On September 28th, Zero Run C11 was officially released with a price range of 159,800 to 199,800 yuan.

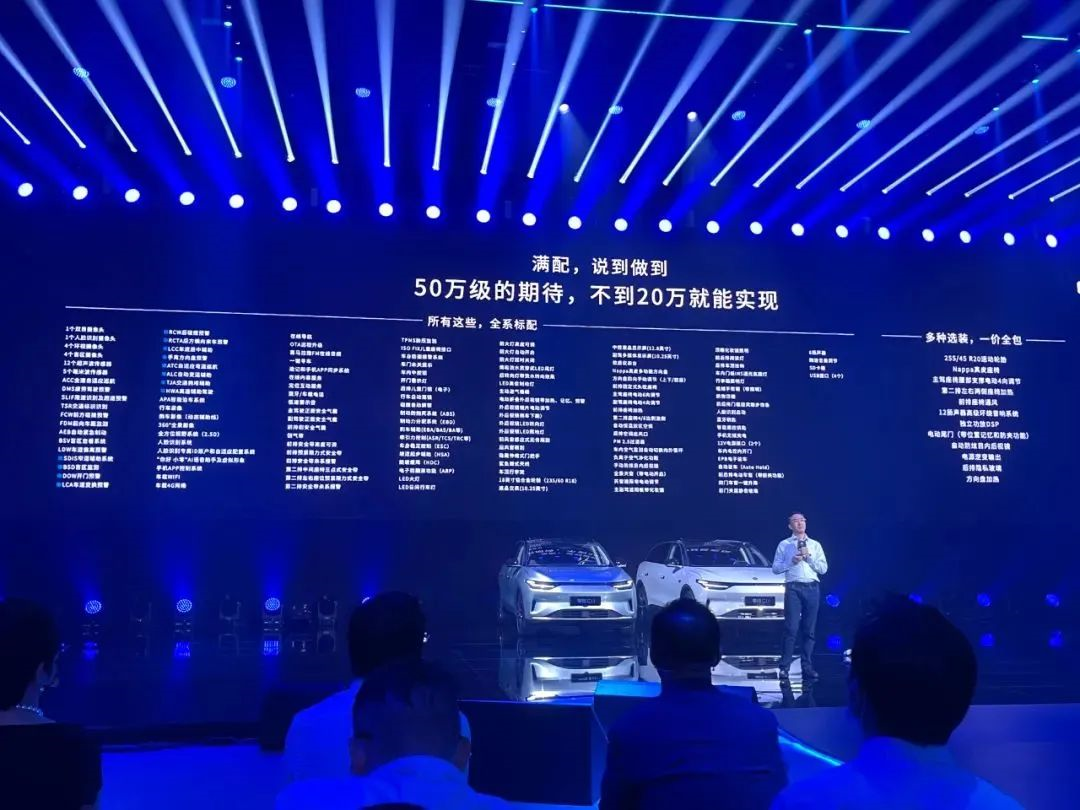

The two most impressive statements from the new car release conference PPT were:

- “Likely the most powerful pure electric SUV under 200,000 yuan.”

- “Expectations of 500,000 yuan, achieved for under 200,000 yuan.”

These two sentences summarized Zero Run C11’s core competitiveness – cost-effectiveness.

For less than 200,000 yuan, Zero Run offers consumers a pure electric SUV with “hard power” such as strong performance and range, and “soft features” such as intelligent cockpit and automatic driving assistance, which are difficult to find shortcomings on paper.

Therefore, many media outlets have referred to Zero Run C11 as a “water bucket machine”, borrowing a popular term from smartphones.

When Zero Run explains how it achieves full configuration but at a low price, it often cites the vague statement: “We have achieved full self-development in many key areas.”

What advantages has full self-development brought to Zero Run? Based on this, how is Zero Run planning for the future? Is Zero Run’s ambition to sell 800,000 units annually by 2025 just talk, or is it serious?

After the release of the Zero Run C11, Supercharging Station conducted an interview with Zero Run’s founder, CEO and chairman Zhu Jiangming, vice president Cao Li, general manager of the marketing department Zhou Ying, and general manager of the strategic planning and product planning department Jiang Tao. From their answers, we can find some clues to the above questions.

The following is the transcript of the interview:

Q: What are the advantages of Zero Run’s full-stack self-development and what advantages does it bring? What is the current level of intelligent driving for Zero Run C11?

