This article is reprinted from the autocarweekly public account

Author: Karakush

The Volkswagen ID.3 is now available for pre-order in China. It will be produced and sold by SAIC Volkswagen, and is expected to be officially launched in the fourth quarter of this year. This marks Volkswagen’s third pure electric product based on the MEB platform in China.

In terms of seniority, ID.3 is actually the first car in the ID series and the first step in Volkswagen’s massive electric strategy. However, it is not called ID.1 or ID.2. The ID. story starts directly with “3” because Volkswagen believes it is the “third great idea” in its industrial treasure trove. The first is obviously the Beetle, and the second is the Golf.

If the Beetle built the Volkswagen brand and the Golf built the Volkswagen faith, ID.3 signifies Volkswagen’s new vision for the electric era.

ID.3 is the product that has been mentioned of this historical status, and its name is engraved with “important”. However, compared to its predecessors, it has not yet had a chance to prove itself. The bigger question now is, will it have the chance to prove itself?

Apart from Volkswagen insiders, no outsider has given a particularly optimistic evaluation of ID.3.

The European King has always been unpopular

Volkswagen’s confidence in ID.3 is largely derived from its performance in Europe. It is one of the best-selling electric cars in Europe and sold more than 31,000 units in the first half of this year. Since the delivery began in September 2020, it has been at the top three and even surpassing Tesla Model 3 in some high-performing months, becoming the sales champion of electric cars in Europe.

With the addition of ID.4, Volkswagen’s share of the new energy market in Europe has reached 11%. Volkswagen hopes that such a victory can be transferred to China. They have set a goal that by 2030, the proportion of pure electric vehicle sales in China will be more than 50% of the total sales. The front line is long, but the direction is clear and the head is clear. If we don’t work hard now, we may not even have the right to be sad in the future.

Therefore, “after ID.4 and ID.6, within six months, Volkswagen has imported ID.3 as the third pure electric vehicle model in China,” Volkswagen Brand CEO Ralf Brandstätter pointed out, “this shows our ambition to take a leading position in the electric vehicle market in China, just like in Europe.”

Their determination and sincerity are beyond doubt. Volkswagen has not launched three completely new car models based on a new platform within a year in China despite years of deep cultivation in China. Often, the more anxious they are, the more they hope for uncontrollable results.

The logic of cross-continental transfer is often flawed due to significant market preference differences. Volkswagen (VW) is very aware of this rule. In the original plan, the compact ID.3 hatchback was only sold in Europe, without a global plan. China and the US markets both started with the compact ID.4 SUV.

The CEO of VW USA, in 2019, bluntly expressed that they would not introduce the ID.3 to the US market because it had no future there. The capacity of the classic two-door hatchback segment in the US is about 100,000 vehicles, while the electric SUV is estimated to be 4-5 million vehicles.

“We need to get the cars on the road to demonstrate success. If we introduce the ID.3, what can we show? That we are just dipping our toes in the water? People will only say it’s another European small car, a regulatory-compliance vehicle. But when they see the electric SUV, they will call it the core of the market, a true product, something to buy! We want to deliver a knockout punch. You don’t want to come out weak with the first punch because you may not have a chance to throw the second punch,” said the CEO of VW USA.

As a professional manager, based on the utility of data, there is nothing to fault. Although there are always high shouts for the two-door hatchback in the market, actual demand shows that there are few who actually invest, while many are only interested in the spectacle.

The Chinese market is no different. SAIC-Volkswagen explained that in the initial project definition phase, considering the high growth of SUVs in China, both German Volkswagen and SAIC hoped to introduce an SUV as the first model. This is the same consideration as the US company.

Market preferences have not changed much today. Yu Jingmin, Executive Vice President of Sales and Marketing at SAIC-Volkswagen and General Manager of Shanghai SAIC-Volkswagen Sales Co., Ltd., said that ID.4 X is for landing, ID.6 X is for expansion, and ID.3 is for building a foundation, and ID.4 X and ID.6 X will be developed in the future based on market performance.

The burden falls back on the ID.3 again.

It costs 150,000, but it only costs 150,000

The start of the ID. family in China was average at best. From 1,500 units in May to 3,000 units in June, and 5,800 units in July, it is expected to exceed 7,000 units in August. These are the sales performance of the four IDs between South and North Volkswagen.

Volkswagen China CEO Stephan Wöllenstein commented, “The delivery volume meets expectations.” VW’s expectation is to deliver 80,000 to 100,000 ID.s by the end of the year – which means they need to maintain monthly sales of more than 15,000 units in the next few months. It is worth emphasizing that there is one prerequisite: a stable chip supply chain. Looking at it now, instability may be more useful than stability.After thinking deep about the complex competitive environment, companies make decisions. ID.3 has some reasonable opportunities.

