four new challengers NIO, XPeng, WM Motor, and Li Auto in September was only 35,833 units. Including the fifth and sixth places WmAuto and LeapMotor, the total sales volume of these new challengers in September was only 44,933 units, significantly lower than the sales volume of BYD’s new energy vehicles.

In BYD’s product line, both the Qin series and the Song series models exceeded 20,000 units in sales, while the Han series sales remained above 10,000 units. The recently launched Dolphin also achieved a sales volume of more than 3,000 units. It can be said that BYD had a diversified performance in September, and if the sales of the Tang series can continue to keep up, then the sales can still rise again.

Also, there are interesting things about the Volkswagen Group, as SAIC Volkswagen and FAW-Volkswagen ranked the top two in September’s sales list. SAIC Volkswagen’s sales were 123,501 units, a year-on-year decrease of 23.1%, while FAW-Volkswagen’s sales were 107,762 units, a year-on-year decrease of 48.6%. Although both saw a significant decline in sales compared to the previous year, they are still at the forefront, given that other brands are also affected by chip supply issues resulting in limited production capacity.

Also, there are interesting things about the Volkswagen Group, as SAIC Volkswagen and FAW-Volkswagen ranked the top two in September’s sales list. SAIC Volkswagen’s sales were 123,501 units, a year-on-year decrease of 23.1%, while FAW-Volkswagen’s sales were 107,762 units, a year-on-year decrease of 48.6%. Although both saw a significant decline in sales compared to the previous year, they are still at the forefront, given that other brands are also affected by chip supply issues resulting in limited production capacity.

Of course, the reason why these two Volkswagen brands are mentioned is not because of their overall sales, but because of their new energy vehicle (NEV) sales. According to data, SAIC Volkswagen and FAW-Volkswagen sold 14,000 NEVs, accounting for 72% of the mainstream joint venture brands’ NEV sales. In absolute terms, this 14,000 units is not high, but it is a good start for traditional joint venture giants to enter the NEV market.

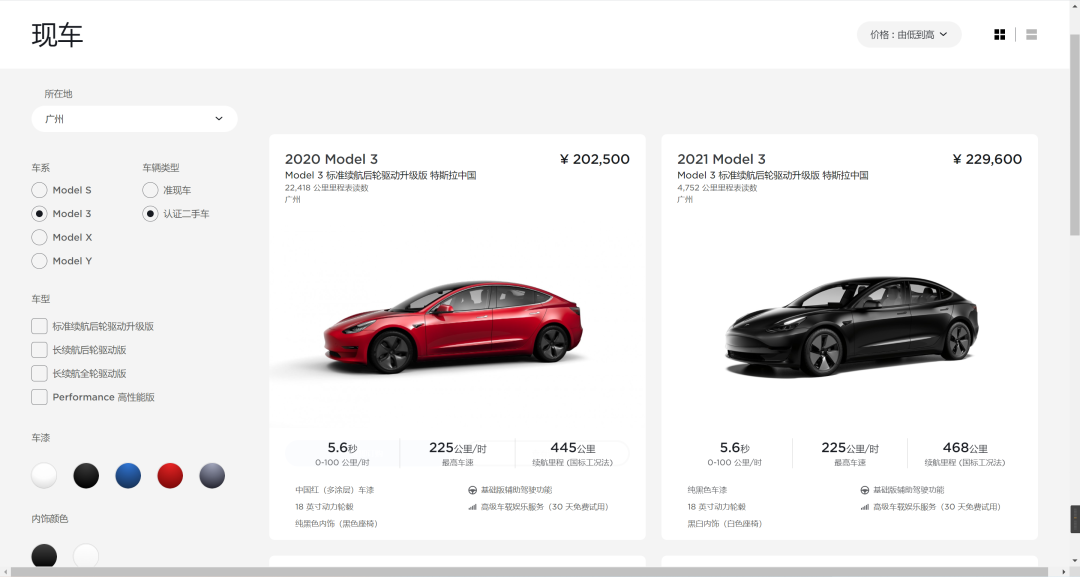

The last brand we’ll consider is Tesla. Tesla delivered 56,006 vehicles in China in September, of which 52,123 were delivered to local customers, with Model Y sales surpassing those of Model 3, reaching 33,033.

