Author: Dayan

On the first day of the National Day holiday, domestic mainstream new energy vehicle companies couldn’t wait to show their results.

Overall, among the three new energy vehicle companies of WM Motor, NIO, and XPeng, NIO and XPeng both delivered over 10,000 vehicles, while if not for the impact of chip shortage, WM Motor’s monthly deliveries could also surpass 10,000. With the gradual introduction of new products, the monthly deliveries of these three car companies will probably advance to another level. Surpassing the sales of second-line luxury brands and reconstructing the domestic luxury car market pattern will no longer be an unattainable goal.

Monthly deliveries surpassing 10,000, NIO alarms temporarily removed

In September, NIO delivered a total of 10,628 smart EVs, a year-on-year growth of 125.7%. After experiencing a sales crisis in August, NIO returned to the top of the domestic new energy vehicle rankings with solid results.

- In terms of specific models, 1,978 ES8s were delivered, 5,260 ES6s were delivered, and 3,390 EC6s were delivered.

- In terms of quarterly data, in the third quarter, NIO delivered a total of 24,439 new vehicles, a year-on-year increase of 100.2%. While setting a quarterly record for deliveries, NIO also maintained a growth trend for six consecutive quarters.

- Regarding the delivery volume in September, NIO’s sales were more affected by chip supply and the Nanjing interior supplier than by the incidents caused by the NOP driving assistance function.

Domestic car companies are still more affected by the new car effect, and car companies often show a spiral upward trend in revenue depending on the size of their new car launches.

Actually, NIO is currently preparing for the launch of three new models next year, including the debut of the NT2.0 platform-based ET7 and the entry-level brand model, which will greatly boost NIO’s deliveries in the terminals. As long as NIO can successfully maintain its position among the top three domestic new energy vehicle makers in terms of deliveries, it is not difficult to achieve a stunning rebound by using the three new models coming out in 2022.

For NIO, one thing that cannot be ignored is that the first batch of ES8 vehicles was delivered in Norway on September 30th. The Norwegian market has basically copied NIO’s practices in the Chinese market, not only opening the first overseas NIO House in Oslo, but also allowing Norwegian car owners to choose NIO’s battery leasing service. While significantly lowering the entry-level price of the car models, it also eliminates all concerns about battery usage.

For NIO, one thing that cannot be ignored is that the first batch of ES8 vehicles was delivered in Norway on September 30th. The Norwegian market has basically copied NIO’s practices in the Chinese market, not only opening the first overseas NIO House in Oslo, but also allowing Norwegian car owners to choose NIO’s battery leasing service. While significantly lowering the entry-level price of the car models, it also eliminates all concerns about battery usage.

The next one to enter the Norwegian market after the ES8 will be the ET7, which is scheduled to be launched in 2022. This new generation of NIO vehicles based on the NT2.0 platform, equipped with LIDAR, is worth looking forward to in overseas markets as well.

XPeng delivers over 10,000 vehicles in a month for the first time

For XPeng, the achievement of delivering over 10,000 vehicles in September is still a proud one.

According to XPeng’s data, its terminal deliveries in September reached 10,412 vehicles, the first time the monthly sales exceeded 10,000 in the company’s history. Among them, the sales of the main model P7 hit a new high again, reaching 7,512 vehicles. Looking at a larger span, XPeng delivered a total of 25,666 vehicles in the third quarter of this year, and a total of 56,404 vehicles from January to September, twice that of the same period last year.

From the perspective of the product matrix, XPeng’s lineup is the most capable of increasing sales. As long as the chip supply chain can be guaranteed, it is not difficult for XPeng to hit a monthly sales volume of 15,000 units in the fourth quarter or next year. The main P7 model by XPeng is aimed at Tesla Model 3, which is already a popular model in the market, and XPeng added two new models for P7 at the end of September, further enriching its product matrix.

The redesign of G3i and the P5 that was just launched in September as a compact SUV and sedan respectively, are the key to XPeng’s future development. G3i not only significantly improved its appearance, but also caught up with P7 in terms of automobile networking technology, undergoing a transformation into a brand new model.

## Lack of Chips Hitting the Brakes of Ideal’s Dreams

## Lack of Chips Hitting the Brakes of Ideal’s Dreams

While NIO was struggling in August, it was Ideal’s turn in September. Although Ideal delivered 7,094 vehicles, a staggering 102.5% increase year-on-year, a 24.8% decrease on a month-on-month basis put a damper on the strong momentum. Especially when NIO and Xpeng both delivered over 10,000 vehicles in September, Ideal had to swallow the bitter pill.

The chip crisis is a common problem facing the entire industry. With the full-scale roll-out of vaccines, although it is difficult to overcome the COVID-19 pandemic fully, it is highly likely that the situation will return to normal working and production conditions. As long as chip companies’ production capacity gradually resumes and international logistics channels become smoother, the chip shortage problem will gradually ease over the next period of time.

