Author: Dan Huang

On October 1st, the National Day, while the whole country was celebrating the birthday of our motherland, new energy vehicle manufacturers announced their delivery results for September. The chip shortage has had a significant impact on the delivery volume of many automakers. However, some carmakers have still achieved outstanding results despite the disadvantageous situation.

First of all, the most eye-catching are NIO and XPeng, the monthly delivery volume of these two carmakers both exceeded 10,000 vehicles. This number is an important milestone among new energy vehicle manufacturers, and it also indicates their important position in the first echelon. Li Auto continues to grow steadily, while it is regrettable that Ideanomics did not become the first carmaker to deliver over 10,000 vehicles in the first month. The sales of Leap Motor also decreased this month, which shows that the “chip shortage” has caused significant delivery impact. It’s worth mentioning that WM Motor, which has been silent for a long time, returned to the list this month, ranking ahead of Leap Motor. Next, let’s take a detailed look at the sales situation of each automaker.

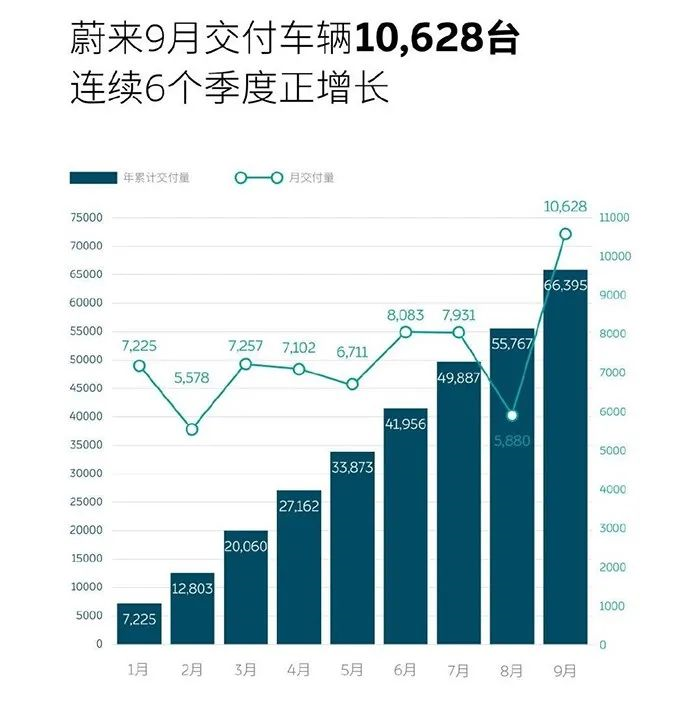

NIO: Delivered more than 10,000 vehicles in a single month, regains the top spot

NIO delivered 10,628 vehicles in September, a YoY increase of 125.7%. This is the first time that NIO has achieved monthly sales exceeding 10,000 vehicles since its establishment, and it also makes NIO regain the top spot.

Among them, ES6 accounted for 49.5% of the monthly delivery volume, contributing significantly to the monthly delivery results with 5260 deliveries. In addition, EC6 delivered 3390 vehicles, and ES8 delivered 1978 vehicles. Since 2021, NIO has delivered a total of 66,395 vehicles, and it is still the new energy vehicle manufacturer with the highest cumulative sales volume.

In August, NIO’s sales hit a trough, delivering only 5880 vehicles, even ranking behind the second-tier new energy vehicle manufacturer, Li Auto. However, NIO quickly rebounded in September, breaking through the sales depression, and even sold out of stock. On September 29th, Ma Lin, the Director of Communications and Public Relations of NIO, wrote on his social media account: “Colleagues have worked hard. The exhibition cars in the showroom have almost sold out, and only car models can be displayed. The small partners in the chip supply chain are under great pressure! ” It can be seen that the chip shortage is still the reason for NIO’s inability to keep up with orders.

Recently, NIO officially released the ET7 wind tunnel test results. The drag coefficient is only 0.208, second only to the Mercedes EQS (0.20), showing a significant improvement compared to the 0.23 announced at NIO DAY. It is reported that the ET7 will be officially launched in January 2022, providing three configuration options with a price range of 448,000 yuan to 5.26 million yuan, and delivery will begin in the first quarter of 2022. It is believed that NIO will achieve better sales performance after the delivery of the ET7.

Recently, NIO officially released the ET7 wind tunnel test results. The drag coefficient is only 0.208, second only to the Mercedes EQS (0.20), showing a significant improvement compared to the 0.23 announced at NIO DAY. It is reported that the ET7 will be officially launched in January 2022, providing three configuration options with a price range of 448,000 yuan to 5.26 million yuan, and delivery will begin in the first quarter of 2022. It is believed that NIO will achieve better sales performance after the delivery of the ET7.

