I have previously discussed the brand Rivian, which was supposed to begin delivery of their R1T pickup truck in July. However, as expected, Rivian has delayed the release due to the poor control of the North American pandemic, as well as the global “chip shortage” crisis. Therefore, I have already relaxed my expectations for Rivian to claim the title of “first mass-produced electric pickup truck.”

On October 1st, during China’s National Day holiday, Rivian submitted a lengthy prospectus to the US Securities and Exchange Commission (SEC). So, in this issue, we will provide a phase summary of Rivian’s current situation. For those who want to have a deeper understanding of Rivian, you can check out my previous article, “This company’s pure electric pickup will begin delivery next month.”

Rivian’s mysterious status in the US has been an ongoing topic of discussion for American automotive media outlets. This has become the usual opening template for any article related to Rivian: “Rivian has remained elusive for most of its existence but is now seen as one of the strongest challengers to Tesla.” Even founder Robert J. Scaringe has a charismatic leadership style similar to Tesla’s Elon Musk.

In Rivian’s prospectus, they summarized their business risks, including the interesting fact that they directly listed their high reliance on RJ Scaringe’s reputation and services as one of their risk factors. However, this has become a standard for new players in the industry. After all, how do you get consumers to buy into your vision without a charismatic leader to help convince them?

As Rivian is about to go public, its veil is being gradually lifted, and we are seeing a clearer picture of how this US electric vehicle startup became a “new noble” in electric vehicle investment.

As the founder and CEO of Rivian, RJ Scaringe has written a letter to potential investors and car buyers at the beginning of the prospectus. Although the letter lacks supporting data, it summarizes Rivian’s past, present, and future.RJ’s original goal when starting the business was to build a hybrid crossover sports car. By 2010, the prototype of the Avera coupé had even been manufactured. However, at the last minute, RJ made the decision to pivot and focus on the “Electric Adventure Vehicle” product line.

In his letter, RJ described the shift as follows: “As we progressed, it started to become increasingly clear that our strategy of building an efficient sports car wasn’t right—the singular reason I had started the company was to have impact and our initial strategy simply wasn’t going to deliver the level of change we felt we had the potential to drive.”

It was this shift in the overall product philosophy that led to the creation of the R1T, R1S and EDV truck that we see today. RJ also believes that Rivian’s most valuable product is its unique culture of collaboration, inclusion, and the integration of innovative and creative thinking.

“Our ability to continue working collaboratively to harvest diverse perspectives and drive creative and innovative thinking into everything we do will ultimately drive our continued growth,” he said in the letter.

Finally, RJ believes that Rivian’s products are designed to help achieve carbon neutrality and improve transportation. While this long-term goal is important, it is also important to focus on what they have done with the $10 billion raised through financing.In its prospectus, Rivian has formed a relatively complete commercial loop through three models corresponding to the consumer C market and the logistics B market, and the most interesting thing is that these two models will promote each other in terms of technology, data, and economies of scale.

Of course, this thing is for investors to see, and I don’t pay much attention to the promotion of the EDV logistics. I just want to know where Rivian is using its money specifically.

As of September 30, 2021, Rivian had approximately 48,390 R1T and R1S pre-orders in the United States and Canada, and customers had paid a refundable deposit of $1,000.

As of September 30, 2021, Rivian has deployed six service centers and 11 mobile service vehicles in California, Illinois, Washington, and New York, and a 24/7 service center in Michigan.

Rivian plans to open more than 120 service centers and deploy more than 1,000 mobile service vehicles by 2023 to address road rescue and off-road rescue issues across the United States. However, currently, Rivian plans to cooperate with third-party platforms to quickly establish its service, and then gradually switch to self-operation.

Currently, Rivian’s Normal factory in Illinois has a planned annual production capacity of 150,000 vehicles and plans to increase it to 200,000 vehicles/year by the end of 2023.

The road is long and difficult, and advantages need to be amplified. In its prospectus, Rivian described itself as a “growing company with a history of losses.” Indeed, Rivian lost $426 million in 2019, $1 billion in 2020, and $994 million in the first six months of 2021. This loss is expanding continuously, but this is a normal phenomenon among startups, because Rivian is using a lot of funds to expand its operational and production capabilities, as well as its service facilities.

Moreover, even after Rivian goes public, it is foreseeable that it will not achieve “turning losses into gains” for a considerable period of time, even if its three models can open up reservations or deliveries as scheduled. This is not only due to Rivian’s own expansion and production problems, but also various external factors such as the COVID-19 pandemic, policies and regulations, fluctuations in component prices, competitors, and lawsuits with Tesla.

