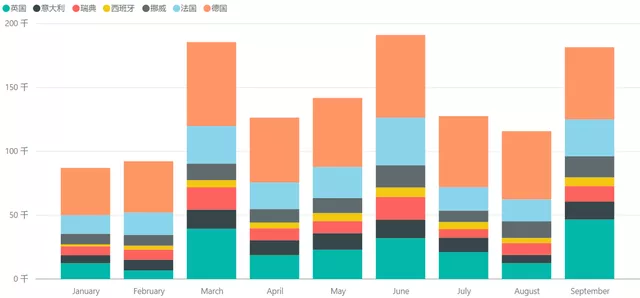

In the condition of chip shortage, both Europe and China have started to prioritize the supply of new energy vehicles. Germany, Norway, Sweden, France, Italy, the UK, and Spain, which are the typical ones, account for more than 80% of Europe’s new energy vehicles. This month, the total sales of new energy vehicles in these countries reached 181,000, an increase of 70,000 compared to the previous month. Let’s analyze the data in detail.

Breakdown of Europe’s overall situation in September

1) Overall situation

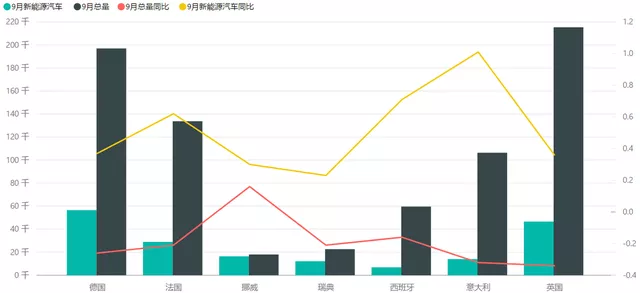

The data in September is actually similar to that in August. The overall car sales in major European countries are declining within the range of -20% to -30%, while new energy vehicles are continuing to grow rapidly based on last year’s performance, resulting in a very high penetration rate.

Among them, Norway has basically completed electrification, and the penetration rate of new energy vehicles is as high as 91.45%, almost surpassing fuel vehicles.

The following figure compares the total sales and sales of new energy vehicles, and it can be clearly seen that in the current condition of chip shortage, Norway’s total sales are almost supported by electric vehicles.

In the long cycle, in the first three quarters, Europe’s overall new energy vehicles are indeed in an upward trend. Germany sold 477,000 units in the first three quarters, and France and the UK sold about 208,000 and 212,000 units respectively, while other countries were in the range of 100,000 units. These several countries supplied and sold 1.2489 million units in the first three quarters, and it is estimated that the overall sales in Europe in the first three quarters will be around 1.56 million.