However, the most significant obstacle facing Ideal at the moment is the need to improve its product matrix as soon as possible, especially to launch pure electric vehicle models that will not be restricted by policies in the future. After all, the deadline of 2023 policy is not far away. In the face of Xpeng and NIO’s increasingly rich product lineups, relying solely on the Ideal ONE will undoubtedly lead to the loss of some customers.

NETA and Leapmotor Gradually Form a New Force in the Second Group of New Energy Automakers

As the second echelon of China’s new energy automakers, NETA and Leapmotor have had extremely rapid growth in the past few months.

Among them, NETA delivered 7,699 vehicles last month, an increase of 16.4% month-on-month and 281% year-on-year, and for the first time delivered over 7,000 vehicles in a single month. In the first nine months of this year, NETA delivered a total of 41,427 vehicles, an increase of more than four times year-on-year.

The delivery volume of NIO in September was 10,628, with a month-on-month increase of 2.1% and a year-on-year increase of 133.2%, while the delivery volume of XPeng was 3,478, with a month-on-month increase of 7.6% and a year-on-year increase of 147%. However, the delivery volume of Li Auto was 4,708, with a month-on-month decrease of 6.6%, but a year-on-year increase of 191%. The delivery volume of Zhi Dou, a subsidiary of Geely, reached 11,446, with a month-on-month increase of 19.7% and a year-on-year increase of 130.3%. The delivery volume of Zero Run Auto in September was 4,095, with a month-on-month decrease of 8.8% and a year-on-year increase of 432%. The reason for the month-on-month decline of Zero Run is also due to the chip shortage issue, while NIO and other new forces enterprises have completely surpassed AICHI and Horizon in the limelight and have gradually begun to distance themselves from WM Motor.

Volkswagen ID Family Begins to Counterattack

In September, another phenomenon worth our attention is that the delivery volume of the Volkswagen ID family exceeded 10,000 for the first time.

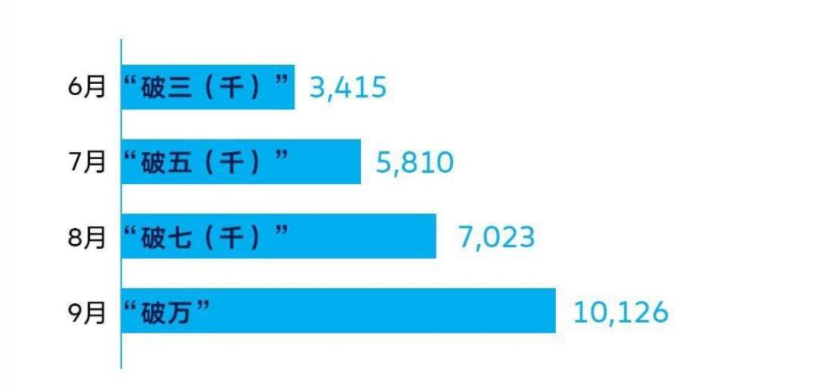

Currently, there are four models in the Volkswagen ID Family in China, namely the compact SUV ID.4 X and ID.4 CROZZ, and the mid-size SUV ID.6 X and ID.6 CROZZ. Starting from June, the Volkswagen ID family has continuously set new sales records. If the Volkswagen ID family can achieve success in terminal sales, it will undoubtedly be a great encouragement for other automakers.

In addition to the existing four models, the crossover model ID.3 is also about to debut. This model, which has cannibalized a large share of Model 3 in Europe, is still worth our attention to see whether it can continue to achieve outstanding results in China. Volkswagen has a deep foundation in China, and with the continuous introduction of competitive electric vehicle models, even if it adopts Volkswagen’s moderate path, there will be many loyal fans of the brand choosing this car model. The competition between traditional automakers and new forces automakers will be the most anticipated show in the domestic electric vehicle market in the future.

It has to be said that the performance of these five mainstream new forces enterprises in China in September was impressive. Even the scores submitted by Ideal and Zero Run, which were affected by the chip shortage caused by the pandemic, were still remarkable.

The Volkswagen ID series, which started off poorly, has begun to recover slowly and hopes to seek a larger market share through continuous introduction of new models.

However, for Chinese electric car companies, the previous power rationing in multiple provinces across the country should be given enough attention. The insufficient reserve of thermal coal or the soaring price of thermal coal is just a manifestation, which can be solved through coordinated efforts.

However, for Chinese electric car companies, the previous power rationing in multiple provinces across the country should be given enough attention. The insufficient reserve of thermal coal or the soaring price of thermal coal is just a manifestation, which can be solved through coordinated efforts.

In addition to thermal coal, the energy consumption targets (referred to as the “dual control”) set by China for various provinces to control the total energy consumption and energy consumption intensity to achieve the goal of carbon peaking by 2030 will undoubtedly become the biggest uncertain factor for consumers to buy electric cars. Although this is not something that electric car companies can control, under the situation where thermal power still accounts for more than 70% of domestic power supply, the dual control targets will also become the biggest “black swan” event for the development of domestic electric cars.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.