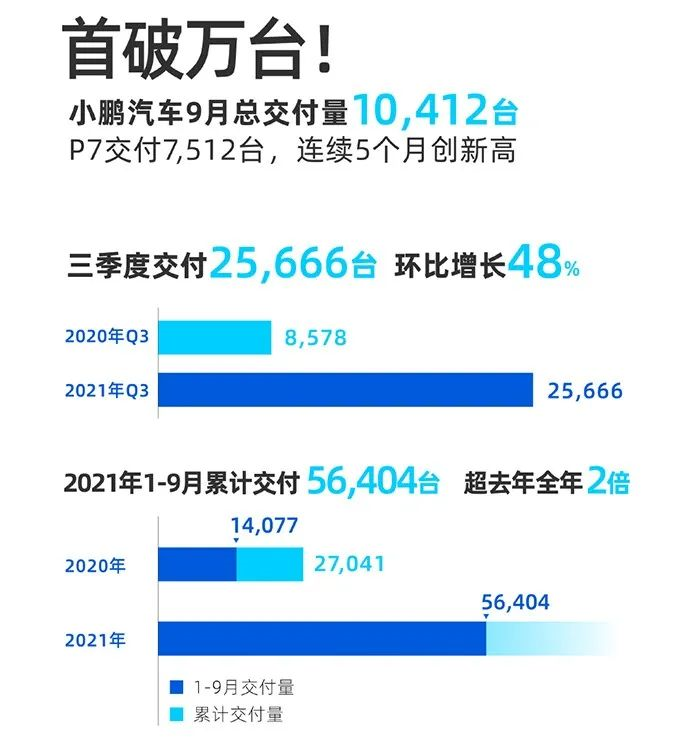

XPeng: Setting New Records with Monthly Sales Exceeding 10,000 But Still Second Place

XPeng also achieved excellent results with monthly sales exceeding 10,000 in September. It delivered 10,412 units in September, with a MoM growth rate of 44% and a YoY growth rate of 199.4%. XPeng’s sales volume leader is undoubtedly the P7 model, which delivered 7,512 units and accounted for 72.1% of the total. It is worth mentioning that XPeng’s cumulative sales from January to September this year reached 56,404 units, twice that of last year’s full year.

XPeng’s sales volume has always been stable, unlike NIO and Li Auto, which have experienced significant ups and downs. XPeng has maintained a good growth trend. However, it still ranks second among new energy vehicle manufacturers in terms of sales volume, and has always been a ‘perennial runner-up’. In July of this year, XPeng’s monthly deliveries exceeded 8,000 units for the first time, but its big brother, NIO, also announced that it broke 8,000 units and surpassed XPeng. This month, XPeng coincidentally broke 10,000 units with NIO, but it still couldn’t get the limelight and lagged behind NIO by 216 units, ranking second.

For new energy vehicle companies, monthly sales exceeding 10,000 is a very important milestone. Although it failed to take the first place, it has added a touch of color to the history of new energy vehicle development.

NIO: Steady Growth Moving Forward

In September, NIO delivered 7,699 units, with a MoM growth rate of 16.4% and a YoY growth rate of 281%, setting a new record for eight consecutive months. Among them, NIO’s ES8 model delivered 5,009 units, accounting for 65% of total deliveries that month, while the ES6 model delivered 2,690 units, accounting for 35%. From January to September this year, NIO delivered 41,427 units, a YoY increase of 425%, indicating significant growth for the company.

NETA Motors owes its impressive sales performance to its V model, which has played a crucial role. As a small SUV, the starting price is only 59,900 yuan, and the cost effectiveness of such a vehicle is difficult to resist. The low price has become NETA’s core competitiveness, and its cumulative sales are constantly approaching the top tier of the industry. At this rate of growth, NETA’s new force in the industry may very well “eclipse XPeng” (‘蔚小理哪’ is a pun that suggests ‘eclipsing XPeng’).

