At the Hainan New Energy Conference, Wuling exhibited quite a few things, primarily divided into three parts: domestic chips, battery swapping, and the large cylindrical Lithium Iron Phosphate battery developed for Wuling by Ningde. In the field of A00 electric vehicles, Wuling has devised many strategies to handle the market post-2022, and the fighting potential is impressive.

The Story of Domestic Chips

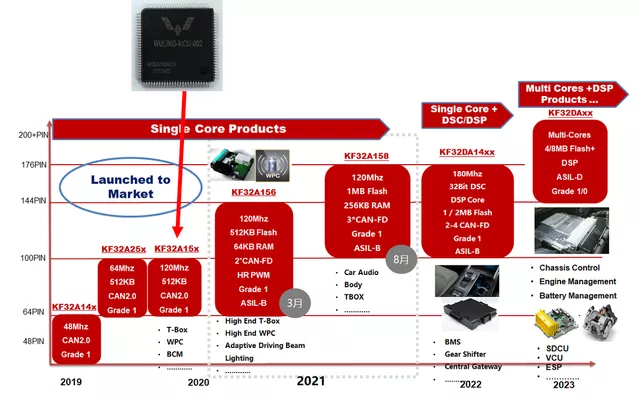

Wuling’s “Strong Chip” strategy is, to put it in simpler terms, to introduce domestically-designed (manufactured and packaged) chips as quickly as possible in the current chip shortage crisis. This is critical for Wuling’s survival going forward. During the chip shortage test, the hardest hit were Tier 1s who could not obtain chips (revoking their eligibility to survive), as well as automakers who could not afford to purchase chips. As a result, Wuling has launched a “independent research and development” computational chip, and in fields such as 5G communication chips, storage chips, energy chips, and artificial intelligence chips, it is attempting to advance the localization of chip production.

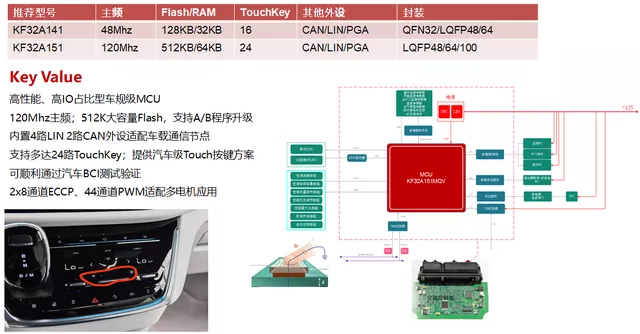

I closely examined Wuling’s KF32A150MQV, which is Chip ON Shanghai Xinvu’s product. I mentioned this in a discussion around March of this year, and it was aided by domestic Tier 1 automotive electronics firms in completing the nationwide production of chips for Wuling.

Note: Wuling has other chip suppliers, so let’s talk about it again after we’ve received a domestic-made VCU and BMS.

Currently, Wuling has selected the ChipON 32-bit MCU, which is primarily used in the car body, including touchscreens, sunroofs, and car fans. Overall, there are more 8-bit MCUs produced domestically, with Wuling importing 32-bit MCUs. This type of MCU is more extensively used in automotive electronics applications, such as node control and slightly more complex functions or those requiring strong functional safety ECU. It can be divided into three application categories based on whether it requires functional safety: non-functional safety and ASIL-B and ASIL-D.

Non-functional safety components are primarily derived from body control and in-vehicle ECU, such as seats, air conditioning panels, lighting control, Tbox, OBC, in-vehicle wireless charging, in-vehicle display screen co-controllers, and so on.

The ASIL-B functional safety level application is primarily for automotive body control, such as BCM, air conditioning power, power management, BMS, instrument cluster control, front lighting, and so on. Sometimes, non-functional safety and ASIL-B applications may have slight overlap, primarily dependent on the regulations established by the automaker.The application of ASIL-D functional safety belongs to strong functional safety applications: from automobile safety airbags, brake ABS, ESP; to electric drive, battery pack BMS, transmission and three electric systems (VCU, MCU, BMS). MCU manufacturers that can provide D level mainly include Infineon’s TC series MCU, Renesas’ RH850 series MCU, and NXP’s latest S32K3 series MCU.

Progress on Battery Swapping and Cylindrical Battery Import

What surprised me most about Wuling was the release of new energy intelligent micro battery swapping technology and related battery swapping stations.

The Wuling intelligent micro battery swapping station, due to its small battery size, has a small overall footprint and flexible expansion to configure multiple energy storage compartments like building blocks. During battery swapping, accurate identification can be achieved through visual recognition and laser positioning technology, and the battery swapping time is very short.

This approach is a bit like the optimization that Hangzhou State Grid did on the “Condi” battery swapping version in the very beginning. If a vehicle-electricity separation is achieved on micro electric vehicles, this is like the approach of electric bicycles, which can really increase the penetration rate of electric vehicles by 5% (1 million) to 10% (2 million).

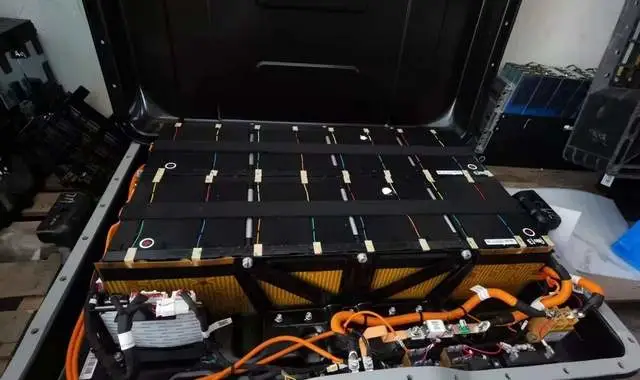

Another noteworthy point is the fast progress of large cylindrical lithium iron phosphate batteries in A00 level landing, as shown below.

Summary: I think Wuling’s approach is very fast and aggressive, and I think this approach has insightful significance in various aspects.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.