For example, there is a considerable consumption capacity for A-class electric cars currently. According to data from the China Passenger Car Association, their market share accounted for 11% of the total new energy vehicle market from January to July this year, which is the third-largest segment in the field. Demand is real —

Although not the type of skyrocketing demand. The average growth rate of this segment is only 57%, which is the weakest among all electric car segments. Compare this to the average growth rate of the entire electric car market, which is 218%. However, it slightly improved in July, with an increase in the growth rate to 97%, and sustainability can be expected.

Capacity is the ceiling for mediocrity. ID.3 has many “unique” advantages in the same class that can break through the ceiling: 20-inch large wheels, shiny golden skin, a weight distribution of 50:50 for the front and rear of the car body, a wheelbase of 2765mm, and rear-wheel drive. With excellent driving quality at the Volkswagen level, it is very light and easy to drive and park in the city. “It will definitely win the favor of Chinese female consumers.”

Of course, male consumers appreciate these advantages too. Everyone likes cars that are easy to drive and park. However, SAIC Volkswagen found that the proportion of female car owners of the ID. series can reach 40%, which is nearly double that of female car owners of the original fuel car. Therefore, they have rarely launched marketing measures such as the Pikachu joint version. Putting them on small cars like ID.3 might achieve a suitable effect.

At the same time, SAIC Volkswagen also likes to highlight the range. It has been announced that the ID.3 is equipped with a 57.3 kWh battery pack, and its range can reach 430 km. Although short, it is true, and the displayed mileage is accurate, which has extended many users’ psychological distance. The overseas version has launched a version equipped with an 82 kWh battery pack, with a range of up to 550 km (WLTP), indicating that it has upgrade space.

In addition, it also has a simple and solid L2+ level intelligent assisted driving system, which can achieve automatic cruise in the range of 0-160 km/h. It is not prominent, but it is mature and reliable, and nothing is more important at present.

Overall, just like the ID.4 and ID.6, it is a product that is difficult to praise. You still have sufficient reasons to criticize it for not being intelligent enough, but there is no place that will discourage people. There is no problem selling it; it can only fail in selling it at an unsuitable price.

Price and configuration are currently under discussion internally. According to past trends, the industry predicts that the domestic price will be between 150,000 to 200,000 RMB. The official statement indicates that the top-end model is expected to be no more than 200,000 RMB.

A portion of friends believe that “as long as” it starts from 150,000 yuan, making the threshold of ID. easily accessible, after all, the cheapest ID.4 in China was priced at 199,888 yuan after subsidies; the other part believes that “actually” starting from 150,000 yuan seems to be unclear about the situation of the compact class, underestimating the level of self-developed new energy. Although there is no definite answer, we can still perceive the price level from some dimensions.

From Volkswagen’s product line, the price difference between 150,000 yuan and ID.3 Pure Electric is negligible, while the latter has a guide price of 147,700 yuan to 168,800 yuan after subsidies.

It is worth noting that, this time, ID.3 will only be introduced by SAIC Volkswagen instead of being produced separately by the two companies in the north and south as before. Some analysts believe that this is because FAW-Volkswagen already has a Golf Pure Electric with the same positioning and wants to avoid internal competition—an absurd idea, real or fake, as Golf Pure Electric is a symbolic product of oil-to-electricity conversion and is incomparable to ID.3 based on the MEB platform.

One major advantage of a dedicated platform is cost reduction and efficiency improvement. The pricing of overseas ID.3 is lower than that of Golf Pure Electric. The latter has a starting price of 36,900 euros and a range of 231 kilometers (WLTP), while ID.3 Pure model has a range of 330 kilometers (WLTP) and is priced at less than 30,000 euros. The pricing of ID.3 Pro, which is similar to SAIC Volkswagen’s data, is also less than 35,000 euros.

In the main German market, there is also a subsidy of 6,570 euros, with a minimum entry-level price of 23,000 euros, although it cannot provide direct reference—equivalent to approximately 180,000 yuan. By the way, a Golf Life with a 1.5L TSI gasoline engine costs at least 26,000 euros. ID.3 is undoubtedly hot-selling in Europe.

In China, the price of the gasoline Golf 1.4T engine version is about 140,000 to 160,000 yuan. As a pure electric vehicle of the same level, ID.3 is already very impressive if priced at 150,000 yuan.

