The data for new energy vehicle sales in the United States is actually very difficult to obtain. Currently, the only reference available is the data from M company, as Argonne’s “Light Duty Electric Drive Vehicles Monthly Sales Updates” has not been released.

Here are some sources for the data on new energy vehicles in the United States:

- Marklines: well-known by everyone;

- EV Volumes: there is an overview in Samsung Securities’ EV Battery Monthly Tracker, but the data inside the report is relatively outdated;

- SNE Research: data can be found in the monthly battery reports of Hana Financial, although it is also delayed by one month;

- Argonne’s “Light Duty Electric Drive Vehicles Monthly Sales Updates”, which is actually sourced from sales reports from J.D. Power and associates, and information from the Electric Drive Transportation Association (EDTA) and HEV manufacturers.

It is possible that there are relevant statistics on new energy vehicles in the United States from IHS and Wardsauto, but I have seen North American friends use this data, which cannot be found in public channels.

Overview of September data in the United States

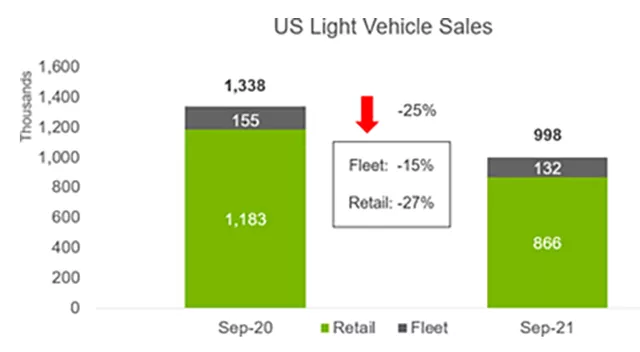

Firstly, it can be confirmed that the overall vehicle market in the United States is relatively gloomy, with around 1 million units sold in September, a year-on-year decrease of 25%, and the chip shortage has had a huge impact on the American automobile industry.

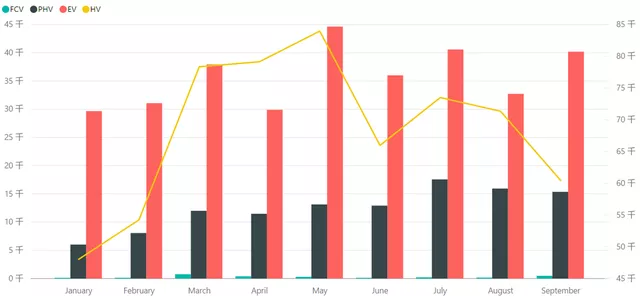

However, in September, the data for new energy vehicles in the United States was around 55,500 units, slightly higher than the 48,600 units in August, with a year-on-year growth of around 55%. From January to September, the total sales of new energy vehicles reached 435,000 units, which is also a very high figure. In September, PHEV sales were 15,300 units, while BEV sales were 40,200 units.

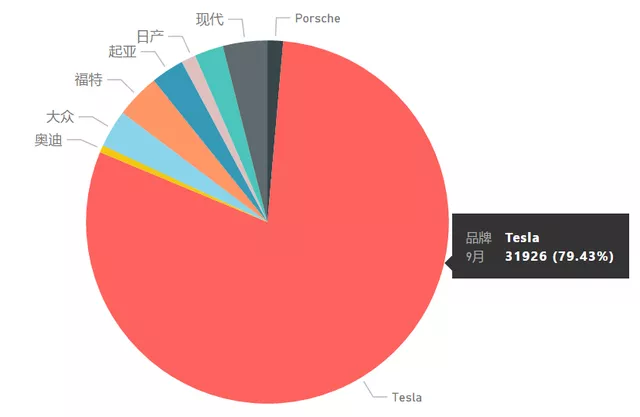

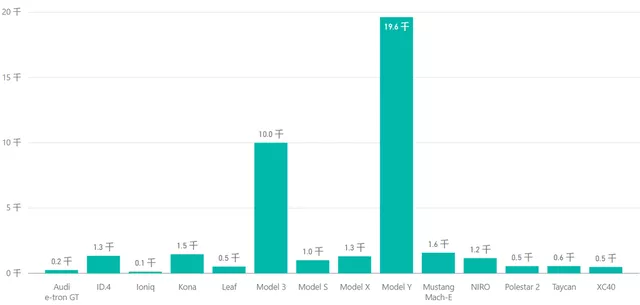

Data shows that Tesla maintains almost 80% of the market share in the BEV market, with a monthly sales volume of 31,900 units. The overall BEV market in September was 40,000 units, and the BEV market from January to September was 322,700 units. With General Motors’ Bolt EV caught in a recall and battery repair vortex, there are currently no competitors that can compete with Tesla in the short term.

