Author: Huangshan

You may think this is another “Wuling Hongguang MINI EV”? But no.

This is the newly released “Punk Dou Dou” by Punk Automobiles, which has 5 doors and 4 seats and can also swap batteries, making it the biggest difference from the Wuling Hongguang MINI EV.

On September 12th, Punk Automobiles released the second model of its “Meiduo La” series, the “Dou Dou”, with a range of 128km and 178km in two versions, and prices for 3 models ranging from 26,800 yuan, 31,800 yuan to 39,800 yuan respectively.

Compared to the Hongguang MINI EV, the Punk Dou Dou is more affordable, but its size is significantly larger.

Since the Wuling Hongguang MINI EV was launched, its sales have far exceeded those of other A00-level cars priced at around 30,000 yuan, igniting the market. This year, Lingbao Automobile launched the “Lingbao Coco” and Reading launched the “Reading Mango”, also targeting this market.

Including Punk Automobiles, all these micro-electric vehicle companies have transformed and upgraded. Wuling, on the other hand, attacked from the top down, and it was only after launching the E100, E200, and E300 models in succession that it finally came up with a blockbuster model.

In the 30,000 yuan price range, these two forces are engaging in fierce competition. Will this market continue to exist? How will the story end?

How did this trend come about?

Even before the Wuling Hongguang MINI EV, there were micro-electric cars such as the Zhidou D series, Zotye Cloud 100, E200, Beiqi EC series, Chery eQ series, and so on. Today, only Chery is still around, while the others are gone without a trace.

Why did these companies produce A00-class small cars at that time?

It was because at that time, low-speed electric cars in Shandong, Henan, and Hebei were so successful that they sold over a million units with no subsidies, and their prices reached 20,000-30,000 yuan, or even up to around 40,000 yuan.

Such a huge market naturally made passenger car companies envious, but unfortunately, they couldn’t achieve the cost-effectiveness.

Another important reason was that they were unfamiliar with the low-speed electric car market, which was mainly in small towns and rural areas, where their aggressive marketing strategies were as useless as using an anti-aircraft gun to shoot mosquitoes.

It was not until the arrival of the Wuling Hongguang MINI EV that everything changed. It did not follow the rules and released a small car priced at less than 30,000 yuan. At this time, low-speed electric cars were suffering from regulatory measures and fierce competition with prices as low as 10,000-20,000 yuan.According to a senior executive at Punk Automobile, the market for Wuling Hong Guang MINI EV can be divided into two categories: one is the large county and town market that truly understands the needs of the bottom-up users, and the other is the first- and second-tier city market hyped up by huge internet public opinion. Wuling just took advantage of the trend for marketing, which is an opportunity that is hard to come by.

In contrast, the large county and town markets are the most familiar markets for companies like Punk and Reading. Once reignited, how could they abandon them? Therefore, they have successively launched benchmark models that meet passenger car standards and can be registered.

Like the recently released Punk Duo Duo, it has also launched multiple color schemes and a more trendy and high-value design, fully comparable in range, lower in price, and even learned new skills such as short video marketing and live streaming sales.

It is bound to rival Wuling Hong Guang MINI EV.

Who Understands the County and Town Markets Better?

For marketing in first- and second-tier cities, it is obvious that the county and town markets have always been the main battlefield for Punk Automobile.

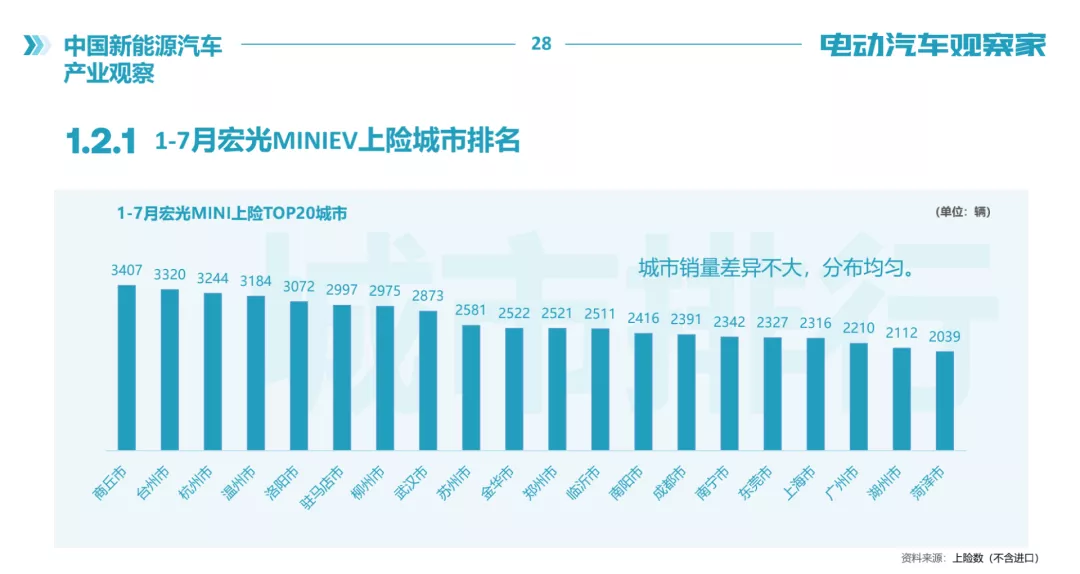

Looking at the insurance city rankings for Wuling Hong Guang MINI EV, excluding first- and second-tier cities, we can see that it is mainly in cities such as Shangqiu, Taizhou, Zhumadian, Luoyang, and Heze. The aforementioned senior executives at Punk Automotive also stated that because these cities have been cracking down on low-speed electric vehicles on the road, consumers have no choice of the same price range of models, and the emergence of Wuling Hong Guang MINI EV just happened to fill this market gap.

