Text:

Full text of 1,792 words

Estimated reading time of 8 minutes

Today we’ll clarify three questions about options:

-

What are options?

-

What do options mean to individuals?

-

How did Elon Musk of Tesla acquire options?

Let’s first answer the first question: What are options?

To put it simply, options are a “promise” given to you containing three key elements: how long it will take in the future, how much money, and how many company stocks will be exchanged.

How long: To bind core staff to continue working hard at this company. Example: Options uniformly unlocked for 4 years. After meeting the unlocking conditions, 1/4 can be exchanged for stocks every year.

How much money: To encourage everyone to work hard and increase the value of the company. Since only if the future stock price exceeds the agreed exchange price now will there be a chance for everyone to “earn”.

How many stocks: Can be simply understood as the cost the company pays to bind you.

Let’s then answer the second question: What do options mean to individuals?

Options represent that for a certain period of time in the future, you have the right to buy a certain number of company stocks at a predetermined price. The stocks you own can be sold or continue to be held and enjoy dividends when trading is allowed in the future (such as going public or merger and acquisition).

If you choose not to buy these stocks when they can be redeemed, you do not have to pay for them. Individuals have the right to choose freely.

Seeing the word “stock” may seem like the smell of money. So why would anyone voluntarily give up these stocks?

From a rational point of view, the reason is simple. Because in publicly traded markets, you can buy the same number of stocks at a cheaper price. Or, you are not optimistic about the future development of the company.

However, from an operational perspective, the reasons can be more complicated. In many cases, individuals are optimistic about the future development of the company, but may be limited by their financial situation at the time and unable to come up with so much money to exchange the company stocks. But at this time, in addition to individuals raising funds to exchange stocks, the company can also negotiate to lend to individuals to exchange stocks, and individuals can use part of their future wages or dividends to periodically repay the company’s loans.

So when it’s time to redeem stocks each time, does the company have any rights?

Yes! That is the “unlocking condition”. After all, employees have tasted such a “sweetness” (the right to purchase stocks at a low price). From a rational perspective, there is no such thing as sweetness without an equivalent return. The company certainly hopes that employees will meet the “company’s expectations” in the future.

Therefore, when granting options, most companies generally set requirements for individual performance in the future, such as performance. Meeting performance can unlock the stocks of the current period in full, and if the performance fails to meet expectations, the number of unlockable stocks can be discounted proportionally.Overall, options for individuals in the car industry mean buying company stocks at a certain price and using their own efforts as a condition for redemption, then enjoying the potential increase in value of the company stocks in the future.

From the perspective of practical operations, options for start-up companies are more valuable, primarily because of the large space for appreciation. If successful in public trading, this could mean returns of tens or even hundreds of times the original investment.

Of course, there is no free lunch, and the “price” here is the sustained growth and development of the start-up company or the probability of going public in the future.

Some people often say that taking options in a start-up company is a high-risk, high-return endeavor.

But the so-called “high risk” only applies to those who do not know what asset they are buying with their money. If you are knowledgeable enough about the company, this could possibly turn into a “low risk” investment. Or in other words, if your entire loss is limited to the money exchanged for the stocks and the potential increase in value of these stocks could be multiplied by tens or even hundreds of times in the future, it would not be a case of limited loss but unlimited income instead.

Finally, let’s take a look at an interesting example of how Tesla offers options.

In 2018, Tesla’s board of directors approved an option plan specifically for Elon Musk. Yes, you read that right. This is an option plan specifically for Tesla’s largest shareholder and CEO.

Now let’s take a closer look at this option plan.

Firstly, the plan stipulates that Elon Musk will not receive any salary, bonus, or time-based equity grants for a period of 10 years. The stock options in the plan are completely based on “performance”.

