Author: Xiao Dong

On August 30th, Li Auto released its financial report for the second quarter of 2021, in which it delivered a total of 17,575 vehicles and achieved car sales revenue of 4.9 billion yuan, with a QoQ increase of 41.6% and a gross profit margin of 18.9%. Achieving such results with only one car model is not easy for Li Auto.

In August of this year, Li Auto successfully completed a dual listing in Hong Kong and raised more than $1.5 billion in funding. This also made Li Auto’s cash flow more abundant. In its Hong Kong prospectus, Li Auto displayed its product plans for the next two years, with extended-range electric vehicles still being the main focus. Recently, Li Auto also revealed news about the new generation of range extender.

In the medium and long-term strategic plan, Li Auto continues to aim at “eliminating range anxiety and focusing on home users”, so what efforts has Li Auto made towards this goal? Let us take a look together.

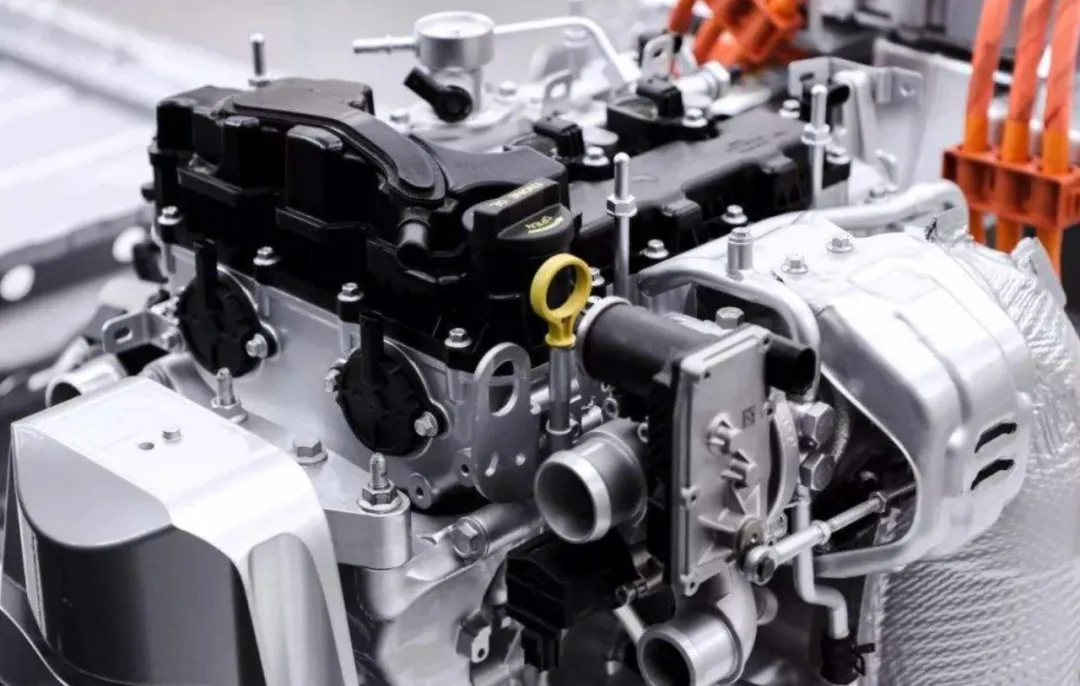

New generation of range extender

As a range extender vehicle, Li ONE has been very successful. In July, the delivery of Li ONE reached 8,589 units. This has also enabled more car companies to see the demand for range extender vehicles in the market, and there are also many range extender vehicle models on the market. For example, the Voyah FREE, the Force SF5 Zero Run, and other range extender vehicle models to be launched soon. By adding the range extender, the range anxiety generated by current EVs can be eliminated.

As the pioneer of domestic range extender vehicles, Li Auto’s range extender has ushered in an upgrade.

On August 27th, Li Auto announced the establishment of a joint venture with New Energy Automobile to produce the new generation of range extender. According to Shen Yanan’s disclosure during the conference call, Li Auto owns 51% of the joint venture, which means that Li Auto has control over the joint venture.

It is known that the new generation of range extender will use a 1.5T four-cylinder engine, which is a significant improvement compared to the 1.2T three-cylinder engine from Dong’an used in the current Li ONE.