A: The advantage of self-development is mainly in quality control and cost.

The most important thing for seats, vehicle systems, and so on is to connect the communication between controllers. If they are not developed in-house and purchased from others, it will be difficult to control quality, experience and cost.

After visiting the exhibition hall of Zero Run’s parent company, Dahua Shares, you will find that many products on display have no substantial difference with controllers and headlights on cars.Translate into English Markdown text, keeping the HTML tags inside the Markdown, and outputting only the result:

On the contrary, Dahua’s products for intelligent transportation have better technical standards and requirements, such as LED lamps that can work for 24 hours.

Therefore, developing and producing our own products such as seat controllers and body controllers in car manufacturing does not mean starting from scratch for us, as we have accumulated profound technical expertise.

Regarding intelligent driving, currently including C11 and T03, the user experience is good. From the underlying driver software, to the upper-level application software and even algorithms, we have developed or used domestically-produced chips and other core components, which need to be gradually improved and optimized in coordination. This is a necessary process of progressive maturity.

Q: What are C11’s core competitors? Also, how does self-development affect cost management differences?

A: For C11, in terms of the logic or concept of car manufacturing, we have no competitors.

Perhaps within the next 2-3 years, there will be followers who will also provide affordable luxury cars to the vast consumers through self-development and manufacturing.

Looking at the market level, all products in the 150-200,000 price range, including petrol cars and electric cars, are our competitors.

With respect to the cost differences of self-development, let’s take the more obscure car lights as an example. We know that as a listed company’s car light manufacturer, Starlight’s gross margin is basically between 15% and 20%, with a net profit of 10%-12%.

Currently, a set of lights sold to manufacturers costs between 3,000 and 4,000 yuan, while new energy automotive lights are relatively more complicated. C11’s light sells for about 4,000 yuan per set. Referring to a gross margin of 15%, by self-developing, we can save about 600 yuan.

Q: How can the Zero Run C11 offer such a high cost-performance ratio? Are other car manufacturers too expensive or are we too cheap?

A: The cost of a car is closely related to the design of its product structure, so cost can be reduced through structural design optimization.

Also, by allowing the manufacturer to make concessions to the user, we can further strengthen the product’s cost-performance advantages.

Yesterday you also saw that many of our core components on display were self-made, which can save a considerable amount of costs. Therefore, Zero Run can provide customers with higher cost-performance products.

Q: Many new car companies have established their brand image with their initial few car models; does this high-cost-performance product mean that Zero Run Automobile intends to establish a low-end positioning?A: Yes. We insist on building luxury cars that people can afford, and continuously improve the luxurious experience of our products.

The product levels will be upgraded, but the cost performance ratio must always be the best. We want to establish this standard at various levels, and C11 is the standard for the 150,000-200,000 RMB range.

Q: Are we taking the route of high cost performance, sacrificing some gross profit in the early stages to quickly generate users, and then increase the gross profit in the later stages to achieve profitability?

A: Not exactly. I remember that Lei Jun had a saying that the gross profit of his products should never exceed 5%. If it exceeds this, it is wrong and not correct.

Q: So where does our profitability come from in the later stages? We always stick to the low gross profit and high cost performance route.

A: It comes from scale. The reason why we want to independently develop technology is to achieve a large scale. Our goal is to reach an annual sales volume of 800,000 by 2025.

Q: Regarding the goal of 800,000 units sold per year, many people say you’re exaggerating. Can we lower the standard a bit?

A: We must not leave ourselves an escape route.

Q: Since we want to independently develop everything, do we have plans for the core component of batteries, the cells?

A: Cells are standardized products and are suitable for mass production. There is no need for us to independently develop them. As I just mentioned, the battery pack and shell will definitely be the responsibility of the car manufacturers in the future, not the battery manufacturers. The division of labor will be clearer.

Q: But looking at the development of the entire electric vehicle industry from now on, whether it is Tesla or General Motors, they are gradually getting involved in self-development by cooperating with battery manufacturers. Do you think that cells can be left to suppliers to make?

A: Yes, because they are standardized and there is no need for them to connect to any protocols or controllers. They are just two outputs, positive and negative, with standard size and capacity. ZERORUN focuses more on intelligence and control in self-development.

Q: What are the expectations for the delivery of ZERORUN C11 in the early stages?

A: Our goal this year is to work towards delivering more than 6,000 units.

