According to data from EV-Volumes, the total registration of new energy vehicles in Europe in August was 155,734, an increase of about 60% year-on-year. The penetration rate of new energy vehicles reached 17%, of which BEV accounted for 8% and PHEV accounted for 9%. In terms of growth rate, pure electric vehicles increased by 72% year-on-year in August, while plug-in hybrid vehicles increased by 47%. This also reflects that European car companies are concentrating their production on pure electric vehicles with limited chips.

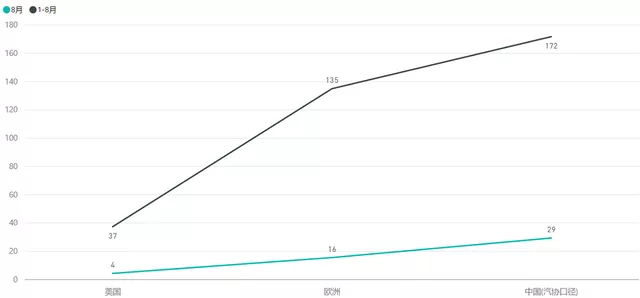

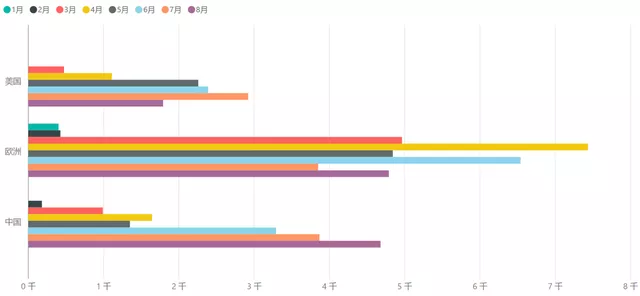

Note: in 2021, Europe has registered 1.35 million new energy vehicles. The number of electrified passenger cars in China, Europe, and the United States are shown in the following figure:

Sales of various vehicle models in Europe

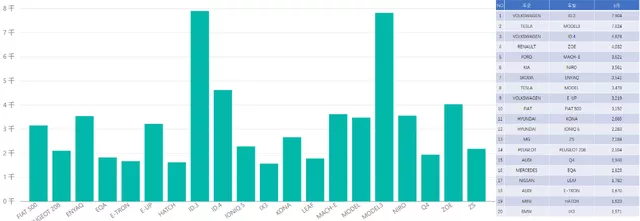

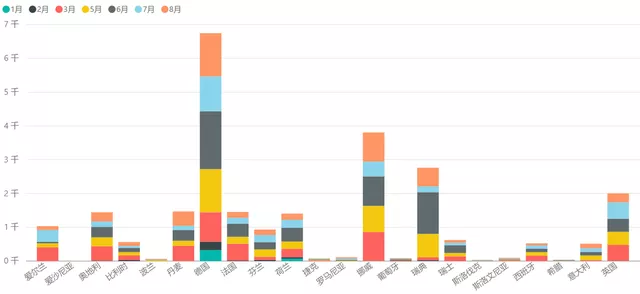

1) Sales of pure electric vehicles

First, let’s take a look at the sales of pure electric vehicles. In August, the best-selling pure electric vehicle in Europe was the ID.3, but the difference between it and the second-ranked Model 3 was very small, and these two vehicles were classified together. The Model Y is also catching up quickly. As Tesla China shifts its focus to exportation, sales data for September are expected to increase rapidly.

In terms of cumulative sales, Model 3 ranks first in the first eight months of 2021 with a total of 76,440. The ID.3 ranks second with 44,625, followed by the ZOE with 38,872 and the ID.4 with 33,543. The Niro EV ranks fifth with 28,393.

It should be noted that the sales of the IONIQ 5 in Europe are replacing the KONA as the main model, but this data still needs some time to reflect.

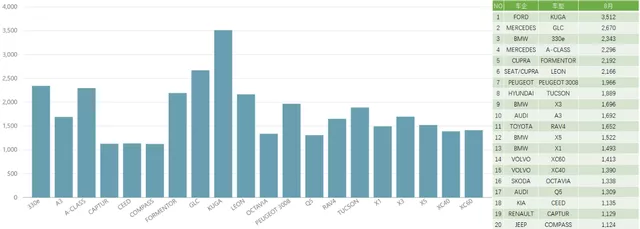

2) Sales of plug-in hybrid vehicles

Among PHEV models, the best-selling one is the Ford KUGA with 3,512 units in August. Although it went through a recall storm last year, the KUGA PHEV has still sold 32,507 units this year. The second-ranked model is the XC40 PHEV with 29,356, followed by the BMW 330e with 26,537. These three PHEVs are among the top ten in cumulative sales of new energy vehicles in Europe this year. After entering a chip shortage in Europe, sales of plug-in hybrid vehicles have been sluggish.

