Because of the entry of new car companies, we have begun to refer to car companies that were born in the last century or even earlier as traditional car companies.

In a sense, traditional car companies are more like middle-aged people in society. They need to withstand the pressure brought by young people in the workplace and keep up with the new ideas and ways of thinking of young people. This pressure is relatively light, as their qualification and experience is something that young people can’t surpass in a short period of time. However, for middle-aged people, the anxiety that comes from their peers is the most fatal.

Lao Li shared his child’s certificate in his Moments, Lao Wang is leading in WeChat steps, and Lao Zhang recently obtained a card at the gym in the community. The various anxieties faced by middle-aged people can also be seen in traditional car companies. B Car Company’s new energy products are on this month’s sales charts; W Car Company has announced its five-year plan for electrification transformation in the future; D Car Company has launched a product based on a pure electric platform.

After more than 100 years of development of gasoline-powered cars, the position of traditional car companies in the car industry has been solidified. The arrival of the electrification era has not only given new car companies an opportunity but also let more traditional car companies see the opportunity to break the existing pattern. It is a bit similar to middle-aged people mutually “chicken-babies,” where the older generation’s hopes are placed on the next generation to fulfill. In this battle of traditional car companies where each tries to take the lead, there has emerged another good hand in selling anxiety- General Motors.

Hi everyone, my “child” is called Ultium.

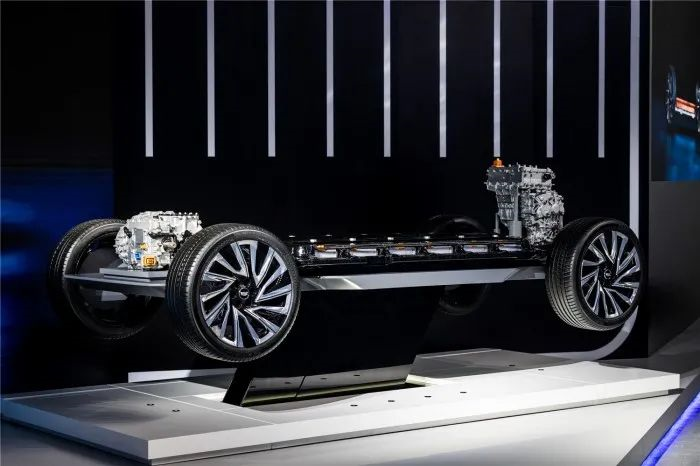

On the evening of 14th September, at the Ultium Day hosted by General Motors, it announced that its Ultium three-electric platform had officially entered the Chinese market, and it also has a Chinese name called “Oute Neng” (Ultraman from the M78 Nebula next door said it best). The first Lyriq, based on this platform, will be launched next year.

In fact, General Motors started releasing news about the Ultium three-electric platform to the Chinese market at the end of last year. By September 14th this year, General Motors had been preparing for a year. Through this, we can already see General Motors’ anxiety in the electrification era, especially in the rapidly developing electric vehicle market in China. However, electric vehicle products are still in the stage of accelerated penetration in the current Chinese automobile consumer market. Faced with this potentially explosive market, General Motors’ entry into the Chinese market is not considered late.

So this time, I want to talk to you about General Motors’ Ultium three-electric platform- what capabilities it has and what advantages it has in the electric vehicle market.## Introduction of Ultium Platform with Revolutionary Wireless Battery Management System

Ultium is a revolutionary three-electric system within the process of General Motors’ electrification layout. The platform boasts advantages in high safety, high flexibility, and high intelligence, all derived from the innovative technology of IoT-crossed wBMS (wireless Battery Management System).

The wireless management technology can hit the pain points of distributed battery management technology, where modules can communicate wirelessly, reducing 90% of internal battery harness to minimize signal attenuation, thereby optimizing battery space, weight and cost.

In terms of safety, the wireless Battery Management System can build a dual-layer protection for the entire battery pack. The first layer is software protection, in which the Ultium Platform creates a real-time intelligent battery monitoring system independently of the entire vehicle system through the wBMS wireless battery management system. This logic can monitor the health status of the battery pack in real-time, differentiate the safety risks of the entire battery system to a pre-detection of a single cell and adjust module and sensors to ensure the health of the battery within the life of the vehicle.

The second layer is structural protection. The 90% reduction in internal wiring in the battery leaves more design space for engineers. The simplest method is to fill the space with a cell, thereby increasing the energy density per unit volume of the entire battery pack. Although the Ultium Platform indeed increases the energy density of the entire battery pack through more spaciousness, engineers have only used a portion of the space to accomplish this goal while the other portion constructs an exhaust passage and safety valve, enhancing the thermal diffusion ability from the module to the pack level for the battery. Currently, this design on the Ultium Platform is patented.

Without the burden of harness, the Ultium Platform obtains higher flexibility in battery configuration. It uses replaceable and upgradable battery modules, as well as flexibly arranged cell schemes that can easily support upgrades of functions and optimizations of cell formulas. Whether it is lithium iron phosphate or ternary lithium batteries or lithium-metal, solid-state batteries which may be applied in the future, Ultium supports them all. During Ultium Day, Perry Zheng, the Senior Vice President of GM China, said that the battery laboratory located at the forefront of the China Science and Technology Research Center had the complete ability to perform from R&D, verification to testing. General Motors researchers are currently developing the next-generation of Ultium cell technology, advanced high-power cells as well as solid-state cells to further enhance battery performance and reduce costs.

