Li Zi from Tiexi District

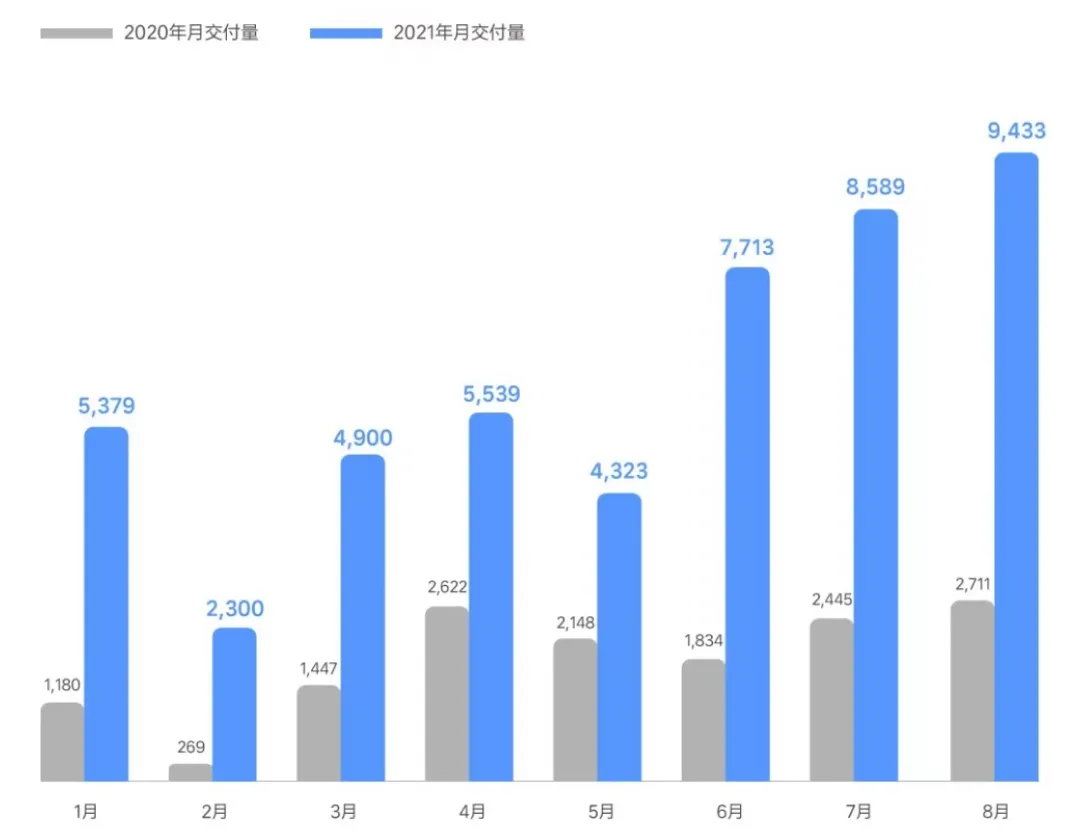

In August, the sales volumes of Li Auto, XPeng, and NIO were 9,433 units, 7,214 units, and 5,880 units, respectively, representing YoY growth rates of 248%, 172%, and 48%, respectively. In other words, compared to the same period last year, the three companies realized an overall increase of approximately 10,000 units. From a startup point of view, the three companies have already achieved over 20,000 units of sales this year.

After the peak in 2017, the domestic auto market never returned to that level in the following three years. And at the same time, subsidies for new energy vehicles have also declined. Li Auto, XPeng, and NIO have started delivering cars during these three years.

In other words, the monthly sales volume of over 20,000 units for these three companies is not from market expansion but from taking away shares from fuel-powered cars in a declining market and reduced subsidies.

It is necessary to find out whose market share they have eaten up. By understanding this issue, we will realize that the impact of new car manufacturing is not only limited to the product level but may also change the market’s price structure and even the fate of cars.

Li Auto’s SUV

The three companies have a total of five SUVs: ONE, ES8, ES6, EC6, and G3.

Among these five models, the least prominent is the XPeng G3, with a monthly sales volume of 1,000 units. The most prominent is, of course, the Li Auto ONE, with monthly sales approaching 10,000 units. NIO’s three SUVs have relatively average sales volumes. By looking at the numbers, the ES8 sells over 1,000 units per month, the ES6 sells over 3,000 units per month, and the EC6 sells over 2,000 units per month. (As the ES8 is priced at over 400,000 RMB and is much higher than the G3, it carries more weight than the G3 in terms of sales volume.) In each SUV’s sales figures, the price effect is very clear.

It is clear that the G3 is the cheapest, with a price range of 150-200 thousand RMB, yet it has the least presence. The reason is simple: it directly entered the market for joint venture compact SUVs and competed against models such as the RAV4, CR-V, and CX-5, which can easily achieve monthly sales of up to 20,000 units. The market in this segment has long been mature. If we count from when joint venture SUVs rushed into this segment and to now, which is almost ten years, two models have already been replaced. The market has already taught us: If you want an SUV at that price, choose a brand from Japan, Germany, or the U.S.