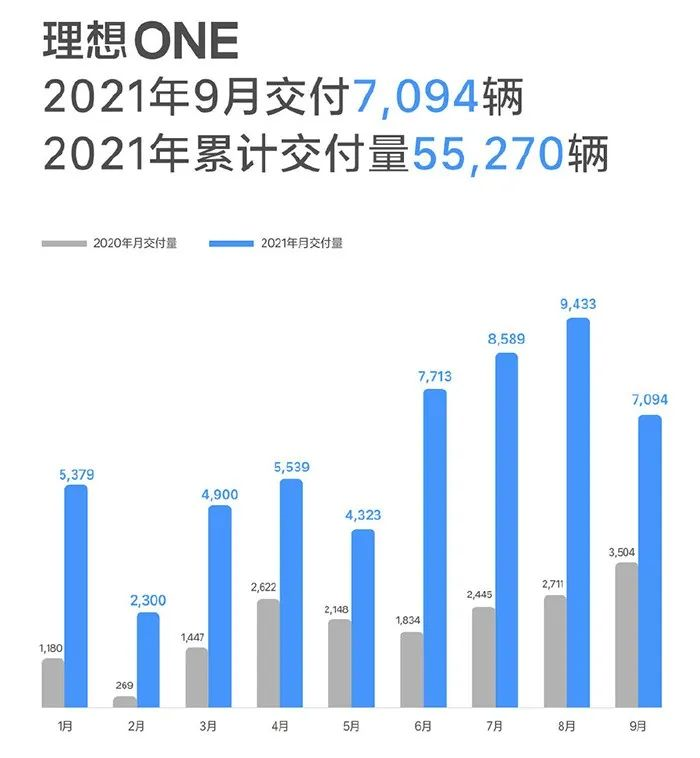

The Ideal: Failed to Sell Over 10,000 Units in the First Month

It was so close to achieving its initial target, but at this critical moment, the global chip shortage dealt a heavy blow to the Ideal car company. In September, Ideal Motors delivered 7,094 cars, a year-on-year increase of 248%, but it’s 2339 less than the previous month – this had dashed most people’s expectations that Ideal would be the first among new players to sell over ten thousand cars within its first month. But within the new players in the auto industry, Ideal seems to be the biggest victim of the “chip shortage” crisis.

Nevertheless, the cumulative sales of Ideal Motors this year are still impressive. In the first nine months of 2021, Ideal delivered 55,270 vehicles. Although this number is behind NIO and XPeng, it has been achieved solely through Ideal ONE, its SUV model, which showcases its excellent product quality.

Regrettably, it seems that Ideal has fallen short of achieving its sales goal due to manufacturing constraints.

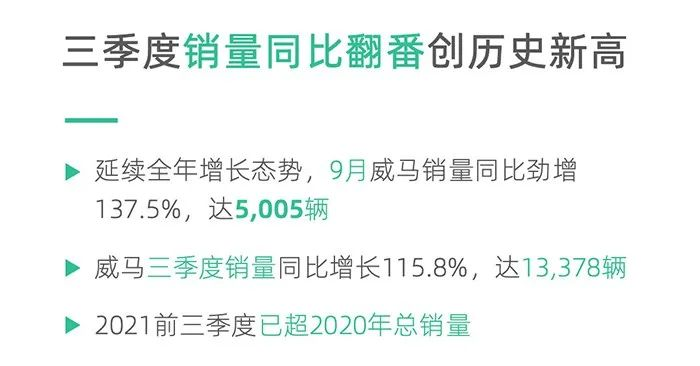

WM Motor Returns to The New Entry List

We haven’t seen it for a long time, but we finally have WM Motor back on the list for the first monthly sales results of 2021. In September, WM Motor delivered 5,005 cars, an increase of 137.5% compared with the same period last year. In Q3, WM Motor sold 13,378 cars, an increase of 115.8% compared with the same period last year.

It is worth mentioning that by September 2021, WM Motor’s sales figures had already exceeded the full-year results for last year. Among these, the cumulative sales of the WM Motor EX5 exceeded 60,000 vehicles, firmly putting it in the top spot among China’s A-level pure electric SUVs among new entrants.

Believe that friends who pay attention to new forces must know that WM Motor is one of the pioneers among new forces in the early stage. However, due to the failure to grasp the best development opportunity, it was like “getting up early and rushing to the late party”, leading to a slumping sales. Previously, WM Motor did not disclose its monthly delivery performance, perhaps because it felt embarrassed.

Believe that friends who pay attention to new forces must know that WM Motor is one of the pioneers among new forces in the early stage. However, due to the failure to grasp the best development opportunity, it was like “getting up early and rushing to the late party”, leading to a slumping sales. Previously, WM Motor did not disclose its monthly delivery performance, perhaps because it felt embarrassed.

As long as you don’t give up, there is still a chance. The rush of new forces in the early days, now there are only a few left, and those who can stay indicate that there are still unlimited possibilities. We also expect WM Motor to thrive in the new energy market.

SERES: More Product Choices, Order Volume Is on the Rise

SERES delivered 4095 vehicles in September, a year-on-year increase of 432%. Similarly, due to chip supply issues, the delivery volume has decreased, with 393 fewer vehicles delivered compared to the previous month. Nevertheless, we can still see that SERES’ orders have continued to increase month by month, with the order volume in September surpassing 8,000 vehicles, once again setting a record.

Among them, the order volume of T03 model in September was 7,541, and that of C11 model was 1,181. T03, which has always been the sales champion, will also share some of its share with C11. The richer product line will create higher monthly sales performance for SERES. With the delivery of C11, SERES expects that the sales volume will exceed 12,000 vehicles in December.

Conclusion

Overall, under the disadvantage of severe global chip shortage, new energy vehicle companies in general have experienced explosive growth, even WM Motor, which has lagged behind in sales, publicly announced its sales volume in September. Such achievements are precious for the new energy vehicle industry. However, Ideal Auto had a more severe month-on-month decline this month, perhaps due to both chip shortage and a problem of a single product.

Although the sales data for the new energy vehicle market in September has not yet been fully released, judging from the rankings of new energy vehicle companies, this month will be a big leap for new energy vehicles. Let’s wait and see what new forces will achieve in the fourth quarter.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.