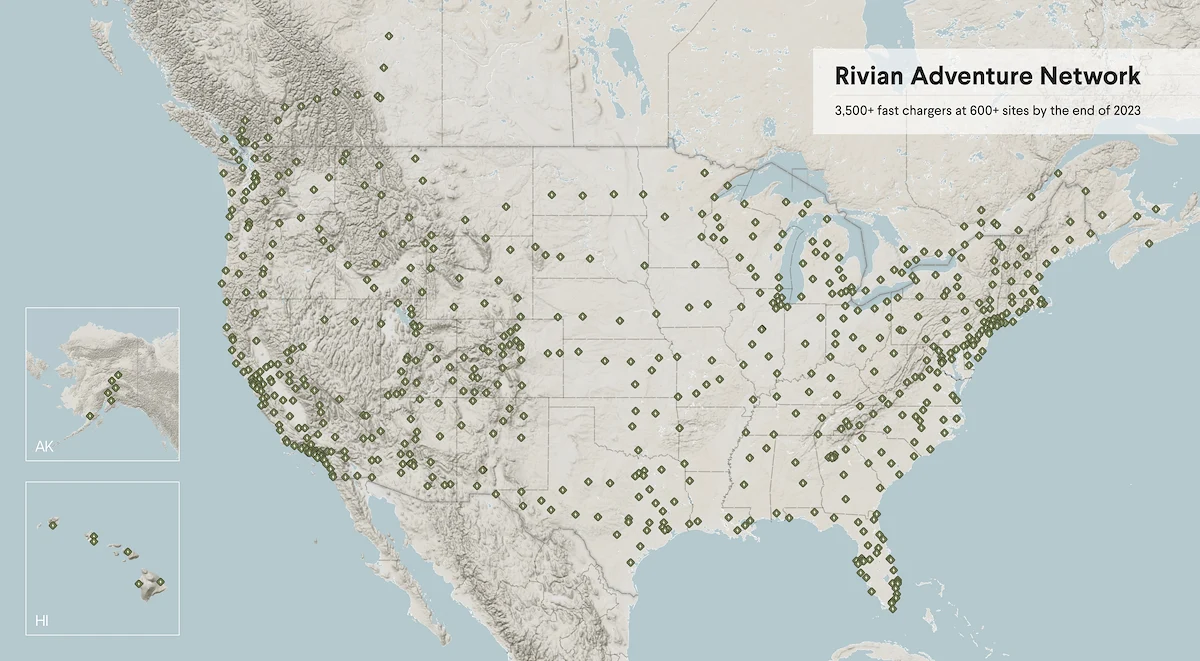

I had previously expressed my appreciation for Rivian’s grand charging and energy supplement plan in an article. In its prospectus, Rivian believed that it “may not have been aware of the benefits of its charging network”.

Rivian’s charging network is mainly divided into the RAN DC (Rivian Adventure Network Direct Current) fast-charging network and the Rivian Waypoint AC charging station.

By the end of 2023, RAN DC plans to establish over 600 fast-charging stations, and equip them with over 3,500 DC fast-charging piles. The goal is to solve the energy supplement problem for long-distance travel. Most importantly, this charging network will further spread to more remote areas, and after exploration, will provide unique “adventure routes” for Rivian car owners, which is also a feature that Rivian has been emphasizing on the R1T and R1S.

Of course, in addition to the favorable charging conditions at home in North America, Rivian also plans to install over 10,000 Rivian Waypoint AC charging stations in vehicle gathering places such as supermarkets, shopping malls, hotels, and restaurants by the end of 2023.

As of September 30, 2021, Rivian has deployed 24 RAN DCFC stations in 7 states in the United States; in 30 states, it has laid out 145 Rivian Waypoints charging stations and 20 service center locations.

When promoting the sales of electric vehicles, Tesla has also extensively laid out its charging and energy supplement network, which is indeed beneficial for promoting vehicle sales. Rivian initially combined energy supplement with unique “adventure routes”, which I think can be developed into a very interesting feature.