The most prominent ONE, originally priced at a level of approximately 320,000 RMB and now being sold for around 330,000 RMB, is now firmly seated as the top-selling mid-size SUV. Whose market share did it take? Toyota Highlander is the first option to consider, although it is a mid-size SUV with a slightly lower classification, it overlaps in the price range and was the market’s first choice for seven-seater SUVs, as it was widely regarded.Ignoring the recent factors of replacement in the past two months and Toyota’s production reduction due to chip shortage, the sales trend of Highlander has remained relatively unchanged. If we expand the scope and look at the direct competitors like Touareg, Q7, Explorer, etc. over the past two years, taking into account the impact of listing cycle, chip shortage, and other factors, their sales trends also follow certain rules. Speaking bluntly, except for Highlander and Touareg, there are barely any direct or indirect competitors with monthly sales averaging over 5,000. So even if they take all their shares, ONE will not be able to reach a monthly sales level approaching 10,000.

This means that no direct competitor has suffered a significant loss of sales due to ONE. The monthly sales of nearly 10,000 for ONE are the result of its own efforts. All purchasers with budgets around 330,000 yuan and all purchasers of 6-seater or 7-seater models have been attracted to ONE.

The key to ONE’s popular phenomenon is its price of around 330,000 yuan. This is the market for large SUVs among joint ventures, but the offerings in this category are generally not persuasive and have low market recognition. New products entering this market don’t encounter substantial resistance. As for the strong products like X3, GLC, and Q5L among luxurious midsize SUVs, their price ranges from around 350,000 yuan, and the hard bone 7-seater Highlander at 330,000 yuan is close to the top-of-the-line or sub-top configurations, not the mainstream.

NIO’s three SUVs have not achieved the same level as ONE for similar reasons. In fact, ES8 has the same price considerations as ONE and has entered the price gap between luxurious midsize and mid-large SUVs, but it comes with an unfortunate starting price of 470,000 yuan, which narrows the market space significantly. The midsize SUV ES6 and EC6 from NIO are directly pitted against luxurious midsize SUVs on price. First of all, they face the same problem as the XPeng G3. The competition has already developed a mature market, and these two models will also compete with each other and scatter their sales. Under the influence of these two unfavorable factors, achieving a total sales volume of around 6,000 is already quite impressive.

Whose market share did Xiaoli from NIO take? This is a question without a specific answer. As a maker of new cars, naturally what they produce is entirely new products, which would be all-purpose. (“I’m not talking about you specifically, but everyone here…”) This is a simple truth. If a car only takes up a large share of sales by targeting a specific competitor, then this car is not new enough, but merely a copycat targeting a specific model.The key is market space. It is certainly taboo for a completely different new product to go into a strictly regulated market area. Ideal ONE found the space with a large enough gap. XPeng G3 and NIO 3 do not have it.

There is only one model available for sale from XPeng, NIO and Li Auto, XPeng P7. Although not as dominant as ONE, this is still a top-selling model. A single product is not enough to indicate significance, but fortunately, there is another highly similar and highly popular product, the BYD Han. Two top-selling models is enough to indicate a trend.

Although the Han is not a new car, it is obviously BYD’s first product that presents a completely new concept, and it is also the first product designed by a world-class design team led by Wolfgang Egger. Of course, these are not the most important things. The most important thing is that both are sedans with prices starting at more than 200,000 yuan.

Sedan + starting price of more than 200,000 yuan, the combination of these two characteristics is approximately equal to the market for joint venture midsize cars, such as the Magotan, Camry, and Teana.

So, have P7 and Han taken away the market share of any other models?

No, it is still difficult to see significant changes in the sales trends of mainstream sedans in the same price range. The sales trends of the Passat have not changed much, and the recent sales of the Lavida have been poor, more likely due to the shortage of chips. The Camry and Teana have even shown an upward trend. For entry-level luxury sedans in the same price range, the BMW 1 Series, Mercedes A-Class, and Audi A3 have not shown any significant changes in sales trends.

P7 and Han can become top sellers because they occupy the key factor: space. The market for sedans with a starting price of over 200,000 yuan is a blank field.

Firstly, even the best-performing joint venture midsize car in this market segment can only sell over 10,000 units a month, and some models still offer significant end-of-term discounts; secondly, their main selling models are mainly luxury versions priced at around 200,000 yuan, rather than higher. In other words, joint venture brands do not have much to say in the market above 200,000 yuan.

As for luxury brands, the products that penetrate into the 200,000-yuan-level market are only the Mercedes A-Class, which can sell over 5,000 units a month, and the BMW 1 Series and Audi A3, whose presence is even weaker. Midsize sedans, such as the BMW 3 Series, C-Class, and Audi A4L, have a starting price of around 300,000 yuan, and the entry-level models have low production batches, which is not enough to meet the market above 200,000 yuan, even with end-of-term discounts.# P7 and Han Have More Significant Acceleration Advantages in the Market of Over 200k

When it comes to the market for over 200k, which is less focused on household consumers and attracts more young customers with a clearer perception and demand for speed, P7 and Han have even more significant EV advantages in terms of acceleration compared to the fact that the SUV models of WM Motor are mostly household cars with weak demand for speed.

