Research and Conferences in Electric Drive Field is NE’s Strength

NE has always been strong in research and conferences related to electric drive. During the holidays, I did some research on the “China’s Leading Electric Drive Industry Chain TOP50” report for 2021. The report consists of 77 pages and is crafted with great care, worth reading. The latter half of the report contains content that is similar to an overview of the enterprise situation, which could prove helpful in educating on the topic.

I have extracted the most valuable content from the report, mainly from the second section, “Electric Drive Industry Trends and Prospects”, and have added in some of my own observations.

Historical Scale

Affected by the pandemic, the total volume of new energy passenger car market for motor and electronic control systems declined YoY in the first half of 2020; however, in the latter half, due to the overall industry growth, the motor and electronic control production entered a stage of sustained growth recovery.

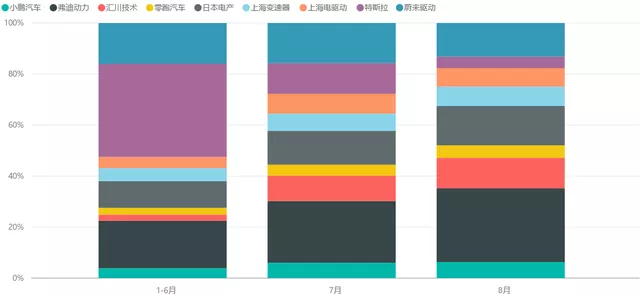

As a comparison, below is a graph I previously created about three-in-one electric drive suppliers. The data has not been updated yet, and also, Tesla’s August data has some differences, and the actual number is approximately 10,000 more.

Competitive Landscape

NE has the following conclusions:

-

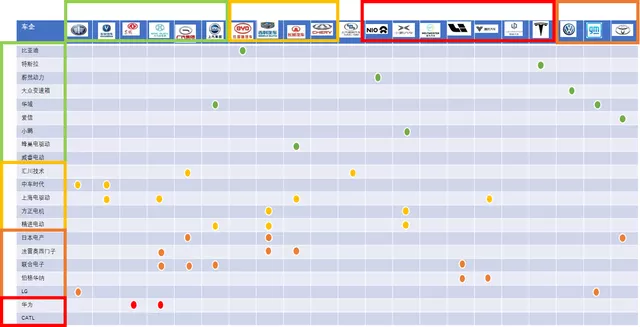

In terms of supporting relationships, some automakers have cultivated their own electric drive suppliers, but they are not averse to incorporating third-party high-quality suppliers to lower costs. They mainly have two types; domestic and foreign, of which the foreign suppliers mostly come from traditional auto parts giants.

-

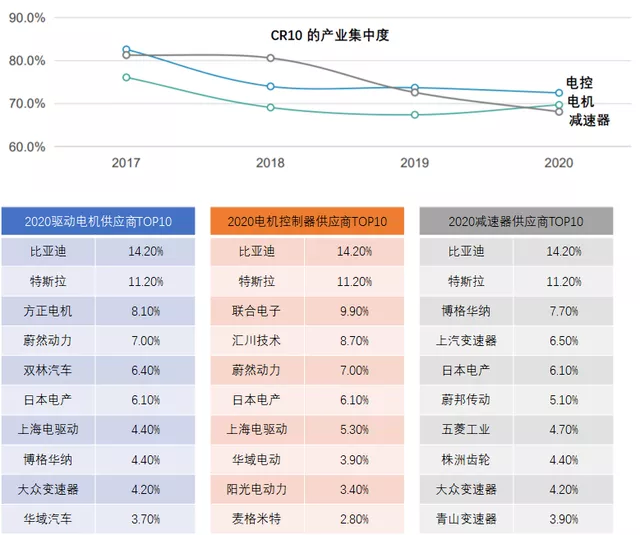

New players are still entering the electric drive market, forming four main types of suppliers together. There are numerous participants in the entire market, and the concentration of the market is not high. The top 15 suppliers split 84% of the market share, but there is no obvious leader.

-

In the electric drive industry, at the component level of motors, electronic control, reducers, etc., there is a trend of decreasing concentration and no leader. The overall competitive landscape is similar to the system level.