However, this 50,000+ sales figure has some caveats. Starting from July, Tesla’s Shanghai factory began its transformation into an automobile export center, and the export volume has been steadily increasing. For example, in August, Tesla China’s total sales were 44,264 units, of which 31,379 were exported overseas, a 29% increase from July.

Therefore, part of the sales figure over 50,000 in September includes deliveries to customers who waited a while for their orders to be fulfilled, as a result of Tesla’s concentrated efforts to clear the backlog. Nevertheless, the domestic deliveries were impacted by the increase in exports. Consequently, Tesla’s official pre-owned car certification sales are also quite popular. In August, the author observed that there were quite a few Model 3 second-hand cars in inventory in Guangzhou, but the remaining amount has now reduced significantly, indicating that the increased export volume has forced some customers to be less patient.

What are the best-selling cars?

If we speak of the best-selling family sedans, we must look at the Sylphy.Here’s the translated English Markdown text, retaining the HTML tags inside the Markdown:

In September, the sales of Nissan Sylphy reached 39,250 units, once again approaching 40,000. Although the sales volume compared to September of last year dropped significantly (sales volume of 57,525 units in the same period last year), it still showed good growth compared to August. For ordinary families, Nissan Sylphy may not be the best choice, but it is indeed a reliable choice.

Geely’s Xingyue L also achieved good sales, with sales in September exceeding 10,000, reaching 10,168 units. We have compared and tested the Xingyue L, and its performance is excellent for this price range, thanks to the CMA platform. Of course, Xingyue L itself is not lacking in buyers, with more than 60,000 orders accumulated, so the sales for the second consecutive month exceeding 10,000 is mainly due to production capacity issues. If the production capacity can keep up, there should be no problem with further growth.

On the other hand, Great Wall Motors’ Big Dog and Tank 300 both performed well. Haval Big Dog sold 10,055 units in September, a year-on-year increase of 230.2%, while Tank delivered 8,021 new cars in September, also setting a new record for monthly deliveries. Now it seems that Great Wall Motors is truly the first SUV brand in China, after all, it has launched SUVs that other carmakers dare not imagine, and has achieved good results. In the near future, Big Dog and Tank 300 should have no direct competitors. For consumers who want to buy this type of SUV, these two cars from Great Wall Motors can be said to be the only choices.

Summary

The highlight of the September car market is not which company’s sales went up or down, but the chip problem. Such a large decline in September is very rare, and the impact of the chip shortage is not limited to one or two automakers, but the entire market. Consumers buying cars now are forced to purchase “cars without discounts” or “cars with fewer discounts”, achieving less for the same amount of money spent. This may be the problem that car buyers will face for the next few months. So, as the saying goes, if you’re not in a hurry to buy a car, it’s better to wait a little longer? You may save a lot of money.

> The Chinese Markdown text with HTML tags:

> The Chinese Markdown text with HTML tags:

对了,最后来个花絮,那个神龙汽车,就是拥有雪铁龙和标致这两个品牌的神龙汽车,就是那个已经有点边缘化的神龙汽车,9 月份销量终于破万了,达到 10089 辆!虽说这销量还不及星越 L一台车的销量,但对于神龙汽车来说,从 19 年 12 月开始就没有试过单月销量破万,这次算是久干逢雨露了吧。

Translated English Markdown text with HTML tags:

By the way, a piece of interesting news: Dongfeng Citroen, which is a car manufacturer that owns the Citroen and Peugeot brands, and is also on the edge of decline, finally broke through the sales barrier of 10,000 units in September with a total sales volume of 10,089 units! Although this sales volume is not as good as that of the Star Yue L SUV, it is a remarkable achievement for Dongfeng Citroen, which has not sold more than 10,000 units in a single month since December 2019.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.