Q: ZERORUN has mentioned that AI technology will also be used in the battery management system (BMS). We know that AI technology is usually applied in perception and voice. How will AI technology be applied in BMS?

A: The cloud platform is independently developed by us, including BMS. Data information for all batteries can be collected.

Then we use this data information to comprehensively judge whether the battery has any abnormalities. If there are problems, they can be quickly dealt with, significantly improving safety performance.A:是的,智能驾驶的技术算法融合是一个特别大的问题。各个厂商在不同领域都有自己的技术团队,如果将所有技术整合在一起,就需要一个很强大的团队来负责这个融合,才能实现智能驾驶的全面发展。A: Yes, the more sensors are integrated, the more difficult it becomes. If even one inaccurate signal is accepted, there will be a misjudgment and the vehicle will rear-end another car during emergency braking. This problem can only be solved if each sensor technology reaches a very high level.

Currently, people do not trust the accuracy of radar, so its sensitivity is adjusted. Even if some low-speed obstacles are detected, they are ignored and the car may only honk twice, but it will not brake. Low-speed targets are unreliable, so why would you trust them and create more trouble?

Q: Is Leapmotor’s development path in intelligent driving technology similar to Tesla’s?

A: Yes, this fusion is definitely a difficult problem to solve. A high level of sensor technology is necessary for ensuring the complete fusion, and a three-in-one approach is more secure. However, if it frequently triggers false alarms, it cannot be used. Millimeter-wave radar is a classic example of this. Additionally, I think the maturity of the current LiDAR technology still needs to be improved, at least in theory and practical testing.

Furthermore, if I want to install an AI platform with 1,000 T or 10,000 T computing power, it’s like buying the highest-end computer now. In three years, how much would such a computer depreciate? According to Moore’s Law, it’s 18 months, but it seems to be accelerating now. After five years, the highest-end AI platform costing 20,000 yuan would depreciate three or four times and become worthless.

Q: Will the intelligent driving chip in Leapmotor’s vehicles be replaceable in the future?

A: Yes, it will be like a box that can be easily swapped out.

Q: Will Leapmotor’s future vehicles also adopt the full-camera solution? Currently, many domestic models pursue cost-effectiveness by using lithium iron phosphate batteries or hybrid battery systems. Does Leapmotor have a similar technical road map for the battery selection plan after C11? What’s the ratio of high-end to low-end models in current C11 orders? Are there many new buyers or more buyers upgrading their cars?

A: We pre-install these sensors for more assistance; overall, we still need to rely on vision.

In terms of technology, China’s level of AI application has surpassed that of the United States. Companies like Dahua have won many first-place awards in global competitions and their license plate recognition is widely used in practical applications, such as for each community entrance, company gate, police checkpoint, and automatic toll collection system on highways. It is very strict and nationwide standards are enforced for highway toll collection.

For each project, there are four to five or ten competitors vying for the contract. The recognition rate depends on the effect of the competition, whether it is 99.5% or 99.8%. Dahua is either first or second, indicating the basis of their technology.Also on facial recognition, China is definitely leading, with Dahua also being one of the best. This technology is closely related to our vision-based target tracking.

So, with the accumulations we have made and the potential we can tap into in the future, we can certainly compete with Tesla. I am fully confident in that.

As for the second battery line, we will also move in the direction of lithium iron phosphate, especially for the luxury version. It has a better cost-performance ratio and safety.

In terms of our C11 users’ choices, the most popular is the Premium Edition with a range of 610 kilometers, accounting for 50%. The four-wheel drive Performance Edition and the luxury edition with a range of 510 kilometers each account for 25%. In addition, the users who added the luxury package for 10,000 yuan reached a level of 70%-80%.

Furthermore, more than 10% of our T03 users made additional purchases. Actually, T03 has a very good reputation among users and we have not done too much advertising. In August, we received more than 7,200 orders.

Q: After the launch of C11, it seems that there were many user feedbacks about sales policy issues. They said that the policy regarding some miscellaneous fees charged by dealerships was not very uniform. Does Leapmotor have any measures on sales policies? Meanwhile, Leapmotor’s sales model is a self-operated + agent marketing model. In this model, how to compete with relatively more direct companies? Under the agent model, how does the manufacturer truly face consumers?

A: First of all, with regard to the first question, we have held an emergency meeting, and all dealers have started to coordinate to address user feedback issues, namely various fees charged by agents. We will try to achieve a unified standard.