In my opinion, the competitive landscape of the electric drive industry can be divided into four categories of automakers: state-owned enterprises, private enterprises, new forces, and foreign companies.

The electric drive enterprise landscape can also be divided into automotive company-owned enterprises (self-made), domestic top independent enterprises, foreign top enterprises, and newcomers.

Based on this idea, I redesigned Table 2 below, which is still in its early version. This table can be divided into past (early exploration stage), present (current supporting relationship), and future (exclusive platform supply), and based on technical specifications, it can be divided into low-end (high cost-performance, extremely low profit), mid-to-high-end (bulk production mainforce), and high-end (Hero Car showcasing high-performance products). This differentiation is a key point, as in the early stages of exploration, designing and manufacturing requires external suppliers to learn, talent cultivation, and learning processes need to be set up, coupled with investment preparation. This stage is generally not done independently.

Mid-game: generally adopts a combination of procurement and self-research to find differentiation.# Endgame: Finding Unique Points in Electric Drive for the Future

In my personal opinion, the industry concentration is actually increasing rapidly because automakers have started to differentiate themselves in the past two years. Therefore, choosing different customers is very critical. Electric Drive industry must find its own positioning. If an automaker can achieve production volume of over 200,000, the significance of third-party procurement is not significant if the overall concentration is high. The inherent dispersion characteristics of electric drive make third-party domestic and foreign enterprises’ procurement control relatively weak. I believe that in the next 2-3 years, the next round of reshuffle will inevitably occur, and a huge gap will form in the mid-to-high-end electric vehicle market.

Opportunities and Threats

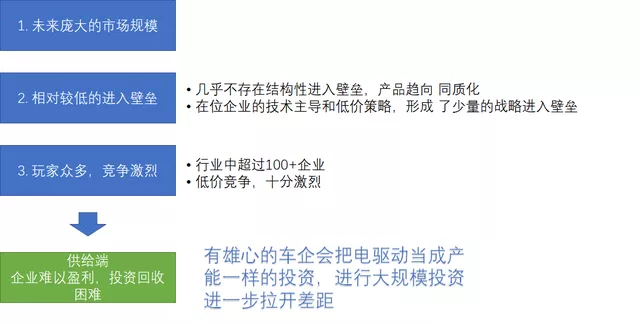

The future electric drive market size is promising, but due to the relatively low barriers to entry, it attracts many players to enter the market, resulting in fierce competition. Enterprises rely on low prices to seize shares, and profit is difficult to obtain. The massive investment in the early stage is also difficult to recover.

In my personal opinion, in the field of electric drive, automakers will match production capacity with vehicle production capacity. As the production capacity of the entire new energy vehicle increases, their investment willingness will be stronger. This mainly pulls themselves away from other competitors and improves the core entry points of upstream control. When the penetration rate reaches 10%, procurement will be more flexible. When it reaches 50% or even 80%, the controllable supply of their own capacity is critical. Since there are so many players and fierce competition, small suppliers are inevitably discouraged and may choose to remain in a comfortable situation. Meanwhile, well-capitalized automakers will inevitably match their new energy vehicle production capacity with the corresponding electric drive production capacity.

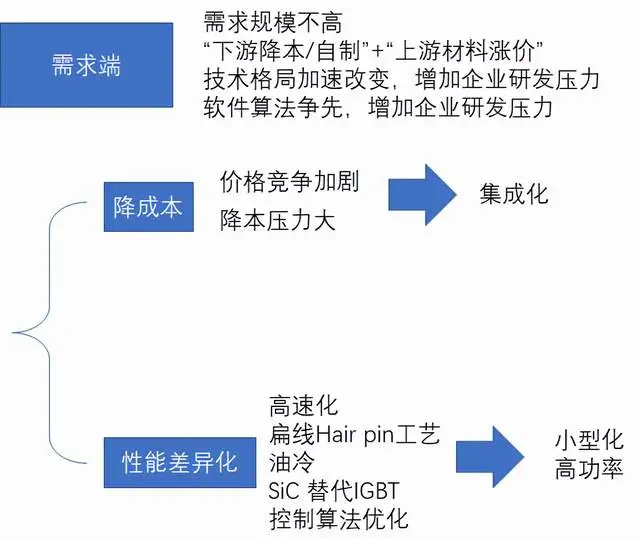

On the demand side, in the past few years, the market size has not been high, and recently, automakers have faced the pressure of reducing costs and upstream raw material price increases, exacerbating price competition. The trend of advancing technology routes and software algorithms will also prompt electric drive companies to seek performance differentiation.