Horizontally, there is a lack of star competitors in the 150,000 to 200,000 yuan range in the pure electric vehicle market. The relatively affordable products at present are GAC Aion S, and the more anticipated one is the upcoming Xpeng P5. They have different styles and target audience compared to ID.3, which still has a lot of solo space.

In the short term, a unique position will be an effective way to open up the market. An example is ID.6, which is more suitable for the Chinese market than ID.4. One reason for this is that it is one of the very few (if not the only) pure electric SUVs in the 200,000-yuan range that offers a choice of six or seven seats, without any decent alternatives.# ID.3 also has uniqueness.

SAIC Volkswagen pointed out that the recent increase in ID. sales is mainly due to add-on users; the big breakthrough still relies on Volkswagen’s loyal fans. They like Volkswagen’s driving pleasure, “good handling, perfect harmony between man and car, and smooth driving.” Volkswagen’s confidence in gasoline cars will be repeated in electric cars.

Just being popular doesn’t make you a Beetle.

No problem, but there is no sign that the ID.3 (or any ID.) will become a Beetle or a Golf.

More regrettable than shaking sales is the lack of Totem’s meaning. They always emphasize the adherence to brand traditions, defend existing rules like any authority, and use reliability to cover up mediocrity, and finally bring out a product that meets the interests of the majority but is rarely expressed. We think this is the attitude of a giant car company.

However, if we look back at Volkswagen’s road to success, we will find that it is a history full of rebellious spirit.

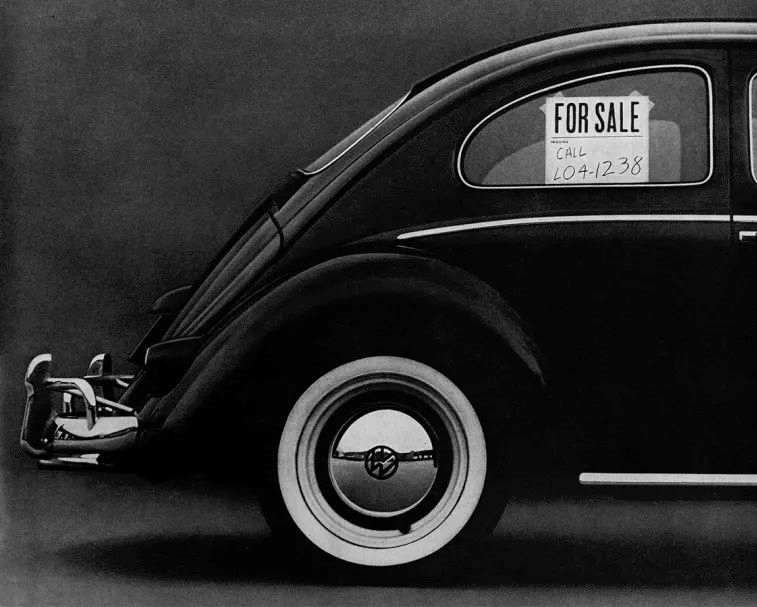

For example, the Beetle. Its success in the European market is no longer the focus. What really pushed it to the mainstream of the world’s culture was the United States. It’s amazing that this violates the general rule of the market. How could European small cars be popular in the United States?

It has some hard advantages.

For example, it is cheap, and it is indeed a car that is made so that everyone can afford it. In the 1960s, a new version of the Beetle was priced at $1,600, while a Ford Mustang was priced at $2,700. The cute curve design was actually developed by Germany after World War II as an efficient design to minimize the amount of metal used, which also requires a large number of manpower to produce such curves, thus promoting domestic demand for labor.

Another advantage is that it is very friendly to gasoline, in other words, it is still cheap, especially compared to American cars. Compared with other imported European cars, it is durable and easy to maintain. Its engine is designed for low-speed performance, and it can run all day long even if you drive it at full speed. At that time, many European cars that were imported could not adapt to the vast driving habits of Americans.