How is New Energy Automobile, the company that established a joint venture with Li Auto, different from Dong’an?

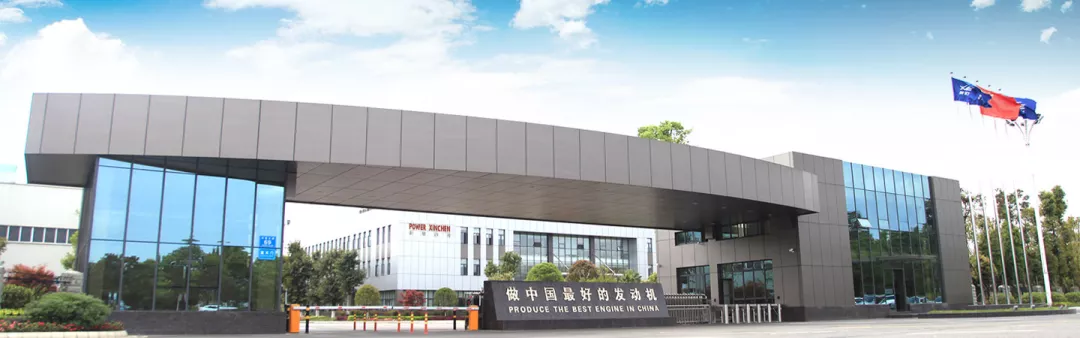

New Energy Automobile, officially known as Mianyang New Energy Power Machinery Co., Ltd., was established in March 1998 and is one of the Chinese domestic engine research and development manufacturers. Its parent company, New Energy China Power Holdings Co., Ltd., is jointly controlled by Brilliance Auto Group and Wuliangye Group.

The company’s vision is to “make the best engines in China”.

Of course, New Energy Automobile’s performance is excellent, with clients including BMW Group, Brilliance Group, Dongfeng Automobile, Zhengzhou Nissan, FAW Geelyn, Changfeng Liebao, Geely Automobile, Golden Dragon Bus, and others, especially its long-standing partnership with BMW Group.Of course, the performance of Xincheng Power is quite good, with customers including BMW Group, Huachen Group, Dongfeng Motors, Zhengzhou Nissan, FAW Geelyn, Changfeng Cheetah, Geely Automobile, Golden Dragon Automobile, and many others, especially its long-term cooperative partnership with BMW Group.

In terms of production capacity, Xincheng Power’s annual capacity is 600,000 engines, 600,000 crankshafts, and 1.6 million connecting rods. For the joint venture of Ideal and Xincheng, the planned production capacity for the first phase is 200,000 engines, which will be put into production in 2023. The production facilities and equipment, product quality system, supply chain system, and staff team are all completed within the BMW Prince engine production system, and the quality also meets the quality standards of the Prince engine.

Although the Prince series is not well received in the market, it has nothing to do with the engine. In the era of fuel vehicles, the matching and self-tuning of the engine and transmission are related, but in the era of extended range vehicles, the engine only needs to generate electricity, and these problems will no longer exist.

For Ideal, being able to establish a new joint venture with Xincheng Power to jointly develop and manufacture the next generation of extended-range systems is undoubtedly a good thing. It can be foreseen that the performance of the extended-range system used on the future X platform will undergo qualitative improvements.

A better extended range system will also bring better NVH and more efficient performance to the next generation of models. Of course, there will also be a certain increase in cost.

Financial Report Data

In the second quarter, Ideal delivered 17,575 vehicles, an increase of nearly 40% compared with the previous quarter. The automotive sales revenue was 4.9 billion RMB, an increase of 41.6% compared with the previous quarter. The most terrifying thing is that Ideal’s gross profit margin reached 18.9%, an increase of 1.6% compared with the first quarter. For comparison, NIO’s gross profit margin in the second quarter was 18.6%, while XPeng’s gross profit margin was only 11.9%.

Regarding the increase in gross profit margin, Ideal has also made an explanation. Firstly, some suppliers have reduced BOM costs, and secondly, the sales volume of Ideal ONE in the second quarter has increased, resulting in a reduction in cost amortization.