As for medium-sized joint venture cars, zero to one hundred acceleration is not worth mentioning, while entry-level luxury cars have relatively stronger competitiveness with 7.5 seconds for the top equipped version of 1 Series 2.0T. In contrast, P7 and Han’s regular versions have zero to one hundred acceleration of 6.7 seconds and 7.9 seconds respectively, while the performance versions are 4.3 seconds and 3.9 seconds respectively. It should not be ignored that EVs have a much faster throttle response and are more linear compared to turbocharging.

Sedans & 200k: Key Markets of the Future

Regarding the phenomenal performance of P7 and Han, follow-up on Tesla’s benchmark, its first-market-disrupting models―Model 3, Model S, and Roadster―are all sedans (even sports cars are classified as sedans).

In recent years, the trend in the Chinese and American auto markets has collectively shifted from sedans to SUVs. Ford even cut off its North American sedan business. Will this trend be interrupted by the emergence of new automakers?

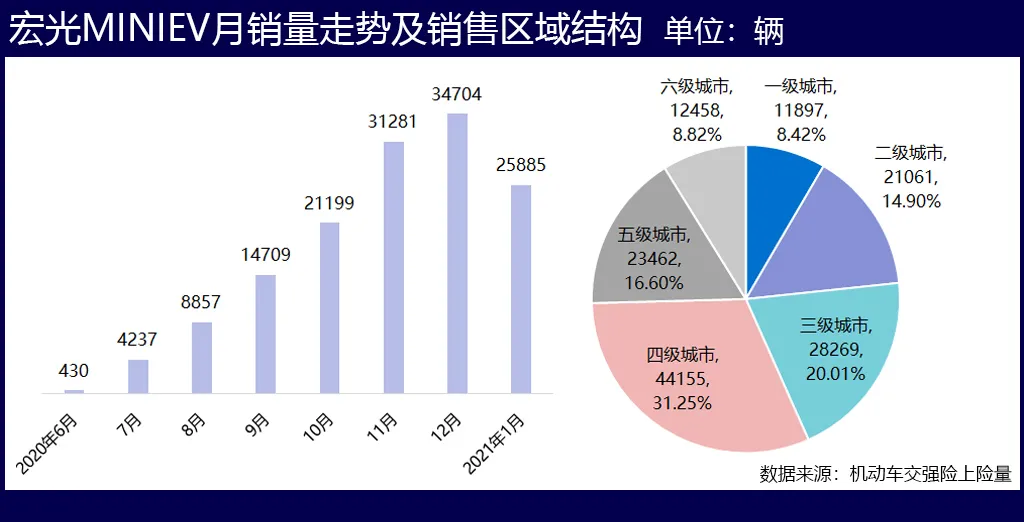

Speaking from the perspective of the Chinese domestic market, we must first not forget the true hegemon on the local EV sales ranking, the Wuling Hongguang MINIEV, which has become a phenomenon in the same way as ONE, P7, and Han by entering a spacious untapped market for micro-cars. Since the earlier years of Chery, QQ, and F0, micro-cars have almost disappeared, and even Suzuki has withdrawn from the Chinese market. The emergence of MINIEV has restored hopes in the micro-car market.

The EV team has discussed the micro-car market internally, with some thinking there are opportunities and others thinking there are none. I thought there were none, but looking back, opportunities are created and things are possible with effort. If we handle it like Chery, QQ, F0, and Suzuki, we will surely have no chance. However, if we design and produce competitive products like MINIEV, we will certainly have a chance.

This is the fundamental reason that new automakers can bring about changes in product structures and price structures.

In recent years, automakers have devoted their energy to the SUV segment that offers larger market share and potential, resulting in the fading existence of sedans. After the emergence of new automakers, including Tesla, their characteristic of targeting market gaps makes sedans a field worthy of attention, and the faster acceleration of EV models is more advantageous for sedans. Sedans have a lower center of gravity and better grip on the road, which inevitably enables them to better leverage the advantage of speed with higher fault tolerance compared to SUVs. The trend of sedans being forced into decline by SUVs may be alleviated.Similarly, in the current market, the largest capacity is 150,000 to 200,000, while the market is chaotic and disordered for vehicles priced above 200,000. The ideal planning focuses on the 200,000 to 500,000 market, and XPeng focuses on the 150,000 to 400,000 market. The 200,000+ segmented market is obviously a core area with high importance. Currently, this market includes the P7, Han, Model 3, and the expected to be reduced in price Model Y, as well as more competitive models to come. Will this market surpass the 150,000-200,000 market?

The possibility of this happening is indeed very small. But, could this market significantly increase its share and no longer linger outside of the mainstream view, becoming a focus market alongside the 150,000-200,000 and 300,000+ markets? This possibility is significant.

Turning back, over the years, the price of the entire consumer market has been rising. It is normal for a decent smartphone to cost a few thousand yuan, and the price of a cup of warm drink has been selling for 20 or 30 yuan. If these things are priced too low, take a look at the trend of housing prices. In fact, our salaries have also risen, although the increase in comparison is much lower.

It is not surprising that car prices have become higher, even though no one expects that kind of outcome.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.