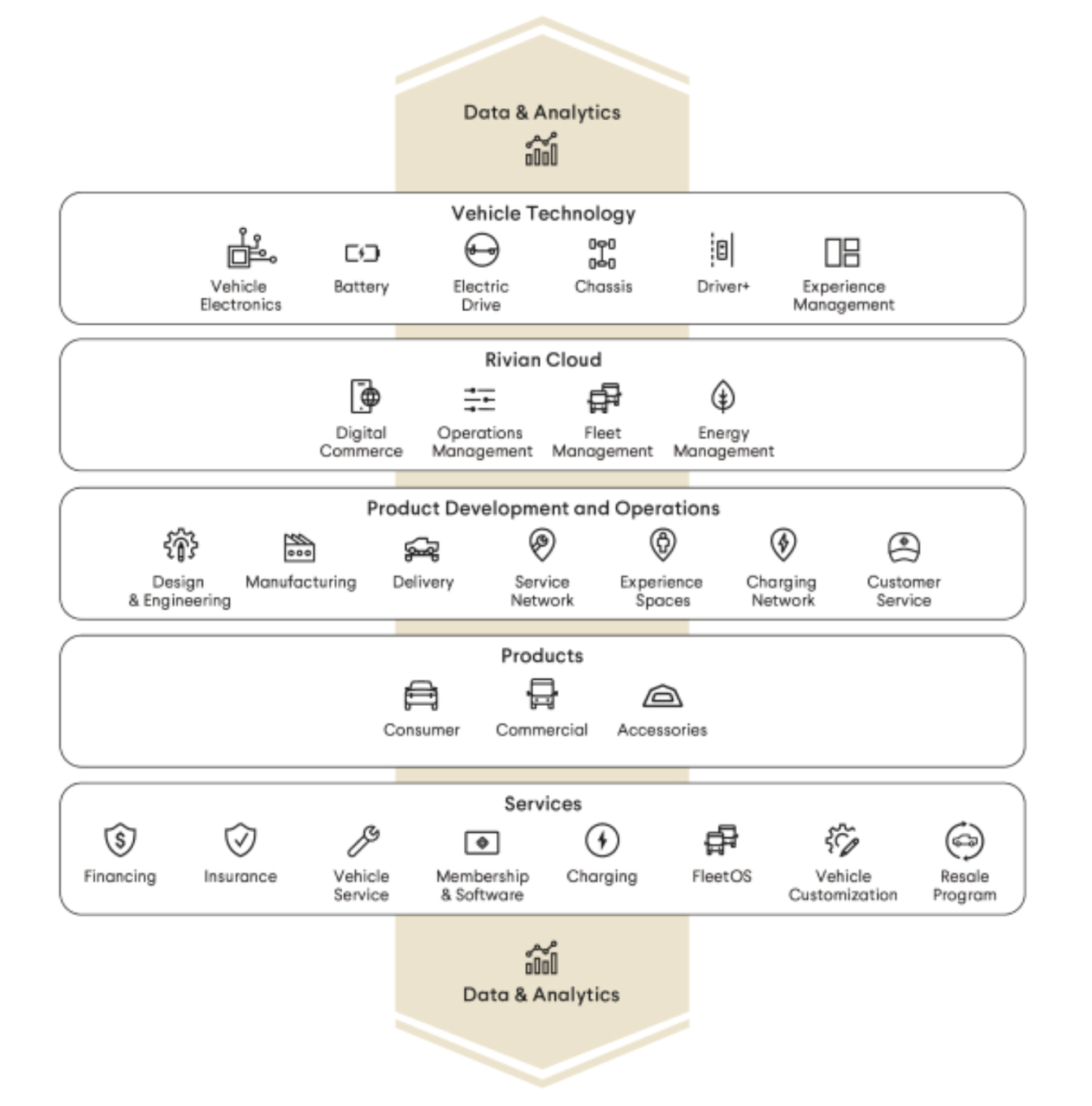

Business Ecological Model

Rivian’s development still requires a large amount of funding to solve current issues such as production, expansion, operation, and follow-up services.

However, Rivian has already formed a somewhat complete vertical ecological system, encompassing six areas including vehicle technology, Rivian cloud, product development and operation, specific segmented models, services, and data analytics.

Here, we will focus on the areas of services and data analytics.# Service Part

Apart from the familiar after-sales maintenance and custom upgrades, the service part also includes vehicle insurance and credit services. This represents Rivian’s intention to master the insurance, credit business and customer experience of customers following Tesla’s online ordering and direct sales model.

Rivian can profit from resale and trade-in business in civilian consumption cars, earning $34,500, and $19,800 in logistics commercial vehicles. The insurance and credit business can each yield $8,700 and $7,400, respectively; and in the automotive after-sales service part, profits of $3,500 and $6,100 can be reached.

As for software service, Rivian is naturally not inferior. Rivian plans to earn $15,500 in revenue per vehicle throughout its entire life cycle through software services, which includes an assisting driving feature valued at $10,000. Coincidentally, this price is the same as Tesla’s FSD feature.

If charging and other software fee services are added, then each civilian consumption car model of Rivian can achieve a profit of $67,900 throughout its entire life cycle! The profits of the EDV are also similar, estimated at $64,600.