At the same time, Shen Yanan believes that in the third and fourth quarters, Ideal’s gross profit margin will continue to increase. The integrated gross profit margin for this year will be between 19% and 20%. In other words, in the second half of the year, Ideal’s gross profit margin will be higher than 20%, which is undoubtedly a virtuous cycle for a new car-making enterprise.At the same time, the increase in gross profit also proves that IDEAL has achieved good sales performance. Behind the sales volume is the expansion of the sales system. As of July 31st, IDEAL has 109 retail centers covering 67 cities, and 176 aftersales and authorized sheet-metal spraying centers covering 134 cities. By contrast, as of May 29th, IDEAL had 82 retail centers. In just two months, IDEAL has opened 27 new retail centers.

In August of this year, IDEAL opened a retail center in Lhasa, Tibet, reaching 100% coverage of its direct sales and service networks in all provinces, autonomous regions, and municipalities in China. By the end of this year, IDEAL aims to achieve its annual goal of 200 retail stores, expanding its footprint to more lower-tier cities, and its channel expansion in the third and fourth quarters is expected to become more apparent.

If the rapid expansion of IDEAL’s offline channels is reflected in its financial reports, we can see that sales, general, and administrative expenses in the second quarter of IDEAL reached CNY 835.3 million, with a QoQ growth rate of 63.8%.

IDEAL’s CEO Li Xiang has also shared that “in the same city, the market share differs by 8 times with or without IDEAL’s stores”. With the rapid expansion of IDEAL’s offline channels, the company’s sales volume is expected to grow significantly.

Of course, for a new force, channel expansion alone is far from enough, and product strength is what consumers value more. In IDEAL’s second-quarter financial report, research and development expenses reached CNY 653.4 million, with a QoQ growth rate of 27%. The annual R&D budget is about CNY 3 billion, which is obviously not as much as NIO’s CNY 5 billion or XPeng’s CNY 4 billion. I think this is largely because IDEAL’s product line is not as complex as NIO and XPeng’s. As we can learn from its Hong Kong IPO prospectus, all of IDEAL’s car models will be mainly SUVs until 2023, which means that IDEAL’s R&D investment is relatively low.

However, IDEAL’s low R&D expenses do not mean slow R&D progress. At present, IDEAL’s R&D on pure electric models has already begun in earnest. For example, IDEAL has prepared samples of its 4C new battery and has completed the conceptual design of supercharging, with plans to have its first pilot supercharging station this year.

According to IDEAL’s CFO Li Tie, IDEAL’s R&D investment will be USD 1 billion from now until 2023, covering the launch of new models and investments in autonomous driving, etc.## Medium and Long-term Strategy

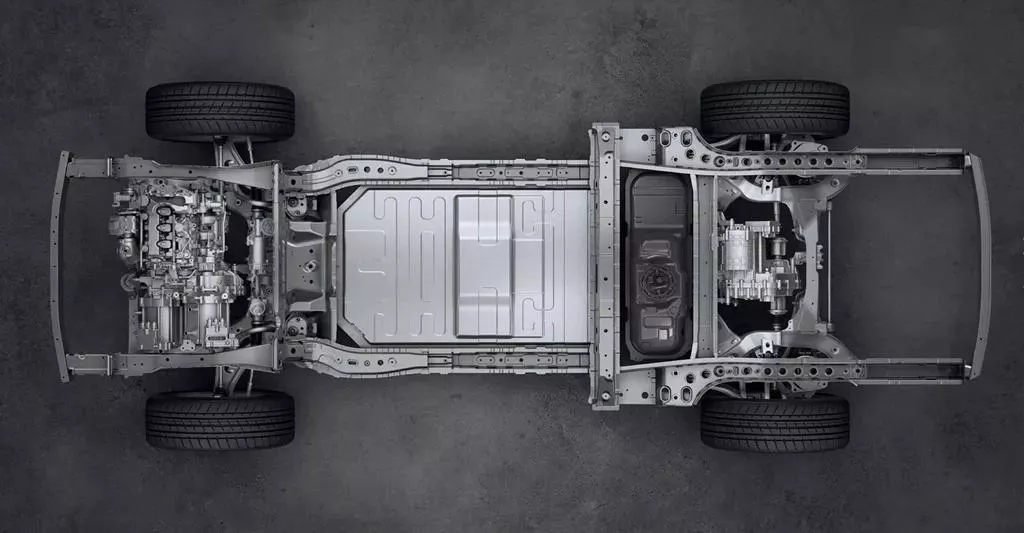

Shen Yanan proposed three key points that IDEAL will adhere to in the medium and long-term strategy during the financial report conference. Firstly, IDEAL aims to solve the problem of range anxiety, which is also the original intention of IDEAL’s development of extended-range products. In terms of pure electric vehicles, IDEAL is still following this point.