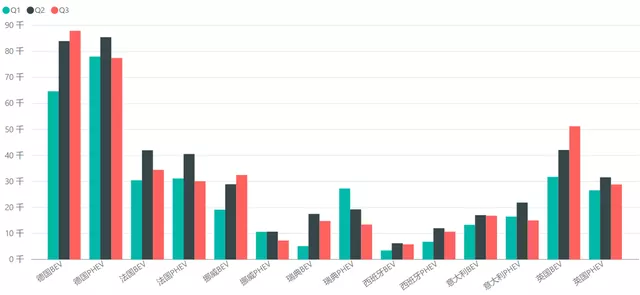

Q1: 364,877 units, including 168,000 BEVs and 197,000 PHEVs

Q2: 459,320 units, including 237,000 BEVs and 221,500 PHEVs

Q3: 426,319 units, including 243,000 BEVs and 182,000 PHEVs

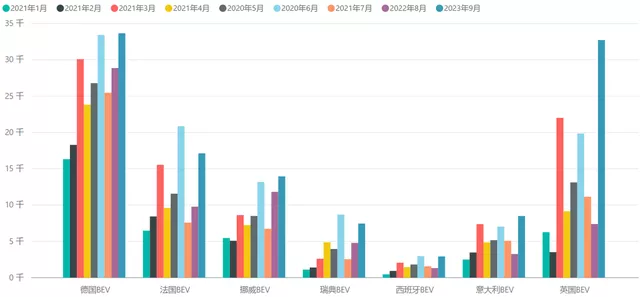

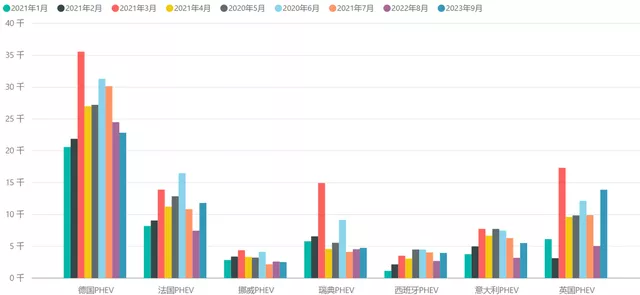

## 2) Situation of PHEV and BEV

## 2) Situation of PHEV and BEV

The impact of chip shortages is most evident in the differences between BEV and PHEV. As shown in the following figure, the sales of BEV in major European countries are generally stable, and the sales of BEV in major countries in September have increased to a certain extent.

Actually, PHEV requires a large number of chips, and the plan with two sets of power systems is currently unfavorable. Therefore, from the incremental perspective, the sales in September are basically flat. Especially compared with the peak in March, the growth was overwhelming before, but in the third quarter, it showed lack of momentum.

Of course, the total sales of BEV and PHEV in these countries are still relatively balanced. The sales of BEV are 649,000 units, and the sales of PHEV are 601,200 units. The sales growth of Q3 has a clear advantage- Q3 sales of BEV reached 243,000 units, significantly leading PHEV at 182,000 units.

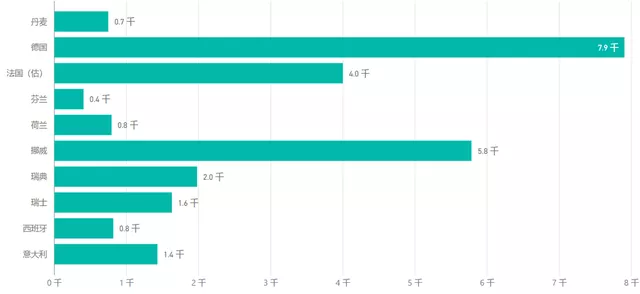

Tesla’s Sales in Europe

Tesla’s sales in Europe are still very strong – according to the sales in these major countries, it has reached 25,485 units in September. Therefore, Trey’s estimate before Q3 must have been conservative, and the quarterly sales should exceed 50,000 units, estimated around 52,000 units.

In Germany, the monthly sales were 7,903 units, and the cumulative sales from January to September were 25,970 units.

In France, the sales of Model 3 were 2,833 units, and the cumulative sales were 18,501 units; there is currently no data on Model Y.

In Norway, the monthly sales were 5,782 units, of which Model 3 was 2,218 units and Model Y was 3,564 units, accounting for a high market share of 40.4% in Norway’s new energy vehicle market.

| In Sweden, the monthly sales were 1,979 units, of which Model 3 was 766 units and Model Y was 1,213 units. The market share of new energy vehicles was 26.5%. | Country | Monthly Sales | Model 3 Sales | Model Y Sales | EV Market Share |

|---|---|---|---|---|---|

| Switzerland | 1629 | 1062 | 567 | 39.9% | |

| Italy | 1429 | – | – | – | |

| Spain | 817 | 720 | 96 | 26.6% | |

| Netherlands | 793 | 446 | 347 | 15.2% | |

| Denmark | 748 | 299 | 449 | 23.5% | |

| Finland | 405 | 186 | 219 | 55.2% |

In summary, the trend of the reduction of the proportion of fuel cars and the increase in the new energy vehicle market share in Europe will continue in 2022. In my opinion, we should now appropriately consider the effect of the transfer of the breakeven point caused by the decrease in the volume of fuel cars. Under the double impact of the epidemic and the chip shortage, the weakness of traditional European automakers is accelerating faster than we expected.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.