As for the self-operated + agent model, which is better between directly operated and franchisee operated, I think either one is good if run properly. If the management is not good, the efficiency of self-operated will also be low and not the best choice.

We once had a communication with Huawei and learned that there are only three directly-operated stores, and all the others are operated by partners. However, it has a very good management method, which makes the franchising model a very good one.

If you want to open a store, you need to have local resources, such as the resources of supermarkets and stores, the advantage of local management, and the mentality of being your own owner. It is not an easy thing to do, so as long as you do the regulation and management well, both direct-operation and franchising can be done well.

Our users need to download our app first, and enter our system with their real identity. This way, we know the situation of each user and can interact with each of them. We have our own user operation department, dedicated to connecting with users.Meanwhile, all of our stores are using a unified marketing management system, which is used by every sales engineer and store manager. This system is also integrated with Enterprise WeChat, enabling more direct and efficient understanding and communication with the users.

Q: With Dahua’s support, what is the cost of the LI’s self-developed chip? LI has already received over 8 billion yuan in financing this year. With so many reserves, where will it focus next? You have previously stated that LI could survive without financing for three years. Do you still hold this view? What are the plans and goals for IPO listing?

A: In fact, the Lingxin 01 chip is mainly developed by the Dahua chip team, and we only provide more requirements.

Developing a chip costs a lot of money. It will be a loss if it is only used in LI’s cars, even if it reaches two or three million units, which is not enough. When we defined this chip, we designed it to meet the requirements of LI’s cars as well as Dahua AI devices. Therefore, developing this chip has two meanings, and only by doing so can we have a future in developing it. Otherwise, it is impossible to account for using it only in LI’s cars.

As for the second question, this financing will definitely be a help, and manufacturing cars is indeed a capital-intensive business.

We have obtained financing mainly for three aspects: building factories, research and development, and market expansion. As we just said, how we aim to achieve annual sales of 800 thousand units, we need at least two to three factories, and the Jinhua factory will expand in the second half of this year. It can produce up to 240,000 units at most by next year.

In the future, we aim to make intelligent driving our core competitiveness, which requires more investment, such as a platform with higher computing power to process more massive data. These all require huge investment.

At the same time, most of this data is collected by us directly, and we attach great importance to the quality of the data. Quality is more important than quantity because intelligent driving is a product of deep learning, so the accuracy of data training is essential.

In March of last year, the environment for new energy vehicles was not very friendly. At that time, we said that even without external financing, we could still keep this team alive because this spark needs to be maintained. But if we really want to develop, it is impossible without financing, because without 20 or 30 billion yuan, there is no point in making cars.

Finally, the IPO goal has been set for next year.

A: Our plan for sales channels is diversified. Besides our website and official flagship store on Tmall, we also have authorized dealerships and experience centers in various cities, providing customers with a direct and convenient purchasing experience. Additionally, we will continue to explore new channels, such as pop-up stores and other cooperation opportunities, to expand our reach and provide more options for customers.A: Currently, LI Automobile has 174 sales outlets in operation and 73 under construction, including 21 direct stores, mainly located in first-tier cities. Meanwhile, we will also set up image stores in a large number of supermarkets, mainly to showcase products and brand image. It is expected that there will be more than 270 image stores by the end of this year, and the first image store will be located in Wuxi.

A: Our plan for sales channels is diversified. Besides our website and official flagship store on Tmall, we also have authorized dealerships and experience centers in various cities, providing customers with a direct and convenient purchasing experience. Additionally, we will continue to explore new channels, such as pop-up stores and other cooperation opportunities, to expand our reach and provide more options for customers.A: Currently, LI Automobile has 174 sales outlets in operation and 73 under construction, including 21 direct stores, mainly located in first-tier cities. Meanwhile, we will also set up image stores in a large number of supermarkets, mainly to showcase products and brand image. It is expected that there will be more than 270 image stores by the end of this year, and the first image store will be located in Wuxi.

Q: Many of the intelligent driving assistance functions will be launched by the second quarter of next year. Will it be on a subscription basis at the software level?

A: It is currently not yet finally determined and is still under evaluation.

Q: Users are concerned about the internal testing of the C11 smart driving assistance in the second quarter of 2022. When is the time point when it can be used by everyone?

A: The latest estimate is the third quarter, with efforts to make it available in the second quarter.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.