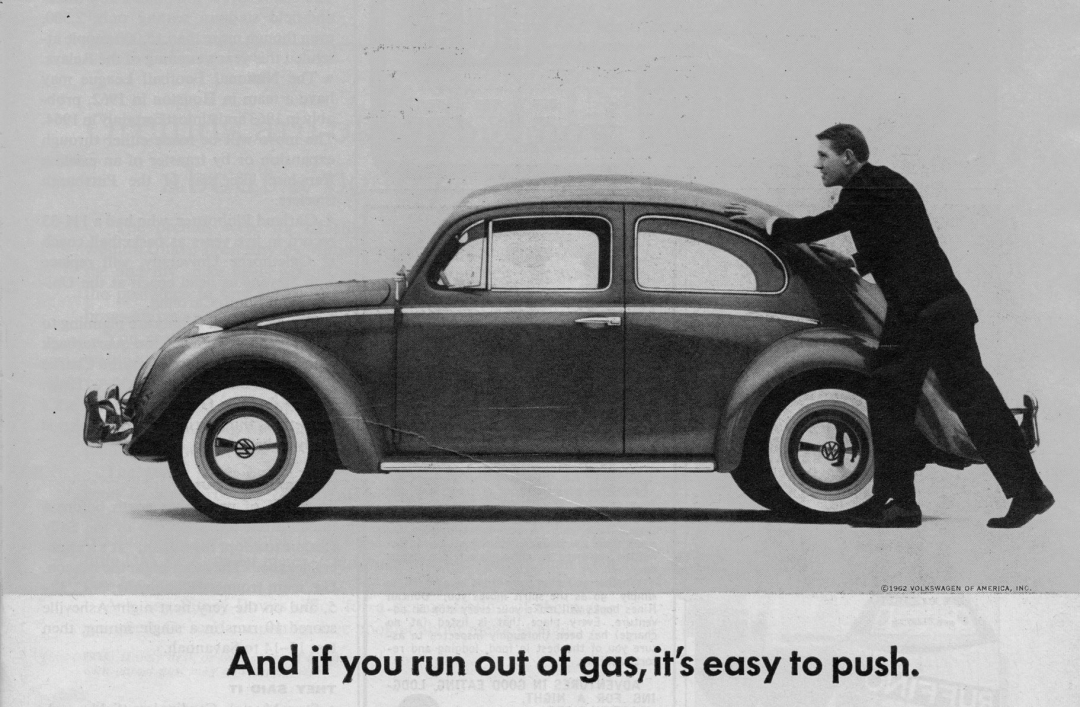

Perhaps more importantly, they found William Bernbach of DDB to write ads, and he packaged those seemingly out-of-place features of the Beetle as an attitude. It did not have the front grille of American cars, and the round headlights were not aggressive at all. Non-mainstream aesthetics are very risky, not to mention low horsepower, small space, and not very high-end temperament.But people like it better that American cars who always rely on patriarchal hormones, think small, show an honest and humble attitude, and communicate a new set of values with people. This also resonates with the social atmosphere of the time, making car consumption a reflection of more widespread real problems.

In the 1960s, the United States was moving away from its great political ideals, and the Vietnam War was the worst result. The hippies’ love of Volkswagen has a reason, it is completely opposite to the cars that their parents and predecessors were trained to drive. Driving a Beetle, driving an unsuitable car, is the most appropriate symbol of counter-cultural rebellion, and to some extent represents an extreme act of rejecting capitalist power. Coupled with its cheap price, it makes it easier for every rebellious young person, always young people, to have the power to rebel and build travel freedom on the basis of economic autonomy.

In today’s words, the success of the Beetle was to grasp the temperament of the times. What is amazing is that even those who missed the golden age of the Beetle cannot escape the meaning of its independent personality when talking about this car now, and regard it as an icon.

If Volkswagen only had the Beetle, we would suspect that it was a one-time luck. Then it got the Golf, which was another rebellion against the boring economic Japanese family car, paying for performance and fun at a price that a young person can afford, especially when the R32 was launched in 2002. Until the Volkswagen emission scandal, the Golf sold more than 60,000 units a year in the United States. This car is closer to our lives, and it is still the soul of Volkswagen today.

The times naturally have their irreproducibility. The world is no longer easily influenced and dominated by a culture as it was more than a decade ago. Every market has accurate and efficient portraits and fortresses. But some rules still follow: a totemic great car model can always achieve global sales that ignores boundaries, and find a gap for survival in various exotic places, because they grasp something essential about human nature, about life, and about the world. In the background of today, even a car model like this is desperately needed to prove that we still have commonality, can still understand each other, and yearn for beauty, hope, and the future, and still have the strength to keep rebelling against the old past.

There are already car models like this in electric cars, such as the Tesla Model 3. Volkswagen and the ID.3 want to become the king of electric cars, and Tesla is an unavoidable opponent.

The current product is such a product, the ID.3 meets Volkswagen’s standards, but it can be helped in marketing. Marketing is not that important, but it is an externalization of the value of an enterprise. For example, in addition to cuteness, building some high-end taste, inheriting the true spiritual core, it has a good chance.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.