Driver+ on Rivian R1T

The standard advanced driving system installed on the Rivian R1T is called Driver+. It is composed of 11 cameras, 12 ultrasonic radars, 5 millimeter-wave radars, and high-precision maps for perception hardware. It can currently realize functions such as changing lanes with signal light, and will be upgraded through OTA to include the leading function on some highways. In the future, Rivian will also launch a perception system consisting of 12 cameras and lidar, which can achieve level 3 autonomous driving capability. This stronger perception system is believed to be beneficial for off-road performance by the company.

As for the EDV, the assisting driving perception hardware is composed of 12 cameras, 16 ultrasonic radars, 5 millimeter-wave radars, and high-precision maps. It shares most of the Driver+ functions and adds customized features to meet the demand for the last mile of logistics, including the “overhead clearance warning” function.### Community Operations

Finally, let’s take a look at Rivian’s Experience Spaces. The setup of this location is similar to NIO House, but with more of Rivian’s own characteristics:

-

Hubs: similar to city centers, mainly to make more people aware of the Rivian brand and promote the concept of outdoor adventure;

-

Seasonal Spaces: as the name suggests, temporary places that last from a week to several months, whether indoors or outdoors, designed to connect with Rivian community members;

-

Outposts: located near adventure destinations, providing equipment and vehicle rental services;

-

Preserves: located in more distant natural areas, the natural spaces that Rivian plans to protect also provide Rivian’s community with more private opportunities to experience nature.

Holding onto the Amazon Lifesaver

Since 2019, Rivian has raised $10.5 billion in funding, with the Amazon Climate Pledge Fund investing at least $2.5 billion or more to support them. According to some foreign media sources, Amazon now owns a quarter of Rivian’s shares.

However, Rivian left me with a bit of suspense in the prospectus. What do you think is the appropriate amount to fill in this space? In my opinion, RJ’s voting rights still maintain a dominant position; otherwise, the prospectus would not sarcastically list RJ’s influence as one of the development risks.

In addition to relying on Amazon for their stock ratio and funding scale, Rivian’s initial revenue also comes from its big client, Amazon. Without this major customer’s orders, various important indicators including cash flow for Rivian would suffer “significant” adverse effects.In September of 2019, Rivian signed an agreement with Amazon to provide EDV trucks for the last mile delivery of Amazon’s logistics. Rivian plans to deliver 10,000 EDVs to Amazon by 2022 and plans to produce a total of 100,000 EDVs by 2030. However, the specific number of Amazon’s orders will depend on the progress of Amazon Logistics’ own business and the layout of charging facilities. Most importantly, Rivian has won Amazon’s exclusive supply of delivery trucks for four years, and in the two years after four years, it still has priority supply rights.

Of course, in the face of Amazon’s strong financial resources, the EDV agreement between Rivian and Amazon also gave Amazon greater power. Amazon can obtain these 100,000 electric trucks in many ways, either by purchasing them directly from Rivian, or by buying Rivian’s skateboard platform and finding other manufacturers to complete the production. If Rivian really falls into a “darkest moment,” Amazon may even choose to abandon the “top hat” tool they develop together and leave immediately.

In this commercial society, Amazon naturally doesn’t want to “lift a stone and hit its own feet,” and Rivian doesn’t want to be a “helpless loser.” However, from Amazon’s exclusive supply and priority supply to Rivian, as long as Rivian does not suffer a major production failure, it should be able to smoothly handle this large order.

I know that you, being smart, must have the same question as me. If Rivian’s EDV can conquer Amazon, then the prospect of EDV’s application in the vast logistics market is worth looking forward to, and Rivian can quickly take down the last-mile transportation services of various logistics companies with this trump card. However, with the strong share support of Amazon, Amazon has the right and reason to prevent Rivian from supplying EDV-related technologies to potential competitors. Moreover, the entry of new players and more advantageous platform technologies in the commercial logistics race are all potential obstacles for Rivian to complete the 100,000 orders.

However, with Amazon as a strong “nanny” with strong order demand and strong cash flow, Rivian can indeed form a preliminary production effect more easily in the early stage of product launch. Relying on the production orders of EDV, Rivian is also more worry-free than other new forces in China and the United States.