According to the Hong Kong stock prospectus, IDEAL will launch at least two high-voltage pure electric vehicles per year from 2023, which include the performance-prioritized Shark platform and space-prioritized Whale platform. To address range anxiety, IDEAL invested in new-generation electric technology in 2020, including CTP or CTC battery layout, adopted a high-voltage platform, and high-power charging network.

This has also brought IDEAL’s ultra-fast charging layout directly to 400 kW, which essentially dispels users’ range anxiety. For extended-range vehicle models under X platform, the problem of range anxiety is even no longer existent.

In terms of ultra-fast charging network layout, IDEAL promised to “establish a certain level of charging network layout before the delivery of pure electric vehicle models.”

Secondly, IDEAL targets at family users. IDEAL has fully realized the above two points from the modification of the IDEAL ONE.

The new IDEAL ONE increases the fuel tank and reaches an NEDC cruising range of 1080 kilometers, adds seat massages, adds third-row space, and realizes free conversation between the whole car for external discharge, crossover sound and locked sound, all of which are centered around range anxiety and family users.

Shen Yanan also stated during the financial report conference, “We only want to focus on family users, and we believe this is a growing sub-segment market. When we design our cars, we hope that the cars we design can meet the needs of all family members.”

Regarding autonomous driving, the new IDEAL ONE has also shifted from the Mobileye EyeQ4 chip to the domestic AI chip Horizon Journey 3 chip. After installing two Horizon Journey 3 chips, the computing power of the new IDEAL ONE has been increased from 2.5 TOPS to 10 TOPS. The improvement in computing power is only one aspect, and the cooperation between IDEAL and Horizon in algorithms will become closer.

For the next generation of autonomous driving, according to the Hong Kong stock prospectus, IDEAL mentioned the “shadow mode”, which uploads driving scenarios and corresponding decisions to the self-developed data platform to optimize the autonomous driving algorithm and improve user experience.Starting from 2022, all new car models from Li Auto will come with L4 level autonomous driving hardware as standard equipment. This means that the more Li Auto cars on the road, the richer the data will become through shadow mode, which will optimize Li Auto’s autonomous driving capabilities at a faster pace. In the future, Li Auto’s car models will be equipped with lidar, and the suppliers will be Hesai and DJI.

In terms of intelligent cockpit, Li Auto will provide in-car sensing systems, integrated maps, vehicle cloud networks, and integrated automotive control and computing units.

Li Auto is constantly consolidating its position in the segmented market, aiming for the target of 1.6 million sales in 2025 and beyond. However, behind the goal of 1.6 million sales, support for production capacity is indispensable.

Rumors about Li Auto’s new factory in Beijing have been circulating since May this year, and it has been repeatedly proven that Li Auto will indeed have a new factory in Beijing. According to the news, the planned annual production capacity of the new factory will reach 250,000 vehicles and it will be put into operation in 2023.

As early as in the prospectus issued for the US stock market listing, it was revealed that Li Auto’s Changzhou factory can achieve a planned annual production capacity of 200,000 through expansion. By 2023, the planned total production capacity of Li Auto’s factories will reach 450,000 vehicles.

By solving range anxiety, focusing on family users, constantly evolving towards intelligence, and expanding production capacity, Li Auto is running on its own track.

In conclusion, by “eliminating range anxiety and focusing on family users,” Li Auto has already chosen its own segmented market and wants to continue to deepen its presence in this market. The constantly improving sales and benign gross margin all prove that Li Auto has not chosen the wrong path and meets the current needs of consumers for electric vehicles. In the future, Li Auto will continue to uphold its philosophy, and we will continue to keep an eye on its journey.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.