In addition, through the modular design of batteries and electric drives, the Ote Energy Platform can combine 12 to 16 battery cells into battery packs of 6, 8, 10, 12 and 24 modules, and the battery packs can be horizontally, vertically or stacked inside the battery tray. These six different energy density battery packs will be combined with three types of electric motors to create a maximum of 19 power units. Currently, the Ote Energy Platform will provide seven driving forms in the Chinese market, including various sizes of models, meeting the needs of different segmented markets and reducing product development cycles to speed up the electrification of SAIC-GM.

In addition, through the modular design of batteries and electric drives, the Ote Energy Platform can combine 12 to 16 battery cells into battery packs of 6, 8, 10, 12 and 24 modules, and the battery packs can be horizontally, vertically or stacked inside the battery tray. These six different energy density battery packs will be combined with three types of electric motors to create a maximum of 19 power units. Currently, the Ote Energy Platform will provide seven driving forms in the Chinese market, including various sizes of models, meeting the needs of different segmented markets and reducing product development cycles to speed up the electrification of SAIC-GM.

Four aspects to consider how the Ote Energy Platform drives SAIC-GM to occupy the Chinese market

Looking back to the 2020 Chinese automotive market, the penetration rate of electric vehicles was around 5%, and some of these cars were used for commercial purposes. From the first three quarters of this year, the market penetration rate of electric vehicles reaching 10% is not a problem, and there are a large number of users actively choosing to purchase electric vehicles in the market. In the next few years, the market penetration rate of electric vehicles will continue to increase. In such a rapidly developing market, the ability of the Ote Energy Platform to drive SAIC-GM to occupy a good market share needs to be considered from the following four aspects.

Finding Market Gaps

Although many car companies are implementing the strategy of creating explosive products, the demands of users are always diverse. Therefore, “segmented markets” have become the key factor for most car companies to gain a good market share in the field of fuel cars. At present, each new energy car company in the electric car market is still in the stage of continuous improvement of the product lineup. Finding opportunities in market gaps and segmented markets and occupying the market first will be important things that SAIC-GM needs to do in the next 2-3 years.

Based on the flexible expansion capability of the Ote Energy platform, SAIC-GM will launch more than 30 pure electric vehicles worldwide by 2025, including more than 20 in China. Rapidly launching products will play a crucial role in seizing the new energy market.

Creating Additional Value

So far, “convergence” is a difficult problem that all car companies can hardly avoid. Additional value has become the key factor for consumers to consider when choosing between two products with the same positioning. For example, the BMW 3 Series and the Mercedes-Benz C-Class are both in the B-Class luxury car market, but people who choose BMW value its sportiness, while Mercedes’ consumers value luxury.

At the brand level, the image of SAIC-GM in the minds of consumers should be higher than that of Chinese independent brand car companies. At the product level, products based on the SAIC-GM Ote Energy platform have advantages in intelligence and space compared to products based on oil-to-electric or hybrid platforms.This advantage will become an added value for General Motors’ products. However, vehicle manufacturers who adopt a conservative platform to build products are mostly joint venture brands, which will be General Motors’ main competitors in the electric vehicle market in the future. Compared with them, General Motors’ advantage is still more obvious.

Tracking Consumer Trends

Consumer needs are not static. In recent years, with the popularization of electric vehicles, consumers’ demand for electric vehicles has gradually shifted from range to the safety of underlying hardware. Recently, many car companies have been keen to conduct needle piercing experiments on battery packs to give users a peace of mind.

General Motors’ Ultium platform can achieve dual battery safety testing and collision protection for both software and hardware, which has been mentioned before. However, wireless battery management systems are a new technology, and General Motors has gone through a lot of trouble to make this technology practical and meet safety standards.

The Ultium platform is rated ASIL-D in ISO26262 functional safety standards, which is also the highest level that all automakers are trying to avoid. Safety rating is divided into five levels: QM, A, B, C, and D. Each level requires several times the research and development cost and technical difficulty of the previous level. The difficulty coefficient for the Ultium platform to achieve system functional safety is comparable to achieving Level 4 autonomous driving at this point in time.

Enhancing Brand Image

I believe that one of the reasons why General Motors has taken nearly a year to register Ultium in China is to prove the company’s determination in electrification transformation and upgrade its brand image.

Today, the electric vehicle market has also been developing in China for nearly a decade. More and more users are beginning to understand the importance of a pure electric platform to a product. And the pure electric platform will also become a watershed for dividing the performance of pure electric products. Brands that plan their pure electric platforms first will get more attention in the market.

Conclusion

We often say that vehicle manufacturers need determination for electrification transformation, and the more determined they are, the more they will pay to make the change. Only when you invest more energy into something than others can you make them feel anxious. This is also why I think that General Motors’ Ultium platform will make competitors start to feel anxious.

Technology is always the driving force behind the development of the automobile industry. Innovative technology allows General Motors to lead the industry and also pushes other car manufacturers to follow the same technological path. I believe that one day in the future, the automotive industry will undergo a large-scale reshuffle due to automation. Those who master the technological dominance will be the last to stand.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.