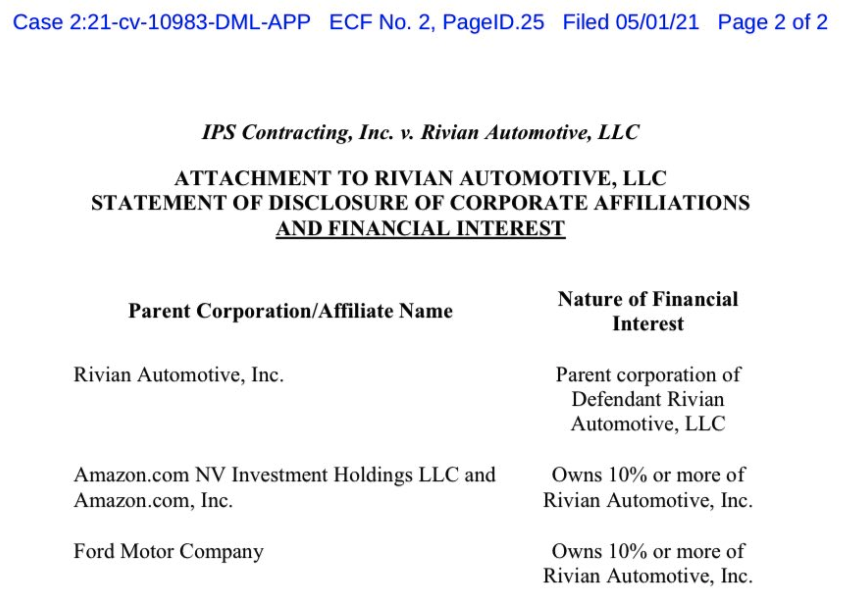

Ford helps build prototype cars

In a previous legal document, it was revealed that Amazon and Ford both own over 10% of shares in Rivian. Ford’s nurturing of Rivian was also very appropriate.

In the prospectus, Rivian claims to have obtained prototype design and development services from Ford Motor Company’s wholly-owned subsidiary, Troy Design and Manufacturing Co. In other words, Ford helped Rivian develop the R1 series prototypes, even the EDV body. From 2019 to the end of 2020, Rivian paid $74 million in service fees to the company.

Ford not only provided the body for Rivian’s three models but also signed an agreement with Rivian in April this year to purchase certain vehicle components from Ford. This includes production tools and some work guidance.

Other parts

When will Rivian come to China?

The reason why the subtitle is written like this, I think everyone is thinking the same thing: if your company makes electric vehicles and gives up the Chinese market, it is no different from staying in your own small corner and wallowing in it, even if your small corner is the American market.

Rivian has not yet sold a single car, but its valuation target and market value are already very high. On these two points, it is very similar to Evergrande Auto before its downfall. Of course, although Rivian is a new force in the United States, my confidence in Rivian is far greater than in Evergrande Auto.

In terms of future market deployment, Rivian will enter the Canadian market shortly after the US market, followed by the Western European market in the short term, and finally the Asia-Pacific region. However, Rivian has not given a specific timeline for this.

When will the deliveries be made?

In the prospectus, Rivian officially introduced that the first batch of deliveries for R1S and EDV will start in December of this year. Subsequently, existing models will be redesigned and upgraded according to customer needs.

Currently, the official confirmation time for the delivery of Rivian has not been given. Rivian will only actively contact reserved car owners before November.### Battery Information

Interestingly, in the prospectus, I also saw an introduction to Rivian’s battery system. Rivian uses nickel-cobalt-aluminum cylindrical batteries with a 2170 specification, and may use chemical formulations with lower costs in the future. Each module consists of two layers of stacked and connected battery cells, with cooling channels concentrated in the middle, which can improve the physical density of the battery cells. At the bottom of the vehicle, a protective cover will be specially installed to absorb and transfer collisions to protect the battery.

Conclusion

When I opened Rivian’s official website, I saw pictures of the R1 model, and almost none of them showed beautiful indoor environments. Instead, these promotional images are all set against the backdrops of high mountains and distant places. Frankly speaking, this is very appropriate, especially during the pandemic that is rampant in North America. I believe North American middle-class consumers will appreciate Rivian’s products and the infinite joy of exploring nature that Rivian portrays for them.

Rivian does not overly describe the exterior and interior design that traditional car companies are so proud of, nor does it excessively emphasize the smart cockpit and assisted driving that Tesla and a number of new forces in China are pursuing. Instead, it repeatedly strengthens people’s perception of Rivian’s brand image of “exploration.” After reading Rivian’s prospectus, I did not find particularly interesting and advanced technologies. In other words, Rivian did not describe how high its technological barriers were.

This is certainly not to belittle them. Because Rivian has strong support (Amazon and Ford), a large number of orders, and expensive consumer models that will soon be put into production. And more importantly, the American middle class really buys into this image. Besides, it is only 2021, and Apple, Huawei, Xiaomi, and other influential technology companies in the industry have just entered the field. The future direction of the development of the new energy market is still full of unknown pleasures, and everything is far from settled.

Let’s continue to observe for a while and have a talk when Rivian starts large-scale delivery.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.