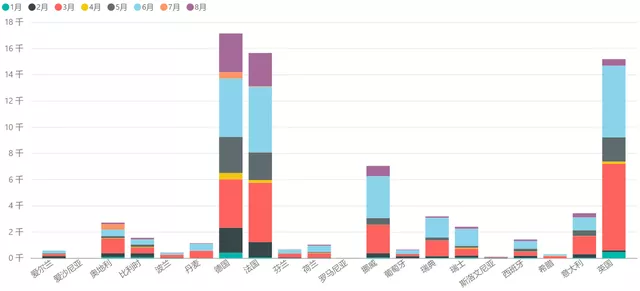

Sales distribution of key models1) Volkswagen ID.3

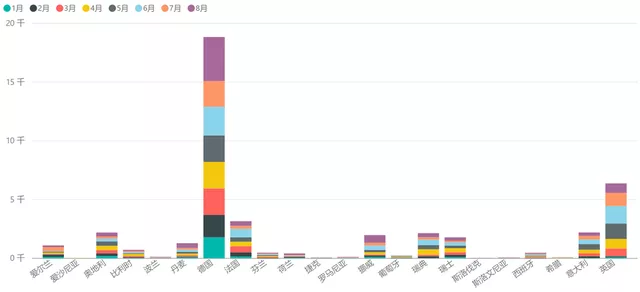

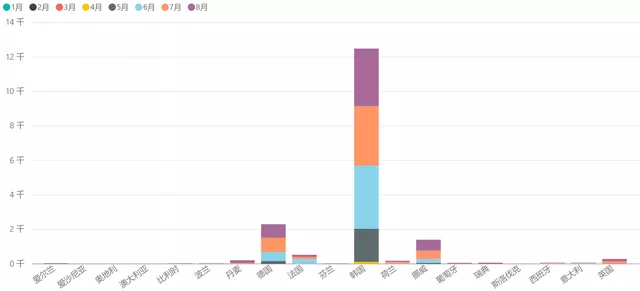

3750 units of ID.3 were sold in Germany, totaling 18845 units and accounting for 42.44% of the total sales. The second highest sales volume was in the UK, with 810 units sold and a total of 6380 units, accounting for 14.37%.

Currently, the promotion of the ID series in Europe is not particularly smooth, and is still concentrated in the German and British markets.

2) Volkswagen ID.4

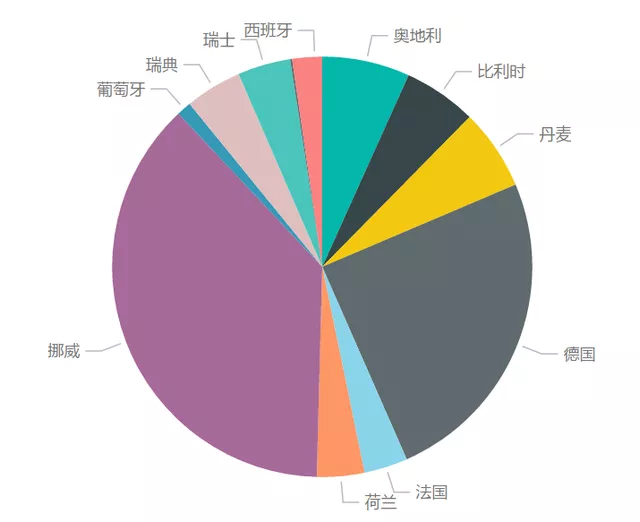

The overall situation of ID.4 is still satisfactory in China, Europe and the United States, as shown in the figure below. In terms of sales, this Volkswagen electric vehicle flagship model has not shown the strong level that Volkswagen wants.

In Europe, the ID.4 sells better in Norway and Sweden, which objectively reflects that this car is more practical. From the current data, ID.4 needs to iterate one round before it can have stronger competitiveness.

3) Tesla Model 3

Tesla’s strategy for Model 3 is aimed at Germany, France, and the UK, which have high subsidies, plus Norway. Tesla’s focus is to leverage the electric vehicle subsidies of European big countries.

4) Tesla Model Y

Model Y currently prioritizes meeting demand in Norway and Germany, so Tesla Norway’s sales volume in August and September suddenly increased.

5) Hyundai Ioniq 5

The wholesale volume of this car is around 8,000. The global actual registration volume is stable at above 5,000. The main registration location is still concentrated in South Korea, and deliveries and production have now begun in Norway and Germany.

I maintain a positive outlook on the demand for fast charging, mainly for this reason.

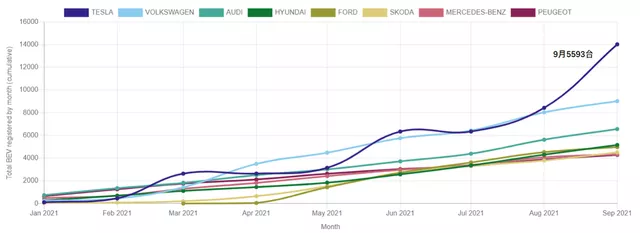

Estimate for September Partial Data

Tesla’s attack in September was still amazing, delivering 5,593 vehicles in Norway (3,524 Model Y and 2,069 Model 3).

Relatively speaking, the increment in Spain and the Netherlands is still relatively limited, with 683 vehicles in the Netherlands and 721 vehicles in Spain.

Conclusion: complete data will not be available until the end of the month. Based on observations from the United States, Europe, and China, the United States has the greatest growth potential in 2022. Next, I will focus on research into the changes in energy storage and power, which is worth studying in depth.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.