Here, all automakers rush to achieve integration. The core issue is still implementing cost reduction. The purpose of multiple integration is still to optimize the high-voltage connectors, minimize the cooling circuit, and gradually improve the utilization rate from a structural perspective.

Future Market SizeThe prediction seems a bit conservative as the main driver for growth in the electric drive market is its application in various industries. Many passenger car electric drive companies are now looking into expanding into other industries.

According to the New Energy Vehicle Industry Plan, the electric drive market will continue to grow, with the market size possibly increasing fivefold by 2025 compared to 2020.

Future Technology Trends

To be honest, with the reduction in differentiation of electric powertrains, the demands put forward by car companies are also homogeneous in nature.

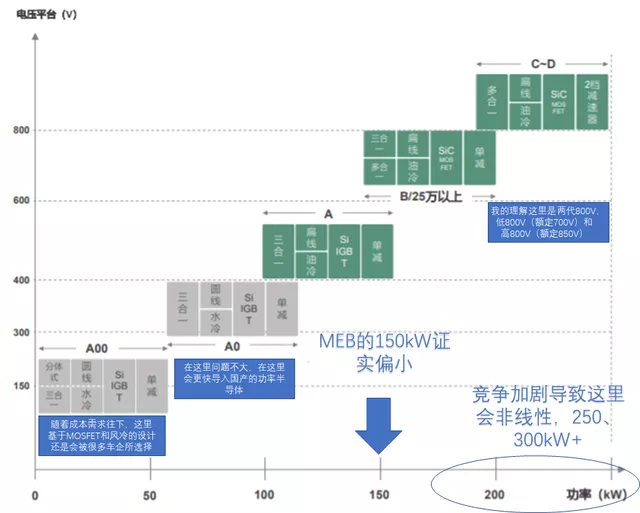

- The vehicle needs of car companies define the product requirements for electric drive, requiring it to achieve low cost, high performance, miniaturization, and weight reduction. This trend leads to the integration, high-speed, and high-efficiency technological trends of electric drive.

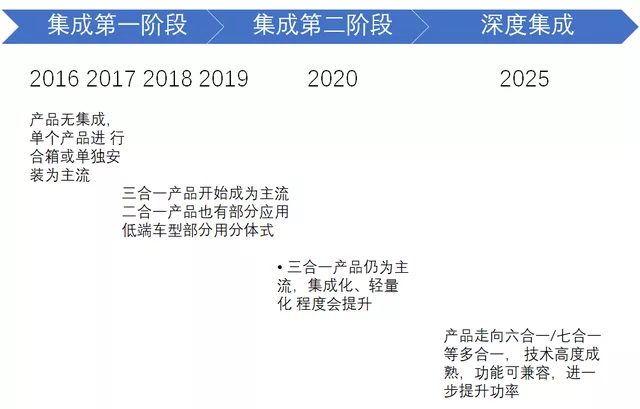

- The electric drive system evolves from initial structural integration to deep system integration, gradually realizing low redundancy and high cost-effectiveness of the electric drive system, from initial two-in-one design to three-in-one design and integrated electric drive axle design.

Looking at the integration of electric drive, it is faster than what people imagine. It is estimated that there will be a large number of multi-in-one products applied in 2022-2023. Most car companies will transition from three-in-one to multi-in-one with only a year needed.

Future Product Forms

In the next 3-5 years, electric drive products will take on different power segments based on vehicle level. A00~A0 level vehicle models will evolve from separate type to three-in-one type, while A level and above will have integrated products such as flat wire three-in-one. SiC and dual gear reduction will be more prevalent in high-performance cars (800V).

In summary, during the holidays, I looked at a lot of information and organized it for everyone’s reference, hoping it is useful. The report on the NE era contributed a lot and is indeed very good.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.