Data shows that Tesla maintains almost 80% of the market share in the BEV market, with a monthly sales volume of 31,900 units. The overall BEV market in September was 40,000 units, and the BEV market from January to September was 322,700 units. With General Motors’ Bolt EV caught in a recall and battery repair vortex, there are currently no competitors that can compete with Tesla in the short term.

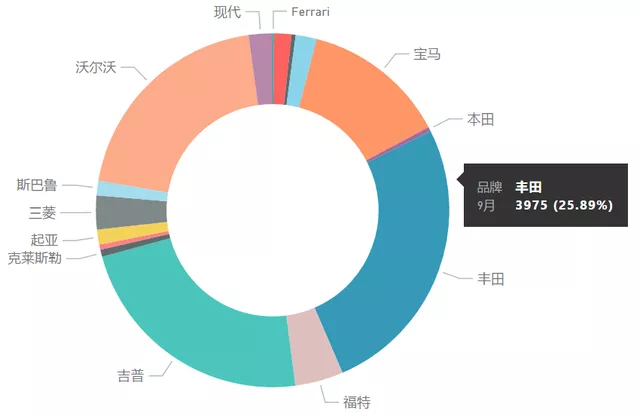

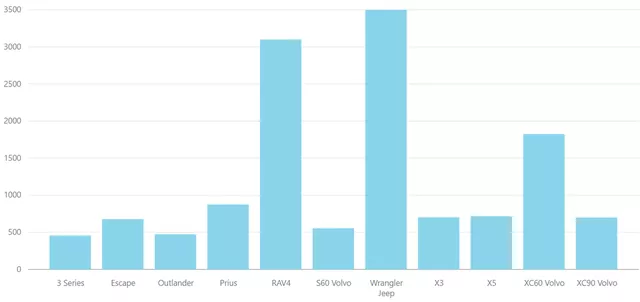

In September, the total sales of plug-in hybrid vehicles in the United States were 15,300 units. In this category, Toyota released a considerable amount this year, with sales of nearly 4,000 units in a single month, which accounted for more than 25% of the market share. The following are Volvo, Jeep, and BMW. From January to September, the total sales of plug-in hybrid vehicles in the United States were 112,400 units, which is significantly higher than last year.

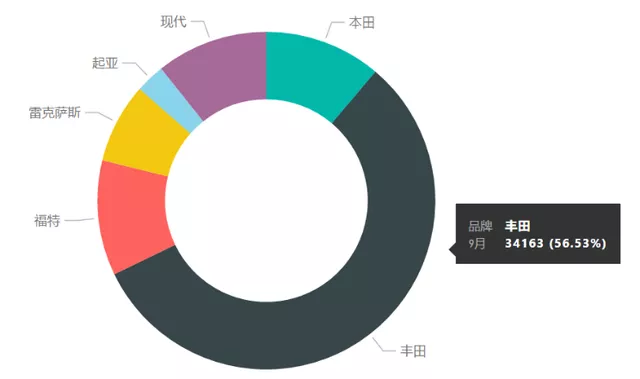

This year’s HEV sales in the United States are still good, with a monthly sales volume of 60,000 units and a cumulative total of 615,000 units from January to September. Toyota accounts for about 60% of the market share, with the remaining survivors in the hybrid market in the United States being Honda, Hyundai-Kia, and Ford.

Key model tracking

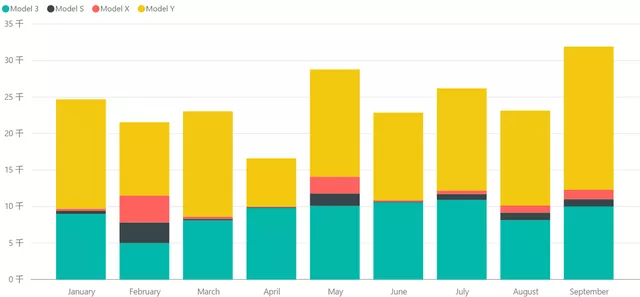

I don’t think the current statistics in the US market necessarily match the data provided by Tesla. Currently, the data shows that the Model Y had a sales volume of approximately 19,600 units in September, while the Model 3 was 10,000 units, totaling 30,000 units.

Based on this, we can compare it to Q3 data. The Model 3 had a sales volume of 29,000 units, and the Model Y was 46,600 units. The total sales in Q3 in the US were 81,200 units. If we assume that the US accounts for one-third of the global Q3 deliveries of 240,000 units, the pressure in other regions is significantly higher, and we may need to match it based on real data later.

In September, the top-selling PHEVs in the US were all SUVs, including Toyota’s RAV4, Jeep’s Wrangler, Volvo’s XC60 and XC90, and BMW’s X3 and X5. The demand for PHEV sedans was relatively low.

In conclusion, whether the data is accurate or not is just a rough judgment for everyone. Later, I will also compare data from different sources for everyone’s reference.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.