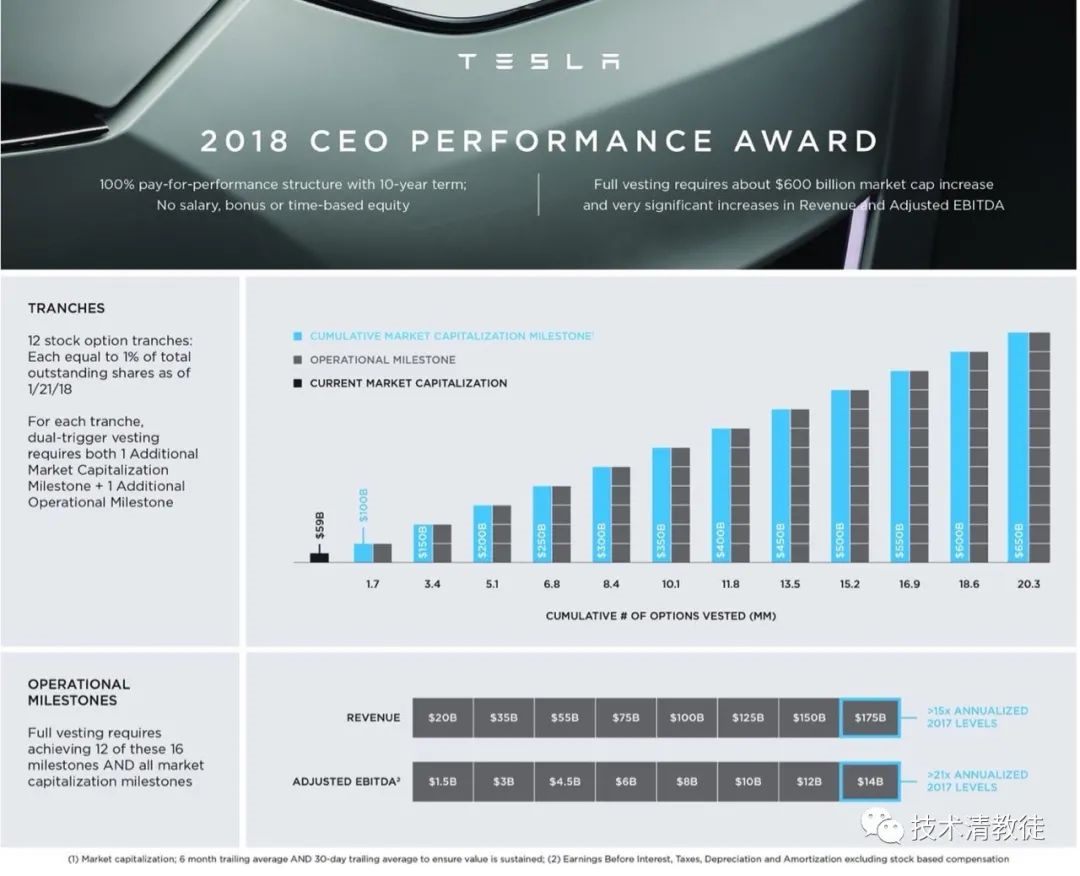

So, what kind of performance is this plan based on? The plan divides performance into three quantifiable metrics: the company’s market value, revenue, and adjusted EBITDA.

For market value, it is divided into 12 increasing levels, starting at $100 billion for level one and increasing by $50 billion for each subsequent level until reaching $650 billion for level 12.

For revenue, it is divided into 8 levels, starting at $20 billion and increasing by $150 billion for each subsequent level until reaching $175 billion.

For EBITDA, it is also divided into 8 levels, starting at $1.5 billion and increasing by $15 billion for each subsequent level until reaching $140 billion.The agreed total number of shares that can be exchanged for the 12 periods will be based on 1% of the stocks already issued in the market on January 21, 2018.

However, in order to exchange these 12 periods of shares, Elon Musk needs to meet all the market value requirements, as well as 12 out of 16 tiers of income and EBITDA combined.

When this plan was developed in 2018, Tesla’s market value was $59 billion, revenue was $11 billion, and EBITDA was $600 million.

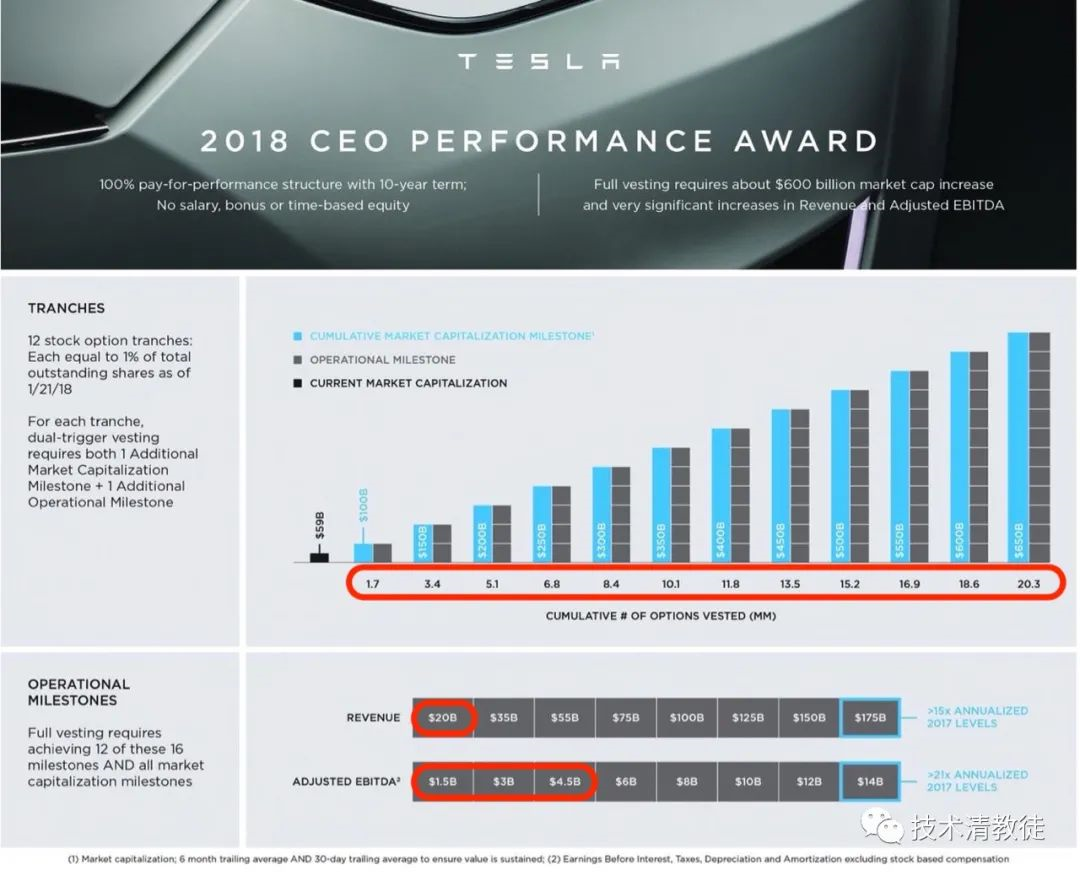

Three years later, today, Tesla has surpassed $750 billion in market value, $31.5 billion in revenue, and $5.8 billion in EBITDA.

That is to say, Elon Musk has already received 4 periods of shares in the past three years (red circles indicate reached targets). In 2021, Tesla is likely to exceed $45 billion in revenue and $8 billion in EBITDA, and subsequently unlock an additional 3 periods of shares.

This is today’s content.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.