And from the recent insurance sales of Wuling Hong Guang MINI EV, it has always hovered around 30,000 units without any obvious upward momentum.

“For the fourth- and fifth-tier county and town markets, Wuling Hong Guang MINI EV has a significant flaw, which is the layout of 2 doors and 4 seats being too small. The large county and town users also hope to carry more passengers and cargo for a larger vehicle, which is a very basic consumer demand,” said a senior executive at Punk Automotive.

Moreover, Punk Duo Duo is equipped with a 5-inch LCD instrument panel, 7-inch central control screen, and features such as reverse image, Bluetooth/car phone, and EDR data event recorder, as well as safety features such as ABS+EBD, central control door locks, tire pressure monitoring, slope assistance, and child safety seat interface across the range. Compared with similar models, Punk Duo Duo is in a leading position in terms of central control large screen and reverse image configuration, and its cost performance advantage is also very obvious with a starting price of 26,800 yuan.The consumers of county and township markets certainly hope to buy a slightly larger and higher-configured car for around 30,000 yuan.

Will the market of around 30,000 yuan continue to exist?

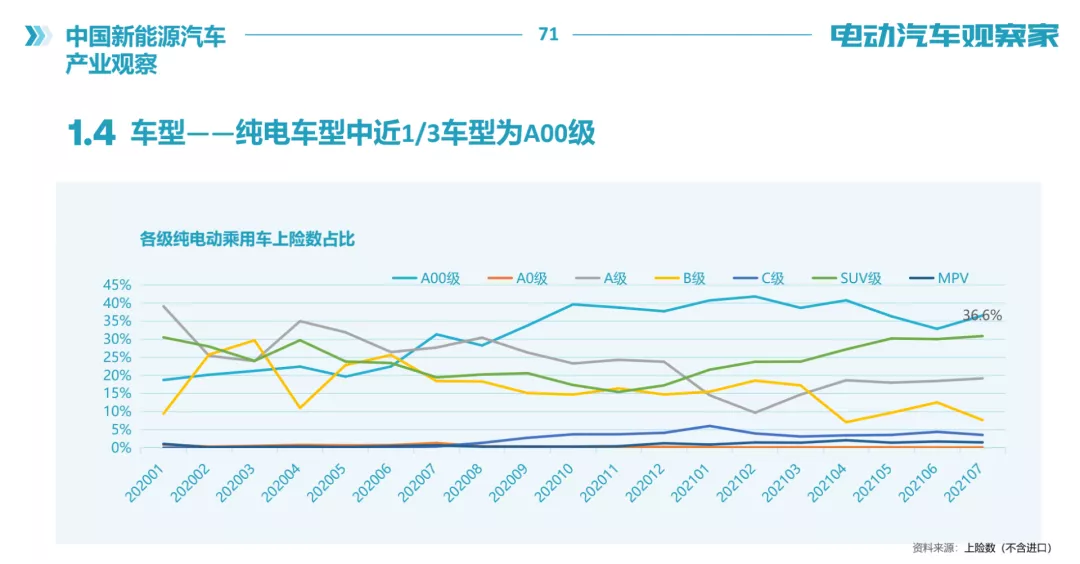

As can be seen from the above figure, A00-class small cars have the most fierce growth momentum and once accounted for more than 40%, even in July, it reached 36.6%, which means that there are 36 A00 small cars for every 100 pure electric cars sold.

A00-class small cars can be roughly divided into two categories according to price. One is around 30,000 yuan, represented by Wuling Hong Guang MINI EV, and the other is 50,000-80,000 yuan, represented by ORA Black Cat.

According to publicly available data, there are 150 million bicycle users, 300 million electric bicycle users, 90 million two- and three-wheeled motorcycle users, and 70 million electric tricycle users, totaling more than 600 million in China. There are still a large number of consumers who have not enjoyed the benefits of cars. As long as 20% of them are converted into A00 pure electric users, a market of over 100 million can be created.

Based on past consumer experience, especially in the county and township markets, purchasing power is gradually increasing.

In addition, for basic car needs such as short self-driving, family transportation, and transporting children, a small car for around 30,000 yuan is already sufficient. Therefore, we believe that the market for small cars around 30,000 yuan will still exist in the short term for the next few years.

Punk Motors has also done product planning for the Multi models to meet the growing market demand.

According to Chen Hong’an, the marketing director of Punk, the company has established 318 sales channels, 228 standard image stores, and 339 after-sales service outlets nationwide from January to August this year, and it is expected that the total number of channels will exceed 500 by the end of this year.

In addition, Punk Multi has been pre-sold for 37 days, and orders have reached 10,039 units. Now, due to the climbing production capacity, there is some pressure on delivery.

Therefore, we can see that for A00-class small cars around 30,000 yuan, numerous micro electric vehicle companies have launched a strong counterattack, trying to regain that familiar market. The war has just begun, and it is still unclear who will win.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.