Author: Big Eyes

Recently, autonomous driving company Pony.ai announced the completion of a $300 million Series B financing, with Alibaba being the most watched capital among the participants. According to relevant data, after this round of financing, Alibaba’s shareholding ratio will reach 19.6820%. It is worth paying attention to and looking forward to what level Pony.ai, an Alibaba subsidiary, has achieved in the field of autonomous driving, and what kind of big moves Alibaba will make in the field of autonomous driving.

Pony.ai will continue to develop L4 technology, abandoning ADAS

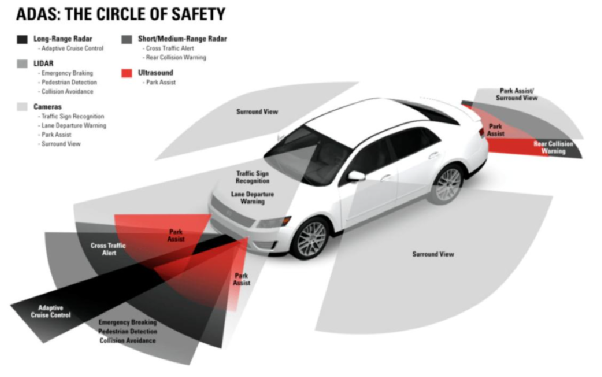

Shenzhen Pony.ai Technology Co., Ltd. was established in February 2019, and it is a provider of L4-level autonomous driving full-stack solutions. The driving assistance ADAS function, which most of us are more familiar with, is not within the business scope of Pony.ai.

Compared with ADAS technology, which has many landing solutions now, with major component giants successively laying out in this field, the competition in the future ADAS will become more and more fierce. Although ADAS technology is easier to monetize and the technical threshold is relatively lower, it is difficult for upstarts like Pony.ai to obtain considerable orders in this market through price competition. However, in the field of L4-level autonomous driving, for the automakers, in the situation where L4-level autonomous driving technology cannot be fully commercialized in the short term, they are undoubtedly more inclined to cooperate with these technology companies to achieve their own technical accumulation in the field of higher-level autonomous driving through incremental iteration. And this is where Pony.ai’s biggest opportunity lies.

Pony.ai’s dual focus

In terms of application objects, Pony.ai from the beginning has focused on two major fields of autonomous driving travel and autonomous driving urban freight, both in traditional passenger car and commercial vehicle fields.

In the passenger car field (named “Yuan Qi Xing” in Chinese), Pony.ai appears more in the form of Robotaxi. In the field of mobility, Pony.ai has launched autonomous driving tests and trial operation in three cities: Shenzhen, Wuhan, and Hangzhou. In terms of fleet size, by the end of 2021, Pony.ai’s self-operated vehicles will reach 100, and the total number of vehicles including cooperative operation will reach 150. By 2022, this number will grow to 200.

In the commercial vehicle field (named “Yuanqiyun”), its relatively fixed usage scenarios provide more possibilities for commercialization and better business prospects for L4 level autonomous driving technology. Currently, Yuanrong Qixing has launched the research and development testing of autonomous driving light trucks, accumulating more than 2 million kilometers of road testing experience in the core areas of three cities nationwide. In 2021, Yuanrong Qixing will also promote the application of autonomous driving in urban cargo transportation. For e-commerce giants like Alibaba, progress in urban freight transportation will play a significant role in improving Alibaba’s logistics efficiency and reducing logistics costs. This is also one of the main reasons why people are optimistic about Alibaba’s investment and will continue to invest in Yuanrong Qixing in the future.

Overall, traditional vehicle companies, suppliers, mobile travel companies, and logistics companies are all potential customers of Yuanrong Qixing, achieving increased company sales revenue through customized autonomous driving solutions.

Alibaba’s Ambition in Autonomous Driving Domain

In the autonomous driving field, a large number of unicorn companies have emerged in China: Xiaoma Zhixing, Wenyuan Zhixing, Momenta, AutoX, and others have become well-known companies in the autonomous driving field, but these companies actually have little to do with Alibaba. In addition, compared with Baidu and Xiaomi, who personally engage in car manufacturing, Alibaba, except for the previously reported investment in SAIC’s Ziji brand, has not made much action. However, Alibaba is only a minor shareholder in the Ziji project, unable to play a decisive role in the company’s strategy. Relevant investment is more to help Alibaba share some of the benefits after sharing technology. But even with Alibaba’s support, there is still considerable uncertainty as to whether Ziji can knock down a group of new forces in the automotive industry given SAIC’s existing system capabilities and operating models. Therefore, in the intelligent connected vehicle industry, Alibaba urgently needs to make its voice heard.

Take Xiaomi Auto as an example. Previously, Xiaomi Auto fully acquired DeepMotion as its flagship in the autonomous driving field and cooperated with other invested-part companies to build a relatively complete autonomous driving industry chain. This model and method demonstrate Xiaomi’s strong supply chain integration capabilities. For Alibaba, who also has a lot of money, Xiaomi’s integrated industry chain model is worth learning, and investing in Yuanrong Qixing will be Alibaba’s first step in carrying out related businesses.

So, for Alibaba, participating in the investment of Yuan Rong Qi Hang may not be limited to hoping to be a financial investor. Alibaba’s strategic investment has left more room for imagination for outsiders. However, apart from Yuan Rong Qi Hang, Alibaba also needs to make more layout in the entire intelligent networked automobile field, including autonomous driving, and the relevant layout can ultimately exert synergistic effects. Only in this way can Alibaba truly obtain a share of the huge cake in the intelligent networked automobile and mobile travel industry.

So, for Alibaba, participating in the investment of Yuan Rong Qi Hang may not be limited to hoping to be a financial investor. Alibaba’s strategic investment has left more room for imagination for outsiders. However, apart from Yuan Rong Qi Hang, Alibaba also needs to make more layout in the entire intelligent networked automobile field, including autonomous driving, and the relevant layout can ultimately exert synergistic effects. Only in this way can Alibaba truly obtain a share of the huge cake in the intelligent networked automobile and mobile travel industry.

In the long run, with more capital giants entering the autonomous driving field, the Matthew effect of start-up companies in this field will become more apparent. More head companies will get more resources, which also means that they can recruit more leading talents, invest more in bottom-level software code and core technology innovation, and have the ability to afford larger-scale fleets. In the future, these head autonomous driving companies are also likely to be merged into automakers or internet giants to become their autonomous driving departments. But before that, more start-ups may be eliminated from the competition.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.