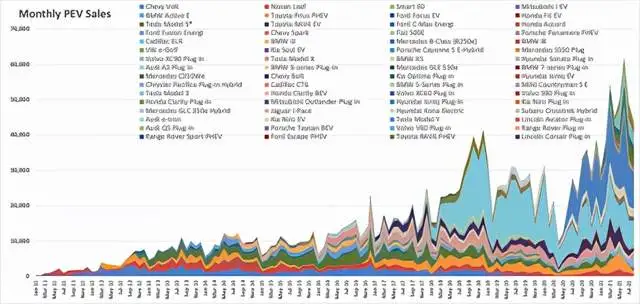

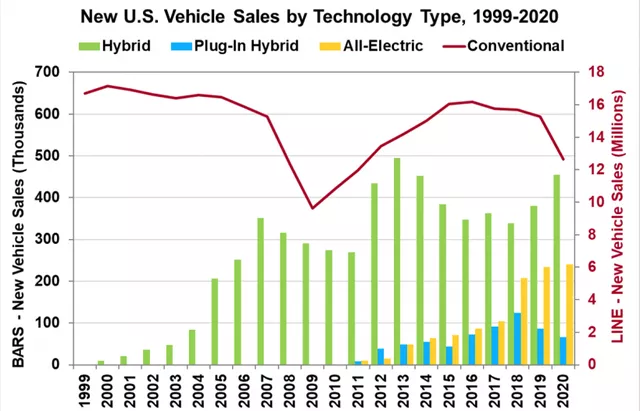

It can be difficult to find data on electric cars in the United States, but by compiling several data sources, an overview can be obtained. According to Argonne National Laboratory’s “Light Duty Electric Drive Vehicles Monthly Sales Updates,” the latest data shows that in August, a total of 43,721 new energy vehicles were sold in the United States, including 28,460 pure electric vehicles and 15,261 PHEVs, a year-on-year increase of 83.9%. In 2021, the US market has sold 374,087 new energy vehicles, with a total stock of 2.08 million (2,085,817) units.

On the hybrid side, in August, 68,043 hybrid vehicles were sold in the US market, including 23,067 cars and 44,976 LTs (Light Truck & SUVs), with Toyota occupying 67.4% of the hybrid market. The hybrid penetration rate for all vehicles in August was 6.24%, with a higher rate of 9.26% in the car market segment.

As for fuel cell vehicles, 169 units were sold in the US market in August, with a cumulative total of 2,261 units in 2021 and a total stock of 11,202 units in the US market.

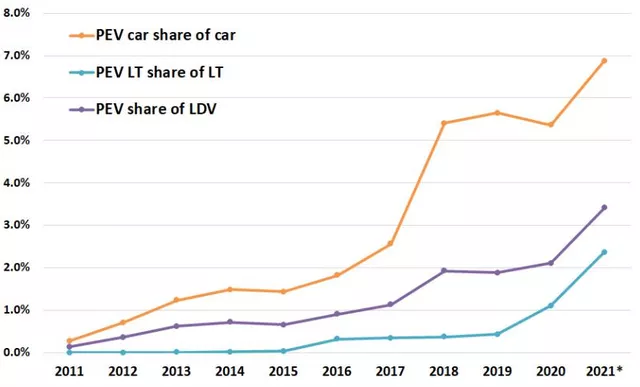

Penetration Rate in the US Market

Due to the difficulty of obtaining US data, I also referred to a report from a Korean securities company, “Global Environmentally-friendly/Secondary Battery Monthly.” After combining the two sets of data, the situation is roughly as follows:

Battery Electric Vehicles (BEVs): The demand for BEVs in 2021 is relatively high. Currently, a total of 278,000 pure electric vehicles have been sold in 2021, with an average monthly sales volume of 34,800.

Plug-in Hybrid Electric Vehicles (PHEVs): With the expected adjustment of tax policies, Japanese and American car companies have released PHEVs from their self-imposed restrictions, and their sales have quickly increased from a few thousand units per month. As of now, 96,000 PHEVs have been sold in 2021.

We can see that before the US adjusted its tax policy, electric vehicles manufactured by US unions were eligible for a tax deduction of $12,500, and the restrictions on 200,000 vehicles were lifted to include Tesla and General Motors again. The penetration rate in 2021 also began to approach 10%, with passenger cars accounting for about 3.4% and Light Truck & SUV accounting for about 2.4%.

We can see that before the US adjusted its tax policy, electric vehicles manufactured by US unions were eligible for a tax deduction of $12,500, and the restrictions on 200,000 vehicles were lifted to include Tesla and General Motors again. The penetration rate in 2021 also began to approach 10%, with passenger cars accounting for about 3.4% and Light Truck & SUV accounting for about 2.4%.

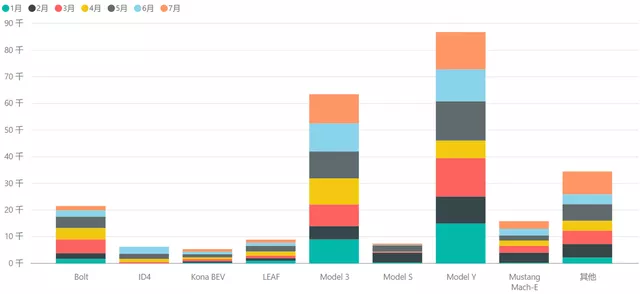

Comparison of Pure Electric and Plug-in Hybrid Vehicles in the US Market

(1) BEV Models

According to securities companies’ data, Model Y is the top selling pure electric BEV vehicle in the current US market, followed by Model 3. With Bolt BEV being left behind, Mach-E and ID4 are also selling well. It is worth noting that Porsche’s Taycan is performing very well in the US market, with 5,285 units sold in the first half of the year, and Audi E-tron has also sold 5,258 units. There are relatively few types of pure electric cars on the US market. With increasing certainty, the US market for pure electric cars will further grow.

Imagine that if Tesla were to obtain a $7,500 tax refund, plus the impact of the phosphate-based extended version, the increment in this area would be considerable.

Note: CleanTechnica has cross-compared the semi-annual data of US electric vehicles.

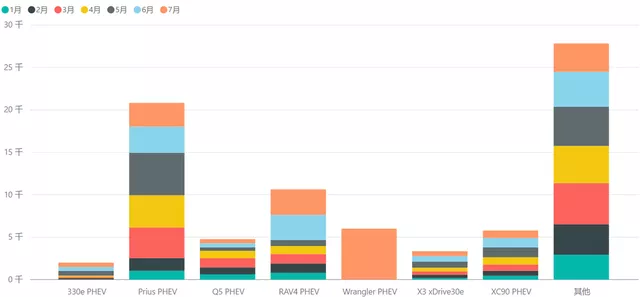

(2) PHEV Models

Jeep Wrangler 4xe has become a hot seller. According to FCA data, even in Q2, it sold more than the Prius PHEV, which sold approximately 11,863 units. The report estimated that it sold 6K in a single month. This data is still very inspiring. Toyota also began preparing to sell more plug-in hybrid vehicles in 2021.

Overall, in 2021, pure electric vehicle sales have exceeded those of 2020, and plug-in hybrid vehicle sales have also surpassed those of the full year of 2020. From the trend, this will change the persistent sluggishness of the US market for plug-in hybrid vehicles.

Summary: I believe that with the implementation of the year-end tax legislation in the United States, the new energy vehicle industry will take off rapidly, making data collection easier. From the materials perspective, Americans are gradually proposing their own recycling and positive electrode material industry chain layouts. I think this is still a relatively independent matter, and the competition for battery minerals is just beginning.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.